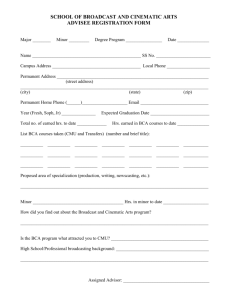

BCA Workshop

advertisement

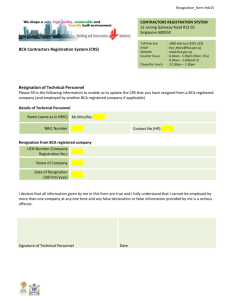

BVI Business Companies Act Workshop Tortola Richard Carpenter Consultant to the BVI Financial Services Commission 19th July, 2007 Financial Services Commission 1 What is a Company? Financial Services Commission 2 How Did Concept of Company Develop? The concept of a company was created to provide a way for individuals to associate together to carry on a business or trade in an efficient way. Until then business carried on by: • Individuals, or sole traders, • Partnerships, or • Groups of associated individuals But many disadvantages Financial Services Commission 3 Some Disadvantages of Partnerships and Sole Traders • Personal liability for all debts of business • Difficulty in raising finance to fund business [eg transferability of interest] • Difficulty in managing business, particularly if many partners Financial Services Commission 4 Company limited by shares (1) Most common type of company - has following features: • Company is separate legal person or entity distinct from members • Company has one or more shareholders who own company in proportion to number of shares they hold • Liability of members limited to amount they have agreed to pay for shares – otherwise not liable for debts of company • Ownership and management roles split, so although shareholders own company, they do not manage it • Company managed by its directors, generally appointed by shareholders Financial Services Commission 5 Position of Shareholders • Shareholders do not own assets of company, but a share usually entitles them to a share in any surplus if the company is wound up • Shares in a company may be sold or transferred by shareholder, although consent of directors may be required • Shares may be restricted to have limited rights, eg limited or no voting rights. • Shareholders, although owners of company, cannot interfere in management of company by directors – their influence lies in being able to appoint and remove directors Financial Services Commission 6 Position of Directors • Director owes certain duties in way he manages the company, including: • must act honestly, in good faith and in what director believes is in best interests of company, • must exercise powers for proper purpose • These duties are owed to company not to shareholders [Duties covered in more detail later in presentation] Financial Services Commission 7 Other types of company and business organisation • • • • • Company limited by guarantee Unlimited company Hybrid company Partnership [may be formal or informal] Limited partnership Note, company must be distinguished from business or trading name. An individual, partnership, company or collection of individuals may trade under a name that is different to his, its or their name, or in the case of a partnership, the firm name. Financial Services Commission 8 Memorandum and Articles Every company must have a memorandum of association and most companies required to have articles of association which are its constitution • Memorandum can be considered the “charter” of the company • Articles are the company’s by-laws or rules, covering: how company governed relationship between members relationship between members and directors Financial Services Commission 9 The Companies Act [Cap. 285] Time to Retire a Dinosaur? Financial Services Commission 10 Background • • • • • • Companies Act came into force 2 March 1885 First modern companies legislation in UK passed in 1844 This was replaced in a862 - BVI Companies Act probably based on UK 1862 Act Since then UK has replaced Companies Act five times: 1908, 1929, 1948, 1985 and 2006 BVI Act amended a number of times Essentially framework based on UK company law as it existed in century before last Financial Services Commission 11 CA - Some Disadvantages (1) • Difficult to follow and understand • Inflexible • • • Unnecessary and burdensome requirements for registration of documents at Companies Registry Strict and inflexible capital requirements, reduction of capital requires Court Order Restrictions on business – potential problems if company acts “ultra vires” Financial Services Commission 12 CA - Some Disadvantages (2) • No registration of charges at Companies Registry • Inadequate protection of members • • • Burdensome and unnecessary administrative requirements, eg annual general meeting No express recognition of circular resolutions or electronic communications Two members required In summary - not suitable for modern business environment Financial Services Commission 13 Benefits of the New Act Financial Services Commission 14 Objectives of BCA • • • • To develop modern companies legislation [the corporate legislation of many countries both on-shore and off-shore was reviewed] To be compliant with international standards To ensure no difference between local and international companies, designed to be suitable for both To use clear drafting style Financial Services Commission 15 BVIBC Act – Objectives (2) • • • To allow for ease of incorporation and use Should be no unnecessary filings or administrative obligations Should provide maximum flexibility for use of BCA companies Financial Services Commission 16 BCA Advantages Advantages to local businesses include: • • • • Flexible and adaptable – can structure company to meet needs of business and owners Single member companies permitted Unless members decide otherwise, no restrictions on business and activities that be carried on by BCA company [as long as lawful] Company may issue many different types of shares Financial Services Commission 17 BCA Advantages (cont.) • • • No need to keep complex accounting records that keep track of “capital”, “share premium” etc although optional No restriction on payment of dividends, or making of other distributions, to members as long as company solvent after distribution. No Court application required to reduce capital Governance and administration much more straightforward, for example: • Written resolutions of members and directors permitted • Members’ and directors’ meetings can be held by telephone, over Internet • No requirement for annual meeting Financial Services Commission 18 BCA Advantages (cont.) • • • • Clear record keeping requirements, types of records and to be kept at office of registered agent – important aid to resolving any disputes Duties and obligations of directors clearly set out [not so under Companies Act] Registration of charges and mortgages at Companies Registry governs priority – attractive to banks and other lenders If necessary, companies may merge or consolidate or enter into arrangements Financial Services Commission 19 BCA Advantages (cont.) • • • • Protection for members who dissent from merger, consolidation and arrangement [entitled to be bought out for fair value of shares] Members have a number of remedies against directors and company, where contravening BCA, memorandum or articles Member may apply to Court where considers that his interests are being unfairly prejudiced More straightforward provisions for voluntary liquidation than under Companies Act Financial Services Commission 20 Important Aspects of New Act Financial Services Commission 21 It is important that members and directors of CapCos familiarise themselves with the major differences between the Companies Act and the BCA The following are critical aspects of the new Act that are likely to impact on CapCos: • Every CapCo will be re-registered under, and become, a BCA company either: Voluntarily, or Automatically on 1 January 2008 • Note: still same company • Every company should consider carefully whether in its best interests to re-register voluntarily [covered later in presentation] Financial Services Commission 22 • • • • • • • Every BCA company must have registered agent Every BCA company must have registered office – this can, and usually is, office of registered agent, but this is not required Every BCA director must comply with duties and obligations under the Act [see User Guide 4 on Directors and their Responsibilities] Directors may become personally liable if they permit company to trade whilst insolvent. Company must not pay dividend to shareholders or make a distribution to members if dividend or distribution would make company insolvent Only a registered agent can incorporate a new company Only a registered agent can file documents and pay fees on behalf of a company Financial Services Commission 23 Registered Agent and Registered Office Financial Services Commission 24 Principal Requirements Every BCA must have a registered agent. Registered agent must be a company licensed by the Financial Services Commission as a company management company or as a Class I or III trust company Every BCA must have registered office: • Not necessary to be provided by licensee • But only licensee can charge for this service Financial Services Commission 25 Why is a Registered Agent Required? • Access to statutory records • Maintenance of records Financial Services Commission 26 Benefits of Registered Agent to Company Requirement enables BVI to comply with international standards, but many benefits to company, its directors and owners: • RA ensures company kept up to date [fees etc] and minimise risk of strike off • RA provides expertise concerning BCA, ensuring compliance with Act • RA ensures timely filing of correct documents, saving delays and expense • RA acts as point of contact with Registry, ensuring directors can get on with their business • RA accepts service of important documents, ensuring company and directors get to know about them Financial Services Commission 27 DIRECTORS Financial Services Commission 28 Requirement for Directors Every BCA company must have at least one director Financial Services Commission 29 Who is a Director? Director, includes a person occupying or acting in the position of director by whatever name called Insolvency Act has a different definition, which includes a shadow director Financial Services Commission 30 Role of Directors Directors pivotal to operation of company Act provides [s. 109(1)]: “The business and affairs of company shall be managed by, or under the direction or supervision of, the directors of the company” In order to enable the directors to undertake their role, the Act gives them “all powers necessary for managing, and for directing and supervising, the business and affairs of the company” Financial Services Commission 31 Companies Without Directors Section 109(6): “If at any time a company does not have a director, any person who manages, or who directs or supervises the management of, the business and affairs of the company is deemed to be a director of the company for the purposes of this Act” Financial Services Commission 32 Duties of a Director • • • To act honestly and in good faith and in what he believes to be the best interests of the company [s. 120(1)] To exercise powers for a proper purpose [s. 121] Not to act, or agree to the company acting in contravention of the Act or the M&A [s. 121] Financial Services Commission 33 Standard of Care Section 122 sets out standard of care to be exercised by a director when exercising powers or performing duties. The director must exercise the care, diligence, and skill that a reasonable director would exercise in the same circumstances taking into account: • the nature of the company; • the nature of the decision; and • the position of the director and his responsibilities. Financial Services Commission 34 Common Misconceptions I’m only a nominee director. I was only acting on instructions. Financial Services Commission 35 Disclosure of Interest • • • Director must immediately after becoming aware of interest in transaction entered into, or to be entered into, disclose interest to the board (every member of the board) Does not apply if transaction or proposed transaction in ordinary course of business Failure to comply does not affect validity of transaction, but is an offence Financial Services Commission 36 Avoidance of Transactions Transaction entered into by company in which director is interested is voidable unless: • disclosed; or • not required to be disclosed Note fair value exception and protection of third parties’ interests Financial Services Commission 37 Who May be a Director? Who may be a director? Any person not disqualified by the BCA, ie: • minor • person disqualified or restricted under Insolvency Act • undischarged bankrupt • person disqualified by the M&A Note “person” includes a corporate body. Any person who although disqualified acts as a director is deemed to be a director Financial Services Commission 38 Appointment of Directors First director(s) must be appointed by registered agent within 6 months of incorporation Thereafter, directors usually appointed by members] Term of appointment – as specified in resolution appointing him NOTE: Director cannot be appointed unless he has consented Financial Services Commission 39 Removal of Directors • Resolution of members passed at a meeting called for the purposes of removing him (notice of meeting must state purpose of meeting) • Written resolution passed by a majority of at least 75% • Subject to M&A by resolution of directors Financial Services Commission 40 Resignation of Directors • Director may resign by giving written • • notice [s. 115(1)] Resignation takes effect from date notice received by company Director must resign if he becomes disqualified to act Financial Services Commission 41 Liability of Former Directors Director who vacates office remains liable in respect of his acts, omissions or decisions whilst he was a director. Financial Services Commission 42 Validity of Acts of Directors • • Note that the acts of a person are valid notwithstanding that: The person’s appointment as director was defective The person is disqualified to act as director [s. 117] Financial Services Commission 43 Re-Registration of Companies Act Companies Financial Services Commission 44 Key Points • • • • • Every CapCo will be re-registered under BCA Re-registered CapCo is still the same company In particular, re-registration: • Does not affect its legal identity • Does not affect its assets, rights or obligations • Does not affect the commencement or continuation of proceedings Re-registered CapCo ceases to be governed by Companies Act Subject to transitional provisions, re-registered CapCo becomes governed by BCA instead Financial Services Commission 45 Methods of Re-registration Re-registration of Companies Act company under the BCA may be: Voluntary, on application of company on or before 30 November 2007; or Automatic, on 1 January 2008, if company does not apply to re-register voluntarily within time period allowed There are significant differences in way BCA applies to voluntarily and automatically reregistered CapCos Financial Services Commission 46 Voluntary Re-Registration • Must apply to Registrar by 30 November 2007 (time for Registry to process before 1 January 2008) • Certified copy of resolution of members must be filed • Must appoint person qualified under section 91(3) of BCA who will become registered agent on re-registration • New registered agent must sign application and new memorandum & articles • Memorandum must contain details of first registered agent of company Financial Services Commission 47 Voluntary Re-Registration CapCos • No reduction of capital (for purposes of CA) if: Resolution to adopt new memorandum passed by members unanimously No. of shares in issue not reduced Max. no. of shares co. authorised to issue equal to or greater than no. of shares into which capital divided under CA Par value of shares remains the same Financial Services Commission 48 Effect of Voluntary Reregistration Company becomes “fully-fledged” BCA Company Voluntarily re-registered company will be able to take full advantage of BCA Financial Services Commission 49 Automatic Re-Registration (1) • • • • 1 January 2008, all CapCos [that have not been voluntarily re-registered] will be automatically reregistered as BVIBCs & CA repealed If Registry has not determined application to voluntary re-register, automatically re-registered on 1 January 2008 No certificate of re-registration may be issued after 31 December 2007 CapCo re-registered automatically as company of same type (eg company limited by shares, company limited by guarantee etc) Financial Services Commission 50 Automatic Re-Registration (2) • Retain own M&A • Certain provisions of CA continue to apply • No certificate of re-registration issued, but may apply ($25.00 fee) • Must appoint a person qualified under section 91(3) of BCA as registered agent within 2 months of re-registration Financial Services Commission 51 Why two types of registration? M & A of CapCo not compatible with new Act: • Requirements for memorandum under BCA different from those under Companies Act • BCA does not recognise capital, which is fundamental under Companies Act • No. of default provisions in BCA (ie subject to Memorandum ad articles and members will not have considered these when agreeing memorandum and articles Financial Services Commission 52 Why two types of registration? • • • Not intention to force all companies to go to trouble of drafting new memorandum and articles Therefore BCA enables automatic re-registration But automatically re-registered company will keep existing Memorandum and articles and cannot be a “fully fledged” BCA company – it must be subject to special transitional provisions Financial Services Commission 53 Part VI Transitional Provisions • • • Automatically re-registered CapCos subject to Part VI transitional provisions Designed to ensure M&A still works for company Continues provisions of CA relating to: • • • • • • Requirements for memorandum Directors with unlimited liability Reduction of capital General meetings Notice to be given of increase in capital Fees based on capital Financial Services Commission 54 Disapplying Part VI Former CapCo may elect to disapply Part VI after re-registration by filing: • • Application to disapply transitional provisions New memorandum and articles that comply fully with the BCA Former CapCo will become fully fledged BCA Company Financial Services Commission 55 User Guides 1. 2. 3. 4. 5. 6. Incorporating a BCA company limited by shares Company names Memorandum and articles of association Directors and their responsibilities Striking of and liquidation Re-registration of CapCos under BCA Financial Services Commission 56