Benefit - All Financials

advertisement

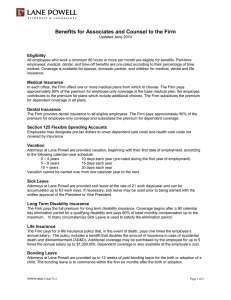

Income Protection Presentation for All Financials August 2007 What is your largest financial asset? Is it your home? Is it your business? Your Income is an Asset... Annual salary of €60,000, aged 40 –Earnings to retirement = €2.1M *Based on retirement age of 65 Creating the Need … who will pay all these bills ? VHI/ BUPA Clothing Insurances Entertainment Light & Heat Mortgage SOCIAL WELFARE SALARY €185pw Food Child-care Car Loan Holidays Life Cover Savings & Investments The Big Drop €40,000 €14,000 €0 Income Protection - Product Review Policy that pays you an income if you’re out of work for more than 13, 26, or 52 weeks If you can’t do your own occupation Premiums are guaranteed Full tax relief on premiums at marginal rate Pay out in 90% of claims Hospital Cash after 8th day Premium depends on …. - Guaranteed (exclusive to FF) Reviewable - 5th anniversary & every 5th after that Level or Indexing options Occupational Class e.g. • 1 Office worker • 2 Salesperson – driving • 3 Vet • 4 Carpenter Length of deferred period - 13, 26 or 52 weeks Ceasing age - 55, 60 or 65 Examples Of Occupation Classes Class 1 Class 2 Class 3 Class 4 Accountant Dentist Driving Examiner Bar Person Office Worker Estate Agent Baker Mechanic Doctor Insurance Broker Social Worker Carpenter Cashier Restaurateur Tiler – Floor & Walls Builder Occupations The cost options: Gold: Deferred 13 weeks, ceasing age 65, indexing Silver: Deferred 26 weeks, ceasing age 60, indexing Bronze: Deferred 52 weeks, ceasing age 60, no indexation Peace of mind …. Guaranteed premiums Help to get back to work if you need it – Rehabilitation Benefit – Proportionate Benefit – Linked Claims – Health Claims Service Ability to increase your level of cover by 30% every 3 years - Guaranteed Increase Option Changing Occupation Benefit Limits Min SA €100 p.w., Max €3,365 p.w. (€175,000 p.a.) Increases to €4,080 p.w. (€250,000 p.a.) for “special occupations” Calculation of benefit: – 75% of income, less single person’s social welfare amount (€9,622 per annum) Max Benefit Calculation • 75% of first €125,000 plus 33% of balance to maximum of €175,000 • less state single person disability benefit • less any continuing income Position the cover “Deluxe” cover - not everyone can get it Depends on your occupation, health history It will never happen to me ... Likelihood of long term absence is twice as high as likelihood of critical illness Average claim payment is for 5.5 years Longest claimant - 27 years (still paying) Claims currently being paid …... Policy Start Date 26-Apr-81 28-Feb-88 16-Dec-94 09-Dec-93 08-Dec-99 11-Jun-99 Claim Started Age claim started 07-Jul-87 42 24-May-94 40 29-Feb-00 52 06-Jul-01 36 09-Feb-01 44 01-May-03 39 Occupation Accountant Butcher Engineer Radiographer Insurance boker Sales Director Cause of claim Benefit Paid to Date Cardiomvopathy €120,000 Rheumatiod Arthritis €125,000 Brain Haemorrhage €59,400 Manic Depression €48,400 Cancer €60,000 Multiple Sclerosis €28,000 Value for Money Cost versus Benefit Male Age 31 n.b, to age 65, Class 2, Deferred Period 26 weeks, premium and benefit escalation Benefit: €20,800 p.a. (€400 p.w.) Gross premium €47.42 p.m. Net premium €27.50 p.m. Company Directors Company pays the premium - its free for the client Tax relief for the company, treated as company expense - reduce the company’s tax bill No BIK Pension contribution protection so can have more than 75% of salary covered, up to €40k p.a. The Business Owner Company Directors can take out Executive Income Protection - company pays the premium Position as business insurance - necessary business expense If out of work for medium period - need to ensure the business is still there is come back to Can cover net profit amount to ensure own salary drawings are covered, plus money to keep business going If business ultimately needs to be sold, then profit made from this does not effect claim payment