Individual Services

advertisement

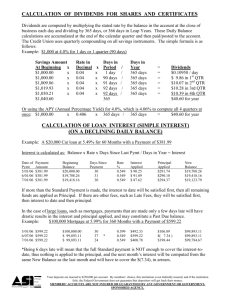

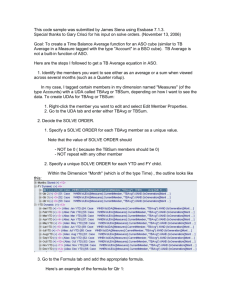

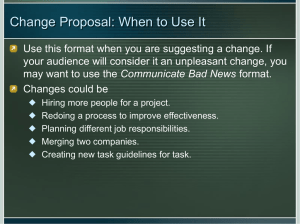

Telanetix Corporation (OTC BB: TNXI) Corporate Presentation October 2009 Safe Harbor Statement This presentation includes forward-looking statements regarding Telanetix’s business, financial condition, products, competition, technology, customers and prospects that are subject to various risks and uncertainties that may cause actual results to differ materially from those referred to in the forward-looking statements. The forward-looking statements made in this presentation are based on information known to us today and we do not undertake any obligation to update them. We refer you to Telanetix's periodic filings with the Securities and Exchange Commission, including our most recent Form 10-K and Form 10-Q. These documents describe important risk factors that could cause actual results to differ materially from those contained in our projections and other forwardlooking statements. An Historic Shift: Communication is moving from Hardware to Software Paradigm Shift HARDWIRED Into the Devices and the Network SOFTWARE-BASED Flexible Devices, Separation from the Network SMB Segment Spend Paying Too Much for a Solution that Doesn’t Fit Their Needs cBeyond • Lock-in model of Long Term Contracts • High Cost Features • Directory Assistance = $1.99/call • International Calling = $1.49/min • International Roaming = $1.29/min • Minimal Service Feature Innovation • Complex Purchase Process $37 Billion Paradigm Change Disrupting the Business Communications Industry App or Service Provider Data Pipe Provider (DSL, Broadband, Wireless) Separation of the “Pipe” from the Application/Service allows • Reduced Cost • Enhance Features/Functionality • Greater Service Flexibility • Simplified Implementation Disrupting Distribution Current Indirect Model 1 of 10,000+ Regional Telco Agents SMB Market Purchase/Implementation Time: Weeks Disruptive Direct Model National Coverage Simple Internet Ordering Purchase/Implementation Time: Days SMB Market Business Voice Market Over 25 Million Businesses in the U.S. Number Of Businesses In Each Segment (US) • SIP Trunking • Individual Services • SIP Trunking • DPS • Individual Services Hosted Market Opportunity 23 Million U.S. Businesses Have Less Than 50 Employees • Key Purchasing Criteria = Hosted Voice Services – Does this save us money? – Is it simple to buy, install and use? (normally small or no IT dept.) – Is feature rich? – And, I need great support • Hosted Digital Phone Service – 25% of 23M SMB’s @ $200/mo = $1.15 Billion/Month – Monthly recurring market opportunity – Just 25% represents a $12 billion annual market opportunity Our Product Offerings • • SIP Trunking: • Digital Phone Service: • Individual Services: The •Best FitDial Tone • Launched in 2008to Acquire, Implement VoIP • Virtual attendant • Easiest and Use works “with” existing network or voice solutions • VoIP Dial Technology Tone on design is premised• onConferencing for existing voice “ease of use” Fortune 100 features your existing network service • Find me/ follow me # • Business Phone • Up market • Low Cost Provider • Toll free number Advantage System solution • Voicemail & Fax Technology ownership – we provide applications ( SaaS margins) • SMB focus Key Channel Partners 76% Of Sales Are Made On One Of Our 18 Websites Our Value Proposition (SMB Example: 3 Phones + 3 Lines for 1 Year) Hosted VoIP Solutions Traditional Business Voice • Hardware – $1,500 upfront for 3 business phone systems • Installer (Indep. Telco Agent) – $1,000 upfront installation – $100 per year maintenance • Phone Service • Telanetix Digital Phone Service – Bundled package includes: – 3 business phones – 3 lines – No installation necessary – Full PBX feature set – Product support Total cost = $1,800 – $50+ per line per month Total cost = $4,400 60% COST SAVINGS Competitive Advantage Simple Hosted 8x8 Bundlers Simplicity Comcast Telanetix Emerging Private Co. cBeyond Carriers Premise Equipment Qwest Verizon AT&T Talkswitch Sprint Avaya Complex High Cost Low Sales/Growth Strategy Investing For Growth In Hosted VoIP Solutions • Increased Channel reach and Web/Marketing – Just beginning to ramp advertising to reach the market – With Internet advertising, clear ROI on dollars spent – Increasing each quarter • Leveraging Brand Power and Exclusivity – Costco: “Business Phone Services” – Office Depot Click Through Rate: 2.1% (varies by product/campaign) – High channel loyalty/ long standing relationships • Inorganic growth – New entrants and complimentary services Company overview and Financials Company Overview Hosted VoIP Solutions For Business Communication • • • • • Founded: 2001 Public: 2006 (reverse merger) Acquisition: AccessLine, 2007 Customers Lines: 77,000 + Business Segment: • • • • • • • • • • Revenues: $32.6M • Voice: $26.1M • Video: $6.5M Gross Profit Margins: 49% Net Loss: $9.7M, or $0.36 1H09 Financial Results: • Costco Office Depot Mitel Headquarters: Bellevue, WA 2008 Financial Results: • SMB Employees: 120 full time Key Partners: • • • • Revenues: $16.2M, up 3% • Voice: $13.9M, up 11% • Video: $2.2M, down 27% Gross Profit Margins: 53% Cash Flow Positive Video Business: • Exploring strategic alternatives Key Financials $000 Voice GM% Voice Revenue 62.0% 7,200 60.0% 6,700 58.0% 56.0% 6,200 54.0% 52.0% 5,700 Qtr 2 Qtr 3 Qtr 4 Qtr 1 2008 $000 Qtr 2 50.0% Qtr 2 $000 - 8,000 (200) 7,000 (400) 6,000 (600) 5,000 (800) (1,000) 4,000 2008 Qtr 4 Qtr 1 Qtr 1 Qtr 2 2009 TNXI EBITDA 9,000 Qtr 3 Qtr 4 2008 2009 TNXI Operating Expenses Qtr 2 Qtr 3 Qtr 2 2009 (1,200) (1,400) Qtr 2 Qtr 32008 Qtr 4 Qtr 1 2009 Qtr 2 Voice Revenue Engine YTD thru Q209 2008 2009 Year over Year SIP trunking (VoIP) $1,788 $2,561 43% $19 $651 3300% Individual Services $6,317 $6,626 5% Core Subtotal $8,124 $9,742 18% $4,477 $4,187 -9% Total $12,601 $13,929 11% Gross Margins 53.2% 58.1% 490 BP increase DPS Legacy Balance Sheet Period ended June 30, 2009 Cash and Cash Equivalents $1.1 M Total Assets $32.9 M Total Long-Term Debt* $17.3 M *Face value of debentures is $29.6 M Total Liabilities $39.1 M Shareholder’s Equity ($6.2 M) Guidance • Double digit annual growth in total voice business – Majority of growth in 2H09 • Cash flow positive by end of 2009 • Looking for strategic opportunities for Video business Capitalization Table Shares O/S 5% Stockholders: Enable Capital Management Enable Growth Partners Aequitas Capital Management Tom Szabo 2,221,158 / 7.1% 2,002,738 / 6.4% 1,915,712 / 6.1% 2,422,929 / 7.7% Named Executive Officers and Directors Steven Davis James Everline Doug Johnson Paul Quinn David Rane All Named Executive Officers & Directors Total Shares Outstanding on June 30 Outstanding Options Fully Diluted Shares on June 30 132,500 / ** 268,500 / ** 256,033 / ** 57,813 / ** 112,500 / ** 827,346 / 2.6% 31,366,662 9,900,000 153,000,000 Investment Summary • The New Telanetix – Well positioned – Focused on the high growth, Hosted SMB voice market – While seeking strategic alternatives for video • Significant Recurring Market Opportunity – Hosted voice market - $4.4 B monthly recurring market • Significantly Improved Financial Results – Core Voice revenue at 18% – Adjusted EBITDA loss improved to $129,000 versus $1.3 million last year • Solid Guidance – – Double digit annual growth in total voice revenue Cash flow positive by end of 2009 Telanetix Corporation (OTC BB: TNXI)