1 - Jeremy Leggett

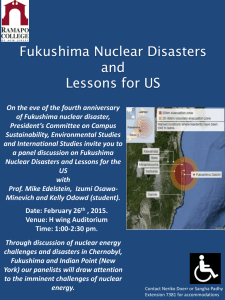

advertisement