CALCULATION OF DIVIDENDS FOR SHARES AND

advertisement

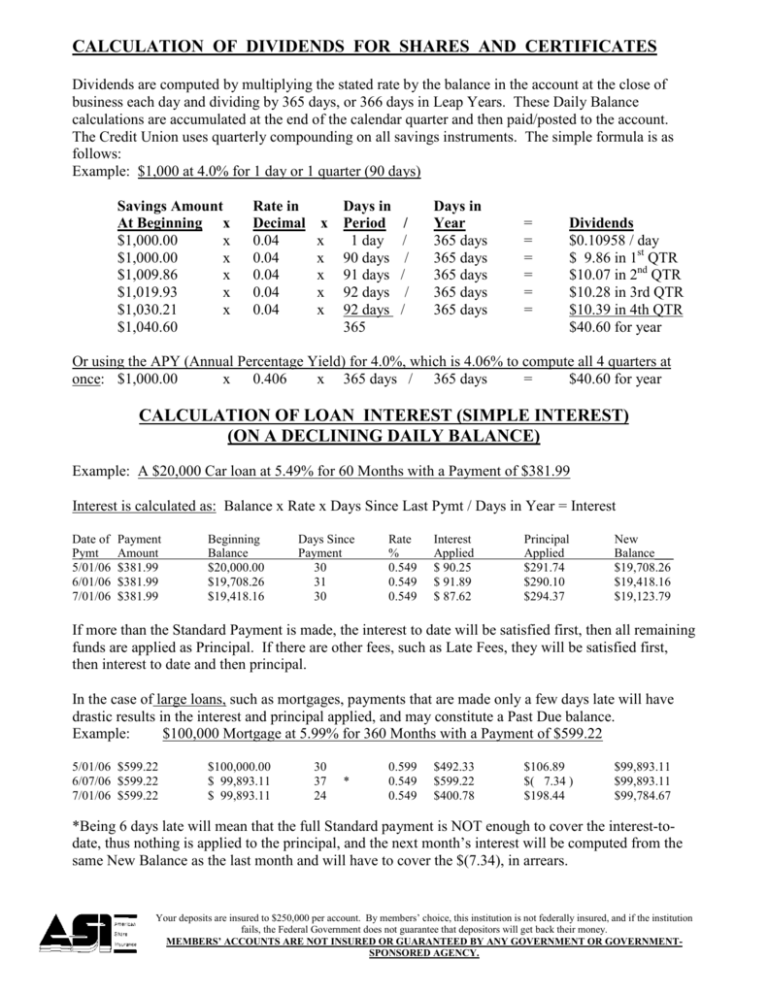

CALCULATION OF DIVIDENDS FOR SHARES AND CERTIFICATES Dividends are computed by multiplying the stated rate by the balance in the account at the close of business each day and dividing by 365 days, or 366 days in Leap Years. These Daily Balance calculations are accumulated at the end of the calendar quarter and then paid/posted to the account. The Credit Union uses quarterly compounding on all savings instruments. The simple formula is as follows: Example: $1,000 at 4.0% for 1 day or 1 quarter (90 days) Savings Amount At Beginning x $1,000.00 x $1,000.00 x $1,009.86 x $1,019.93 x $1,030.21 x $1,040.60 Rate in Decimal 0.04 0.04 0.04 0.04 0.04 x x x x x x Days in Period 1 day 90 days 91 days 92 days 92 days 365 / / / / / / Days in Year 365 days 365 days 365 days 365 days 365 days = = = = = = Dividends $0.10958 / day $ 9.86 in 1st QTR $10.07 in 2nd QTR $10.28 in 3rd QTR $10.39 in 4th QTR $40.60 for year Or using the APY (Annual Percentage Yield) for 4.0%, which is 4.06% to compute all 4 quarters at once: $1,000.00 x 0.406 x 365 days / 365 days = $40.60 for year CALCULATION OF LOAN INTEREST (SIMPLE INTEREST) (ON A DECLINING DAILY BALANCE) Example: A $20,000 Car loan at 5.49% for 60 Months with a Payment of $381.99 Interest is calculated as: Balance x Rate x Days Since Last Pymt / Days in Year = Interest Date of Pymt 5/01/06 6/01/06 7/01/06 Payment Amount $381.99 $381.99 $381.99 Beginning Balance $20,000.00 $19,708.26 $19,418.16 Days Since Payment 30 31 30 Rate % 0.549 0.549 0.549 Interest Applied $ 90.25 $ 91.89 $ 87.62 Principal Applied $291.74 $290.10 $294.37 New Balance___ $19,708.26 $19,418.16 $19,123.79 If more than the Standard Payment is made, the interest to date will be satisfied first, then all remaining funds are applied as Principal. If there are other fees, such as Late Fees, they will be satisfied first, then interest to date and then principal. In the case of large loans, such as mortgages, payments that are made only a few days late will have drastic results in the interest and principal applied, and may constitute a Past Due balance. Example: $100,000 Mortgage at 5.99% for 360 Months with a Payment of $599.22 5/01/06 $599.22 6/07/06 $599.22 7/01/06 $599.22 $100,000.00 $ 99,893.11 $ 99,893.11 30 37 24 * 0.599 0.549 0.549 $492.33 $599.22 $400.78 $106.89 $( 7.34 ) $198.44 $99,893.11 $99,893.11 $99,784.67 *Being 6 days late will mean that the full Standard payment is NOT enough to cover the interest-todate, thus nothing is applied to the principal, and the next month’s interest will be computed from the same New Balance as the last month and will have to cover the $(7.34), in arrears. Your deposits are insured to $250,000 per account. By members’ choice, this institution is not federally insured, and if the institution fails, the Federal Government does not guarantee that depositors will get back their money. MEMBERS’ ACCOUNTS ARE NOT INSURED OR GUARANTEED BY ANY GOVERNMENT OR GOVERNMENTSPONSORED AGENCY.