Flexible Working April 2015

advertisement

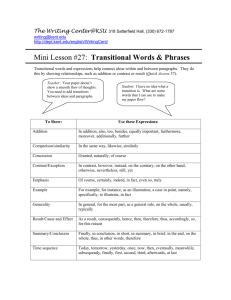

Flexible Working, Reward and Recognition Policy May 2015 Contents Chapter 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 11.0 12.0 13.0 14.0 15.0 16.0 17.0 18.0 19.0 20.0 21.0 22.0 23.0 24.0 25.0 26.0 27.0 28.0 29.0 30.0 31.0 32.0 Page Policy statement Introduction Flexible Working Maternity leave Paternity leave Shared Parental Leave Adoption leave Parental leave Grandparent leave Time off for dependents Compassionate leave Part-time working and requests for flexible working Flexible working hours Time off in lieu scheme Annualised hours Compressed hours Working from home Retirement age Career (or ‘sabbatical’) break Short-notice annual leave days (or ‘duvet days’) Time off for volunteering Keep in touch days Childcare Vouchers Workplace Nursery Salary Exchange Scheme Additional Annual Leave/Incremental Cycle to Work Scheme Private Health Care Staff Discounts Pension Schemes Length of Service Birthday & Christmas GEM (Go the Extra Mile) Award 3 3 3 4 5 6 7 7 7 9 10 8 9 10 10 11 11 12 12 13 13 13 14 14 15 15 16 16 17 18 18 19 Appendices A1 A2 A3 Application for maternity leave form Application for adoption leave form Application for shared parental leave form 20 21 22 Noted by: Director Group Approved by: Board of Trustees In: April 2015 In: May 2015 Manager responsible for implementation: Human Resources Manager Manager responsible for interpretation: Chief Executive 2 1.0 2.0 3.0 4.0 Policy statement 1.1 Kent Union is committed to being an excellent employer; the Union recognises that in order to be a highly successful organisation the Union must be an employer of choice with high calibre and well-motivated staff. Integral to this goal is ensuring that Kent Union is a flexible employer. 1.2 Kent Union recognises that staff are its greatest asset and that achieving its goals is dependent upon its staff. Kent Union also acknowledges that it has a social and moral responsibility to its staff, to ensure their health, welfare and happiness. 1.3 This policy allows staff to pick and choose different options to suit their circumstances. This document details the flexible benefits, such as childcare vouchers, additional annual leave, a range of pensions and a range of flexible working, which includes grandparent leave and duvet days. 1.4 The Flexible, Reward and Recognition Policy only applies to staff on Kent Union’s Terms and Conditions of Employment. Information and advice on any aspects of the policy is available from the Union’s Human Resources Department (01227 824220). 1.5 Kent Union reserves the right to amend this policy from time to time. This policy is not contractual and does not form part of Kent Union’s terms and conditions of employment. Introduction 2.1 Kent Union’s reward package must reflect the needs of people working in the modern-day, who are increasingly juggling busy lives and trying to balance their work and home lives. The reward package must both attract high-calibre staff and retain existing staff, ensuring they feel valued, recognised and motivated during their time with Kent Union. 2.2 This document outlines policies, systems and schemes that Kent Union has adopted to achieve the policy statement above. The document details how Kent Union will meet statutory requirements, for example those covering maternity benefits, and how Kent Union goes beyond legal obligations to implement flexible working conditions. 2.3 The Union will endeavour to meet the needs and desires of its employees, and flexibility will always be considered as long as these do not compromise the goals of the organisation. Flexible Working 3.1 This policy is intended to provide a range of options from which employees and their line managers can choose an appropriate way of working that suits the individual and the needs of Kent Union. Not all of the options will be applicable or possible for every employee, depending upon the circumstances of their job. 3.2 This document is an organic policy that will be added to and revised in light of legislation, the changing nature of employment and feedback from employees. Time off for ante-natal appointments 4.1 4.2 This policy outlines the statutory right to take time off to attend antenatal appointments. If you are pregnant you may take paid time off during working hours for antenatal appointments. You should try to give us as much notice as possible of the appointment. 3 Unless it is your first appointment, we may ask to see a certificate confirming your pregnancy and an appointment card. 4.3 (a) you are the baby's father; (b) you are the pregnant woman's spouse, civil partner or are living with her in an enduring family relationship and she is not your sister, mother, grandmother, aunt or niece; or (c) she has undergone assisted conception and at that time you were her wife or civil partner or gave the required legal notices to be treated in law as the second female parent; or (d) you are one of the intended parents in a surrogacy arrangement and expect to obtain a parental order in respect of the child. 4.4 5.0 You may take time off to accompany a pregnant woman to an antenatal appointment if you have a "qualifying relationship" with the woman or the child. This means that either: Please give us as much notice of the appointment as possible. You must provide us with a signed statement providing the date and time of the appointment and confirming: (e) that you meet one of the eligibility criteria in paragraph 4.3; (f) that the purpose of the time off is to accompany the pregnant woman to an antenatal appointment; and (g) that the appointment has been made on the advice of a registered medical practitioner, registered midwife or registered nurse. 4.5 You may take time off to accompany a pregnant woman to up to two antenatal appointments in relation to each pregnancy. Time off to attend these appointments is unpaid. 4.6 If you wish to take time off to attend further antenatal appointments you should request annual leave. 4.7 For our Time off for Adoption Appointments Policy please contact the HR Department. Maternity leave 5.1 Kent Union is committed to supporting female employees during pregnancy and after the birth of their child. This section outlines the rights, entitlements and obligations of employees who become pregnant. 5.2 All employees, regardless of the hours worked and length of service, have the following rights: 5.2.1 To maternity leave – staff are entitled to 52 weeks’ maternity leave. 5.2.2 To return to work in the same or similar job if the old job no longer exists. 5.2.3 To protection against dismissal for reasons wholly or partly relating to pregnancy. 5.2.4 To time off for antenatal care on production of evidence of appointments. 4 5.3 Maternity leave does not count as a break in service; whilst on maternity leave the employee is entitled to full contractual benefits, excluding remuneration, for the maternity leave period. 5.4 It is unlawful for the employee to return to work within the two weeks following the baby’s birth. 5.5 To be eligible for Statutory Maternity Pay (SMP) the employee needs to satisfy the following criteria: 5.5.1 To have been employed by Kent Union for at least 26 weeks continuing into the 15th week before the expected week of childbirth (EWC). 5.5.2 To be earning at least the Lower Earnings Limit for National Insurance Contributions. 5.5.3 To be still pregnant at the 11th week before the EWC. 5.5.4 To have stopped work wholly or partly because of pregnancy or confinement. 5.6 In circumstances where an employee is not entitled to receive SMP they may be entitled to Maternity Allowance, which is paid directly by the Benefits Agency. 5.7 All employees who are eligible to receive SMP and who have more than 52 weeks’ continuous service with Kent Union continuing into the 15th week before the EWC will be paid for 16 weeks at full pay and 23 weeks at half pay (unless this is lower than statutory payment); payments are subject to normal deductions and will be made through the payroll on usual paydays. The employee may take up to a further 13 weeks unpaid maternity leave. 5.8 If the employee has more than 26 weeks’ but less than 52 weeks’ service with Kent Union at her 15th week before her EWC then, if entitled, she will receive Statutory Maternity Pay. Leave may be taken at any time from 11 weeks before the EWC and up to 52 weeks after the birth of the child. 5.9 An employee wishing to exercise her right to maternity leave must: 5.9.1 Notify Kent Union in writing that she is pregnant by completing the Application for Maternity Leave Form (appendix A1). The completed form must be given to the employee’s line manager and copied to the Human Resource Manager no later than 15 weeks’ before the EWC in order to qualify for maternity pay. 5.9.2 The employee must also complete the section of the Application for Maternity Leave Form to indicate when she intends her maternity leave to commence and where applicable when she intends to return to work. Once notification is given, the maternity leave must begin on that date. 5.9.3 The Application for Maternity Leave Form must be accompanied by a medical certificate (form MAT B1 usually available from your midwife) to verify pregnancy and EWC. 5.9.4 The maternity leave period may begin any time after the 11th week before the EWC. However, if the employee is absent wholly or mainly due to pregnancy after the 6 th week before the EWC then the maternity leave period is automatically triggered. 5 6.0 6.0 5.10 In the tragic event of still-birth, the employee is still entitled to SMP if the child is born after the 16th week before the EWC. 5.11 If the baby is born after the EWC the SMP is not affected. For the purpose of calculating the return to work date, the actual week of birth will be used. 5.12 When the line manager has received written notification of pregnancy they will conduct a risk assessment to ensure that there is nothing in the workplace that presents a risk to the employee’s health or that of their unborn child. 5.13 Kent Union will write to the employee 28 days before the end of the maternity leave to confirm the intended date of return. If the employee wishes to return to work before her intended return date, she must write to the Human Resources Manager giving 8 weeks’ notice. 5.14 If the employee has received contractual maternity pay and fails to return to work, or continue in employment for at least 3 months following her maternity leave, Kent Union has the right to reclaim the whole or part of the non-statutory element of the contractual maternity pay (this is not applicable if the employee is absent through sickness following her return to work). 5.15 An employee undertaking IVF treatment will be able to take reasonable time off work to attend clinics and receive treatment. Paternity leave 6.1 Kent Union recognises that the birth of a child is an important time for both parents and therefore goes beyond statutory requirements by offering employees up to 20 working days’ paternity leave at full pay, after their wife, partner or civil partner has given birth. 6.2 Employees must (normally) give at least 28 days’ notice of the anticipated dates of paternity leave. Notice should be in writing to the employee’s line manager and copied to the Human Resources Administration. 6.3 In order to qualify for paid paternity leave, an employee must have at least 52 weeks’ continuous service ending with the week immediately preceding the 14th week before the expected week of childbirth (EWC). If the employee has less than 52 weeks’ service, they are entitled to 10 days’ paternity leave paid at the statutory level (as long as they are eligible for Statutory Paternity Pay). 6.4 The employee should agree with their line manager how and when the paternity leave will be taken; the leave should be taken within two years’ after the child is born. 6.5 To qualify for paternity leave the employee must have or expect to have responsibility for the child’s upbringing. Shared Parental Leave 6.0 Shared parental leave (SPL) is a form of leave that may be available if a child is expected to be born on or after 5 April 2015. It gives the employee and their partner more flexibility in how to share the care of the child within the first year after the birth. 6.1 This policy is intended to give a broad overview of SPL so do contact the HR department for further information. 6 6.2 You are entitled to SPL in relation to the birth of a child if: (a) You are the child’s mother, and share the main responsibilities for the care of the child with the child’s father or with your partner. (b) You are the child’s father and share the main responsibility for the care of the child with the child’s mother; or (c) You are the mothers partner and share the main responsibilities for the care of the child with the mother (where the child father does not share the main responsibility with the mother) 6.3 The following conditions must also be fulfilled: (a) You must have at least 26 weeks continuous employment with us by the end of the Qualifying Week, and still be employed by us in the week before the leave is taken; (b) The other parent must have worked (in an employed or self-employed capacity) in at least 26 of the 66 weeks before the EWC and had average weekly earnings of at least £30 during 13 of those weeks (c) You and the other parent must give the necessary statutory notices and declarations, including notice to end any maternity leave, statutory maternity pay (SMP) or maternity allowance (MA) periods 6.4 The total amount of SPL available is 52 weeks, less the weeks spent by the child’s mother on maternity leave (or the weeks in which the mother has been in receipt of SMP or MA if she is not entitled to maternity leave). 6.5 Any request for shared parental leave must be submitted no later than eight weeks before the date the employee intends the SPL to start, a written opt-in notice must be provided giving specific information, and (full details can be obtained from the HR Department). 6.6 If an employee wishes to end their maternity leave and opt into the SPL scheme, they must give eight weeks’ written notice to end their maternity leave before they can take SPL known as a ‘curtailment notice’ and at the same time as the curtailment notice, a notice to opt into the SPL scheme. Notice can be given before or after the birth, but the maternity leave cannot end until at least two weeks after the birth. 6.7 If requested certain information must be provided to Kent Union, including a copy of the birth certificate; and 6.8 The name and address of the other parent’s employer (or a declaration that they have no employer) 6.9 When an employee has opted into the SPL system, leave must be booked by giving us a period of leave notice. This may be given at the same time as the op-in notice or later, provided it is at least eight weeks before the start of the SPL. In general, a period of leave notice will set out a single continuous block of leave. We may be able to consider a period of leave notice where the SPL is split into shorter periods with periods of work in between. The blocks of leave should be at least one week, and no more than three separate blocks of SPL. 7 7.0 8.0 6.10 Employees can cancel a period of leave by notifying us in writing at least eight weeks before the start date in the period of leave notice. Employees can change the start date for a period of leave by notifying Kent Union in writing at least eight weeks before the original start date and the new start date. 6.11 Your terms and conditions of employment remain in force during SPL, except for the terms relating to pay. You may be able to claim Statutory Shared Parental Pay (SHPP) of up to 39 weeks (less any weeks of SMP or MA claimed by you or your partner) if you have at least 26 weeks’ continuous employment with us at the end of the qualifying week and your average earnings are not less than the lower earnings limit set by the government each year. You may also be entitled to an enhanced Shared Parental Pay of 14 weeks at half pay, (unless this is lower than statutory payment) and the remaining 23 weeks at statutory pay. 6.12 Employees are normally entitled to return to work in the position held before starting SPL and on the same terms of employment. However if it is not reasonably practicable for us to allow you to return into the same position, we may give you another suitable and appropriate job on terms and conditions that are not less favourable but only where the employee’s SPL and any maternity or paternity leave taken adds up to more than 26 weeks in total; or if SPL was taken consecutively with more than 4 weeks’ ordinary parental leave. 6.13 Both parents will be required to “self-certify” by each providing details of their eligibility to their employer. Employers and HM Revenue and Customs will both be able to carry out further checks of entitlement if necessary. Adoption leave 7.1 Kent Union recognises that parents adopting a child need time together with their new child to bond as a family. 7.2 The conditions for adoption leave and pay shall be the same as those for Maternity, Paternity and Shared Parental Leave (Adoption) and will apply for the adoption of any child up to the age of 18. 7.3 The time of the placement of a child with the employee will be treated in the same way as the EWC (see above). 7.4 Employees who are adopting are requested to give 28 days’ notice in writing to their line manager of their intention to take adoption leave by completing the Application for Adoption Leave Form (see appendix A2). 7.5 Please contact the HR department for further details. Parental leave 8.1 Kent Union believes that parents should have the flexibility to be able to spend additional time with their young children. The Employment Relations Act 1996 requires employers to offer employees 18 weeks’ unpaid leave taken before each child’s 5th birthday or for each child who qualifies for Disability allowance up to the child's 18th birthday, and for each adopted child up to 18th birthday, or the 5th anniversary of their adoption, whichever comes first. 8.2 Kent Union will allow parents (including adoptive parents) to take up to 26 weeks’ unpaid leave for each child, to be taken before the child’s 5th birthday. 8 9.0 10.0 8.3 Parents of children with a disability will be able to take up to 30 weeks’ unpaid leave for each child, to be taken before the child’s 18th birthday. In such cases the employee must provide proof to Kent Union that their child is in receipt of disability living allowance. 8.4 To qualify for parental leave the employee must have a minimum of 12 months’ continuous service with Kent Union. 8.5 A request for parental leave should be made in writing to the employee’s line manager and copied to the Human Resource Manager. When and how parental leave is taken should be agreed with the employee’s line manager; it should normally be taken in blocks of at least one week and at least 21 days’ notice must be given. 8.6 Kent Union reserves the right to postpone any period of parental leave if it considers that the operation of the organisation would be substantially prejudiced if the employee took leave at a specific time. Kent Union will however ensure that the employee is able to take their leave within six months of the original date. If Kent Union has to postpone a period of parental leave it will respond to the employee stating the reasons for the postponement within five working days of receiving the request to take parental leave. Grandparent leave 9.1 An employee who becomes a grandparent is eligible to 3 days’ paid leave to enable them to support their children around the birth (or adoption) of a grandchild. The employee may also take 7 days’ unpaid leave on top of their paid entitlement. 9.2 Any requests for grandparent leave should be made in writing to the employee’s line manager, copied to the Human Resource Manager, and giving at least 14 days’ notice of the requested date. The employee and line manager must agree how and when the leave is to be taken. 9.3 Grandparent leave should normally be taken before the grandchild is 12 months’ old. Time Off for Dependents 10.1 The law recognises that there may be occasions when you need to take time off work to deal with unexpected events involving one of your dependants. This time off for dependant’s policy gives all employees the right to take a reasonable amount of unpaid time off work to deal with certain situations affecting their dependants. 10.2 Kent Union is committed to ensuring that all employees are able to take a reasonable amount of time off during working hours in the following circumstances: 10.2.1 To provide assistance when a dependent falls seriously ill, gives birth or is injured or assaulted. 10.2.2 To make arrangements for the provision of care for a dependent who is seriously ill or injured. 10.2.3 In the event of the death of a dependent. 10.2.4 Because of the unexpected disruption or termination of arrangements for the care of a dependent. 9 10.2.5 To deal with an incident, which involves a child of the employee and which occurs during a time when they would normally be at school. 10.2.6 Other exceptional circumstances or emergencies, at the discretion of Kent Union 10.3 For the purposes of this policy Kent Union defines a “dependent” as: a partner/spouse a child a parent a person who lives in the same household as the employee including relatives but who is not an employee or lodger any person who reasonably depends on the employee for assistance such as an elderly neighbour 10.4 This policy applies to time off to take action which is necessary because of an immediate or unexpected crisis. Whether action is considered necessary will depend on the circumstances, including nature of the problem, the closeness of the relationship between you and the dependant, and whether anyone else is available to assist. Action is unlikely to be considered necessary if you knew of a problem in advance but did not try to make alternative care arrangements. 10.5 You will only be entitled to time off under this policy if, as soon as is reasonably practicable, you tell your line manager: 10.5.1 the reason for your absence; and 10.5.2 how long you expect to be away from work. 10.6 11.0 12.1 If you fail to notify as set out above, you may be subject to disciplinary proceedings under our Disciplinary Procedure for taking unauthorised time off. Compassionate leave 11.1 Kent Union recognises the needs of its employees to take reasonable time off to deal with family emergencies (including bereavements) that may not be covered by any other parts of the policy. 11.2 Compassionate leave will be paid as full pay normally for no more than 5 working days’ per annum; any further days’ leave will be unpaid. Employees should give their line manager reasonable notice of the need for leave, as is practicable. Confirmation must be sought from the Human Resources Manager, or Director Group as to the amount of paid leave that can be taken. Part-time working and requests for flexible working 12.1 Kent Union will deal with flexible working requests in a reasonable manner and within a reasonable time. In any event the time between making a request and notifying you of a final decision (including the outcome of any appeal) will be less than three months unless we have agreed a longer period with you. All employees will have a right to request flexible working provided they have worked for Kent Union continuously for 26 weeks at the date the request is made and provided also that they have not made a flexible working request during the last 12 months (even if the request was withdrawn by the employee). 10 12.2 A flexible working request under this policy means a request to do any or all of the following: (a) to reduce or vary the employee’s working hours; (b) to reduce or vary the days the employee works; (c) to work from a different location (for example, from home). 12.3 An employee’s flexible working request should be submitted to the Human Resources Department in writing and dated. It should: (a) state that it is a flexible working request; (b) explain the change being requested and propose a start date; (c) identify the impact the change would have on Kent Union and how that might be dealt with; (d) state whether you have made any previous flexible working requests. 11.0 A meeting with the Director of People will be arranged at a convenient time and place to discuss the request. The employee may be accompanied at the meeting by a colleague of their choice. The colleague will be entitled to speak and confer privately with the employee, but may not answer questions on the employee’s behalf. 11.1 The Director of People may decide to grant the employee’s request in full without a meeting, in which case the Human Resources Manager will write to the employee with the decision. 11.2 Kent Union will inform the employee in writing of Kent Union’s decision as soon as possible after the meeting. 11.3 If the employee’s request is accepted, Kent Union will write to the employee with details of the new working arrangements and the date on which they will commence. The employee will be asked to sign and return a copy of the letter. 11.4 Unless otherwise agreed, changes to the employee’s terms of employment will be permanent. However, we may suggest an initial trial period. 11.5 Kent Union may reject an employee’s request for one or more of the following business reasons: (a) the burden of additional costs; (b) detrimental effect on ability to meet customer demand; (c) inability to reorganise work among existing staff; (d) inability to recruit additional staff; (e) detrimental impact on quality; (f) detrimental impact on performance; (g) insufficiency of work during the periods that the employee proposes to work; or (h) planned changes. 11.6 If Kent Union is unable to agree to the employee’s request, we will write to tell the employee which of those reasons applies and why. We will also set out the appeal procedure 11.7 The employee may appeal in writing to the Chief Executive within 14 days of receiving the written decision. 11.8 The appeal must be dated and must set out the grounds on which the employee is appealing. 11 11.9 Kent Union will hold a meeting with the employee to discuss the appeal. The employee may bring a colleague to the meeting. 11.10 Kent Union will tell the employee in writing of its final decision as soon as possible after the appeal meeting, including reasons. There is no further right of appeal. 12.0 Flexible working hours 12.1 Kent Union is committed to offering flexible working hours (or flexi-time), within certain boundaries, where these are commensurate with the organisation’s needs. The flexi-time scheme allows employees to be flexible about when they start and finish work, but is not designed for employees to accumulate additional days off. 12.2 Some employees may be unable to operate flexible working hours, for example, if they work shifts or where there is a need for the employee to offer a service to customers during a particular time (e.g. Reception staff). Ultimately an employee’s manager will decide what hours an employee should work. 12.3 ‘Flexible working hours’ means that an employee chooses the hours that they work, in agreement with their line manager, with the following limitations: 12.3.1 (Most) employees must work ‘core hours’ of 10am – 4pm (with an unpaid lunch break of up to 2 hours between 12 and 2). 12.3.2 Employees cannot opt out of having a lunch break or ‘save’ their breaks until the end of the day and leave early as this will mean it is not a “rest” break. The minimum lunch break that an employee must take is 30 minutes. Whether or not an employee takes the 30 minutes, it must be counted as having been taken. 12.3.3 Hours should (normally) be worked between 8.00am and 6.00pm. Case study – flexible working hours Sarah works in the Student Activities Department, based in Canterbury; she travels into work from Maidstone and finds the commute to work problematic. She talks to her line manager about the possibility of coming into work later in the day, so that she misses rush hour and doesn’t have to get up so early, and finishing later in the evening. Sarah’s line manager agrees to the request, particularly as it ties in with the Union’s desire to extend opening hours beyond 5pm. Sarah and her line manager therefore agree that she will start work at 10am and finish at 6pm, Monday – Friday. 13.0 Time off in lieu scheme 13.1 Kent Union is committed to ensuring that its employees do not have to work excessive hours. Where particularly busy times of year, such as Freshers’ Week and the Summer Ball, serve to make this difficult a time off in lieu (TOIL) scheme operates. 13.2 If an employee is requested by their line manager to work additional hours and the employee is happy to do so, the line manager will record these additional hours as lieu time on the employee’s Annual Leave form and the employee should be allowed to take this time at a mutually convenient time. 12 14.0 15.0 13.3 It is not the purpose or intention of the TOIL scheme to allow staff to build up additional annual leave. 13.4 Kent Union is not able to offer financial reimbursement to employees for any additional hours worked. Annualised hours 14.1 An ‘Annualised Hours’ contract differs from a ‘normal’ contract in that it does not detail the employee’s normal work pattern. Rather, the work pattern reflects the changing needs of the organisation over the period of a year. For example, an employee may work 45 hours per week for 33 weeks of the year and have the rest of the year ‘off’. The employee’s pay is not affected by the work pattern and is still (normally) paid in 12 equal instalments. 14.2 Most of Kent Union’s business is conducted during the 31 weeks of term-time; this is particularly true for the Licensed Trade Department. For the other 21 weeks the Union does not need all its ‘career’ staff to be at work. Annualised hours contracts therefore make good sense for the Union and are often attractive to employees, offering them the opportunity to take most of the summer holiday off as paid leave. Compressed hours 15.1 Compressed hours involves an employee ‘compressing’ their working hours into a shorter number of days; for example, this could involve compressing a 35-hour working week into 4 ½ or 4 days. This has obvious advantages to employees, who benefit from a longer weekend, but can also work well for Kent Union, for instance by facilitating extended opening hours. 15.2 Compressed hours may be used for part or all of the year, for example, they may only be suited for term-time, or for the summer vacation. Compressed hours may also work over any of the days of the week, and not necessarily Monday-Thursday or Tuesday-Friday. Days off for holiday or sickness must be taken as 7 hours. No more than 9.5 hours (excluding lunch) may be allocated as part of compressed hours worked within one day. If more than one day per week is taken as holiday or due to sickness, then the employee will not be able to take their compressed day off during that week. 15.3 With all flexible working the Union will consider all requests on a case-by-case basis. Staff working compressed, annualised or flexible hours will discuss regularly with their line manager to ensure that both they and the organisation are continuing to benefit from the flexibility. The employee may at any time be asked to revert back to their previous contracted working pattern. 15.4 An employee wishing to move to compressed hours should discuss the option with their line manager. If the line manager agrees, the manager and the employee should agree the new working days and working hours and the duration that the compressed hours can be worked; the line manager should also inform the Human Resource Manager about the changes to working hours. Case study – compressed hours Mark is a Student Advisor working in the Mandela Building in Canterbury; he is keen to have a longer weekend and is willing to work longer days in exchange. Kent Union wants to extend the opening hours of its Advice Centre, following research into the needs of its clients. Mark and his line manager discuss the possibility of him moving to compressed hours and agree that Mark will move to a 4-day working week; this involves Mark working Monday, Tuesday, Wednesday and Thursday, 8.15am-6pm 13 each day, with an hour lunch break. Mark and his line manager agree that this working pattern is suitable for term-time only; during vacation time, Mark reverts to a ‘normal’ working pattern. This enables Kent Union to extend the opening hours of the Advice Centre until 6pm. 16.0 17.0 18.0 Working from home 16.1 Kent Union recognises that on occasion employees may find that they are more productive if they work at home, away from distractions and interruptions and avoiding a tiring commute into the office. Similarly, working from home gives people greater flexibility and control over their lives. 16.2 Kent Union therefore allows employees to work from home on an occasional basis, with the agreement of their line manager. Obviously, some employees must be at work in order to fulfil their function, for example, staff working behind bars, in receptions or behind tills in the shop; such employees will not normally be able to work from home. 16.3 The opportunity to work from home must be agreed in advance with an employee’s line manager. The employee and manager will agree specific targets that must be completed during the day at home. 16.4 Before an employee may work from home, the Union must conduct a risk assessment of their home-working environment. Further information about this is contained in the Union’s Health and Safety Policy. Retirement age 17.1 Kent Union does not have a set retirement age; Kent Union believes that age is not a determinant of whether an employee can work effectively, nor of whether an employee will want to cease working. Therefore, Kent Union will treat each individual’s retirement on a case-by-case basis. 17.2 Employees are encouraged to advise Kent Union if they are considering retirement at any point. If an employee is considering retirement, as much notification of their proposed retirement date would be appreciated to ensure we can provide all necessary advice and support and to give us time to consider requirements in respect of re-organisation of work, recruitment and succession. Employees could also consider a phased retirement by working flexibly. 17.3 Employees should consult the Human Resource Department and/or their pension provider to discuss any implications for pensions. Career (or ‘Sabbatical’) break 18.1 Kent Union recognises that some employees may wish to take an extended break from work in order to continue their personal development, care for a child or elderly relative or for travelling. In such cases, many employees will wish to return to their original job. 18.2 Kent Union is keen to facilitate the personal development of its employees, to reward long service and to retain employees where possible. Therefore, Kent Union offers employees who have at least 5 years’ continuous employment, the opportunity to take up to 1 year’s unpaid leave as a career break. 14 19.0 20.0 18.3 Career breaks must be agreed by the Human Resource Manager and the employee’s line manager. Requests for career breaks should be made in writing to the Human Resource Manager giving at least 3 months’ notice of when the career break is required. If the career break request is agreed, Kent Union will hold open the employee’s job (or comparable) for a fixed, agreed period. 18.4 Continuity of employment will be offered to any employee returning to work after a career break, but this will not include the career break itself. 18.5 Employees on a career break will have no entitlement to paid annual leave or any other benefits during their break from work. Short-notice annual leave days (or ‘duvet days’) 19.1 Kent Union recognises that, on occasion, employees will wish to take a day’s annual leave at very short notice, either because of an unexpected situation at home or because they do not feel like coming into work. 19.2 Therefore, Kent Union will allow employees to take up to 5 days of their annual leave entitlement as short-notice annual leave days. The intention of this is to give employees greater freedom and flexibility to govern how they spend their time. 19.3 The only requirements are that the employee phones their line manager before 9am (or at least one hour before s/he is due into work) and that their line manager agrees to the leave. 19.4 The employee’s absence must not affect Kent Union’s operations i.e. s/he must not have a meeting scheduled or any other operational need to be in work. Time off for volunteering 20.1 One of Kent Union’s values is a commitment to volunteering. Via Kent Union, hundreds of students volunteer their time each year to help others. Kent Union wishes to widen this opportunity to its career staff, recognising the mutual benefits this offers to employees, the Union and the community. 20.2 Therefore, Kent Union will allow career staff to take up to 25 hours per annum of normal work time to volunteer (hours for part-time staff will be pro-rata). 20.3 Volunteering times must be agreed in advance with the employee’s line manager. Volunteering should normally be through the Union’s existing volunteering programmes. 20.4 On an annual basis, the employee must provide the Union’s Volunteering Department with a report of their volunteering, including the number of hours volunteered, where the volunteering took place and any learning that the employee has obtained. Case study – staff volunteering Rosie is a manager in Marketing; she volunteers with a local children’s charity, providing mentoring for children from disadvantaged backgrounds. Kent Union recognises the benefit to the community and to Rosie that this volunteering provides and therefore allows Rosie to volunteer during normal work-time, for up to 25 hours per annum. Each year Rosie produces a brief report for the Union’s volunteering department about her volunteering and what she has 15 learnt from it. 21.0 22.0 Keep-in-touch days 21.1 ‘Keep in-touch’ days have been introduced to help make it easier for employees to come back to work after maternity leave. These days can be taken as single days or in blocks and can be used for training events or keeping in-touch with developments within the employee’s department. 21.2 Employees have the choice to come back to work for up to 10 days during their maternity leave (except for during the compulsory 2 weeks after the birth); they are paid in arrears on a monthly basis for any days they come to work during this time. 21.3 Kent Union has many term-time only staff who spend long periods away from work over the summer. In order to keep these staff up-to-date with developments that take place over the summer, the Union will organise two ‘keep-in-touch days’ during the summer vacation. The days will be structured to include time to learn about organisational changes, time within the employee’s department to meet new staff and keep up with changes within the department and social time with staff. Term-time only staff will normally be expected to attend one of the keep-in-touch days; they will receive a day-off in lieu for attending the day. 21.4 Staff on career breaks, paternity leave or other types of extended leave may request keepin-touch days or time at work to stay up-to-date with developments, via their line manager. Childcare Vouchers 22.1 Childcare voucher schemes are a government-led initiative to support working parents with their childcare costs; childcare vouchers can be used in exchange for all types of registered or approved care, such as registered child-minders and nurseries, including ‘The Oaks’ Nursery. 22.2 Kent Union has an agreement with Sodexho PASS to administer the scheme, which is operated through a ‘salary sacrifice’ arrangement. This means that parents save National Insurance and Tax on the childcare vouchers; total savings can be up to £1,195 per parent, per annum (depending on salary) 22.3 You can join the scheme if you are a parent or legal guardian responsible for, and paying towards the upkeep of, a child; and the child is under the age of 16. Staff can take up to £55 per week in childcare vouchers, depending on their salary. For full details please contact the HR department. 22.4 Staff wanting to take advantage of this scheme should write to the Human Resource Manager detailing when they would like to start receiving vouchers, and how much they would like to receive in vouchers each month. Staff are advised to check that their childcare provider accepts childcare vouchers. Case Study – Childcare Vouchers Jackie is a Kent Union employee and a working mother with a young daughter in full-time nursery care; her annual salary is approximately £20,000. Jackie opts to take the maximum entitlement in 16 childcare vouchers each week - £55. Due to the salary sacrifice arrangement, Jackie does not pay income tax or national insurance contributions on the value of the childcare vouchers. Over a full year, she receives £2,860 of her salary in the form of childcare vouchers; as this sum is tax and NI exempt, this saves her £829 (20% income tax plus 9% NI) In total, the Childcare Vouchers saves Jackie £886 over the year. 23.0 24.0 Workplace Nursery Salary Exchange Scheme (Oaks Nursery) 23.1 Workplace Nurseries are childcare facilities provided by an employer which are offered to employees, usually through a tax efficiency salary sacrifice scheme. We can offer this scheme to our staff because Kent Union runs the Oaks Nursery and staff can only benefit from this particular scheme when they use the Oaks Nursery for their childcare provision. If staff use other nurseries they may benefit from Childcare Vouchers, see section 23.0. 23.2 Staff wishing to use the Oaks Nursery to benefit from a nursery salary exchange scheme will be able to do so. The scheme enables eligible staff to opt to receive a lower salary (salary exchange) in return for Kent Union paying an equivalent amount of their nursery fees on their behalf directly to the Oaks Nursery. By doing this staff may save money as they will no longer have to pay any Tax or National Insurance contribution on the amount of salary agreed to be exchanged. 23.3 All staff are able to join the scheme, subject to their salary being greater than the equivalent cost of the nursery fees/proposed salary exchange, and any salary reductions requested through this scheme must not take a staff members’ gross salary below the National Minimum Wage. Staff may also wish to consider that if the salary exchange takes earning below the annual Lower Earning Limit for National Insurance (NI) contributions, any entitlement to the Basic State Retirement Pension and/or Statutory maternity pay, may be affected. 23.4 The scheme can be used to cover all/part of the childcare costs for as many children as they have at the Oaks Nursery, and staff must be able to commit to a minimum of twelve months’ membership in the scheme. Kent Union will need to be notified 28 days before an agreement can come into effect, and staff can only enter the scheme on the first day of the month only. 23.5 Nursery fees are deducted in advance of the childcare provision being made. Changes to the amount that has been agreed to exchange cannot be altered until they have been in the scheme for one year, (and then every twelve months thereafter), unless the child leaves the nursery, or they have a ‘significant lifestyle change’. For further information on how the Oaks Nursery invoicing arrangements work, please visit their website at; www.kentunion.co.uk/oaksnursery Additional Annual Leave 24.1 Kent Union staff are entitled to 23 days’ annual leave per annum; staff receive 1 extra day’s leave after the first full year of service and an additional day for each year of service up to a maximum of 28 days. Staff also receive 6 ‘customary’ leave days, which are normally taken over the Christmas vacation, as well as all statutory leave days for England and Wales. 24.2 Staff may purchase additional annual leave, up to a maximum of 5 extra days per year. Each day’s leave is calculated as the number of hours that the staff member works in a normal shift, up to a maximum of 7 hours. The cost of purchasing each day is calculated by the staff member’s hourly rate multiplied by the number of hours in a normal working day. 17 The cost of purchasing additional annual leave is deducted from the employee’s monthly salary, in equal instalments, over the remainder of the financial year. 24.3 25.0 27.0 Staff wishing to take additional annual leave must first agree this with their line manager and must give a minimum of 1 months’ notice. Once agreed with the line manager, the Human Resources Department must be notified in writing of the amount of additional leave that has been agreed. Cycle to Work Scheme 25.1 Staff will now be able to benefit from the Government’s Cycle to Work initiative. It’s a great programme where both staff and Kent Union benefit. Staff will receive savings on new bikes, and on National Insurance contributions (NIC), and Kent Union get healthier and more motivated staff, whilst making a reduction to our carbon footprint. 25.2 In response to staff requests and the Union’s ongoing commitment to environmental conservation, a Cycle-to-Work scheme has been launched which allows employees to hire a bicycle and related safety equipment as a tax-free benefit. Cycling benefits your health and fitness by helping you meet the governments' guidelines of exercising for 30 minutes or more on most days of the week. In addition, travelling by bicycle is a quick, cheap mode of transport in urban areas and is good for the environment by improving air quality and helping to ease traffic congestion. 25.3 Kent Union, in conjunction with www.cyclesolutions.co.uk now offers employees the opportunity to hire a cycle and associated safety equipment through a salary sacrifice system in which employees take a reduced gross salary during the hire period thus making savings by paying reduced income tax and national insurance contributions. Employees can hire a brand new cycle and associated safety equipment up to a value not exceeding £1000.00 which must be used mainly for commuting to and from work. 25.4 The hire period is 12 months and at the end of this period, you can either return your bike back to Cycle Solutions, you can pay the market value for the bike and equipment which is 18% or 25% of the original price, or extend the agreement directly with Cycle Solutions, for a small refundable deposit (3% or 7%) sign up to their ‘Extended Use Agreement’ and there will be nothing else to pay and no further monthly rentals. Pay and no further monthly rentals. 26.5 Employees can take part in the scheme if they have completed their probationary period, and whose term of employment is more than the hire period of 12 months. Staff must also ensure their hourly rate will not be reduced below the National Minimum Wage as a result of the salary sacrifice. Employees would sign a participation agreement that sets out Kent Union’s terms and conditions, and also a hire agreement provided via Cycle Solutions Private Health Care 27.1 With people increasingly paying for dental care, eye-care, alternative therapies and private health treatment, private medical cover is becoming popular. However, comprehensive private medical cover is normally beyond the reach of most people. Kent Union has negotiated a generous health package with HSA, a major national operator of private medical cover. 27.2 The scheme offers private medical cover for an employee, their children and partner/spouse; it includes dental cover, optician costs, alternative therapies, hospital treatment and health 18 screening. For the 5 levels of cover and benefits available at each level, please see the HR Department for different levels of cover. 27.3 28.0 The cost of the private medical cover is taken out in equal instalments directly from employees’ monthly salary. Anyone considering taking out the private medical cover should discuss the packages with the Union’s Human Resources Department. Staff Discounts 28.1 Kent Union employees can take advantage of reduced annual membership costs of the University’s Sports Centre. The reduced rate for 2014/15 for Union and University staff starts from £219 per year; the normal rate for members of the public is £392. This amount can be deducted from your salary and paid in one lump sum or by direct debit each month. Please contact the Human Resources Department if you wish to take up this opportunity. 28.2 Kent Union staff receive a £2 discount on entry to the Venue on any night and at any event in the Venue. Staff wishing to receive the discount must show their staff ID card when arriving at the Venue and purchasing their ticket. 28.3 Kent Union staff are entitled to a 20% discount off their Summer Ball ticket or Freshers’ Ball ticket. Staff may only purchase one discounted ticket for each event; discounted tickets are non-transferable and checks will be made on the door to ensure discounted tickets are not given to other people. 28.4 Kent Union staff receive a free NUS Extra card from the Union. The NUS Extra card entitles the bearer to discounts from many retail outlets including Amazon, Dominoes, Prezzo, Matalan, Superdrug and receive 10% off Co-operative products within Essentials. NUS Extra cards can be collected from Mandela Reception; staff will need to provide proof of employment. Case Study – Staff Discounts Adam is a student working in one of the Union’s Retail outlets. Adam opts out of the Union’s pension schemes and doesn’t want to take advantage of the private medical cover but, as a regular user of the Venue, he takes advantage of the staff discount that the Union offers and saves approximately £50 over the year in reduced Venue entry. He also attends the Summer Ball, saving a further £9, and with his free NUS Extra card receives discounts of £50 across the year. In total, the Flexible Reward Policy saves Adam £109 over the year. 29.0 Pension Schemes 27.1 In order to provide a more balanced package of benefits and in recognition of the fact that some staff have other priorities than saving for retirement, the Union is introducing two new alternatives to joining its CARE pension scheme. Staff may now choose from one of two options: a CARE pension or a Group Personal pension scheme. 29.1 The SAUL (Superannuation Arrangements of the University of London) is a Career Average Revalued Earnings (CARE) pension scheme, this pension is based on the average salary the employees earns throughout their employment. The scheme requires employees to contribute 6% of their salary and Kent Union contributes an additional 13% on top. This pension scheme is available to all staff on Kent Union’s Terms and Conditions of Employment. 19 29.2 The Union has set up a salary sacrifice arrangement with SAUL and as such, if you become a member of the salary sacrifice arrangement with SAUL you will automatically sacrifice 6% of your salary which will be paid on your behalf into SAUL by Kent Union, and which together with the employers contribution of 13% of pensionable salary, equates to a total contribution paid into SAUL of 19%. By doing this employees benefit by paying less National Insurance contributions. If staff decide to opt out of the salary sacrifice arrangement but remain in SAUL, they will contribute 6% of their pensionable salary, and Kent Union will contribute 13%, therefore the total contribution paid into SAUL will also be 19%. 29.3 Existing staff will be given the opportunity to join salary sacrifice each year on 30th September. Those staff that are already in salary sacrifice may opt out each year on 30th September or at any time if they have a lifestyle change; some examples of what would be considered ‘lifestyle events’ Birth/adoption of a child Notification or commencement of maternity leave Return from maternity leave Divorce or separation Death of a partner Marriage/civil partnership Commencement of or return from long term sick Decrease in hours or salary (salary below the lower earing rate) Material changes in partner’s circumstances (e.g. Redundancy) Commencement of or return from sabbatical or unpaid leave Commencement of or return from overseas secondment Leaving the pension scheme Cease to be eligible to participate in the pension scheme 29.4 Staff that take advantage of salary sacrifice and have less than two years’ service will not be able to receive their contributions back if they leave SAUL. 29.5 The Aegon pension scheme is a ‘mid-level’ Personal Pension scheme; under this scheme, the employee pays a minimum of 3% of their annual salary and Kent Union pays a further 6% on top. The costs of joining this scheme are thus considerably lower than joining the SAUL pension scheme; however, the benefits upon retirement are also likely to be considerably lower. This pension scheme is available to all staff on Kent Union’s Terms and Conditions of Employment. Case Study – Pension Provision David is a permanent member of staff in his fifties; he has a family and has worked for the Union for over five years. David has reached a point in his life when the financial pressure is off and his priorities are spending more time with his family, looking after his health and preparing for retirement. David is in SAUL and looks forward to the very generous pension that he will receive when he retires; on top of his annual salary of £22,000, the Union pays an additional £2,860 into his pension each year. 30.0 Length of Service 30.1 Kent Union values all staff but would like to reward staff for their loyalty and will recognise length of service in the following ways; staff who’ve been employed for 10 years’ will 20 receive a payment worth £100, this amount will increase every 5 years’ of service by £20, to a maximum of £200. 31.0 32.0 Birthdays, Christmas and Social Events 31.1 The Union will arrange Christmas functions each year; the venue and the type of function will be decided on each year by Director Group. 31.2 In recognition of birthdays, unless there is an unavoidable organisational need for the member of staff to attend work that day, the Union will make a commitment that all staff are able to take time off on their birthday to celebrate; this may be taken from annual leave entitlement, TOIL or unpaid leave. Staff will also receive a personal message from the Union, in recognition of the day. 31.3 There will be an allocated amount of money given to each department to spend during the year on rewarding staff within their department. This will be based on the amount of staff within that department, an average amount of £10 per employee; this will be reviewed each year. Where the Union’s financial resources allow, £10,000 will be allocated within the Staff Related Expenses budget for staff social events, to include the above. GEM (Go the Extra Mile) Award 32.1 Kent Union, through its website, will encourage customers and stakeholder to nominate staff members for the ‘GEM’ scheme, if they feel that they have received exceptional customer services. 32.2 Each staff member that receives a nomination will receive a personal email, call or visit from the Chief Executive or one of the Directors to thank them for their efforts. 32.3 On a monthly basis, the nominations will be considered by Director Group who will choose a monthly winner. The staff member will be mentioned in the Kent Union bi-monthly bulletin and will receive a £25 voucher. 32.4 An overall annual winner will be chosen from the 12 monthly winners. This winner will receive a £100 voucher and an award which will be presented at the Staff Development Day in September. 21 Appendix 1 Kent Union Application for Maternity Leave Form Name: Address: Job Title: I have received and read the Kent Union Maternity Leave detailed within the Flexible Working, Rewards and Recognition Policy In all applications: Expected Week of Childbirth (stated on Medical Certificate MAT B1): ________________ I intend my maternity leave to commence (No earlier than 11th week before the expected week of childbirth (EWC): _______________ My expected date of return is: ___________________(no later than 52 weeks after EWC) Declaration: I understand that if I fail to return to work or fail to notify my employer of my intention to return to work within the specified dates I will lose my right to return to work at Kent Union. Also if I have received contractual maternity pay and fail to return to work, or continue in employment for at least 3 months following my maternity leave, Kent Union has the right to reclaim the whole or part of the non-statutory element of the contractual maternity pay (this is not applicable if the employee is absent through sickness following her return to work). Signed: ________________ Date: _____________ 22 Application for Adoption Leave Form Appendix A2 Name: Address: Job Title: I have received and read the Kent Union Adoption Leave Policy and wish to apply for the following category of adoption leave Ordinary leave: the period of leave to which all women are entitled, regardless of length of service Additional leave: the longer period of leave. This requires one-year continuity of service Ordinary leave: I have been employed by Kent Union for less than 26 weeks at my qualifying week (15th week before the EWP). I understand that I must return to work at the latest 26 weeks after the Sunday before the week of placement. I have been employed by Kent Union for more than 26 weeks but less than 1 year at my qualifying week. I understand that I must return to work at least 26 weeks after the Sunday before the week of the placement and I am therefore claiming a payment of 16 weeks at full pay and 23 weeks at half pay. Additional leave: I have been employed by Kent Union for more than 12 months at my qualifying week, I am therefore claiming a payment of 16 weeks at full pay and 23 weeks at half pay. I also claim my right to an additional period of leave of up to 13 weeks, which I understand will be unpaid. My expected date of return is: ___________________(no later than 52 weeks after EWP) In all applications: Expected Week of Placement: ________________ I intend my adoption leave to commence (No earlier than 11th week before the expected week of placement (EWP): _______________ Declaration: I understand that if I fail to return to work or fail to notify my employer of my intention to return to work within the specified dates I will lose my right to return to work at Kent Union. Signed: ________________ Date: _____________ Checked and authorised by line manager: 23