Week 11 template v3

advertisement

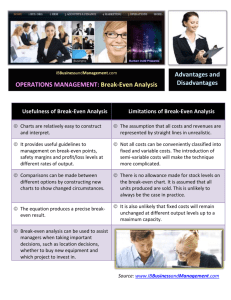

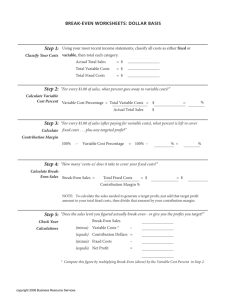

[Web Page 1] WEEK # 11 BREAK-EVEN AND COST-VOLUME-PORFIT ANALYSIS DESCRIPTION / OVERVIEW OF WEEK In any business, the goal is to make a profit. To achieve this goal, a good understanding of Cost-Volume-Profit relationship is important. It is necessary to understand how revenue and costs change with the quantity produced and sold. To be competitive in the market, businesses should look into ways of lowering their costs by reducing fixed costs and unit variable costs, while optimizing the quantities of items produced and sold, as well as by analyzing the resulting effects on their revenue. In this week’s lecture, you will learn to answer some of important questions in making such business decisions. LEARNING OUTCOMES At the end of this lesson, you will be able to: Discuss Cost-Volume-Profit Analysis. Construct and interpret cost-volume-profit charts. Compute break-even values using cost-volume-profit relationships. Compute break-even values using contribution margin and contribution rate. Compute the effects of changes to cost, volume, and profit. Week11 Page 1/26 CHECKPOINT / REVIEW In the previous lesson, we have learned to: Explain the net present value criterion rule Determine the net present value of a capital investment project and infer from the net present value whether a project is feasible. Methods of Evaluationg Investment Decisions Discounted Cash Flow Criterion Net Present Value Criterion Amortization Schedules In this lesson, we moved away from the interest formulas and into the application of linear equation. We need to review how to graph a linear equation in two variables. For example: Given: y = 50x + 8000 Step 1: Construct a table of values for the range of x (say, from 0 to 200) x 0 100 200 y = 50x + 8000 y=50(0) + 8000 = 8 000 y=50(100) + 8000 = 13 000 y=50(200) + 8000 = 18 000 Step 2: Construct and label the axes. Then plot the points. Insert graph here Week11 Page 2/26 Note: To construct the graph of a linear equation, it is sufficient to have just two (x,y) pairs in the table of values. Plotting a third point provides a check of your calculations. If not all three points lie on a straight line, then you have made an error in calculating the coordinates of the points or in plotting the points. REQUIRED READINGS FROM TEXTBOOK Readings: Text, 6.1, (pages 227-244) Readings: Text, 6.2, (pages 244-249) Readings: Text, 6.3, (pages 249-253) BA II plus calculator Manual RECOMMENDED READINGS AND/OR RESOURCES 1. Glossary Terms (Week 11) 2. http://www.wolframalpha.com (type ``graphing calculator`` and enter above equation as an example. ) 3. http://en.wikipedia.org/wiki/Cost-Volume-Profit_Analysis 4. www.youtube.com/watch?v=TLOo2mY6FIw 5. http://tutor2u.net/business/production/break_even.htm Week11 Page 3/26 [Web Page 2–…] 6.1 COST-VOLUME-PROFIT (CVP) ANALYSIS Cost-Volume-Profit Analysis is a valuable tool in evaluating the potential effects of decisions on profitability. It helps to determine the number of units you need to sell, the price to charge, the costs you may incur, and the profit that results. Eric`s example, Eric has started business making and selling wooden birdhouses. The data related to the business is shown below. Selling price = $30 per unit (birdhouse) Materials and supplies cost = $10 per unit (birdhouse) Rental of workshop for business = $ 400 (Rental Fee for a year) Eric can make a maximum of 50 birdhouses per year. (Production capacity) To determine how much profit he would make, Eric calculated his income on the basis of different numbers of birdhouses sold, summarizing the information in the table below: Eric discovered that he would cover all the costs if he could make and sell 20 units in a year. This level of production (20 units), at which total revenue = total cost, is called the break-even point. Break-even point is one of the key outcomes from a cost-volume-profit (CVP) analysis. At the break-even point, the profit is zero (ie, there is no gain or loss incurred). Week11 Page 4/26 In the presentation of cost-volume-profit (CVP) analysis, several assumptions are made: I. Revenue per unit of output (price) is constant, and total revenue varies directly with volume. II. Costs can be either fixed or variable. III. Fixed costs remain constant over the time period considered for all levels of output. Note: Fixed costs per unit decrease as the volume of production increases. Examples of fixed costs: property taxes rent executive salaries insurance cost depreciation of equipment equipment rental IV. Variable costs are constant per unit of output regardless of volume. Note: Total variable cost increases or decreases as the level of production increases or decreases. Examples of variable costs: Variable Manufacturing Costs o direct material costs o direct labor costs o machine hour costs Variable Selling Costs o sales commissions o advertising cost Note: In most real life situations, Fixed costs are not necessarily constant across all levels of output, they tend to be a step function. Per unit variable costs are not always constant, they are often influenced by economies of scale. Costs cannot be rigidly classified as fixed or variable; many costs are with both a fixed and a variable component. However, the above assumptions are a simplification of the real world but are adequate for introducing break-even analysis. Week11 Page 5/26 [Web Page 3–…] 6.1 COMPUTING BREAK-EVEN (BE) POINT ALGEBRICALLY USING COST-VOLUME-PROFIT RELATIONSHIPS: Let’s look at the symbolic notation for the variables in the break-even model to facilitate the discussion of concepts and formulas: P VC FC TR TVC TC X selling price per unit variable cost per unit fixed costs total revenue total variable cost total cost volume (in units) Some of the important relationships in the break-even model: TR P X TVC VC X TC = FC + TVC PROFIT = TR – TC Week11 Total Revenue = Price x Volume (in units) Total Variable Cost = Variable cost per unit × units Total Cost = Fixed Cost + Total Variable Cost Profit = Total Revenue – Total Cost Page 6/26 In the Eric example, find the break-even (BE) point: Let X be the number of units produced and sold. Selling Price per unit = P= $30 Fixed Cost = FC = $400 (per period, in this case a year) Variable Cost = VC per unit = $10 Production Capacity = 50 units (per period, in this case a year) TR = $30X TC = $400 + $10X At break-even (BE): TR = TC 30X = 400 + 10X 30x -10X = 400 20X = 400 X = 20 units to breakeven Expressing Break-even point in terms of: (a) Units (b) Sales Dollars (c) % of Capacity BE (X) = X = 20 units BE ($) = P X $30 20 $600 BE units 20 BE (%) = 100 100 40% Capacity 50 YOUR TURN 6.1 Part A (p.241-242) – Questions #2 parts (a) and (b) A firm manufactures a product that sells for $12 per unit. Variable cost per unit is $8 and fixed cost per period is $1200. Capacity per period is 1000 units. Perform a break-even analysis: (a) Provide an algebraic statement of the total revenue and total cost TR = answer TC = answer (b) Compute break-even point in units; BE (x) = answer (c) Compute break-even point in dollars; BE ($) = answer (d) Compute break-even point as a percent of capacity; BE (%) = answer Week11 Page 7/26 [Web Page 4–…] 6.1 FIND BREAK-EVEN POINT USING BREAK-EVEN CHART Steps in constructing a breakeven chart: 1. Label x and y axis 2. Plot Total Revenue (TR) line and label TR 3. Plot Fixed Cost (FC) line and label FC Note: this is a straight horizontal line 4. Plot Total Cost (TC) line and label TC 5. Identify the break-even point (in terms of units or % of capacity and sales $) Note: Break-even point is the point at which the total revenue line and the total cost line intersect. 6. Label Profit and Loss areas Note 1: the area between the total revenue line and the total cost line to the left of the break-even point represents the loss area where total revenue is less than the total cost. Note 2: the area between the total revenue line and the total cost line to the right of the break-even point represents the profit area where total revenue is greater than the total cost. Week11 Page 8/26 With Eric example, construct the break-even (BE) chart: Note: To plot a straight line, 3 points should be used. It is suggested that you use x = 0, x = BE units and x = capacity units. x Plot TR = 30 x x Plot TC = 400 +10 x 0 30 x 0 = 0 0 400 + 10 x 0 = 400 20 30 x 20 = 600 20 400 + 10 x 20 = 600 50 30 x 50 = 1500 50 400 + 10 x 50 = 900 (50, 1500) (50, 900) (20, 600) $600 (0, 400) FC = 400 20 units Week11 Page 9/26 YOUR TURN 6.1 Part A (p.241-242) – Questions #2 parts (c) …. Continued from part (a and b) A firm manufactures a product that sells for $12 per unit. Variable cost per unit is $8 and fixed cost per period is $1200. Capacity per period is 1000 units. Show a detailed breakeven chart. Recall: BE point from part (b) = answer (on webpage 3) x Plot TR = answer x Plot TC = answer 0 answer 0 answer answer 1000 answer answer Week11 answer 1000 answer answer Page 10/26 [Web Page 5–…] 6.1 FIND BREAK-EVEN POINT USING BAII PLUS CALCULATOR You can use the BREAKEVEN function of the BAII Plus Calculator to determine the break-even point. In this function: P VC FC PFT Q = Unit price = Unit variable cost = Total fixed cost for the period = Resulting Profit = Input or the Computed Quantity (in units) (NOTE: this was called X above) Any four of the five variables may be entered. You can then compute a value for the fifth variable. With Eric Example, find the break-even (BE) point: Let Q be the number of units produced and sold. 2nd BRKEVN FC = 400 ↓ VC = 10 ↓ P = 30 ↓ PFT = 0 (at breakeven) ↓ Q CPT 20 (units) Wayne show demo!! YOUR TURN 6.1 Part B (p.242) – Questions #2 Let Q be the number of hats produced and sold for children and adults. 2nd BRKEVN FC = answer VC = answer P = answer PFT = answer Q CPT answer Hence, Break-even point in i. units = answer ii. dollars = answer iii. % of capacity = answer Week11 Page 11/26 [Web Page 6…] 6.2 FIND BREAK-EVEN POINT USING CONTRIBUTION MARIGN (CM) AND CONTRIBUTION RATE (CR) As an alternative to using the break-even relationship, TOTAL REVENUE = TOTAL COST, we can use the concepts of contribution margin and contribution rate to determine breakeven units and sales dollars. Contribution margin is a helpful indicator to business people. They view the contribution margin as being the amount left over from the sales revenue per unit after the variable costs have been paid. This excess can be used to pay off fixed costs or contribute to profit after the break-even point. Note that while fixed costs can eventually get paid off, variable costs are always be there for every unit you produce. Unit Contribution Margin (CM) = Selling Price per unit – Variable cost per unit Contribution Rate (CR) = Unit Contribution Margin Unit Selling Price Break-even point (in units) = Fixed Cost Contribution Margin Break-even point (in sales dollars) = Fixed Cost Contribution Rate With Eric example, find the contribution margin, contribution rate, break-even (BE) point in terms of units and dollars: a. Unit Contribution Margin (CM) = Selling Price per unit – Variable cost per unit = $30 - $10 = $20 per unit (ie, Profit increases by $20 for each additional birdhouse sold. This is used to cover the fixed cost.) b. Contribution Rate (CR) (minimum of 4 decimal places) = $20 0.6667 (i.e. contribution margin expressed as a fraction of unit selling price. $30 In this case 67% of each sales dollar covers the fixed cost.) Week11 Page 12/26 c. Break-even point (in units) = $400 20 units $20 d. Break-even point (in sales dollars) = $400 $600 OR 20 units x $30 = $600 0.6667 Example #1 6.2 Part A (p.246-247) – Questions #4 Find the contribution margin, contribution rate, break-even (BE) point in terms of units and dollars. Let Q be the number of units produced and sold. P = Unit price = 80% of $100 = $80 VC = Unit variable cost = $38 FC = Total fixed cost for the period =$720 a. Unit Contribution Margin (CM) = Selling Price per unit – Variable cost per unit = $80 - $38 = $42 per unit b. Contribution Rate (CR) = $42 0.525 $80 c. Break-even point (in units) = $720 17.14 units (at least ) 18 units $42 d. Break-even point (in sales dollars) = $80 18 $1400 (Note: It is not feasible to have 0.14 units, therefore round up.) Week11 Page 13/26 YOUR TURN 6.2Part A (p.246) – Questions #2 Let Q be the number of units produced and sold. P = Unit price = answer VC = Unit variable cost = answer FC = Total fixed cost for the period = answer (a) Unit Contribution Margin (CM) = answer (b) Contribution Rate (CR) = answer (c) Break-even point (in units) = answer (d) Break-even point (in sales dollars) = answer Week11 Page 14/26 [Web Page 7…] EFFECTS OF CHANGES TO COST-VOLUME-PROFIT ANALYSIS Using an understanding of the relationships between cost, volume, and profit, it is possible to determine the effects of changes to any of the variables of the formula. This type of analysis is called “what-if analysis” or “sensitivity analysis”. What-if Analysis is to find out the effect on profitability if : The variable cost change The fixed cost change The selling price change The quantity change There is a target amount of profit to be achieved. As mentioned before, using the BREAKEVEN function in the BAII plus calculator, any four of the five variables (FC, VC, P, PFT and Q) may be entered. You can then compute a value for the fifth variable. Example #1 6.3 (p.250-251) – Questions #2 Let Q be the number of calendars purchased and sold. P VC FC = Unit price = $9.99 (selling price per calendar) = Unit variable cost = $ 2.69 (purchased cost of each calendar from supplier) = Total fixed cost of their business for the period = $190+$321 = $511 (in this case, per day) a) How many calendars must they sell each day to break even? 2nd BRKEVN FC = 511 ↓ VC = 2.69 ↓ P = 9.99 ↓ PFT = 0 (at breakeven) ↓ Q CPT 70 (units) b) If they decrease the wages to $240.70 per day, how many must they sell each day to break even? New FC = $190+$240.70 =$430.70 Week11 Page 15/26 2nd BRKEVN FC = 430.70 ↓ VC = 2.69 ↓ P = 9.99 ↓ PFT = 0 (at breakeven) ↓ Q CPT 59 (units) c) If they put the calendars “on sale” at 25% off, what would be their profit if they sold 120 units in a day? New P = $9.99 x (1 – 0.25) = $7.49 2nd BRKEVN FC = 511 ↓ VC = 2.69 ↓ P = 7.49 ↓ Q= 120 ↓ PFT CPT $65.00 d) On the last day that they plan to be in the mall, they have 200 calendars remaining on hand. If the wages for the day are $222, what is the lowest price they can charge for each calendar and still breakeven for that day? New FC = $222+$190 = $412 2nd BRKEVN FC = 412 ↓ VC = 2.69 ↓ PFT = 0 ↓ Q= 200 ↓ P CPT $4.75 YOUR TURN 6.3 (p.250-251) – Questions #3 Let Q be the number of sandwiches sold. P VC FC = Unit price = = Unit variable cost = Total fixed cost for the period Week11 Page 16/26 a) How many sandwiches must they sell each day to break even? 2nd BRKEVN FC = VC = P = PFT = Q CPT b) If they increase variable costs by $0.20 per sandwich, how many sandwich must they sell to break even? New VC = answer 2nd BRKEVN c) If the rent increases by 10%, what would their profit be if they sold 1600 sandwiches? New FC = answer 2nd BRKEVN d) If the sandwich price were reduced by $0.20, how many sandwiches must they sell to make $1000 profit? New P = answer 2nd BRKEVN Week11 Page 17/26 Week11 Page 18/26 Example #2 Self Test – Question 1 (p.255) Let Q be the number of CD sold. P = Unit price = $10 per CD VC = (Unit variable cost = Manufacturing + Marketing + Royalty Payment) per CD = $2.60 + $2.40 + 0.20*$10 = $7.00 per CD FC = Total fixed cost for the period =$18000 Capacity = 15000 CDs (c) Let the number of CDs be x. Revenue = 10 x Cost = 18 000 2.60 x 2.40 x (0.2)(10) x 18 000 7.00 x Week11 Page 19/26 (d) New FC = answer New VC = answer 2nd BRKEVN FC = answer VC = answer P = answer PFT = answer Q CPT answer (e) New P = answer New VC =answer New FC = answer 2nd BRKEVN FC = answer VC = answer P = answer PFT = answer Q CPT answer Week11 Page 20/26 [Web Page 6–…] SUMMARY + NEXT STEP In this lesson, we have learned to: Construct and interpret cost-volume-profit charts. Compute break-even values using cost-volume-profit relationships. Compute break-even values using contribution margin and contribution rate. Compute the effects of changes to cost, volume, and profit. In the next lesson, we will look at Chapter 5 - Trade Discount and Cash Discount: Week11 Solve problems involving trade discounts Calculate equivalent single rates of discount for discount series and solve problems involving discount series Apply methods of cash discount Page 21/26 [Web Page 7–…] READINGS Please read Hummelbrunner, Coombs, Fullone Chapter 6 o Readings: Text, 6.1, (pages 227-244) o Readings: Text, 6.2, (pages 244-249) o Readings: Text, 6.3, (pages 249-253) EXERCISES Exercises are not graded but you are responsible for understanding the materials. All answers are at the back of the book. Please check. Exercise 6.1 – Page 241 Part A – Questions 1, 2 Exercise 6.1 – Page 241 Part B – Questions 1, 3 Exercise 6.2 – Page 246 Part A – Questions 1, 3 Exercise 6.2 – Page 246 Part C – Questions 1, 3 Exercise 6.3 – Page 250 Questions 1, 3 Review – Page 254 Questions 1, 4, 5 Self-Test – Page 255 Question 1 EVALUATION (included in final grade) After you have read the require reading, test your comprehension by taking this week’s quiz. QUIZ MODULE 11 1. On a break-even chart, the fixed cost line is: a. parallel to the x-axis @ Correct.(See Chapter 6, Section 6.1B, Break-even charts) b. parallel to the y-axis @ Incorrect.(See Chapter 6, Section 6.1B, Break-even charts) c. has a positive slope @ Incorrect.(See Chapter 6, Section 6.1B, Break-even charts) d. has a negative slope @ Incorrect.(See Chapter 6, Section 6.1B, Break-even charts) Week11 Page 22/26 2. A break-even chart has been set up to show the current break-even point. Due to an increase in the price of raw materials, the variable cost per unit has increased. Assume all other costs and the selling price per unit remains constant. How does this change in the variable cost per unit affect the break-even chart? a. The y-intercept of the total cost line increases @ Incorrect.(See Chapter 6, Section 6.1B, Break-even charts) b. The slope of the total cost line increases. @ Correct.(See Chapter 6, Section 6.1B, Break-even charts) c. The break-even point in units decreases. @ Incorrect.(See Chapter 6, Section 6.1B, Break-even charts) d. The y-intercept of the total cost line decreases. @ Incorrect.(See Chapter 6, Section 6.1B, Break-even charts) 3. The contribution rate is a. The unit selling price as a fraction of the contribution margin @ Incorrect. (See Chapter 6, Section 6.2B, Contribution Margin and Rate) b. The fixed costs as a fraction of the unit contribution margin @ Incorrect. (See Chapter 6, Section 6.2B, Contribution Margin and Rate) c. The fixed costs as a fraction of the contribution rate @ Incorrect. (See Chapter 6, Section 6.2B, Contribution Margin and Rate) d. The contribution margin as a fraction of the unit selling price @ Correct. (See Chapter 6, Section 6.2B, Contribution Margin and Rate) 4. Consider the following data related to the production of an electronic gadget. The sales price is $20 per unit. The variable cost per unit is $15, and fixed costs are $85 000. Find the break-even point in units. a. 4250 @ Incorrect. (See Chapter 6, Section 6.1C, Computing Break-even using formulas) b. 5667 @ Incorrect. (See Chapter 6, Section 6.1C, Computing Break-even using formulas) c. 17 000 @ Correct. (See Chapter 6, Section 6.1C, Computing Break-even using formulas) d. 15 567 @ Incorrect. (See Chapter 6, Section 6.1C, Computing Break-even using formulas) Week11 Page 23/26 5. J.B. Lincoln, Ltd. produces a DVD player. Fixed costs are $360 000. The variable cost per unit is $58, and the selling price per unit is $84. Find the contribution rate per unit. a. 31% @ Correct. (See Chapter 6, Section 6.1C, Computing Break-even using formulas) b. 69% @ Incorrect. (See Chapter 6, Section 6.1C, Computing Break-even using formulas) c. 15% @ Incorrect. (See Chapter 6, Section 6.1C, Computing Break-even using formulas) d. 85% @ Incorrect. (See Chapter 6, Section 6.1C, Computing Break-even using formulas) 6. Johnson, Ltd. produces a desk lamp. Fixed costs are $280 000. The variable cost per unit is $17, and the selling price per unit is $35. Find the break-even point in terms of sales dollars. a. $15 556 @ Incorrect. (See Chapter 6, Section 6.1C, Computing Break-even using formulas) b. $544 444 @ Correct. (See Chapter 6, Section 6.1C, Computing Break-even using formulas) c. $264 452 @ Incorrect. (See Chapter 6, Section 6.1C, Computing Break-even using formulas) d. $279 982 @ Incorrect. (See Chapter 6, Section 6.1C, Computing Break-even using formulas) 7. A plant produces small TV sets. The plant has a capacity of 24 000 units. Fixed costs are $320 000. The selling price is $128 per unit, and the variable cost is $88 per unit. Find the break-even point as a percent of plant capacity. a. 15.15% @ Incorrect. (See Chapter 6, Section 6.1D, Calculating Break-even when the unit prices and unit costs are unknown.) b. 10.42% @ Incorrect. (See Chapter 6, Section 6.1D, Calculating Break-even when the unit prices and unit costs are unknown.) c. 21.33% @ Incorrect. (See Chapter 6, Section 6.1D, Calculating Break-even when the unit prices and unit costs are unknown.) d. 33.33% @ Correct. (See Chapter 6, Section 6.1D, Calculating Break-even when the unit prices and unit costs are unknown.) 8. The variable costs on a new product will be $40 per unit and the fixed costs are estimated to be $4800. The selling price of the product is to be $75 per unit. What is the contribution margin? Week11 Page 24/26 a. $15 @ Incorrect. (See Chapter 6, Section 6.2A, Contribution Margin) b. $75 @ Incorrect. (See Chapter 6, Section 6.2A, Contribution Margin) c. $60 @ Incorrect. (See Chapter 6, Section 6.2A, Contribution Margin) d. $35 @ Correct. (See Chapter 6, Section 6.2A, Contribution Margin) 9. Merit, Ltd. manufactures a remote control device. The device sells for $25 per unit. The current fixed costs are $75 000 and the current variable cost per unit is $10. Find the new break-even point in units if fixed costs increase by 20%. The other values stay the same. a. 6000 @ Correct. (See Chapter 6, Section 6.3, Effects of changes to Cost-Volume-Profit) b. 5000 @ Incorrect. (See Chapter 6, Section 6.3, Effects of changes to Cost-Volume-Profit) c. 5770 @ Incorrect. (See Chapter 6, Section 6.3, Effects of changes to Cost-Volume-Profit) d. 9000 @ Incorrect. (See Chapter 6, Section 6.3, Effects of changes to Cost-Volume-Profit) 10. Total variable costs are $58 750 when total sales revenue is $124 396. Find the breakeven point in sales dollars if fixed costs are $424 000. a) $803 460 @ Correct. (See Chapter 6, Section 6.1D, Calculating Break-even when the unit prices and unit costs are unknown.) b) $902 128 @ Incorrect. (See Chapter 6, Section 6.1D, Calculating Break-even when the unit prices and unit costs are unknown.) c) $656 460 @ Incorrect. (See Chapter 6, Section 6.1D, Calculating Break-even when the unit prices and unit costs are unknown.) d) $362 250 @ Incorrect. (See Chapter 6, Section 6.1D, Calculating Break-even when the unit prices and unit costs are unknown.) Week11 Page 25/26 ASSIGNMENT # 3 See attached file. No Discussion Topic in Week 11 CHAT: There is no chat. ATTENTION: The math centre is now online! If you are at home and need math help Monday to Friday from 10:30 am to 4:00 pm, you can just go the math centre website http://liberalarts.humber.ca/maths/maths_centre.htm and “click to chat”. Week11 Page 26/26