The SIMPLE Tax

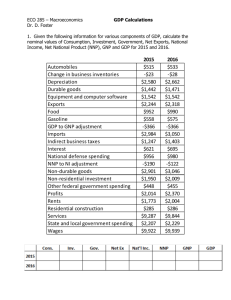

advertisement

The BEST Tax (The Broad Economic Simplification Tax Plan) Presented by David R. Burton Partner, The Argus Group Senior Fellow, Free Enterprise Fund 46 S. Glebe Road, Suite 101 Arlington, VA 22204 703-521-3900 Overview The BEST Tax would repeal: the individual income tax, the corporate income tax, and the estate and gift tax. The BEST Tax would replace those taxes with: A national sales tax, and A business transfer tax. The BEST Tax would protect poor and lower middle income taxpayers with rebates, paid in advance, of sales tax paid on spending up to the poverty level. The National Sales Tax Component The national sales tax component would: Tax all purchases of goods and services when sold to consumers for the first time. Avoid cascading and hidden taxes by not taxing business inputs and investment. Include a rebate to protect all Americans from sales tax on essential goods and services. Treat all education and job training expenditures as an investment in human capital. The BTT Component The business transfer tax (BTT) component would: Tax gross receipts from the sale of goods and services. Allow business to deduct the cost of purchasing goods and services from other businesses; capital investment is therefore expensed. Exclude gross receipts from export sales from the taxable base. Impose a border adjustment on imports. The Tax Base • Both the BTT and the sales tax are: destination principle consumption taxes; neutral between savings and consumption; neutral among types of investment; neutral between capital and labor; and neutral between foreign-produced and U.S. produced goods and services. Comparison to Current Tax Base The current income tax: is an origin principle tax, encouraging businesses to locate production outside of the U.S. and providing to foreign firms a relative advantage in the U.S. market and abroad. taxes on a world-wide basis, which encourages production and corporate headquarters to leave the U.S. is biased against savings and investment and in favor of consumption. treats different types of investment and business activity very differently, which is both unfair and economically damaging. Tax Rates Over the period 2000-2004, the BEST Tax would be revenue neutral with: a sales tax rate of 8.4 percent; and a business transfer tax of 8.4 percent. Note: These figures were developed by Fiscal Associates using Joint Committee on Taxation methodology. In the real world, the required tax rates would be lower due to growth effects. The BTT tax rate is tax inclusive; sales tax rate is tax exclusive. Economic Growth • The BEST tax plan would be extremely pro growth. • Lower marginal tax rates and a neutral tax base will increase work, savings, investment. • Higher investment would yield higher productivity, lower costs and higher output which in turn will increase employment, wages and consumption. • A level international playing field will increase U.S. business activity. Corporate headquarters would come to the U.S. (or stay) because the system is territorial; production would come to the U.S. (or stay) because the system is destination principle (i.e. border adjusted). • The most attractive investment climate in the developed world will draw capital from throughout the world. • The BEST plan can be expected to increase GDP and wages by 10 to 15 percent over baseline within the first decade (based on work by Kotlikoff, Jorgenson, Robbins and others). The Current Tax System Harms Competitiveness • The current tax system imposes a heavy tax on U.S. producers, whether their goods are sold in the U.S. or abroad. • The current tax system effectively imposes no tax burden on foreign producers. • All other OECD countries collect a large proportion of their revenue from destination principle taxes that abate taxes on their exports and impose taxes on U.S. goods entering their country. • U.S. corporate tax rates are among the highest in the world. • U.S. capital recovery allowances are inadequate. • The taxation of world-wide income places U.S. firms at a competitive disadvantage. • The BEST tax plan would address all of these problems. Evidence of Declining Competitiveness • Manufacturing as a share of the economy has fallen dramatically and continues to fall (from 25 percent in 1970 to less than 13 percent now). • Manufacturing employment has fallen to only about 10 percent of the total. • The merchandise trade deficit is nearly six percent of GDP. • The capital surplus is NOT being used to fund investment but to fund current consumption. • The U.S. is mortgaging its future. Manufacturing as a Share of the Overall Economy 35% 30% % of GDP 25% 20% 15% 10% 5% 0% 1947 1952 1957 1962 1967 1972 1977 1982 1987 1992 1997 2002 Year Source: Calculations using NIPA data. U.S. Investment and International Capital Inflow 20.0% % of GDP 15.0% Private fixed investment as % GDP Capital surplus as % GDP 10.0% 5.0% 1997 1987 1977 1967 1957 1947 0.0% -5.0% Year Source: Calculations using NIPA data Jobs and Wages The BEST Tax plan will: • Create more jobs and increase wages by increasing the capital per worker, by enhancing productivity, by making the economy more efficient and by eliminating the tax bias against U.S. workers and U.S. producers inherent in the current system. • Reverse the decline in high-paying manufacturing jobs. • Reverse the outsourcing of service sector employment. The Sales Tax Rebate The annual sales tax rebate is equal to the sales tax rate times the HHS poverty level. It will be provided monthly, in advance through withholding table adjustments for employees, through benefit check adjustments for retirees and through direct payments to others. There is an extra amount for married couples to prevent a marriage penalty. Annual Consumption Spending That is Tax Free Due to Rebate Household Size Unmarried Married One $9,570 n.a. Two $12,830 $19,140 Three $16,090 $22,400 Four $19,350 $25,660 Fairness • All Americans can consume essential goods and services free of consumption tax. • The BEST plan exempts the poor from the sales tax and reduces the tax burden on the lower middle class. • The BEST tax dramatically reduces the marginal tax rates on the working poor and the lower middle class (especially for those in the EITC phase-out range). • The BEST tax is progressive. • The BEST tax will improve the material well-being of virtually all Americans. • The BEST tax will increase upward mobility. • The BEST plan taxes people based on what they use for themselves, not what they contribute to society. Effective Tax Rate by Consumption Class (Married Couple, Two Children) Simplicity and Compliance Costs • Unlike the complex morass that is the Internal Revenue Code, the BEST plan is simple. • Only businesses need to file a tax return. • Individuals file a one page form indicating who lives in their household and their Social Security number(s). • Sales tax returns will reflect sales to consumers. • Business transfer tax returns will reflect information that all businesses must keep in the ordinary course of business. • Compliance costs will drop dramatically. • The BEST plan reimburses businesses (1/4 of one percent of taxes collected) for the cost of compliance. • The policy goals of tax preferences are best handled by spending programs. Intrusiveness and Privacy • Under the income tax we must report a great deal of private information to the federal government, including how much we earn and from what sources, what charities we support, what property we own, where we invest, our medical expenses and so on. • Under the BEST plan, there is no need to report anything to the federal government unless you are in business. Housing • Housing will become more affordable under the BEST tax. • Mortgage interest will be paid from pre-tax income by everyone (which is the result that the current mortgage interest deduction achieves for itemizers). • Interest rates should fall toward the tax-exempt bond rate since interest is neither taxable nor deductible. • Landlords of rental real estate will be able to expense their structures. Charities and Charitable Giving • The BEST tax would reduce the cost of charitable giving because all taxpayers would be able to give to their favorite charity free of any tax. • Today, only itemizers are able to make gifts from pre-tax dollars and over 70 percent of taxpayers do not itemize. • Giving tends to be most responsive to income, staying relatively stable as a percentage of income. Under the BEST tax, incomes will grow dramatically. Thus, so will giving. • The BTT would allow businesses to deduct charitable giving. Conclusion The BEST tax plan offers a plan that can achieve wide public acceptance and will: • promote economic growth and higher wages by reducing the bias against work, savings and investment; • place U.S. workers and businesses on an equal footing with their foreign competitors; • be fair; • be simple; and • be transparent and understandable. Appendix Education • The BEST tax treats education as a human capital investment and does not subject tuition to sales tax or the government consumption tax. Health Care • There is no special treatment for health care expenses. • One of the major contributing factors to our spiraling health care inflation is the tax system because it provides a major incentive for employers to purchase health insurance on behalf of employees. • Employer-provided health insurance means that those using or providing health care services (doctors and patients) have virtually no incentive to economize. Social Security • The BEST tax does not change Social Security benefits, social security payroll taxes or the Social Security trust funds. • Social Security benefits would no longer be subject to income tax. • Most seniors would find the rebate protects a large proportion of their spending from tax. • Benefits would be indexed on a sales tax inclusive basis. Government • The BEST tax taxes government consumption. • It is important that government consumption (e.g. government provided trash collection, health clubs, electricity, etc.) are taxed so that consuming through government is not tax preferred. • Government enterprises are taxed like businesses. Transition • In the case of the sales tax, relatively few transition rules are necessary. The BEST tax provides for a transition rule for inventory held on the changeover date. This inventory will not have been deducted for income tax purposes (i.e. will have been acquired with after-tax dollars) but will be subject to sales tax. To prevent double tax, a sales tax credit is provided. • In the case of the BTT, allowances are made for deducting unrecovered basis in equipment, structures and inventory by placing the basis in three pools roughly corresponding to the period over which it would have been recovered under the income tax and deducting it on a straight-line basis. • There may be a few other areas where transition rules are appropriate. However, these rules may be funded by taxing those on the opposite side of the transaction who are experiencing a windfall gain. Administration • The BEST plan will be much easier to administer. • Audits will be dramatically less complex; thus a given amount of enforcement resources will enable more audits to be conducted. • Major sources of complexity will disappear (e.g. qualified pension plans, employee benefit rules, uniform capitalization rules, inventory accounting, capital cost recovery and recapture, the taxation of financial transactions, income sourcing and expense allocation rules, controlled foreign corporation rules, tax-free exchanges, tax-motivated estate planning, etc.). • States have the most expertise administering a sales tax and will be afforded the opportunity to administer the federal sales tax for a fee. Fiscal Federalism • The federal sales tax and business tax base are likely to serve a harmonizing function. • In both cases, the federal tax base is broader than current state taxes, so state tax rates can come down. • Most states would probably give up the income tax. • Under the BEST tax, states with conforming tax bases would be able to tax inbound internet or direct mail sales. Evasion and Avoidance • Research indicates that evasion is primarily a function of the tax rate (the benefit from cheating) and the likelihood of getting caught. • The BEST plan would substantially reduce marginal tax rates (reducing the benefit from cheating). • The BEST plan would dramatically increase the chance of getting caught since audit rates would increase if enforcement spending is held constant. • Thus, evasion will go down. • Lawful avoidance will decline since sheltering opportunities have largely been eliminating. End of Appendix