ACCT11059 ASS3 S0241057 Helen Bensilum

advertisement

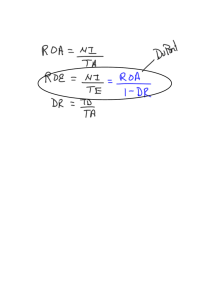

Name: Helen Bensilum Student Number: S0241057 Program: Using Accounting for Decision Making Course Code: ACCT11059 Assignment: Assignment Stage 3 (ASS#3): Restated financial statements Topic: The third of the course’s major assignments which explores the financial statement items, demonstrates required ratios calculated from the financial statements and the restated financial statements, provides an example of a capital investment decision for Spark NZ and demonstrates interaction with others in the course. Word Count: 6777 Lecturer: Martin Turner Date Due: 11.00 am Monday 8 June 2015 Step 1 Ratio Analysis The ratios requested have been calculated and an attempt to analyse these is set out below. Net Profit Margin Ratio Net Profit Margin Net profit after tax/sales 12.4% 6.3% 24.0% 1.4% Figure 1: calculated Net Profit Margins 2014 - 2011, Spark NZ Figure 1 above of the Net Profit Margin shows the relationship between the net profit after tax and the sales (revenue) earned. There is considerable variation from year to year. In 2014, for every dollar that Spark NZ earned the firm kept 12.4 cents while in 2013, the firm only retained 6.3 cents of every dollar earned. Operating revenues and other gains 3,638 3,735 4,576 5,004 Figure 2: Operating revenues and other gains 2014 - 2011,Spark NZ It is interesting to note the actual revenues, shown in Figure 2 above, that Spark NZ recorded each year and notice that higher revenue does not automatically result in a higher profit. So I am wondering what the main influence on the profitability was each year. 2011 – A low finance income ($15m) with a high finance expense ($152m) and high depreciation and amortisation amounts increased the expenses significantly. Without the earnings from a discontinued operation ($245m) the Telecom firm would have recorded a net loss and the profit margin would have been -3.4%. Interestingly the firm did not record a tax expense in this year compared to the other years where there was a large tax expense. 2012 – Income from a discontinued operation ($846m) caused a substantial increase in the profitability and removing this income shows a profit margin of just 5.6%. 2013 – A loss ($32m) on a discontinued operation and high expenses kept the profit margin at 6.3% 2014 – Income from a discontinued operation ($137m) coupled with reduced expenses helped the firm to record an improved profitability. The firm has reduced the operating expenses by $159m through its turnaround programme which has focused on operational efficiencies in the areas of labour and procurement costs while increasing business momentum. A look at the annual reports, general media, social media and the firm’s new website shows a rebranded, modern and upbeat image ready to secure the growing market share of customers seeking convenient, easy communication solutions. Maturing debt has been replaced with lower cost debt also. The influence of the discontinued operations can influence the net profit margin substantially. It can be seen that the board had to make some decisions about the direction of the firm and which operations to keep and which to sell. The opportunity to secure debt at lower cost has also helped to improve the situation. The overall trend of the net profit margin does point to the profitability improving when the discontinued operations are removed. Return on Assets Ratio Return on Assets Net profit after tax/total assets 13.9% 6.7% 29.9% 1.1% Figure 3: Return on Assets 2014-2011, Spark NZ Helen Bensilum S0241057 Page 2 of 6 ACCT11059 Figure 3 above of the Return on Assets shows the relationship between the value of the assets and the net profit after tax. This ratio highlights how efficiently the assets are being used to generate profit; how many dollars the firm keeps after expenses for every dollar invested into assets. Like the net profit margin there is considerable variability in the results for Spark NZ. Total assets 3,243 3,493 3,667 6,392 Figure 4: Total assets 2014-2011, Spark NZ Figure 4 above shows that the total assets have been similar for the previous three years while 2011 had a higher value of assets. The high expenses in 2011 resulted in a low profit margin and it can be seen that there was limited efficient use of the assets to create value. The firm has sought to turn the situation around and by 2014 it can has demonstrated that the company strategy is working. Removing the discontinued operations shows a steady increase in the ratio from 2.7% in 2011 to 6.9% to 7.7% to 9.8% in 2014. The 2012 result stands out as unusual and is impacted greatly by the large dollar sale recorded of a discontinued operation. Total Asset Turnover Ratio Total Asset Turnover Ratio Sales/total assets 1.12 1.07 1.25 0.78 Figure 5: Total Asset Turnover Ratio 2014-2011, Spark NZ The total asset turnover ratio shown in figure 5 above demonstrates the amount of revenue earned for every dollar invested into assets. It can be seen that there has been some improvement from 2011. Given Spark NZ is a utilities company and has a large asset base the 2014 result would be viewed favourably and shows the sale of some subsidiaries has been beneficial in assisting with increased return on investment. Figure 6 below shows the total assets and revenues and how much reduction has occurred in both areas which are due to the streamlining of the firm’s operations. Given the improvements in the profitability ratios and the efficiency of the asset turnover it appears the business restructuring plan is working positively. Total assets Operating revenues and other gains 3,243 3,493 3,667 6,392 3,638 3,735 4,576 5,004 Figure 6: Total assets and Revenues 2014-2011, Spark NZ Current Ratio Current Ratio Current assets/current liabilities 1.09 0.77 0.81 0.67 Figure 7: Current ratio 2014-2011, Spark NZ The current ratio looks at the solvency of the business; can it pay its liabilities in the short term. Figure 7 above shows that Spark NZ has not been financially healthy in this area during past years and investors would be relieved to see the positive result posted for 2014 of $1.09 available to pay current debt. The firm has reduced the current liabilities significantly through the sale of some subsidiaries placing the firm in a better position to meet liabilities as they fall due. The annual report does however defend the past liquidity stating that, “positive operating cashflows enabled working capital to be managed to meet short-term liabilities as they fell due” (Spark NZ 2014 Annual report p.36). Financial structure ratio Debt/Equity Ratio Equity Ratio Debt Ratio Helen Bensilum S0241057 Debt/equity Equity/total assets Total liabilities/total assets 89.9% 52.7% 47.33% 147.2% 40.5% 59.55% 125.5% 44.3% 55.66% 176.6% 36.2% 63.85% Page 3 of 6 ACCT11059 Figure 8: Financial structure ratios 2014-2011, Spark NZ Figure 8 above shows the three required financial structure ratios. Firstly there is the debt to equity ratio. A high result here shows that a lot of funds have been borrowed to enable capital investment rather than equity funds. This increases the risk if the firm cannot handle the debt. From an investor perspective a high debt/equity is of concern if the firm cannot meet its obligations as creditors receive payment before equity holders. It can be seen that Spark NZ has reduced the debt/equity ratio considerably and this has occurred due to the restructuring of debt and sale of some subsidiaries. Telecoms require large capital outlays and therefore a high result here is not unusual in this industry. The equity and debt ratios show the relationship between debt and equity funding; how much capital comes from debt funding and how much capital comes from the equity holders. It can be seen that in 2014 Spark NZ had a little more funding sourced internally through equity holders. Viewing the previous years there is a positive trend of movement towards more internal funding. Market ratios Earnings per Share (EPS) Dividends per Share (DPS) Price Earnings Ratio Net profit after tax/nos of issued ordinary shares Dividends/number of issued ordinary shares Market price per share/earnings per share 0.25 0.13 0.59 0.04 (0.16) (0.19) (0.19) (0.17) 9.26 14.29 3.22 31.12 Figure 9: Market ratios 2014-2011, Spark NZ Market ratios look at how the firm is viewed in the market place and how much the investors are receiving. Figure 9 above starts with the earnings per share ratio which divides the net profit after tax by the number of shares on issue at the balance date. Spark NZ has had some variance here. A large profit recorded in 2012 due to funds from the sale of a discontinued operation has distorted the actual improvement the firm has made towards returning more value per share on issue. Without the revenue of $846m from the sale of discontinued operations the earnings per share for 2012 would have be 0.14. Shareholders were possibly dissatisfied with their investment in 2011 due to low earning per share and the results to 2014 show that streamlining the business activities by ensuring the correct business and product mix produces better results. Dividends per share have remained fairly constant and retaining funds to enable internal funding for projects has realized the improved financial health of the Spark NZ. The price earnings ratio (P/E) for telecommunications industry is generally high because people believe in the ability of the company to be able to generate economic growth. In 2011, Spark NZ had a high P/E ratio. The decline in 2012 can be attributed to the impact of the large discontinued operations sale. The market share price for this year still increased but the earnings per share was inflated by the additional revenue from the sale of discontinued operations. With this revenue removed the P/E would have been 13.93. It can be seen that the investor confidence in the firm to produce growth in the sector has waned with the decreasing P/E ratio. Perhaps this trend will change in coming years as the firm gains market share and improves the financial stability. Helen Bensilum S0241057 Page 4 of 6 ACCT11059 Return on Equity (ROE) Return on Net Operating Assets (RNOA) Net Borrowing Cost (NBC) Profit Margin (PM) Asset Turnover (ATO) Economic profit Comprehensive Income/shareholders' equity Operating income after tax (OI)/net operating assets (NOA) Net fin. expenses after tax/net financial obligations Operating income after tax (OI)/sales 26.46% 16.56% 67.53% 3.12% 20.83% 11.52% 46.63% 5.50% -4.99% -3.74% -11.91% -7.72% 13.26% 7.18% 26.54% 5.27% Sales/net operating assets (NOA) (RNOA - cost of capital) x net operating assets (NOA) 1.57 48.2 1.60 26.8 1.76 121.5 1.04 26.4 Figure 10: Ratios based on reformulated financial statements 2014-2011, Spark NZ Figure 10 above displays the results of the ratios calculated from the restated financial statements. The return on equity (ROE) shows that 26.46% of the shareholders equity for 2014 was from the comprehensive income for that year. The 2012 result is impacted by the large dollar value of discontinued operations while the 2011 result is low because of high finance costs. The ≈10% increase in the 2014 result compared to 2013 can be attributed to revenue from discontinued operations and some decrease in operational expenses. Return on net operating assets (RNOA) was low in 2011 and it seems the alarm bells were ringing that some restructuring was needed to return this firm to solid growth. The RNOA for 2012 was impacted by the large dollar value of discontinued operations. The removal of this revenue amount reduces the RNOA for 2012 to 14.5%. By 2014 the RNOA has increased and this is due to the restricting of the firm’s activities through considering which subsidiaries and activities to focus on. Net borrowing costs (NBC) represent how much it is costing to fund the financial obligations. In 2011 Spark NZ had high financial obligations, earned a low interest income and paid high finance costs. In 2012, the firm reduced its financial obligations but continued to pay high financial costs. By 2013 the firm had reduced the financial obligations and was restructuring debt with lower finance costs. It carried less debt and therefore less risk which improved the ability to negotiate funding at better terms. In 2014 the NBC was 4.99% and appeared more stable beside the 2013 rate. Profit margin (PM) has been calculated from the restated financial statements as a relationship between operating income after tax and sales. In figure 11 below it can be seen that the net profit margin calculated from the original statements is similar to the PM calculated from the restated statements for most years. The 2011 shows a large difference and this is due to the issues the firm had with debt. The firm was still able to produce good operating results but was carrying a lot of debt and therefore finance costs were increasing which inhibited the financial health of the firm. The restructure of the firm through selling some subsidiaries, lowering debt levels and having the opportunity to seek improved funding terms has increased the stability of the firm. Net Profit Margin Net profit after tax/sales Profit Margin (PM) Operating income after tax (OI)/sales 12.4% 6.3% 24.0% 1.4% 13.26% 7.18% 26.54% 5.27% Figure 11: Profit margin compared between original statements and restated statements 2014-2011, Spark NZ Helen Bensilum S0241057 Page 5 of 6 ACCT11059 Step 2 Helen Bensilum S0241057 Page 6 of 6 ACCT11059