Time Series Analysis of the Historical Equity Risk Premium and

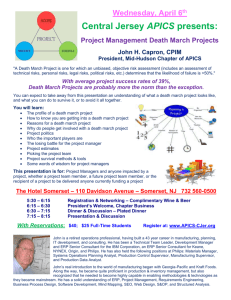

advertisement

27th April 2012 WHAT HAS HAPPENED TO THE EQUITY RISK PREMIUM? Prepared by: Aytac Aydogan Ryan Chadha Bansi Jashapara Sevan Tahmasian Melanie Tom TABLE OF CONTENTS INTRODUCTION.................................................................. 2 LITERATURE REVIEW AND ANALYSIS…………………………........ 3 I. II. III. IV. Historical ERP……………………………………………………………..... 4 Implied ERP…………………………………………………………………… 17 Surveys…………………………………………………………………………. 25 Alternative Premiums……………………………………………………. 29 CONCLUSION…………………………………………………………………… 30 REFERENCES………………………………………………………………...... 35 APPENDICES……………………………………………………………………. 29 Equity Risk Premium | April 2012 1|Page INTRODUCTION What is the risk premium and what determines it? The Equity Risk Premium reflects the incremental return that shareholders require from holding risky securities rather than risk-free securities. Thus, it is a vital part of the expected return which investors demand for a risky investment, and effectively the cost of equity and the cost of capital. It affects the way we allocate capital across different asset classes and specific assets within each asset class. Its key determining factor is the risk aversion of investors, with higher risk aversion translating into higher risk premiums. Another contributing factor is the uncertainty or volatility of economic variables including employment, consumption and GDP growth, as higher predictability corresponds to lower risk premiums. Technological advancements, especially in the last couple decades, have led to improved transmission channels of corporate earnings and cash flow data, increasing investor confidence and lowering the demand for a risk premium. When comparing the premium of developed and emerging markets, liquidity risk materializes as another determining factor, particularly during periods of economic slowdown. During crises, liquidity dries up and the equity risk premium increases. The risk premium must also reflect catastrophe risk - risks of periods such as the Great Depression or the recent credit crisis. Last, but not the least, it includes a behavioural irrational component, pertaining to quirks in human behaviour. With all these determinants in mind, one needs to consider how the historic observation of the equity risk premium in practice compares with finance theory. This has sparked a wide debate known as the equity risk premium puzzle. This paper seeks to explain the historical path of the ERP, why it has recently been low, and how it may progress in the future. The study will be performed through historical analysis, implied analysis and summarized surveys. Looking at the ERP over the last 60 years When we look at the Treasury bond returns from the late 50s onwards, we see different patterns over time. After the 2nd World War, economies started to recover and the demand for consumer products and oil increased heavily, leading to increased global inflation and interest rate hikes. In the 70s and 80s, Treasury note rates increased severely as a result of the oil crisis and the Iran-Iraq war. Since then, inflation has been relatively under control, while interest rates have been trending downwards. Global macro and political conditions have similarly caused S&P returns to vary over time. The increase in oil prices in the 70s caused a decline in economic growth, resulting in decreased equity Equity Risk Premium | April 2012 2|Page returns. The growing trend towards globalization, as well as the boom in technology and housing markets has diminished the risk awareness of investors and caused a significant shift of assets into equities. LITERATURE REVIEW AND ANALYSIS Damodaran (2012)1 discusses three approaches used in calculating the ERP. These are: historical time series analysis, surveys incorporating the views of fund managers’ and economists, and an implied ERP calculated from available market data. i) Historical risk premium: With historical data there will be varying ERP figures depending on the time period over which the ERP is calculated, whether an arithmetic or geometric analysis2 is done, and whether T-bills or to T-bonds are used. Damodaran (2012) states that one should aim to estimate the ERP using 40 or 50 years of data because stock return volatility results in returns calculated over shorter time periods to have very large standard errors. Damodaran is sceptical of assuming mean reversion for the US due to the structural changes caused by globalisation. ii) Implied risk premium: Damodaran states that this is the best estimate, even though this calculation is based on one’s assumption of expected future cash flows. He views it as a better estimate than the historical premium because it is based on future cash flows and the standard error on the estimate (which arises from expected future cash flows) is lower than the standard error on the historical premium. iii) Surveys: Survey reports are often not good indicators of the actual ERP as they frequently represent the hopes of those interviewed opposed to what the actual expectations are. Additionally, the interviewees’ estimates are more reflective of the past than the future. Following periods of good returns, investors tend to report higher expected ERP estimates, and following periods of poor returns, their expectations tend to be lower. 1 Damodaran, A., 2012, Equity Risk Premium (ERP): Determinants, Estimation and Implications – The 2012 Edition, Stern School of Business. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2027211 2 The arithmetic mean is the simple average of the periodical rates of return whereas the geometric mean is the compound rate of return earned between certain two dates. It is known that the arithmetic average return exceeds the geometric average return and that if the returns are lognormally distributed; the difference between the two averages is one half the variance of the returns. Equity Risk Premium | April 2012 3|Page I. HISTORICAL ERP In an updated research piece, Dimson, Marsh and Staunton (2011)3 revisit the cumulative total returns in nominal terms for US equities, bonds, bills, and inflation for the period 1900 to 2010. Their results show annualized returns for equities of 9.4%, for bonds of 4.8%, for bills of 3.9%, and the inflation rate is 3%. They calculate the historical equity premium by taking the geometric difference between equity return and the risk-free rate, resulting in an ERP of 4.4% for the US and 3.9% for the UK. While these figures seem relatively low when comparing to other commonly referenced estimates such as Ibbotson4, the difference is mainly caused by a bias in the longer time frame used. Their estimate of a survivorship bias is rather negligible and estimated to be about one tenth of a percent. The reason for this is that 11% of market value was lost over 111 years, averaging a mere 0.1% per annum. Dimson, Marsh and Staunton do not see mean-reversion playing a critical role in the stock markets due to the weak evidence of mean-reversion in their data set. They explain that if there was mean-reversion, it should, to some level, make the ERP predictable, and therefore long-term investors would favour equities compared to short-term investors as there is less risk in the long-run. However, they note this is still extensively debated, even though there has been a lot of research done surrounding this. When analysing the time-varying risk premium, the fluctuations in market volatility and investors’ risk aversion is clearly visible. However, they conclude that “when forecasting the long-run equity premium, it is hard to improve on evidence that reflects the longest worldwide history that is available at the time the forecast is being made”. In conclusion, the historical ERP is larger than initially expected by investors because of unexpected factors such as exchange rate gains, unanticipated expansion in valuation multiples, and by significantly improved business conditions in the second half of the 20th century. In its Global Investment Returns Yearbook5, Credit Suisse reviews the equity risk premium across 19 different countries relative to bonds and to bills, measured over various time periods – a decade, 25 years, 50 years and the full period of 112 years. In their analysis, they attempt to create a world equity risk premium in which each country is weighted by its starting-year equity market capitalization, or alternatively by its GDP if market capitalizations were not available. When comparing the world equity premium to the country specific equity premiums, it becomes apparent that investors can achieve risk reduction through global diversification (see Figure 1 below and Figure 19 in the appendix). 3 Dimson, E., Marsh, P. and Staunton, M., 2011, Equity Premia Around the World, Working Paper Series. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1940165&rec=1&srcabs=1928764 4 Ibbotson Stocks, Bonds, Bills and Inflation Yearbook (SBBI), 2011 Edition, Morningstar. 5 Credit Suisse Global Investment Returns Yearbook 2011, Research Institute. https://infocus.creditsuisse.com/app/_customtags/download_tracker.cfm?dom=infocus.creditsuisse.com&doc=/data/_product_documents/_shop/300847/credit_suisse_global_investment_yearbook_2011.pdf &ts=20110324030332 Equity Risk Premium | April 2012 4|Page Figure 1: World Equity Risk Premium6 World Ex-US Equity Risk Premium7 For country-specific equity risk premiums please refer to the Appendices. Time Series Analysis of the Historical Equity Risk Premium and Estimation We have calculated the historical equity risk premium on an annual basis over the time period ‘1928 to 2011’ for the US and ‘1936 to 2011’ for the UK. This is the longest time period for which quality financial data is available and is deemed to be the appropriate time horizon for our analysis. For both markets, we estimated the ERP as the excess return from the relevant equity markets over both short and long term risk free assets (3-month Treasury Bills and Treasury Bonds with a maturity of 15-20 years) and compared the results for each. The graphs in Figure 2 below depict the movement of the historical 6 7 Source: Credit Suisse Global Investment Returns Yearbook 2011 Source: Credit Suisse Global Investment Returns Yearbook 2011 Equity Risk Premium | April 2012 5|Page ERP over the time periods specified for both the US and UK. It can be seen that the trend for both markets are similar – volatility in the initial years but later stabilizing towards the end of the period. Figure 2: Additionally, as part of the analysis, we have also compared the arithmetic means to the geometric means of the historical ERP for the US and UK over periods of 10 years, 50 years and for the full time horizon under review. We notice that the arithmetic means for each time period produces historical ERPs which are higher than the corresponding geometric means for the US market. According to a number of research papers, the decision to focus on arithmetic averages versus geometric averages depends mainly on the use of the information. The ‘Ibbotson’s Answer’ research paper8 specifies the use of geometric averages when analysing historical data and trends whilst the most suitable use of arithmetic averages is for forecasting. Tables 1 and 2 below indicate the results of our analysis. We observe that the historical equity risk premiums, using long term riskless asset returns, were negative over the last 10 year period ranging between -4.46% and -6.39% for the US and -3.01% and -1.96% for the UK. Table 1: US Market Arithmetic average S&P return 1928-2011 (84 yrs) 11.2% 1962-2011 (50 yrs) 10.63% 2002-2011 (10 yrs) 5.03% Geometric Average S&P return 1928-2011 (84 yrs) 8.89% 1962-2011 (50 yrs) 9.63% 2002-2011 (10 yrs) 2.97% T-bills 4.31% 5.82% 2.44% T-bills 4.27% 5.85% 2.43% T-bonds 6.208% 8.02% 9.49% T-bonds 6.03% 7.83% 9.36% S&P ret - T-bills 6.90% 4.81% 2.59% S&P ret - T-bills 4.62% 3.78% 0.54% S&P ret - T-bonds 5.01% 2.61% -4.46% S&P ret - T-bonds 2.85% 1.80% -6.39% 8 Ibbotson’s Answer http://corporate.morningstar.com/ib/documents/MethodologyDocuments/IBBAssociates/IntnlRiskPremium.pdf Equity Risk Premium | April 2012 6|Page Table 2: UK Market Arithmetic average 1936-2011 (76 yrs) 1962-2011 (50 yrs) 2002-2011 (10 yrs) Geometric Average 1936-2011 (76 yrs) 1962-2011 (50 yrs) 2002-2011 (10 yrs) FTSE return 11.7% 12.30% 4.50% FTSE return 9.21% 9.53% 4.57% T-bills 6.69% 8.29% 4.58% T-bills 6.69% 8.28% 4.58% Gilt bond 6.87% 9.21% 6.69% Gilt bond 6.64% 8.88% 6.53% FTSE ret - T-bills 5.02% 4.01% -0.08% FTSE ret - T-bills 2.52% 1.25% 0.00% FTSE ret - Gilt bonds 4.84% 3.08% -2.19% FTSE ret - Gilt bonds 2.57% 0.66% -1.96% Does the historical equity risk premium follow a random walk? Having compiled annual data and thus a time series on the historical equity risk premiums, we were able to perform various tests to analyse certain trends as well as forecasts on the ERP. We thought it interesting to test whether the calculated historical ERPs’ time series followed a random walk or was mean-reverting. A time series follows a random walk if the predicted value in one period is equal to the value of the series in the previous period plus a random error term. To determine whether a time series follows a random walk, the following requirements must be met: 1. The expected value of the error term is zero. 2. The variance of the error terms is constant. 3. There is no serial correlation in the error terms. The formal Augmented Dickey Fuller (ADF) test was performed in statistical software package, “R Excel”, to test whether or not the calculated historical ERP time series (ERPs calculated using both the short term and the long term riskless assets) for the US and UK are ‘unit root’ processes. Based on the results of this test, we can decide whether we can or cannot reject the null hypothesis of the existence of a unit root. If the sequences contain a unit root, we can conclude that they follow a random walk and are not covariance stationary. A process is said to be covariance stationary if the series has finite and constant expected value, variance and covariance. In such a case, it is necessary to transform the series to ensure covariance stationarity before we can conduct a forecast. Based on the results of the aforementioned test, we conclude that both the US and the UK historical ERP series do not follow a random walk and are said to be covariance stationary. The results of the tests are indicated in Table 3 below: Equity Risk Premium | April 2012 7|Page Table 3: ADF Test - Test for unit root Time series US ERP (calculated over T-bills) US ERP (calculated over T-bonds) UK ERP (calculated over T-bills) UK ERP (calculated over Gilts) ADF statistic -5.444 -4.738 -4.952 -3.469 p-value 0.010 0.010 0.010 0.051 Decision Conclusion Reject null Stationary Reject null Stationary Reject null Stationary Reject null Stationary Forecasting the ERP over the next 10 years (2012 – 2021) One of the most important uses of time-series analysis is to forecast future patterns of variables or to compare series of different kinds of variables. It is common within time series for the observations close together in time to be serially dependent or correlated with each other. Time series analysis helps us to explain this correlation using appropriate statistical models. Once a suitable model is found, we can fit the model to the relevant data and proceed to use such model to forecast future values. We have utilised this analysis to assist us in forecasting the ERP over the next 10 years for both the US and the UK markets. It is important to recall that a stationary series is a critical property of modelling and it is necessary for the series to be transformed into a stationary process before we can proceed to determining a suitable model. From the analysis in the previous section, we determined that the historical ERPs for both the US and UK were stationary series. We will use the plot of the autocorrelation function (ACF) and the partial autocorrelation function (PACF), known as the correlogram to guide us in determining a suitable model. A correlation of a variable with itself at different times is known as autocorrelation whilst partial autocorrelation at lag k is the correlation that results after removing the effect of any correlations due to the terms at shorter lags. The correlograms for the time series variables are shown below with the abbreviated series defined as follows: LTUSERP – ERP calculated as S&P500 equity returns less T-bond returns STUSERP - ERP calculated as S&P500 equity returns less T-bill returns LTUKERP - ERP calculated as FTSE100 equity returns less Gilt bond returns STUKERP - ERP calculated as FTSE100 equity returns less UK T-bill returns Equity Risk Premium | April 2012 8|Page Figure 3: First, since both the ACF and PACF decline for each series, we determine this to be an ARMA (p,q) model with the number of spikes in the PACF determining the AR(p) order and the number of spikes in the ACF determining the MA(q) order. Autoregressive terms (AR): The number of terms in the model that describe the dependency among successive observations. Each term has an associated correlation coefficient that describes the magnitude of the dependency. For example, a model with two auto-regressive terms is one in which an observation depends on (is predicted by) two immediately preceding observations. Moving Average terms (MA): The number of terms that describe the persistence of a random shock from one observation to the next. A model with two moving average terms is one in which an observation depends on two preceding random shocks. A few models have been estimated with the best one selected based on certain criteria and passing certain diagnostic tests. These diagnostic tests include: Ljung-Box Test for autocorrelation, Jarque-Bera test for normality and ARCH LM test for homoskedasticity. Table 4 below specifies the parameters of the best models found. These models were used to predict future values of the ERP for US and UK. Equity Risk Premium | April 2012 9|Page Table 4: Time series 1. US ERP (Equity 2. US ERP (Equity 3. UK ERP (Equity 4. UK ERP (Equity returns returns returns returns - T-bill returns) T-bond returns) T-bill returns) Gilt returns) Best Mean Model MA(0,3) AR1 AR3 MA1 ARMA(1,1) AR1 MA1 MA2 MA3 The forecast values obtained from the relevant ARMA (p,q) model as previously specified for our varying time series are indicated below. Prediction plots are also shown. Table 5: Market Year 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Prediction 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 US UK ERP (Equity returns - T-bill returns) ERP (Equity returns - T-bond returns) ERP (Equity returns - T-bill returns) 5.11% 3.96% 2.45% 5.37% 4.07% 2.73% 5.43% 4.08% 2.83% 5.41% 3.96% 3.03% 5.51% 4.09% 3.08% 5.44% 4.03% 2.95% 4.69% 3.31% 2.40% 4.91% 3.46% 2.67% 5.02% 3.49% 2.80% 4.99% 3.23% 2.70% MA(0,3) Prediction AR1 AR3 MA1 Prediction ARMA(1,1) Prediction 5.26% 3.73% 2.83% 3.62% 3.87% 2.89% 4.92% 4.12% 2.91% 4.92% 3.80% 2.92% 4.92% 3.59% 2.93% 4.92% 3.33% 2.93% 4.92% 3.49% 2.93% 4.92% 3.71% 2.93% 4.92% 3.99% 2.93% 4.92% 3.95% 2.93% ERP (Equity returns - Gilt returns) 2.81% 3.06% 3.16% 3.30% 3.33% 3.25% 2.71% 2.95% 3.07% 2.74% AR1 MA1 MA2 MA3 Prediction 2.56% 2.39% 2.58% 2.70% 2.78% 2.83% 2.87% 2.89% 2.90% 2.91% Figure 4: Equity Risk Premium | April 2012 10 | P a g e Equity Risk Premium | April 2012 11 | P a g e When we look at the forecast values based on the relevant ARMA (p,q) models, it can be observed that ‘the US ERP over T-bills’ is expected to stabilize at 4.92 % over the 10 year horizon, which indicates an evenly distributed performance of equities over T-bills. However, ‘the US ERP over T-notes’ moves more or less around 3.5% – 4%. So, when the historical ERP over T-notes decreases; this means that the US equities underperform the US T-notes, since the historical ERP focuses on aggregate performance since 1928 in our analysis. A similar pattern can be observed for the UK ERP: ‘The UK ERP over T-bills’ is expected to stabilize at 2.93 % over the 10 year horizon, which indicates an evenly distributed performance of equities over T-bills. However, ‘the UK ERP over gilts’ moves more or less around 2.5% – 3%. So, when the historical ERP over gilts decreases; this means that the UK equities underperform the UK gilts, since the historical ERP focuses on aggregate performance since 1935 in our analysis. Structural changes which caused disparities in markets As an additional step, we investigated potential structural breaks that may have been caused by “external factors” during the credit crisis and impacted the ERP. Frank, Gonzales-Hermosillo, and Hesse approach this question by studying the market illiquidity and funding illiquidity that appeared during the crisis. In normal market conditions, market liquidity shocks are short lived, as they create trading opportunities for traders to make profit and help to create price-discovery. However, systematic risk increased significantly during the credit crisis as the linkage between balance sheets of financial institutions and deteriorating asset prices amplified and propagated liquidity shocks across financial markets. Financial institutions faced market-to-market price declines and margin calls leading to funding illiquidity. As a result, the massive deleveraging process of liquid positions set the movement in asset prices in motion. With increasing turbulence and stress in the financial markets, investors shifted their capital into U.S. Treasury bonds in a flight to liquidity. This is evident when one compares the stronger interactions between the market liquidity in the bond market and the stock market return volatility (see chart below), with a higher correlation amongst the S&P 500 returns and the two year on-the-run spread. This suggests that in dawn of the credit crisis new channels of transmission of liquidity shocks were established. Equity Risk Premium | April 2012 12 | P a g e An analysis of Holding Period Returns The holding period equity returns in the US and UK markets seem to be maximized between the periods of 15 to 20 years. We therefore preferred the long-term bonds as our reference risk-free bonds to ensure consistency. However, we have also analysed the equity risk premium with respect to 3-month T-bills in order to see the relative difference in magnitude and effect. A long term horizon does not always assure equity investors safe returns, although, this has been the case most of the time in both markets. Figures 5 and 6 demonstrate the average total equity returns for the US and the UK stock markets in different time periods: Figure 5: The US Case: 20.00% 5 yr holding period returns 14.00% 10 yr holding period returns 12.00% 15.00% 10.00% 10.00% 8.00% 5.00% 6.00% 0.00% 4.00% -5.00% 2.00% -10.00% 0.00% -15.00% -20.00% 5 yr return 16.00% Average 15 yr holding period returns 14.00% 12.00% 10.00% 8.00% 6.00% 4.00% 2.00% 0.00% 15 yr return Average Equity Risk Premium | April 2012 10 yr return 9.00% 8.00% 7.00% 6.00% 5.00% 4.00% 3.00% 2.00% 1.00% 0.00% Average 20 yr holding period returns 20 yr return Average 13 | P a g e 8.00% 25 yr holding period returns 9.00% 7.00% 8.00% 6.00% 7.00% 5.00% 6.00% 4.00% 5.00% 30 yr holding period returns 4.00% 3.00% 3.00% 2.00% 2.00% 1.00% 1.00% 0.00% 0.00% 25 yr return Average 30 yr return Average Figure 6: The UK Case: 20.00% 5 yr holding period returns 16.00% 10 yr holding period returns 14.00% 15.00% 12.00% 10.00% 10.00% 8.00% 6.00% 5.00% 4.00% 0.00% 2.00% 0.00% -5.00% -10.00% 5 yr return 16.00% Average 15 yr holding period returns 14.00% 12.00% 10.00% 8.00% 6.00% 4.00% 2.00% 0.00% 15 yr return Average Equity Risk Premium | April 2012 10 yr return 9.00% 8.00% 7.00% 6.00% 5.00% 4.00% 3.00% 2.00% 1.00% 0.00% Average 20 yr holding period returns 20 yr return Average 14 | P a g e 25 yr holding period returns 8.00% 7.00% 6.00% 5.00% 4.00% 3.00% 2.00% 1.00% 0.00% 25 yr return 9.00% 8.00% 7.00% 6.00% 5.00% 4.00% 3.00% 2.00% 1.00% 0.00% Average 30 yr holding period returns 30 yr return Average The relationship between the volatility of equities and holding period returns When we look at the US & UK equity returns in different holding periods and compare them with their corresponding periods’ volatilities; we observe that the longer the holding period of equities, the more consistent the volatility. Below is a demonstration of this relationship in both the US and the UK markets. This also supports why we have chosen 15 to 20 year long term bonds as our reference bonds for the long-term notes: Figure 7: The US Case: 30.00% 25.00% 20.00% 15.00% 10.00% 5.00% 0.00% 20.00% 15.00% 10.00% 5.00% 0.00% -5.00% -10.00% 1 2 3 4 5 yr Vol 5 6 7 10.00% 5.00% 5.00% 0.00% 0.00% 2 15 yr HPR Equity Risk Premium | April 2012 5.00% 5.00% 0.00% 0.00% 2 10 yr Vol 10.00% 15 yr Vol 10.00% 1 15.00% 15.00% 10.00% 15.00% 5 yr HPR 20.00% 15.00% 20.00% 8 25.00% 1 25.00% 3 4 10 yr HPR 20.00% 19.50% 19.00% 18.50% 18.00% 17.50% 17.00% 16.50% 7.00% 6.50% 6.00% 5.50% 1 20 yr Vol 2 20 yr HPR 15 | P a g e Figure 8: The UK: 30.00% 20.00% 20.00% 10.00% 10.00% 0.00% 0.00% -10.00% 25.00% 20.00% 15.00% 10.00% 5.00% 0.00% 1 2 3 4 5 6 7 8 9 10 5 yr Vol 10.00% 5.00% 0.00% 2 0.00% 2 3 4 5 10 yr HPR 18.00% 8.00% 17.00% 6.00% 16.00% 4.00% 15.00% 2.00% 14.00% 0.00% 3 15 yr Vol 5.00% 10 yr Vol 15.00% 1 10.00% 1 5 yr HPR 25.00% 20.00% 15.00% 10.00% 5.00% 0.00% 15.00% 1 15 yr HPR 2 20 yr Vol 20 yr HPR Apart from the relationship between the holding period returns and volatility of equity indices, one should also take the more recent pattern of volatility movements into account. Especially after 2007, when the subprime mortgage crisis showed and ample amount of liquidity being pumped into the markets, volatility has been settling around 20% in both of the analysed markets. This level seems to be the long-run average of the historical equity volatility: Figure 9: The US Case: Annual SPX Volatility: After 2007 Annual SPX Volatility: Before 2007 50.00% 50.00% 40.00% 40.00% 30.00% 30.00% 20.00% 20.00% 10.00% 10.00% Annual SPX Volatility Equity Risk Premium | April 2012 2007 2004 2001 1998 1995 1992 1989 1986 1983 1980 1977 1974 1971 0.00% 0.00% 2008 2009 2010 2011 Annual SPX Volatility 16 | P a g e 2012 Figure 10: The UK Case: Annual FTSE Volatility: Before 2007 Annual FTSE Volatility: After 2007 50.00% 50.00% 40.00% 40.00% 30.00% 30.00% 20.00% 20.00% 10.00% 10.00% 1960 1963 1966 1969 1972 1975 1978 1981 1984 1987 1990 1993 1996 1999 2002 2005 0.00% 0.00% Annual FTSE Volatility 2008 2009 2010 2011 2012 Annual FTSE Volatility II. IMPLIED ERP The Expected Risk Premium is a non-constant variable with wide ranging estimates and for which historical data might provide little indication. While determining its value requires knowing the future return on stocks and bonds, Taylor tries to explain the unknown variables by looking at the expected inflation rate, GDP growth rate, and future corporate profits. In order to estimate the return on cash and returns on alternatives to bonds and equities, investors need to predict the future rate of inflation. In order to estimate the return on bonds, investors need to predict the return on long term investments, which should effectively be equal to the expected growth rate of the economy (GDP). Similarly, in order to estimate the return on equities investors need to have a future view on corporate profits. As estimates on inflation, economic growth, and corporate profit change, so does the ERP. Applying this concept to the current market environment, current monetary policy, i.e. quantitative easing in the US and UK has led to an increase in money supply and hence increased expected long term inflation rates. The prolonged economic recession since 2008 has also dampened the expected GDP growth rate and future corporate profitability. While rising inflation rates are favourable for equities and unfavourable for bonds, it must be that the negative expectation of corporate profitability outweighs the impact of inflation and the relative underperformance of bonds in order to explain the currently low ERP. The implied risk premium method makes the following assumptions: - An assumption about the growth rate of dividends in the short term Equity Risk Premium | April 2012 17 | P a g e - An assumption about the long term growth rate of dividends – this is usually assumed to be the long run growth in GDP (approximately 2%). Damodaran (2012) uses the yield on the ten year T bond as the proxy for long term growth rate Assuming that markets are efficient, we take the current market level, the expected dividends for the next period, and the expected growth rate in earnings and dividends as market observable data. With no use of historical data, we calculate an implied required return on equity, from which we can subtract the risk free rate to obtain an ERP. The limitation of this model is that one needs to assume the reliability of the valuation model and its market observable inputs. Damodaran (2012) goes further to examine the higher rate of variability in the implied risk premiums relative to the historical risk premiums and comes to the following conclusions: (i) the survivor bias causes implied risk premiums to be generally lower than historical risk premiums, (ii) the equity risk premium needs to be adjusted for changes in inflation and interest rates, (iii) the risk premium has been on a downward trend since the early 80s. He ascribes the reason for the latter conclusion to be attributable to a decline in inflation uncertainty and lower interest rates, changes in investor risk aversion, and he does not rule out the possibility of investors having overpriced equities historically. Table 6: 2000 2001 2002 2003 2004 2005 Implied ERPs by year since 2000 (US) 2006 2.87% 2007 3.62% 2008 4.10% 2009 3.69% 2010 3.65% 4.08% 2011 4.16% 4.37% 6.43% 4.36% 5.20% 6.04% As per Damodaran’s calculations, the implied ERP for the US is 6.0% as at 1 April 2012. Damodaran uses a two stage dividend growth model for his calculation. He assumes a dividend yield of 2.1% and a stock buyback yield of 3.6% for a total yield of 5.7% on the index. The long term growth rate is assumed to be 2%, which is the rate on a long term (10 year) government bond. The short term growth rate is 7.2%, which is a median forecast from analysts. In the UK, we used the H model to calculate an implied ERP. The H model assumes that the growth rate decreases linearly over time until it settles at its long term growth rate. We assumed a dividend yield of 2.7% and a buyback yield of 2%. In the absence of easily available data on stock buybacks on the FTSE 100, we used 2% as it is a conservative average of the historic buyback yield on the Equity Risk Premium | April 2012 18 | P a g e S&P 500. The long term growth rate is assumed to be 2%, which is the rate on the long term (10 year) government bond. The short term growth rate is 5.8%, which is a consensus of analyst estimates. The UK implied ERP based on the above methodology is 5.0%. Therefore, as the analysis above suggests, the implied ERP for both the US and UK is above its long term average. This probably reflects that the realized ERP has been quite low since 2000, and is also a function of the very low government bond yields currently. Volatility and the ERP One of the central themes in finance is the relationship between risk and return. For a riskaverse investor the higher the risk of an investment the higher the required return. The equity risk premium can be seen as the additional return required compensating an investor for the higher volatility of equity returns. Therefore, when volatility increases, one would expect an increase in the equity risk premium. Figure 11: Harvey and Graham (2012)9 explored the relationship between estimates of ten year risk premiums and the VIX index from the third quarter of 2000. This graph shows that there is a positive relationship between implied volatility (for the next 30 days) and the equity risk premium. Though the VIX is not calculated with the same time horizon in mind, it nevertheless shows a positive relationship. 9 Graham, J.R. and C.R. Harvey, 2012, The Equity Risk Premium in 2012, Working paper, http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2020091 Equity Risk Premium | April 2012 19 | P a g e This relationship is intuitive as an increase in volatility would mean higher probabilities of losses. Given that equity options tend to exhibit a skew (downside volatility is greater), the risk premium demanded by investors increases when volatility increases. Figure 12: Relevant to this discussion is the volatility of different indices, and how the volatility in one index tends to ‘spill over’ into other markets. As the graph above illustrates, the volatility on three European indices from 2001 have tended to move very much in line with each other. This has implications for the ERP as such linkages are likely to mean that a development in one equity market is very likely to have effects on other closely linked equity markets. Equity Risk Premium | April 2012 20 | P a g e Figure 13: Implied versus Historical Premiums for US: 1961-201110 It is interesting to note that implied premiums have been lower than historical premiums for most of the time since 1960 (see Figure 13 above). It is only recently since 2008 where implied premiums have been higher than historical premiums (as previously mentioned). This can be attributed to the very low returns on treasury bonds and also to the large drop in equity values in 2008. Also visible from the graph is the tendency of implied risk premiums to exhibit mean reversion – which possibly indicates that implied risk premiums can possibly be estimated from averaging implied premiums over ten to fifteen year periods. 10 Damodaran, A., 2012, Equity Risk Premium (ERP): Determinants, Estimation and Implications – The 2012 Edition, Stern School of Business. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2027211 Equity Risk Premium | April 2012 21 | P a g e The relationship between realized returns and implied volatility Studies show the relationship between implied volatility and realized returns is negative and asymmetric. This result is supported by Whaley (2000)11. Whaley studied the correlation between weekly changes in the VIX verses S&P 100 returns, for when it started (1986) to 1999. He found when the VIX fell 100 basis points, the S&P 100 index increased by 0.469%, however when the VIX rose by 100 basis points, the S&P 100 index fell by (-0.707%). Given this relationship Whaley explained the VIX to be the ‘investor fear gauge’. Simon (2003)12 studied the daily NASDAQ volatility index (VXN) data for January 1995-May 2002 and also found the negative and asymmetric relationship between implied volatility and returns. His study showed this relationship continued in bubble and post-bubble times. Hibbert, Daigler and Dupoyet (2008)13 did a study of the new VIX index and as expected found a significantly negative and asymmetric relationship. They looked at daily and intraday data for January 2004–December 2006. Hibbert et al. (2008) discuss that the two accepted theories for the negative relationship between implied volatility and returns are the Leverage hypothesis and the Volatility feedback hypothesis. The Leverage hypothesis theory explains that when firm value falls, that firm’s equity value decreases as a percentage of the firm’s total value. Accordingly the volatility should increase because the equity of the firm assumes the risk of the whole firm. The Volatility feedback hypothesis suggests negative returns are caused by positive shocks to volatility. Equity Returns and Recessions Given that we have just come out of a recession in the US and the UK, it is useful to look at historical data of returns from the start of the recession as well as immediately after the end of recessions. The 80s and 90s were really good decades for equity investing in both the US and the UK. The ten year equity return on the FTSE100 and S&P500 just after the recession in 1980 ended, i.e. for the period 1981 to 1999, just prior to the dot com crash, was 12.1% per year and 13.6% per year respectively. We also analysed the ten year equity return from the start of the 1980 recession and we noted the same trend, with the FTSE100 and S&P500 providing average return of 11.9% and 16.7% per year, respectively. 11 Whaley, R., 2000. The investor fear gauge. Journal of Portfolio Management. 12 Simon, D., 2003. The Nasdaq volatility index during and after the bubble. Journal of Derivatives 13 Hibbert, A., Daigler, R., and Dupoyet, B., 2008. A behavioural explanation for the negative asymmetric returnvolatility relation. Journal of Banking and Finance Equity Risk Premium | April 2012 22 | P a g e The following graphs compare returns from equity markets in the US and UK ten years subsequent to the start and end of recessionary periods from 1970 onwards. The X axis on the charts refers to the dates of negative GDP growth. Figure 14: US Annualized return - 10 years after end of recession 20.00% 20.0% 16.00% 15.0% 12.00% 10.0% 8.00% 5.0% 4.00% Annualized returns - 10 years from start of recession 0.0% 0.00% -5.0% 10 yrs from start of recession As can be seen from the graph above, the decade since the dot com crash has been a particularly bad one for equities. This is further evidenced by the negative historical equity risk premium over this period. Additionally, it is important to note that the equity return calculated from the start of the global financial crisis was -1.3% whilst the average annual return subsequent to the end of the recession was highly positive at around 15%. The S&P500 index was at its low at the end of the recession and since then has recovered quite well to produce a 15% average return. On the other hand, the returns from equities in the ten year periods following the three recessions prior to the dot com bubble have been reasonable – ranging from 8.04% to 12.04%. The same trend is noted when analysing returns from the start of those recessionary periods, with average returns ranging from 5.4% to 16.7%. The returns from Q4 2007 and Q2 2009 are to date. It is interesting to note that when returns are calculated from the start of the recession, equity markets have already fallen by quite a bit before the start of the recession, and therefore the returns from the start tend to be higher at times when compared with returns calculated from the end of the recession. This relates to the fact that the stock market is a leading indicator of the strength of the economy. Equity Risk Premium | April 2012 23 | P a g e Figure 15: UK Annualized return - 10 years after 16.00% 15.0% Annualized returns - 10 years from start of recession 10.0% 12.00% 5.0% 8.00% 4.00% 0.0% 0.00% -5.0% 10 yrs from start of recession In the UK, similar to the US, equity returns have usually been considerably high after the start and end of recessions with the exception of the period from Q1 2008 to present which produced an average annual return of negative 1.8% similar to that in the US equity market. Returns ranged from 7.96% to 13.84% for the 10 year periods after the recession whilst for the 10 year periods after the start of the recession, returns ranged from negative 1.8% to 11.9%. The returns after Q1 2008 and Q1 2009 are to date. The returns calculated from the start of the recession are higher due to the fact that equity markets have already fallen significantly by the time a recession starts. Thus, equity returns in the ten year period following recessions have been impressive, barring the last decade in the US and the UK. It must be noted that the period from 2000 onwards has been a period of very low returns for equities, giving rise to a negative historical equity risk premium since then. This is partially due to the fact that the dot com crash in 2000 and the credit crunch in 2008 were only a few years apart, and both resulted in large negative returns for equities. If equity market crashes continue to happen with greater frequency in the future, it will have significant implications for asset allocation decisions and a possible move away from equities and towards less volatile asset classes. Increasing correlations between markets From the analysis above, there have been two instances of very large equity market falls between 2000 and 2008. With the increasing use of technology, there have been suggestions that correlations between markets have increased and will continue to do so in the future. This also increases the probability of disasters occurring more frequently. Tapon and Sun (2006)14 support the above with the finding that correlations across equity markets increase during times of extreme stress or high volatility. In 2008, markets moved up and down 14 Yang, Li , Tapon, Francis and Sun, Yiguo, 2006, International correlations across stock markets and Equity Risk Premium | April 2012 24 | P a g e together, with emerging markets showing slightly more volatility. The chart below shows the movement of the major stock markets from 12th September 2008 to 16th October 2008. The implication of this is that there is a higher probability that the ERP in one country becomes more closely linked to the ERP in other closely linked countries. Figure 16: The Globalisation of Risk15 III. SURVEY ERP Damodaran (2012) looks at a range of surveys that have been conducted regarding the ERP. The Securities Industry Association16 surveyed individual investors between 1999 and 2004 on what they predicted stock and yield returns to be. The 2004 survey of 1500 U.S. investors implied a median ERP of 8.3% over Treasury Bonds. Merrill Lynch17 conducts a monthly global survey of over 300 institutional investors. Their January 2012 report showed an average expected ERP of 4.08% for the US. For most of 2010, the estimates lay between 3.85% and 3.90%. industries: trends and patterns 1988-2002, Applied Financial Economics. 15 Damodaran, A., 2012, Equity Risk Premium (ERP): Determinants, Estimation and Implications – The 2012 Edition, Stern School of Business. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2027211 16 Annual SIA Investor Survey http://www.sifma.org/uploadedfiles/research/surveys/2004investorsurvey.pdf 17 Merrill Lynch, http://www.ml.com/index.asp?id=7695_8137_47928. Equity Risk Premium | April 2012 25 | P a g e Graham and Harvey (2012) take a quarterly survey of US CFOs to estimate what the CFOs expect the ERP for the S&P 500 for the next ten years to be compared to the ten year bond rate. In March 2012 they found this estimate to be 4.48%, whereas in June 2010 this was much lower at 3%. The average estimated ERP for the 12 years of the survey is 3.45%; and there have been approximately 9000 responses. They have an average of 347 responses each quarter. Below is a graph of these CFO estimates from June 2000 (when it commenced) to Feb 2012. Figure 17: Graham and Harvey ERP estimates from CFOs18 Standard Deviation Average Premium Median Premium The CFO surveys show that the highest mean ERP (4.74%) was in February 2009, straight after crisis; and the lowest mean ERP (2.47%) was in September 2006. Two recession periods are covered by Graham and Harvey’s analysis- March 2001 to September 2001, and December 2007 to June 2009. As expected, their findings show the risk premium is higher during recession period compared to the following recovery period. They find the average risk premium to be 3.93% in recession periods and 3.27% in non-recession periods. Welch (2000)19 took a survey of 226 financial economists on what they thought the US ERP would be. The economists predicted an average arithmetic annual ERP of approximately 7% for a tenyear period. There is a large range in the survey that results from 2% to 13%. 18 Damodaran, A., 2012, Equity Risk Premium (ERP): Determinants, Estimation and Implications – The 2012 Edition, Stern School of Business. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2027211 (for graph) 19 Welch, I., 2000, Views of Financial Economists on the Equity Premium and on Professional Controversies, Journal of Business, v73, 501-537. Equity Risk Premium | April 2012 26 | P a g e Graham and Harvey report a 4.35% ERP for Q3 2000, this is 2.65% lower than the 7% reported by Welch (2000). Graham and Harvey’s respondents are providing a geometric mean, whereas Welch’s are providing an arithmetic mean- nonetheless the difference is large. Sörensson (2011)20 explains this difference may be due to the fact academics and CFOs use their ERP estimates for different purposes- in that for CFOs it is required for the hurdle rate whereas academics use it for research. Fernandez, Aguirreamalloa and Corres (2011)21 looked at the ERP estimates on the US economy by analysts, companies and academics. 3,768 participants provided them with exact ERP estimates that they were using in 2011 and they had 5,731 replies in total. The results were as follows: Table 7: Average ERP estimates 5.0% 5.6% 5.7% Analysts Companies Academics S.D in ERP estimates 1.1% 2.0% 1.6% The range of the estimates was 2% to 14.5%. They also did a survey22 of analysts, companies and academics in 56 countries and from over 3,500 responses they found that those surveyed in Emerging Markets had higher ERP estimates. Some of these results are shown below: Table 8: U.S. Spain U.K. Colombia Russia Brazil China India Taiwan Average ERP estimate 5.5% 5.9% 5.3% 7.5% 7.5% 7.7% 9.4% 8.5% 8.9% SD of ERP estimate 1.7% 1.6% 2.2% 4.3% 3.7% 4.6% 5.1% 2.8% 3.8% Number of answers 1503 930 112 38 37 35 31 28 17 Equity Risk premium in Emerging Markets vs. Developed Markets 20 Sörensson, T., 2011. The Equity Risk Premium on the Swedish Stock Market. Royal Institute of Technology Industrial Engineering and Management. http://www.nasdaqomx.com/digitalAssets/76/76005_theequityriskpremiumontheswedishstockmarket.pdf 21 Fernandez, P., J. Aguirreamalloa and L. Corres, 2011, Equity Premium used in 2011 for the USA by Analysts, Companies and Professors: A Survey, Working Paper, http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1805852&rec=1&srcabs=1822182 22 Fernandez, P., J. Aguirreamalloa and L. Corres, 2011, Market Risk Premium used in 56 countries in 2011, http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1822182 Equity Risk Premium | April 2012 27 | P a g e The equity risk premium in the emerging markets is notably higher than that of the developed markets. In addition, the difference in the equity returns between the two is of a more cyclical nature. Why the ERPs are dissimilar is usually addressed to the country risk premiums, which include an aggregate of other risk parameters. One of the basic reasons of this reality is that the survivorship bias is more stringent in the developed markets, so the companies with bad results or performance go out of the game more frequently or more harshly in these countries. This results with a relative underperformance of equities in the DM. In fact, since emerging markets are perceived to be more risky, one would expect a higher incentive for taking a position in these markets. Barry, Peavy and Rodriguez [1997] and Claessens, Dasgupta and Glen [1995] have shown that investing in emerging markets is beneficiary in a risk/return framework. Salomons and Grootveld did their analysis by using the MSCI indices for the EM. They evaluated US$ returns in developed and emerging market equity returns versus US$ risk-free rates of return. The annualized ERP of the G7 countries were calculated as 3.6 % from 1988 till 2011, whereas the annualized ERP of the selected EM countries were calculated as 12.7% over the entire sample. As seen, there is a huge difference in the equity risk premiums of the two samples. Following Jarque-Bera test, they have tested for non-normality and the test results confirmed that the observed equity premiums are nonnormally distributed. This is true for all individual G7 and emerging markets. So, one explanation between the differences in the ERP of the two is that investors exhibit decreasing absolute risk aversion; and they tend to have a preference for positive skewness. In addition to that, investors are rewarded with higher return, but if things go wrong, the damage can be severe and detrimental to performance. Hence, this pushes investors to demand more premium for the risky investments they have. Another explanation is that since EM countries are mostly export-oriented countries, their currencies are pretty sensitive on the exchange rate fluctuations. Therefore, their current account balances oscillate depending on the currency movements. This results with a certain premium demand by the investors to protect themselves against such risks. It is also observed that cyclical time varying behaviour exists in the emerging market ERP data, but cannot be claimed the presence of a structural break. The extent to which investors are rewarded in emerging markets tends to follow a pattern similar to the global business cycle. Added to this are the better growth rates emerging markets are likely to experience compared with the developed markets. Equity Risk Premium | April 2012 28 | P a g e IV. ALTERNATIVE PREMIUMS Ibbotson23 explains that the ERP can be estimated through many methods, including supply, demand, historical extrapolation, and a mixture of these. However, he emphasises that although ERP is the largest market premium it is not the only one that should be considered. These are company size, value, momentum, default risk, inflation risk and the liquidity premium (whereby less frequently traded stock provide significant returns in excess of more frequently traded stock). Ibbotson argues investors frequently do not differentiate between a short-term view of the ERP and the “true” more fundamental long-term supply-driven equilibrium. This implies that the low ERP of the past decade may not reflect the “true” long-run ERP. He states the need to look at not only the effects of the expected ERP on investor behaviour but also the effect of investor behaviour on the ERP value. The ERP could be heightened or lowered by factors such as transaction size, trade urgency, and additional asset holdings. 23 Hammond, P.B, Leibowitz, M.L and Siegel, L.B., 2011, Rethinking the Equity Risk Premium. http://www.cfapubs.org/doi/pdf/10.2469/rf.v2011.n4.full Equity Risk Premium | April 2012 29 | P a g e CONCLUSION Using the information stated in Damodaran (2012) as the main guideline, this paper focuses on analysing the historical, implied and surveyed equity risk, focusing predominantly on the US and the UK. We have used a geometrical mean analysis and also chosen 3-month and 15-to-20-year government bonds in our analysis. The stated long-term horizon should capture a long enough period to include a full business cycle and yet be short enough to capture changes over time. It is also in line with the corresponding 10 and 20 year Treasury notes, which are the most liquid and appropriate in terms of true pricing. In our analysis, we found that the longer term holding periods of 20 years, 25 years and 30 years have provided the highest returns. In addition, the risk (measured in annual volatility) is more ‘consistent’ for longer holding periods. In other words, the variation of the volatility is lower for longer holding periods. Estimating discount rates is a critical part for investors and companies. The standard approach based on risk-based pricing models, such as the CAPM, is to estimate equity returns based on a risk-free rate plus a risk premium. For conventional valuation purposes, it is well accepted that the risk free rate should be long term Treasury yields. Therefore, it is a better approach to focus on long term bonds in such an analysis. Historical time series analysis has been performed for both the US and the UK markets and future estimates forecasted. In the next 10 years; the ERP in the US over 3-month bills is forecasted to be approximately 5% and the UK over 3-month bills is forecasted to be approximately 3%. However, the US ERP over long-term notes and the UK ERP over gilts is forecasted to be approximately 3.5% - 4% and 2.5%-3% respectively. In comparison with the historical approach, we also analysed the implied risk premium for the US. The implied premium has historically been lower than the realised historical premium, however since 2008 this trend has reversed; the implied ERP has been higher than the realised ERP. The most likely reason for this is higher inflation expectations as a result of substantial liquidity in the financial markets and very low interest rates. With interest rates forecasted to be low in the US until growth reverts to long run averages, the implied premium in the US is more likely to be in the higher bound of its historical average. Also, the low, and sometimes negative, risk premium realised in the last fifteen years prompts investors to expect better returns in the future. The implied premium in the US is in line with that which we have forecasted using time series analysis. The implied premium also seems to be mean reverting when analysed from 1960 to present. Equity Risk Premium | April 2012 30 | P a g e We have explored the relationship between volatility and changes in the ERP as estimated in surveys. Harvey and Graham have shown that the ERP estimated by survey participants does indeed change as volatility changes. When volatility increases, the ERP estimated increases, as investors demand a higher risk premium to take on more risk. From an analysis of surveys conducted by various practitioners, we also found that the ERP estimates by practitioners in emerging markets are higher than those in developed markets. This is a finding that we expect given the higher expected growth in emerging markets. An analysis of returns after recessions both in the UK and the US led to the finding that returns after recessions have been quite strong after all of the recessions since the 1970s, except the dot com bubble. The main reason for this is that the decade since 2000 has been a bad one for equities in both countries. Additionally, the low return on equities also helps explain the negative equity risk premium since 2000. Though the historical evidence suggests strong returns on equities after recessions, this should not be taken to mean that returns will be strong going forward. The 2008 credit crisis followed soon after the dot com crash, resulting in low returns since 2000. If this were to happen again, which is likely given how closely linked equity markets have become; it is therefore difficult to draw a definite conclusion on the ERP. Equity Risk Premium | April 2012 31 | P a g e DISCLAIMER This work has been undertaken as part of a student educational project and the material should be viewed in this context. The work does not constitute professional advice and no warranties are made regarding the information presented. The Authors, Judge Business School and its Faculty do not accept any liability for the consequences of any action taken a result of the work or any recommendations made or inferred. Equity Risk Premium | April 2012 32 | P a g e REFERENCES Annual SIA Investor Survey http://www.sifma.org/uploadedfiles/research/surveys/2004investorsurvey.pdf Credit Suisse Global Investment Returns Yearbook 2011, Research Institute. https://infocus.creditsuisse.com/app/_customtags/download_tracker.cfm?dom=infocus.creditsuisse.com&doc=/data/_product_documents/_shop/300847/credit_suisse_global_investment_yearboo k_2011.pdf&ts=20110324030332 Damodaran, A., 2012, Equity Risk Premium (ERP): Determinants, Estimation and Implications – The 2012 Edition, Stern School of Business. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2027211 Dimson, E., Marsh, P. and Staunton, M., 2011, Equity Premia Around the World, Working Paper Series. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1940165&rec=1&srcabs=1928764 Fernandez, P., J. Aguirreamalloa and L. Corres, 2011, Equity Premium used in 2011 for the USA by Analysts, Companies and Professors: A Survey, Working Paper, http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1805852&rec=1&srcabs=1822182 Fernandez, P., J. Aguirreamalloa and L. Corres, 2011, Market Risk Premium used in 56 countries in 2011, http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1822182 Frank N., González-Hermosillo B., and Hesse H., Transmission of Liquidity Shocks: Evidence from the 2007 Subprime Crisis http://www.imf.org/external/pubs/ft/wp/2008/wp08200.pdf Graham, J.R. and C.R. Harvey, 2012, The Equity Risk Premium in 2012, Working paper, http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2020091 Hammond, P.B, Leibowitz, M.L and Siegel, L.B., 2011, Rethinking the Equity Risk Premium. http://www.cfapubs.org/doi/pdf/10.2469/rf.v2011.n4.full Hibbert, A., Daigler, R., and Dupoyet, B., 2008. A behavioural explanation for the negative asymmetric return-volatility relation. Journal of Banking and Finance. Ibbotson’s Answer http://corporate.morningstar.com/ib/documents/MethodologyDocuments/IBBAssociates/IntnlRiskPrem ium.pdf Ibbotson Stocks, Bonds, Bills and Inflation Yearbook (SBBI), 2011 Edition, Morningstar. Merrill Lynch, http://www.ml.com/index.asp?id=7695_8137_47928 Salomons R. and Grootveld H., The Equity Risk premium: Emerging vs. Developed Markets http://som.eldoc.ub.rug.nl/FILES/reports/themeE/2002/02E45/02e45.pdf Simon, D., 2003. The Nasdaq volatility index during and after the bubble. Journal of Derivatives. Equity Risk Premium | April 2012 33 | P a g e Sörensson, T., 2011. The Equity Risk Premium on the Swedish Stock Market. Royal Institute of Technology Industrial Engineering and Management. http://www.nasdaqomx.com/digitalAssets/76/76005_theequityriskpremiumontheswedishstockmarket. pdf Welch, I., 2000, Views of Financial Economists on the Equity Premium and on Professional Controversies, Journal of Business, v73, 501-537. Whaley, R., 2000. The investor fear gauge. Journal of Portfolio Management. Yang, Li , Tapon, Francis and Sun, Yiguo, 2006, International correlations across stock markets and industries: trends and patterns 1988-2002, Applied Financial Economics. Equity Risk Premium | April 2012 34 | P a g e APPENDICES Table 8: US ERP prediction and forecast error LTUSERP prediction (%) 3.733567 3.870634 4.119995 3.327043 3.494575 3.714211 3.80142 3.993312 3.591313 3.949953 LTUSERP forecast error (%) 2.711981 3.021479 3.073603 3.084789 3.084841 3.084851 3.082842 3.084853 3.084493 3.084853 STUSERP prediction (%) 5.256571 3.620945 4.920433 4.920433 4.920433 4.920433 4.920433 4.920433 4.920433 4.920433 STUSERP forecast error (%) 4.673868 6.373699 8.004885 8.054986 8.071617 8.088214 8.02162 8.104777 8.03832 8.121306 2.781716 2.913495 LTUKERP forecast error (%) 2.277771 2.650529 2.716335 2.800148 2.898781 3.021784 2.715553 3.158966 2.737228 3.302983 STUKERP prediction (%) 0.3661931 0.1735456 0.0920314 0.0575406 0.0429466 0.0367715 0.0341586 0.0330531 0.0325853 0.0323873 STUKERP forecast error (%) 2.711981 3.021479 3.073603 3.084789 3.084841 3.084851 3.082842 3.084853 3.084493 3.084853 Table 9: UK ERP prediction and forecast error LTUKERP prediction (%) 2.560748 2.39013 2.578857 2.833793 2.867697 2.889769 2.701725 2.904139 Figure 15: Plots of US ERP and riskless asset yields Figure 16: Plots of S&P500 returns and riskless asset returns Equity Risk Premium | April 2012 35 | P a g e Figure 17: Plots of UK ERP and riskless asset yields Figure 18: Plots of FTSE returns and riskless asset returns Figure 19:Country-Specific Equity Risk Premium Over 10 to 112 years (Source: CS Global Investment Yearbook) United States Equity Risk Premium | April 2012 Canada 36 | P a g e United Kingdom Germany Japan South Africa Equity Risk Premium | April 2012 37 | P a g e