Building a realistic banking system within a stock

advertisement

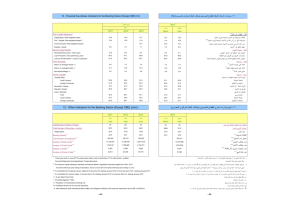

Financialisation Issues in a Post-Keynesian Stock-Flow Consistent Model Marc Lavoie University of Ottawa (based on work with Wynne Godley) Paper is… Based on Chapter 11 of a book written with Wynne Godley Monetary Economics: An Integrated Approach to Credit, Money, Income, Production and Wealth Macmillan/Palgrave 2007 The model … Can be found as an E-views file on the web site: gennaro.zezza.it/software/models Outline of the presentation SFC features Main features of the model Experiments (simulations): changing some parameter values linked to financialisation issues: charts SFC ? All sectors face budget constraints Financial interdependence between sectors Stock variables arise from flows and capital appreciation: historical time There exist stock-flow norms (which may change through time) People react and adjust to disequilibria SFC of some form in PKE and other heterodox economics Davidson, Minsky Eichner 1985 Peter Skott 1989 Institutionalists: Copeland 1947 The buffer principle: All sectors need a buffer that provide an adjustment factor Firms: inventories and bank loans Households: holdings of money deposits Government: bills issued Central bank: residual purchaser of bills or advances made to private banks Banks: bills held or advances obtained from central bank Objective To simulate a complicated model that entertains several realistic features All blocks (sectors) are well developed Growth model Where demand is constrained in the long run by the growth rate of the supply side (labour productivity) Here we look at issues tied to financialisation Table : The balance sheet of the Chapter 11 growth model Households Firms Govt Central bank Σ Banks Inventories +IN +IN Fixed capital +K +K H HPM +Hh Money +M Bills +Bh B Bonds +BL.pbL BL.pBL Loans Lh Lf Equities +e.pe e.pe Bank capital +OFb Balance Vh Vf Vg Σ 0 0 0 +Bcb +Hb 0 M 0 +Bb 0 0 +L 0 0 OFb 0 0 0 (IN+K) 0 0 0 Firms Follow normal cost pricing procedures, based on historical costs Mark-up depends on planned entrepreneurial profits, which depend on investment expenditures Firms borrow mainly to fund inventories Firms issue shares to finance investment not funded through retained earnings The rate of accumulation depends on capacity utilization and the real interest rate The main drawback is that firms do not hold financial assets Inflation: a kind of conflictual inflation Workers are targeting a real wage, based on productivity growth and employment rates. Firms are looking for a profit margin that will finance a given proportion of their investments. The inflation rate is proportional to the discrepancy between the actual and the target real wage. The Phillips curve is flat within a certain employment range. Households Consumption on the basis of past real wealth current disposable income net of interest payments on loans, plus net additions to outstanding loans Gross new loans is a fraction of personal income Standard portfolio equations with adding-up conditions Government and the central bank Pure government expenditures (excluding debt servicing) grow at a rate equal to the growth rate of labour productivity. This is the main exogenous variable. Cash, bank reserves, bills and bonds are all supplied on demand (monetization is fully demand-led) More realistic PK bank Banks have own funds (net worth) Banks have retained earnings Banks make loans to firms and to consumers Banks face a BIS-imposed capital adequacy ratio (CAR) – the Cooke ratio (own funds to loans ratio) Banks have a target liquidity ratio: bills to deposits ratio (both target ratios must be achieved in the medium run The determination of interest rates The (nominal) Treasury bill rate is set exogenously by the central bank. The bond rate is also set exogenously (or it can be made endogenous, if its supply is set in relative terms) The deposit rate relative to the bill rate is endogenous, set by banks, based on a bank reaction function that depends on the liquidity preference of banks The lending rate is marked up over the deposit rate, to insure bank profits and fulfil BIS rules Experiments Increase the proportion of gross investment financed by retained earnings (i.e. diminish equity issues) Increase the proportion of profits distributed as dividends Increase the desire to hold equities Increase the ratio of gross new loans to personal income Increase the default rate on loans