WINDING-UP PETITION NO: 28NCC-60

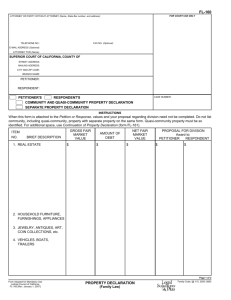

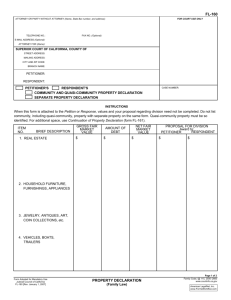

advertisement

1 IN THE HIGH COURT OF MALAYA AT KUALA LUMPUR (COMMERCIAL DIVISION) WINDING-UP PETITION NO: 28NCC-60-01/2014 URBAN DOMAIN SDN. BHD v. PINS OSC & MAINTENANCE SERVICES SDN. BHD. GROUNDS OF JUDGMENT The Petition Enclosure 1 is the Petition filed by the Petitioner dated 27.1.2014 pursuant to section 218 (1)(i) of the Companies Act 1965 (CA). The Petitioner prays for the following: “ (i) that PINS OSC & Maintenance Services Sdn. Bhd. (Company No. 723800-A) be wound up under the provisions of the Companies Act, 1965; (ii) that Chong Chuan Long (NRIC No. 710625-10-5475) [Approval No. 2681/01/14 (J/PH)] of CL Chong & Co., Chartered Accountants of 12-1A, Jalan Perdana 4/3, Pandan Perdana, 55300 Kuala Lumpur be appointed as the Liquidator of the Respondent Company; (iii) that the remuneration of the Liquidator of the Respondent Company shall be on a time-cost basis or as provided under the Companies Act, 1965 and the Companies (Winding-Up) Rules, 1972 and be paid out of the assets of the Respondent Company; 2 (v) that the costs of this Petition be taxed by the proper officer of the Court and be paid out of the assets of the Respondent Company to your Petitioner; and (vi) such other reliefs as deemed reasonable and appropriate by this Honorable Court.”. The Affidavits (i) Affidavit verifying the Petition by Dr. Haji Ahmad Kamal Bin Zakaria dated 20.2.2014 (“Petitioner Affidavit Number 1”). (ii) Affidavit in Reply affirmed by Zadey Che Wan on behalf of the opposing contributory, Perak Integrated Network Services Sdn. Bhd. (“PINS”) dated 24.3.2014 (“Opposing Contributory Affidavit Number 1”). (iii) The Affidavit to oppose the Winding up affirmed by Muhammad Noor Aswadi Bin Arawi on behalf of the opposing creditor Sumber Bayu Enterprise dated 25.3.2014 (“Opposing Creditor Number 1 Affidavit”). (iv) The Affidavit to oppose the Winding up affirmed by Ong Boon Poh on behalf of the opposing creditor Sutera Impian Sdn. Bhd. dated 25.3.2014 (“Opposing Creditor Number 2 Affidavit”). (v) The Affidavit to oppose the Winding up affirmed by Ahmad Zulkifli Bin Hj. Samsudin on behalf of the opposing creditor Productive Plus (M) Sdn. Bhd. dated 25.3.2014 (“Opposing Creditor Number 3 Affidavit”). 3 (vi) The Affidavit to oppose the Winding up affirmed by Harisun Binti Kassim on behalf of the opposing creditor Inovatif Jentayu Sdn. Bhd. dated 26.3.2014 (“Opposing Creditor Number 4 Affidavit”). (vii) Affidavit in Reply to Opposing Contributory Affidavit Number 1 affirmed by Dr. Haji Ahmad Kamal Bin Zakaria dated 27.3.2014 (“Petitioner Affidavit Number 2”). (viii) Affidavit in Reply to all four opposing creditors’ Affidavit affirmed by Dr. Haji Ahmad Kamal Bin Zakaria dated 28.3.2014 (“Petitioner Affidavit Number 3”). (ix) Affidavit in Reply affirmed by Zadey Che Wan’s dated 3.4.2014 (“Opposing Contributory Affidavit Number 2”). (x) Affidavit in Reply to Opposing Contributory Affidavit Number 2 affirmed by Dr. Haji Ahmad Kamal Bin Zakaria dated 17.4.2014 (“Petitioner Affidavit Number 4). Background The nominal capital of the Respondent Company is RM100,000.00 divided into 100,000 ordinary shares of RM1.00 each. The amount of the capital paid up or credited as paid up is RM100,000.00. The objects for which the Respondent Company was established are as contained in the Memorandum of Association, (i) to carry on business, and to act as merchants, general traders, commission agents, carriers, or in any other capacity, in Malaysia or elsewhere, and to import, export, buy, sell, barter, exchange, pledge, make 4 advance upon, or otherwise deal in goods, produce, articles and merchandise; (ii) to carry on the trade or business of builders and contractors for construction work of any kind and for the demolition of any structure; and (iii) to carry on the business of an investment company and for that purpose to acquire and hold either in the name of the company or in that of any nominee shares, lands, buildings, stocks, debentures, debenture stock, bonds, notes, obligations and securities issued or guaranteed by any company wherever incorporated or carrying on business. The initial shareholders of the Respondent Company were two individuals by the name of Salasiah Binti Mohd Said (NRIC No. 720125-10-5750) and Asiah Binti Osman (NRIC No. 600123-106294) who each held one (1) shares in the Respondent Company. Pursuant to Shareholders Agreement dated 21.5.2007 (SA) entered between the Petitioner on one hand and a company known as Perak Integrated Network Services Sdn. Bhd. (Company No. 522474-U) (“PINS”) on the other hand, PINS subscribed 50,000 ordinary shares of RM1.00 each in the Respondent Company which is equivalent to 50% of the paid-up capital of the Company whilst the Petitioner subscribed 49,998 ordinary shares of RM1.00 each in the Respondent Company and purchased from the then shareholders of the Respondent Company 2 ordinary shares of RM1.00 each, which in total is equivalent to 50% of the paid-up capital of the Respondent Company. 5 The SA sets out the terms of the agreement between the Petitioner and PINS with regard to the organization, management and operation of the Respondent Company. The SA also specified the relationship between the Petitioner and PINS shareholders of the Respondent Company. A Management Agreement dated 21.5.2007 (MA) was entered between the Petitioner and PINS, the Respondent Company and another company known as PINS Capital Sdn. Bhd. (Company No. 732370-P) (“PINS Capital”). Pursuant to the MA, the Respondent Company was appointed to undertake and perform works and services forming part of the works agreed to be exclusively undertaken by PINS under a Concession Agreement entered into with the Kerajaan Negeri Perak Darul Ridzuan (“the Concession Agreement”). In the Concession Agreement the construction services and maintenance services are described as follows:“ (a) Construction services which inter alia involved the following: (i) Monitoring the construction of telecommunication towers and new broadcasting/broadband structure (“Infrastructures”) in the State of Perak, (ii) Identifying sites for the location of the Infrastructure and negotiating with landowners on the rental terms; (iii) Ensuring the construction of the Infrastructures in accordance with specifications prescribed by the operators of telecommunication and broadband services namely Maxis Broadband Sdn Bhd, Celcom (Malaysia) Berhad and Digi Telecommunication Sdn Bhd (collectively as “the Operators”); (iv) Making payment of all upfront capital costs and related expenses for the construction and completion of the Infrastructures; and 6 (v) Making payment of all agreed liquidated damages to the Operators in the event PINS and/or the Respondent Company is/are made liable for the payment of agreed liquidated damages pursuant to the terms of a Licence Agreement dated 1.6.2006 entered into between PINS and the Operators vide which PINS licensed the use of the Infrastructures to the Operators (“Licence Agreement”). (b) Maintenance services which inter alia involved the following: (i) Ensuring the satisfactory maintenance of Infrastructures in accordance with the terms of the Licence Agreement; (ii) Assisting PINS in liaising with the Operators regarding the construction and maintenance of the Infrastructures and with the Malaysia Communications And Multimedia Commission (“MCMC”) and other relevant bodies or authorities on licensing compliance and other issues; (iii) Assisting PINS in all negotiations with the Operators; (iv) Assisting PINS to observe and performs PINS’ obligations under the Concession Agreement, the Licence Agreement and the tenancy agreements with the landlords of sites on which the Infrastructures will be erected; (v) Assisting PINS in resolving any dispute between PINS and the State Government and /or the Operators; (vi) Making payment of all agreed liquidated damages to the Operators in the event PINS is made liable for the payment of agreed liquidated damages pursuant to the terms of the Licence Agreement; and (vii) Ensuring the efficient management of day to day operations of the construction, completion and maintenance works of the Infrastructures; 7 (c) One Stop Centre services which inter alia involved the following: (i) Acting as facilitator for the compliance submission for location and construction of new Infrastructures on behalf of the State Government and telecommunication providers with other state agencies or other relevant authorities; (ii) Carrying out surveillance of maintenance works including repair and safety audit of the Infrastructures; and (iii) Maintaining and creating a database for the collection of data on Infrastructures in the State of Perak for the purpose of information sharing with the State Government. ”. A First Supplemental Management Agreement dated 27.5.2007 was subsequently executed between the Petitioner, PINS, the Respondent Company and PINS Capital (“1st Supplemental Management Agreement”). The 1st Supplemental Management Agreement provides for the fees to be paid by PINS to the Respondent Company for the works and services under the MA. It is contended that PINS breached the MA as well as the 1st Supplemental Management Agreement by failing to pay to the Respondent Company the fees which it had agreed to pay pursuant to the 1st Supplemental Management Agreement. The Petitioner then filed a derivative action on behalf of the Respondent Company in Kuala Lumpur High Court Suit No. 22NCC -1041-07/2012 (“the Suit”) against PINS and another party being one Dato’ Seri Dr. Abdullah Fadzil Che Wan, who is a director of both the Respondent Company and PINS. The Respondent Company was made the 1st Defendant in the Suit. On 26.9.2013 the Court in the Suit gave judgment in favor of the Petitioner against PINS. 8 The Petitioner contends that the Respondent Company has not been trading since its functions under the MA and/or the 1st Supplemental Management Agreement were taken over completely by PINS. The Petitioner further contends that the Respondent Company does not have, at present, any employee. Due to the abovementioned reason, it is contended by the Petitioner that the reasons as stated above had caused the substratum of the Respondent Company to disappear and the foundational purpose of the Respondent Company’s incorporation to come to an end. It is therefore contended that it is just and equitable to wound up the Respondent Company. The Grounds It is the contention of the Petitioner that it is just and equitable for the Respondent to be wound up on the following grounds:1. The substratum of the Respondent and the purpose of the incorporation of the said Respondent no longer exists. 2. The sole purpose that the 2 shareholders took equity in the company no longer exists. 3. The 2 shareholders are involved in pending litigation. 4. The 2 directors of the Respondent, that is, Dr. Haji Ahmad Kamal bin Zakaria and Dr. Abdullah Fadzil Che Wan, can no longer get along. Both cannot continue to participate together in any form of business enterprise. 9 Parties opposing the Petition A total of 5 parties opposed the Petition, PINS (opposing contributory) as well as 4 others creditors, (i) Sutera Impian Sdn. Bhd.; (ii) Productive Plus (M) Sdn. Bhd.; (iii) Sumber Bayu Enterprise; and (iv) Jentayu Sdn. Bhd. The Petitioner’s Submissions The Petitioner and PINS (the opposing contributory) are the 2 equal shareholders in the Respondent Company. Dr. Abdullah Fadzil Che Wan was nominated by PINS as a director and Dr. Haji Ahmad Kamal bin Zakaria was nominated by the Petitioner as a director. Dr. Abdullah Fadzil Che Wan holds 90% shares of PINS and 45% of the Respondent. Pursuant to the SA, the parties had agreed that the purpose of the Respondent is to provide construction services, maintenance services and OSC services as defined in the Management Agreement entered between the Petitioner and PINS dated 21.5.2007. PINS then appointed the Respondent to provide the aforesaid services. Dr. Abdullah Fadzil Che Wan opposed the Petition through PINS. It is argued by the Petitioner that no solicitor was appointed to represent the Respondent as no Board of Directors meeting was called due to the dispute. 10 A dispute arose between the Respondent and PINS with regard to non-payment of fees by PINS to the Respondent. It is contended by the Petitioner that PINS breached the MA and the first Supplemental Agreement when it failed to pay the fees to the Respondent. The Petitioner filed a derivative action on behalf of the Respondent against PINS and Dr. Abdullah Fadzil Che Wan vide 22NCC-1041-07/2012. On 26.9.2013 the High Court gave judgment in favour of the Petitioner and the Respondent against PINS. However, the said suit is now pending appeal to the Court of Appeal. It is further contended that the Respondent has not been operational since it was taken over by PINS in 2011 and that the Respondent currently does not even have any employee. The Petitioner further argued that all the allegation by PINS and the 4 creditors in respect of the same priority payments are without merit. The Law Section 218(1) of the same Act list out the circumstances a Company may be wound up by an order of the Court if:“ (a) the company has by special resolution resolved that it be wound up by the Court; (b) default is made by the company in lodging the statutory report or in holding the statutory meeting; (c) the company does not commence business within a year from its incorporation or suspends its business for a whole year; (d) the number of members is reduced in the case of a company (other than a company the whole of the issued shares in which are held by a holding company) below two; 11 (e) the company is unable to pay its debts; (f) the directors have acted in the affairs of the company in their own interests rather than in the interests of the members as a whole, or in any manner whatsoever which appears to be unfair or unjust to other members; (g) an inspector appointed under Part IX has reported that is of opinion:- (h) (i) that the company cannot pay its debts.....; or (ii) that it is in the interest of the public or shareholder..... when the period, if any, fixed for the duration of the company by the memorandum or articles expires or the event, if any, occurs..........; (i) the court is of the opinion that it is just and equitable that the company be wound up; (j) the company held a license under the Banking and Financial Institutions Act 1989 or the Islamic Banking Act 1983 and that license has been revoked or surrendered; (k) the company has carried on Islamic banking business...in contravention of the Islamic Banking Act 1983 or the Banking and Financial Institutions Act 1989, as the case may be; (l) the company has held a license under the Insurance Act 1966 and:(i) the license has been revoked; (ii) Bank Negara has petitioned for its winding up... (iii) an order under paragraph 59(4)(b) of the Insurance Act 1966 has been made... (m) the company is being used for unlawful purposes......; and (n) the company is being used to any purpose prejudicial…”. 12 Lord Wilberforce in Ebrahimi v. Westborne Galleries [1873] AC 360 (cited with approval in Tien Ik Enterprise Sdn. Bhd. & Ors v. Woodsville Sdn. Bhd. [1995] 1 LNS 99; [1995] 2 AMR 1033) at p. 379 observed, “ …The foundation of it all lies in the words “just and equitable” and, if there is any respect in which some of the cases may be open to criticism, it is that the courts may sometimes have been too timorous in giving them full force. The words are a recognition of the fact that a limited company is more than a mere legal entity, with a personality in law of its own; that there is room in company law for recognition of the fact that behind it, or amongst it, there are individuals, with rights, expectations and obligations inter se which are not necessarily submerged in the company structure. That structure is defined by the Companies Act and by the articles of association by which shareholders agree to be bound. In most companies and in most contexts, this definition is sufficient and exhaustive, equally so whether the company is large or small. The “just and equitable” provision does not, as the respondents suggest, entitle one party to disregard the obligation he assumes by entering a company, nor the court to dispense him from it. It does, as equity always does, enable the court to subject the exercise of legal rights to equitable considerations: considerations, that is, of a personal character arising between one individual and another, which may make it unjust, or inequitable, to insist on legal rights, or to exercise them in a particular way. It would be impossible, and wholly undesirable, to define the circumstances in which these considerations may arise. Certainly the fact that a company is a small one, or a private company, is not enough. There are very many of these where the association is adequately and exhaustively laid down in the articles. The super imposition of equitable considerations requires something more, which typically may include one, or probably more, of the following elements: (i) an association formed or continued on the basis of a personal relationship, involving mutual confidence - this element will 13 often be found where a pre-existing partnership has been converted into a limited company; (ii) an agreement, or understanding, that all, or some (for there may be “sleeping” members), of the shareholders shall participate in the conduct of the business; (iii) restriction upon the transfer of the members’ interest in the company so that if confidence is lost, or one member is removed from management, he cannot take out his stake and go elsewhere. It is these, and analogous factors which may bring into play the just and equitable clause, and they do so directly, through the force of the words themselves.”. Ramly J (as his Lordship then was) in Eng Man Hin @ Ng Mun Heng & Anor v. King’s Confectionery Sdn. Bhd. [2005] 8 CLJ 77; [2006] 4 MLJ 421 said, “ The court is of the view that it is not sufficient for the Petitioners to allege a mere intention in order to discharge their evidential burden. The Petitioners have the burden to prove the followings: (1) That the 1st Respondent Company is an ‘Ebrahimi’ type of company or a quasi-partnership company; (2) That there is in existence a specific identifiable legitimate expectation that the petitioners are entitled to the alleged sharing of management control; and (3) That there has been a breach of this agreement or understanding relating to this legitimate expectation which according to established principles of equity, the court finds it just and equitable to restrain. An ‘Ebrahimi’ type of company is a ‘quasi-partnership’ company having the following three elements, namely: (i) An association formed or continued on the basis of a personal relationship involving mutual confidence; (ii) An agreement or understanding that all or some of the shareholders shall participate in the conduct of the business; and 14 (iii) Restriction upon transfer of the members interests so that if confidence is lost or one member is removed from management, he cannot take out his stake and go elsewhere. (See the decision of Lord Wilberforce in Ebrahimi v. Westbourne Galleries Ltd [1973] AC 360 at p 370). It is an established principle of law that the courts will subject the exercise of legal rights to equitable considerations in given circumstances. There is no universal formula to determine the circumstances under which the courts will do so. Lord Wilberforce in Ebrahimi’s case, provided an illustrations as to the circumstances whereby the courts will do so. The case for giving effect to equitable considerations must be made in each instance and it is not sufficient simply to assert that the company is small or private, for in many cases the basis of the relationship will be adequately and exhaustively laid down in the Articles of Association of the company. If it is so defined by the Articles of Association or supplemented by a shareholders' agreement, then there is little room for founding further legitimate expectation beyond those outlined in the documents, (see also Company Law by Farrar (3rd Ed, 1991 at pp 464 - 465).”. Abdul Malik, J in Gulf Business Construction (M) Sdn. Bhd. v. Israq Holding Sdn. Bhd. listed out the illustrations for ‘just and equitable’ as follows, “ What is just and equitable would vary from case to case. Thus, a company may be wound-up where it is just and equitable that the company should be wound-up. So many reasons can be advanced to wind-up a company under the just and equitable principle, and the following illustrations would suffice: (a) where the substratum of the company has gone; (b) where the company’s main object for its existence has lapsed; (c) where the principal object of setting up the company can no longer be achieved; (d) where the company’s only business is ultra vires the company; 15 (e) where the company is carrying on its business at a loss and the remaining assets of the company are insufficient to pay its debts; (f) where there is no reasonable hope of ultimate profit for the company; (g) where the relationship of the parties in the company has broken down irretrievably; (h) where there is a lack of confidence among the shareholders that threaten the very existence of the company; and (i) where the winding-up of the company would open the door to investigate the misconduct of the directors or promoters of the company).”. The winding up Court can determine whether or not there is a bona fide dispute, consider all the evidence and finally determine whether to order the winding up or not. In the case of Morgan Guaranty Trust Co of New York v. Lian Seng Properties Sdn. Bhd. [1991] 1 CLJ 317 (Rep); [1991] 1 CLJ 260; [1991] 1 MLJ 95, where at p. 97 Hashim Yeop A. Sani, CJ (Malaya) said: “ There are many tests to be applied to see whether a petitioner for a winding-up order has locus standi. Insolvency is always a ground relied on in a petition. Prima facie an unpaid creditor is entitled to petition for a winding-up order against a company which fails to pay its debt. Macpherson says that the only test which seems capable of resolving all difficulties is that suggested by Grossman J in Re North Bucks Furniture Depositories Ltd [1939] 2 All ER 549, namely, that the term ‘creditor’ ‘includes every person who has the right to prove in winding-up’. Looking at the grounds given in the petition in the instant case it is clear to us that the petition should not have been struck out in limine and should have been heard on its merits. This was the approach of this court in Chip Yew Brick Works Sdn Bhd v. Chang Hee Enterprise Sdn Bhd [1988] 1 CLJ 5 (Rep); [1988] 2 CLJ 424. The appellant should not be prevented from pursuing its petition so that the court would be able to consider all evidence and determine whether it 16 should exercise its discretion to order winding-up or not. Relevant to this appeal is that part of the judgment in Chip Yew Brick Works Sdn Bhd v. Chang Hee Enterprise Sdn Bhd [1988] 1 CLJ 5 (Rep); [1988] 2 CLJ 424 which appears at p. 425: Even where the whole amount of debt claimed is disputed, the court can allow evidence to be adduced to enable it to consider whether or not there was a bona fide dispute and the court is competent to go into the evidence to consider that question for the purpose ultimately of determining whether it should exercise the discretion: Re Welsh Brick Industries Ltd [1946] 2 All ER 197.”. Ramly Ali J (as he then was) in his judgment in Wong Thai Kuai & Anor v. Kansas Corporation Sdn. Bhd. (2007) 3 LCJ 263 said that the right to have a company wound up is a right which belongs not to the Petitioner alone but to all the class of unsecured creditors. His Lordship referred to the case of Pilecon Engineering Bhd v. Remaja Jaya Sdn. Bhd. [1997] 1 MLJ 808 where the case of Re:Crigglestone Coal Co. Ltd. [1906] 2 Ch. D 327 was referred. Buckley J said at page 331, “ The right ex debito justitiae is not his individual right, but his representative right. If a majority of the class are opposed to his view, and consider that they have a better chance getting payment by abstaining from seizing the assets, then, upon general grounds and upon section 91 of the Companies Act 1862, the Court gives effect to such right as the majority of the class desire to exercise. This is no exception. It is a recognition of the right, but affirms that it is the right not of the individual, but of the class, that it is for the majority to seek or to decline the order as best serves the interest of their class. It is a matter upon which the majority of the unsecured creditors are entitled to prevail, but on which the debtor has no voice.”. 17 In the case of Re ABC Couple & Engineering Co. Ltd. [1961] All ER 354, the petition was opposed by a number of creditors whose debts (disregarding those owed to the subsidiary companies of the company) amount to £18,328 odd, that being a sum about £800 more than the debt owed to the petitioning creditors. It was said by the learn judge Pennycuick J at p. 356 that, “ It seems to me, however, that it must still be right, having regard to the terms of section 346, to have regard to the wishes of the majority of the creditors. Although those wishes may not be conclusive, they still possess great weight, and it seems to me that, where the wishes of the majority of the creditors are, on the face of them, reasonable, the Court ought to follow those wishes in the absence of any special circumstances.”. Further, at p. 357, the judge went on to say that: “ In all the circumstances, it seems to me that in the present case the right course for me to take is to have regard to the wishes of the majority in value of the creditors (disregarding the subsidiary companies) and to refuse to make an order on the Petition.”. In Kim Wah Theatre Sdn. Bhd v. Fahlum Development Sdn. Bhd. [1990] 2 MLJ 511 Siti Norma Yaakob, J (as she then was) said, “ ....whilst continuing to recognize the Creditor’s prima facie right to a winding up Order, there are instances where such right is subject to the discretion provided by the language of section 221(1)A the Companies Act 1965,....one such instances is where the Petition is opposed by a majority of the creditors.”. Therefore, in considering whether or not to allow this Petition filed by the Petitioner, this Court must also consider the voice of the 18 majority of creditors in the same class as the Petitioner, that is the opposing creditors. Decision and Reasons In the instant Petition there are four opposing creditors opposing the winding up Petition. The “just and equitable” winding up petition is a drastic remedy, and a Court should be slow to allow such a Petition. Winding up on just and equitable grounds is based on equitable principles. The maxim, “he who comes to Court in equity must come with clean hands” is therefore applicable. In assessing whether it would be just and equitable to wind up on grounds of the alledged deadlock, it is essential for the Court to consider who has, in actual fact caused the deadlock. The Privy Council (PC) in Re Semantan Estate (1952) Ltd. [1965] MLK 238 PC Lord Donovan delivering the judgment of the PC held that, “ The question whether such deadlock exists makes it just and equitable to wind up the company up is a question predominantly of fact in each case. The principle is clear that if the Court is satisfied complete deadlock exists in the management of the company the jurisdiction will be exercised.”. Lord Shaw in Lock & Amor v. John Balckwood Ltd. [1924] AC 783 PC in delivering the judgment of the Board held that, “ ....the foundation of application for winding up on the ‘just and equitable’ rule there must lie a justifiable lack of confidence in the conduct and management of the company’s affairs. But this lack of confidence must be grounded on conduct of the directors, not in regard to their private life or affairs, but in regard to the company’s business.”. 19 The Affidavit in Support of the Petition failed to prove that the relationship of the parties in the Respondent Company has broken down irretrievably. This Court must also take into consideration the views of the opposing creditors. It is submitted that Dr. Haji Ahmad Kamal bin Zakaria failed to ensure that the Respondent Company’s account was properly audited. As the director of the Respondent Company in charge of auditing the accounts of the Respondent Company, he should have ensured the preparation of audited accounts. It is important also in considering such a Petition, that the Petitioner relying on the just and equitable ground must not be the author of the breakdown in confidence between him and the other director and/or parties based on the Petition as well as the Affidavits filed. Furthermore, the opposing creditors argued that the Petitioner being a 50% contributory of the Respondent Company in a derivative action had obtained a judgment vide High Court Civil suit No. 22NCC-1041-07/2012. However, the appeal against the High Court’s decision in that suit is pending in the Court of Appeal. It is, therefore, submitted that it is premature to compel the Respondent Company to be wound up. In the event the Respondent Company is able to recover all or any monies under the aforesaid case then it would not be justified to wound up the company. The Petitioner argued that the substrantum of the company broke down in 2011. However, the Petitioner only filed the Petition in 2014. In the on present case there is clearly an inordinate delay in filing the Petition on the part of the Petitioner 20 which was not explained in any of the Affidavits. The delay in filing the Petition, would mean that the Petitioner had acquiesced the conduct of the affairs of the company. I am of the considered view that there are insufficient facts and evidence to conclude that mutual trust and confidence between the directors have irretrievably broken down. Furthermore due to lack of facts and evidence this Court cannot ascertain who is the author of the breakdown. I have also considered the view of the opposing creditors and guided by the authorities and principles mentioned above I therefore conclude that it is neither just nor equitable for the Respondent Company to be wound up. sdg. ( HASNAH BINTI DATO’ MOHAMMED HASHIM ) Judge High Court of Malaya Kuala Lumpur. 15th August 2014 21 Counsels: For the Petitioner/Appellant: Messrs. Dennis Nik & Wong - K.W Leong - S. Raven - Y.L. Chau For the Respondent/Respondent/Opposing Contributory: Messrs. Vicknaraj, RD Rahman Rajesh Kumar & Associates - Subarna Paul - R.K. Sharma - Adam Kiob Messrs. Amrit & Co. for Opposing Creditors - Amrit Pal Singh - Fuzal