International Portfolio Management

Fin 263 Syllabus

Fall 2015

Lee Hall

Mondays

6:30pm-9:20pm

Brandeis University

International Business School

Christopher B. Alt PhD CFA

Victoria Samatova TA

Course Objectives and Methodology:

International Portfolio Management FIN 263 focuses on security

analysis and portfolio management throughout the global

economy. Within this context, students will review various

approaches to asset allocation and the valuation of stocks, bonds,

and selected derivative securities. Throughout this course,

students are expected to master both the theoretical constructs of

investments and portfolio management and their application to

current industry practice.

office hours: after class

Sachar 1G

cell (617 281-1636)

chrisalt01@gmail.com

TA – Victoria Samatova

cell (858) 768-1158

victoriasamatova@gmail.com

Learning Goals

A. Understand the fundamental principles of global investment management:

1. How foreign exchange issues influence investment decisions and risk management

2. What factors determines global asset valuations and returns

B. Gain a quantitative understanding of:

1. Equity markets and instruments

2. Fixed income markets and instruments

3. Selected alternative investments

Derivatives’ use in shaping investment decisions

C. Acquire a basic understanding of:

1.

2.

3.

4.

Domestic and international capital asset pricing models

Pros and cons of international diversification

Evaluation of global investment performance

Structuring the global investment process

Disabilities:

If you are a student with a documented disability on record at Brandeis University and wish to have a

reasonable accommodation made for you in this class, please see me immediately.

Academic Integrity:

You are expected to be honest in all of your academic work. Please consult Brandeis University Rights

and Responsibilities for all policies and procedures related to academic integrity. Students may be

required to submit work to TurnItIn.com software to verify originality. Allegations of alleged academic

dishonesty will be forwarded to the Director of Academic Integrity. Sanctions for academic dishonesty

can include failing grades and/or suspension from the university. Citation and research assistance can be

found at LTS - Library guides

Prerequisites:

Fin 201a (Investments)

Textbooks and Other Readings:

Required:

Global Investments, Solnik & McLeavey (SM) (6th edition, Pearson Prentice Hall, 2009).

Investments, Bodie, Kane & Marcus (BKM) (10th edition, McGraw Hill Irwin, 2014).

Case & article packet from Harvard Business School online

https://cb.hbsp.harvard.edu/cbmp/access/38057469

Recommended:

Wall Street Journal

International Portfolio Management Fin 263

March 14, 2016

2

Grades

Class Participation

First Case

Second Case

Third Case

Midterm

Final Exam

Total

10%

10%

10%

10%

30%

30%

100%

Class Participation and Homework Problems

Class participation will be based on the quality and quantity of a student's contribution to classroom

discussions. All students are expected to come to class prepared (having already read and reviewed the

material) and ready to discuss the assigned readings. No wall flowers allowed (i.e. everyone is expected to

participate in class discussions). Laptop use in the classroom is discouraged because it thwarts active

participation in class discussions. Class notes will be distributed (on LATTE) so students only have to add

their own margin comments.

Homework problems are assigned for each class and are helpful both in boosting students’ mastery of

investments and for exam preparation. Because of time constraints, only a limited number of homework

problems will be discussed in class but solutions will be distributed (on LATTE). In addition, the teaching

assistant(s) for this course will be available to review solutions to homework problems. Additional problems

are available through EZTest Online. Other additional materials are available through the text book

publishers.

Classroom Etiquette

Name tents (last name, first name, American or nickname) – bring to every class

Cell phones and similar technology MUST always be turned off when you are in the classroom because they

are a distraction to class discussions.

Students should view this class as a business meeting with corresponding expectations for what is expected

of the professor and the other students. Business casual (e.g. leave the hats off). Just first names (e.g. Chris;

no need for Dr. Alt or Professor Alt).

International Portfolio Management Fin 263

March 14, 2016

3

Cases

Cases are an integral part of this course. To prepare cases, you are expected to form groups (4-6 students)

and work in a collaborative fashion. Prior to second class, email me names of students in your group. If

you don’t, I’ll assign you to a case group. For each case, one or more students selected at random will be

called upon ("cold calling") to present his (her) group’s analysis and proposed solution to the assigned case.

Each group will also submit a written case analysis no later than the Sunday prior to class.

These situations simulate what happens in the real world when your boss calls you in at the end of the week

and asks you and your team:

a. to have a report on a topic for him (her) at the scheduled staff meeting next week,

and, by the way,

b. "keep it short".

Most cases will be accompanied by case guidance questions (posted on Latte). Some cases will also have

spreadsheet data supplements (also posted on Latte).

The cases must be typed and can be no longer than 5 pages plus exhibits.

An integral part of case analysis is careful quantitative analysis. As appropriate, please email me a copy of

your report and its accompanying spreadsheet. And remember – spreadsheets NEVER explain themselves.

That is your job in your case writeup. It is a key way in which you will be evaluated.

For selected cases, only an abbreviated, summary case writeup needs to be submitted (by Sunday prior to

class). For these case write-ups (1 page maximum), you need to: 1) “set the stage”, and 2) identify key

issue(s) and make recommendations as to what the key decision-maker(s) should do.

International Portfolio Management Fin 263

March 14, 2016

4

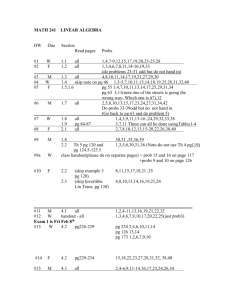

Course Calendar

Alt

International Portfolio Management FIN 263

DATE

Mo 8/31

Fall 2015

TOPICS

PREPARATIONS AND

ASSIGNMENTS

Introduction

Introduction & Discussion of Course Objectives

Mo 9/7

BKM Ch. #1 The Investment Environment

Review

BKM Ch. #2 Asset Classes and Financial

Instruments

Ch. #2; Probs 5-8, 10, 13, 15

No class – Labor Day

Th 9/10

Brandeis

Foreign Exchange

Monday

SM Ch. #1 Currency Exchange Rates

Ch. #1; Probs. 1, 4, 11, 15, 19

SM Ch. #2 Foreign Exchange Parity Relations

Ch. #2; Probs 2, 4, 8-9, 11, 15

FX markets and transactions

Desai article

Mo 9/14

No class – Rosh Hashanah

Mo 9/21

SM Ch. #3 Foreign Exchange Determination

and Forecasting (skim pp. 91-103)

Ch. #3; Probs 3, 6-7, 9-10

FX group case analysis and summary writeup

Groupe Ariel S.A.: Parity Conditions and

Cross-Border Valuation case

International Portfolio Management Fin 263

March 14, 2016

5

Course Calendar

Alt

International Portfolio Management FIN 263

DATE

TOPICS

PREPARATIONS AND

ASSIGNMENTS

Mo 9/28

No class - Sukkot

Tu 9/29

Brandeis Monday – no class due to schedule

conflict

Th 10/1

Location

Fall 2015

Investment Vehicles: Conventional and

Selected Alternatives

TBD

BKM Ch. #4 Mutual Funds and Other

Investment Companies

Ch. #4; Probs 2-3, 7, 15-18

SM Ch. #8 Alternative Investments - ETFs

(skim pp. 332-378

Ch. #8; Probs 1-2

Mo 10/5

No class – Shmini Atzeret

Mo 10/12

Equity Securities

Mo 10/19

SM Ch.#5 Equity: Markets and Instruments

(skim pp. 166-177)

Ch. #5; Probs 2-4, 11, 13

ADRs - Kuemmerle article

BKM Ch. #3 (pp.59-76)

MSCI group case analysis and summary

writeup

MSCI and the Chinese A Shares case

Fixed Income Securities

BKM Ch. #16 Managing Bond Portfolios

Ch. #16; Probs 3-4, 7-9, 12, 15-16

SM Ch. #7 Global Bond Investing

(skim pp. 265-268, 276-284, 300-307)

Citicorp: 1985 group case analysis and

writeup

International Portfolio Management Fin 263

Ch. #7; Probs 3, 5, 9, 13, 17

Citicorp: 1985 case

March 14, 2016

6

Course Calendar

Alt

International Portfolio Management FIN 263

DATE

Fall 2015

TOPICS

PREPARATIONS AND

ASSIGNMENTS

Swaps and Risk Management

Mo 10/26

BKM Ch. #22 Futures Contracts

BKM Ch. #23 Futures, Swaps, and Risk

Management

Review

Ch. #23; Probs 6-7, 12, 21-22

SM Ch. #10 Derivatives: Risk Management

with Speculation, Hedging, and Risk

Transfer (skim pp. 464-478)

Ch. #10; Probs 2, 5-7, 9

FX Swaps – Kester article

Global financing with swaps group case

analysis and summary writeup

Th 10/29

Walt Disney Company’s Yen Financing case

Midterm exam review session

Location?

Mo 11/2

Midterm Exam

Mo 11/9

BKM Ch. #20 Options Markets: Introduction

Review

SM Ch. #10 Derivatives: Risk Management

with Speculation, Hedging, and Risk

Transfer (pp. 464-478)

Ch. #10; Probs 15-17, 19

FX hedging group case analysis and

summary writeup

Hedging Currency Risk at AIFS case

Currency Risk Management

Mo 11/16

SM Ch. #11 Currency Risk Management

Ch. #11; Probs 3, 6, 12

FX hedging strategy group case analysis and

writeup

Hedging Currency Risk at TT Textiles

International Portfolio Management Fin 263

March 14, 2016

7

Course Calendar

Alt

International Portfolio Management FIN 263

DATE

Mo 11/23

Mo 11/30

Fall 2015

TOPICS

PREPARATIONS AND

ASSIGNMENTS

International Diversification

BKM ch. #25 International Diversification

Ch. #25; Probs 1-4

SM Ch. #9 The Case for International

Diversification

Ch. #9; Probs 1, 3, 6, 8, 20

Privatization

Privatization fundamentals

HBR privatization articles – Moore;

Johnson/Loveman

Privatization group case analysis and writeup

Mo 12/7

Th 12/10

Privatization of Rhone-Poulenc – 1993 case

Portfolio Performance Evaluation

BKM Ch.#24 Portfolio Performance

Evaluation

Ch. #24; Probs 5, 9-11

SM Ch. #12 Global Performance Evaluation

(skim pp. 523-534, 548-555, 568-569)

Ch. #12; Probs 3-5, 8-9

Final Exam Review Class

TBD

6-9pm

Final Exam

tentative

International Portfolio Management Fin 263

March 14, 2016

8