Day 2 - Waverly-Shell Rock School District

advertisement

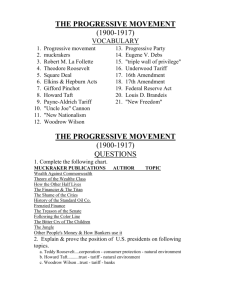

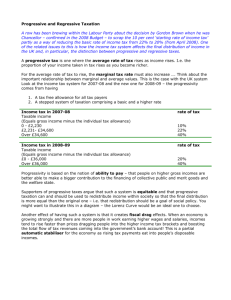

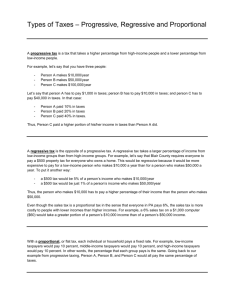

Civics Daily Lessons While you were gone Civics - Make-up Assignments Mr. Cook/Mrs. Colvin Room 214 Student-_____________ Date Absent- Jan. 16 Date Due-______ Please attach your make-up work to this sheet when you hand it in! Homework: • Ch. 12.2 NotesJan. 17 • Ch. 12.3 NotesJan. 18 • Chapter 12 TestJan. 22 In Class Work: – – – – – – – – – – – – • • • Ch. 12.1 Vocabulary- 12.2 Reading Quiz – 12.1- 10 points Go over 12.1 homework – 30 points5 points per section. Coop- back of homework In Class Reading- Chapter 12.2 We will use the audio from the book. Income Tax Social Security Government Taxes and Spending Other Kinds of Taxes. 12.2 Section questions Homework will be given out when the audio is finished or at the end of the period- Go over the requirements. On Line Quiz- section 2 on the overhead if time. Examination: Date and Period you will take the exam-______ Signature:____________ Day #2 • Homework due today- Section 1 Ch. 12 Ch. 12.1 – Reading Quiz – Go over 12.1 homework – Coop- back of homework – On Line Quizsection 1 on the overhead if time. Chapter 21 Section 2 Terms CHAPTER 12 KEY TERMS Income tax [299] Progressive tax [300] Profit [300] Regressive tax [302] Property tax [302] Tariff [303] SECTION 12.2 TERMS Chapter 21 Section 2 Terms CHAPTER 12 KEY TERMS Income tax [299] Progressive tax [300] Profit [300] Regressive tax [302] Property tax [302] Tariff [303] SECTION 12.2 TERMS Tax on the earnings of individuals and businesses. Chapter 21 Section 2 Terms CHAPTER 12 KEY TERMS SECTION 12.2 TERMS Income tax [299] Tax on the earnings of individuals and businesses. Progressive tax [300] Tax that takes a larger percentage of income from higher-income groups than from lower-income groups. Profit [300] Regressive tax [302] Property tax [302] Tariff [303] Chapter 21 Section 2 Terms CHAPTER 12 KEY TERMS SECTION 12.12TERMS Income tax [299] Tax on the earnings of individuals and businesses. Progressive tax [300] Tax that takes a larger percentage of income from higher-income groups than from lower-income groups. Profit [300] Income a business has left after paying expenses. Regressive tax [302] Property tax [302] Tariff [303] Chapter 21 Section 2 Terms CHAPTER 12 KEY TERMS SECTION 12.2 TERMS Income tax [299] Tax on the earnings of individuals and businesses. Progressive tax [300] Tax that takes a larger percentage of income from higher-income groups than from lower-income groups. Profit [300] Income a business has left after paying expenses. Regressive tax [302] Tax that takes a larger percentage of income from low-income groups than from high-income groups. Property tax [302] Tariff [303] Chapter 21 Section 2 Terms CHAPTER 12 KEY TERMS SECTION 12.2 TERMS Income tax [299] Tax on the earnings of individuals and businesses. Progressive tax [300] Tax that takes a larger percentage of income from higher-income groups than from lower-income groups. Profit [300] Income a business has left after paying expenses. Regressive tax [302] Tax that takes a larger percentage of income from low-income groups than from high-income groups. Property tax [302] Tax on the value of the property owned by a person or business. Tariff [303] Chapter 21 Section 2 Terms CHAPTER 12 KEY TERMS SECTION 12.2 TERMS Income tax [299] Tax on the earnings of individuals and businesses. Progressive tax [300] Tax that takes a larger percentage of income from higher-income groups than from lower-income groups. Profit [300] Income a business has left after paying expenses. Regressive tax [302] Tax that takes a larger percentage of income from low-income groups than from high-income groups. Property tax [302] Tax on the value of the property owned by a person or business. Tariff [303] Import tax on products from other countries. Reading Quiz-A Sect. 1 Fees Fines 300 Taxes National Debt Ability to pay Government Bond Compulsory Equal Application Interest Reading Quiz- A Sect. 1 Civics - Unit IV- The Citizen in Government Chapter 12- Paying for Government Homework- Section 1- Raising Money pg. 294-298 What are the ways Governments raise money? Why does Government cost so much? II. Define the following Terms a. b. c. d. e. f. g. interestnational debtrevenuefeesfinebondPrimary- What is the Tax System? What are other ways to pay for government? Identify the three principles of taxation and explain why each one is important. Principle Importance Homework 12.1 Identify the three principles of taxation and explain why each one is important. Ability to pay Equal Application Scheduled Payments Importance Sets taxes Applies the tax at the same rate for similar items. Ensures that taxes are paid on schedule. Principle at different rates so that citizens can pay. Ch. 12.2- Pages 299-303 • In Class ReadingChapter 12.2 We will use the audio from the book. Group Work • Mr. Whitcher will assign you groups of 2-3. • You will have 1 min. to answer the questions on each slide. • Write down the your collective answers. • At the end of 5 min. you will be asked to answer the question as a group. What are the two main kinds of income taxes.? Income Taxes 1. Identify: What is Social Security tax? 2. Make Inferences: Why do you think the federal government separates Social Security taxes from other federal income taxes? 3. Predict: How might congress solve the problem of acquiring money in a changing economy? What are the other types of taxes? Other Major Taxes 1.Recall: Name two kinds of property on which property tax is collected? 2.Contrast: How are excise taxes different from sales taxes? - Unit IV- The Citizen in Government Chapter 12- Paying for Government Homework- Section 2- Types of Taxes pg. 299-303 Types of Income Taxes that People Pay II. Define the following Terms a. b. c. d. e. f. income taxprogressive taxprofitregressive taxproperty taxtariff- What are the other major taxes people pay. On Line Quiz- Ch. 12.2 • Ch. 12.2 On line Quiz