Background on the issue

advertisement

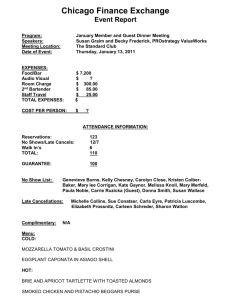

PRESENTATION TO THE PORTFOLIO COMMITTEE ON TRADE AND INDUSTRY CHEESE AGREEMENT MR. VICTOR MASHABELA CHIEF DIRECTOR: BILATERAL TRADE RELATIONS INTERNATIONAL TRADE & ECONOMIC DIVISION (ITED) E-mail: VMashabela@thedti.gov.za 1 Outline of the presentation • • • • • • • • Purpose Introduction Background on the issue Challenges Global Governance Committee Implementation Benefits Financial implications Stakeholder consultations Global Governance Committee 2 Purpose • To seek Parliament’s approval for the ratification of the cheese agreement and also to notify on the negotiated outcome of Annex IV of the SA-EU TDCA. 3 Introduction • The TDCA (Trade Development and Cooperation Agreement) governs trade relation btw SA and the EU. • The Agreement provides for the establishment of a Free Trade Area (FTA) between the Parties over a transitional period of 12 years. • It was signed on 11 October 1999; ratified in November 1999 and applied provisionally in January 2000. • The Agreement entered into force on 1 May 2004 and became fully implemented in January 2012. • Upon entry into force of the TDCA; both parties agreed to a “build-in agenda” to improve market access conditions and effect technical changes to the TDCA. These include “the cheese issue” 4 Background on the issue Three market access issues have been the subject of dispute since entry into force of the TDCA: 1.Export subsidies: The Agreement holds that no export subsidies would be allowed for subsidized cheese exports. In contravention to the provisions of the Agreement, the EU continued to provide subsidies to the three categories of cheese exports [cheddar, gouda and processed cheese] to SA market. 2. Review of exclusion list: Some cheese lines that are of interest to SA were listed as excluded products for liberalization in the TDCA and SA had since registered concerns with the EU around this issue. 3. Definition of “gross weight” for canned fruit: The EU has granted SA 3 separate quotas of canned fruit, cleared on the basis of gross weight which also included further packaging. SA raised concerns regarding packaging as this resulted in the unnecessary filling of the quotas. The proposal put forward was to consider the contents and exclude packaging. 5 Challenges The challenges encountered over the 12 year period include the actual implementation of some of the agreed provisions within the Agreement: - The EC reneged on the “no export support clause” for cheese exports to SA. To protect the industry, SA issued a GG notice to impose duties on cheese imports from the EU that were not accompanied by a declaration confirming that the product at hand did not receive any export subsidies. - SA exports of canned fruits were cleared on the basis of gross weight which also included further packaging. This lead to the unnecessary filling of the quota. Extensive bilateral engagement on the cheese issue continued and this was addressed in parallel with the definition of the gross weight for canned fruit and the erroneous listing of some cheeses from the protected list to the reserved list. 6 Implementation An agreement was endorsed by the SA-EU Joint Cooperation Council (JCC) on 4 November 2008 to effect the technical changes to the TDCA. -The EU made a commitment to cease subsidizing cheese exports to SA and in-turn SA to re-open tariff quota for those cheeses. SA removed duties on cheese imported from the EU. - Parties agreed to review certain provisions of the agreement in future negotiations. - The gross weight’s new definition is the aggregate mass of the goods themselves with immediate packaging, but excluding any further packing. 7 Benefits • Agreement has cemented SA’s trade relations with the EU by providing certainty to SA economic operators: 1. Improved market access provisions are laid out in the Agreement: 2. The removal of export subsidies for EU cheeses destined to SA market. 3. The agreement has a defined scope for the review of products/offers in the future negotiations. 4.The new gross weight allow SA to export a greater volume of canned fruit duty free to the EU than was allowed in the previous definition. The new Gross weight is now considered as the aggregate mass of the goods themselves with the immediate packaging, but excluding any further packing. 8 Financial implications • The Cheese Agreement was implemented on 1 April 2010 and a notice issued in the Government Gazette to that effect. • All operators that paid normal customs duties between November 2009 and April 2010 were not reimbursed for the higher duties paid as the agreement does not apply retrospectively. • Implementation of the cheese quota resulted in a reduced revenue collection in the case of customs duties. • Since the Agreement have an impact on revenue, the legal opinions received advised that ratification by Parliament is necessary as guided by Section 231(2) of the SA constitution. 9 Consultations The dti consulted with all key stakeholders, namely: 1. DAFF – Department of Agriculture, Forestry and Fisheries 2. DOJ – Department of Justice 3. DIRCO – Department of International Relations and Cooperation 4. NT - National Treasury 5. SARS – South African Revenue Services 6. GGC - Global Governance Committee 7. ICTS cluster – International Cooperation, Trade and Security cluster 10 THANK YOU 11