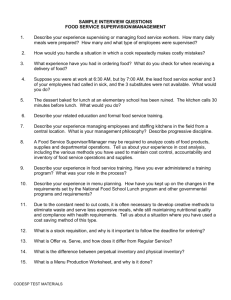

ch07_3

advertisement

DECISION MODELING WITH

MICROSOFT EXCEL

Chapter 7

Nonlinear

Optimization

Part 3

Copyright 2001

Prentice Hall Publishers and

Ardith E. Baker

The EOQ Inventory Model

Inventories are defined as _________in storage,

waiting to be used. For example, inventories of

Raw materials

In-process materials

Finished goods

Cash

Individuals

Inventories are held for many reasons:

1. Inventories smooth out the ___________

between supply and demand.

2. The possibility of holding inventory often

contributes to lower _____________costs.

3. Inventories provide a way of ______labor.

4. Inventory is a way of providing quick

_________________at the time an item is

needed.

The costs associated with inventory activity are

_______costs, ordering costs, and _______costs.

STECO Example:

STECO stocks a short length optimal fiber

network cable (NC) used to connect Internet

routers to local area network equipment.

Consider the following costs:

Holding Costs:

3000 NCs x $8 per unit cost = $24,000

Note that this money is tied up in_________. By

holding inventory, STECO forgoes the opportunity

to make other investments (_______________).

Other components of holding costs include

_________, pilferage, insurance, warehousing,

and special handling requirements.

As inventory increases, holding cost__________.

Ordering Costs: Every time an order is placed

(independent of the ___________ordered), an

ordering cost is incurred. This cost is related to

the amount of ____________time required for

accounting, invoicing, order checking, etc. when

an order is placed.

Stockout Costs: When a company runs out of

________, a stockout occurs (i.e., orders arrive

after inventory has been depleted. There are two

ways to treat such orders:

1. ___________(save up the orders and fill

them later after the inventory comes in).

In addition to backlogging cost, stockout

cost includes the ________from late

delivery of stock.

2. No Backlogging

In this case, a _____________(the per unit

cost of unsatisfied demand) occurs.

Stockout cost includes the lost profit from

not making the__________.

Stockout cost can also include the cost of losing

the___________, loss of goodwill, and of

establishing a poor ________of service.

So, to avoid stockouts (and stockout costs), have

enough inventory_________. However, carrying

inventory implies a holding cost. This cost can be

reduced by _________more often. However, this

increases the ordering cost. It is important to

__________these three costs against each other.

For every type of ___________ordered, there are

two key questions that must be answered:

1. ________should an order be placed?

2. ________should be ordered?

Some considerations are:

The extent to which future _______is known.

The cost of ____________and management’s

policy (backlogging or not).

The inventory holding and ordering costs.

The possibility of long __________(the time

from when an order is placed to when it is

received).

The possibility of quantity___________.

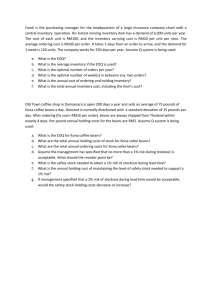

STECO Wholesaling: The Current Policy

The monthly demand (orders received) is:

MONTH

DEMAND (UNITS)

January

February

March

April

May

June

July

August

September

October

November

December

Total Annual Demand:

Average Monthly Demand:

5,300

5,100

4,800

4,700

5,000

5,200

5,300

4,900

4,800

5,000

4,800

5,100

60,000

5,000

Over a period of several years, the demand has

remained at a steady rate of about 5000 NCs per

month.

STECO’s policy last year was to add 5000 NCs to

inventory each month. Since demand is expected

to be the same, this is also the current policy.

Based on this policy, assume

Shipments always arrive on the first day of

each month.

Demand is known and constant (at a rate of

5000 units per month).

No backlogging (i.e., no stockouts).

Plot of inventory on hand at any time:

5,000

Average

Inventory

2,500

0

1

2

3

4

5

6

Time

Given the previous_______________, the cost of

operating the system above depends only on how

much new stock is ordered and on the holding

and ___________costs.

Since demand is 5000 NCs and we order 5000

every month, the ___________inventory is

5000/2 or 2,500 NCs.

The effect of ordering 10,000 NCs every other

month is shown below.

10,000

Average

Inventory

5,000

0

1

2

3

4

5

6

Time

The demand remains __________at 5000 NCs

per month. Average inventory is doubled but the

annual number of orders is cut in________.

A policy of increasing the order quantity increases

the _________costs and decreases the annual

ordering cost.

Developing the EOQ Model:

The Economic Order Quantity (EOQ) model is a

simple model which attempts to ________the

cost of placing orders with the cost of holding

inventory.

The EOQ model assumes

No __________are allowed.

There is a constant rate of____________.

The __________costs are ordering and

holding costs.

The EOQ finds the _____________________(the

quantity that minimizes the total cost).

Total cost is based on:

Ordering cost = Co

STECO estimates the cost of placing an order

for NCs, regardless of the number of units

ordered, to be

$20 (clerical & purchasing agent labor)

+ $ 5 (material & telecommunications costs)

$25

Holding cost = Ch

STECO estimates the cost of holding an NC in

inventory for one year is

20% (opportunity cost)

+ 4% (variable cost)

24% of its purchase price. Since each NC

costs $8, the holding cost = $8 x .24 = $1.92

First derive an expression for the annual _______

and ordering cost (AHO) as a function of the

order__________.

The Annual Ordering Cost:

Annual Ordering Cost = Co x (no. of orders/yr)

Total Demand = 60,000

Order Quantity = 5,000

Therefore, STECO will place

60,000/5,000 = 12 orders per year

The general formula is N = D/Q

where N = no. orders/yr

D = annual demand

Q = order quantity

Annual Ordering Cost = CoN = Co(D/Q)

The Annual Holding Cost:

1. Annual _________cost is equal to Ch times

the average inventory

2. The average ________is equal to ½ of the

maximum inventory when demand occurs

at a __________rate.

Annual Holding Cost = Ch(Q/2)

Therefore, add the two expressions to get:

AHO(Q) = Co (D/Q) + Ch(Q/2)

Now, substituting the values, we get

AHO(Q) =$25(60,000/Q) + 1.92(Q/2)

= (1,500,000/Q) + 0.96Q

When Q = 5,000 it is seen that

AHO(5,000) = $300 + $4,800 = $5,100

This graph shows the optimal order quantity that

minimizes AHO(Q):

Dollars

6,000

AHO(Q) = Annual holding and ordering cost

5,000

4,000

Annual holding cost = 0.96Q

3,000

2,000

1,000

Annual ordering cost = (1,500,000)/Q

0

1,000

2,000

3,000

4,000

5,000

Here is the spreadsheet model for this example:

This model is

_______because

of the Q in the

denominator of

the ordering cost

formula.

Here are the solver parameters:

This ___________

(specifying that

there be at least

one order per

year) is included

to prevent Solver

from testing an

unreasonable

____________.

The EOQ Formula: Q*

Q* is the optimal order quantity or __________

order quantity expressed in terms of Co, Ch and D.

To develop a _____________expression for Q*,

first set annual holding cost equal to annual

ordering cost.

Ch(Q*/2) = Co (D/Q*)

Solving for Q* we get

(Q*)2 = 2CoD/Ch

Q* = 2CoD/Ch

Ch can be estimated with i [a ___________of the

purchase price (P)] and P, this equation can be

rewritten as:

Q* = 2C D/iP

o

Remember, P = $8, i (the fraction of P that is

used to calculate Ch) is 0.24 and D is 60,000.

Now, solve for Q*

Q* = 2(60,000)25/1.92

Q* = 1250

Now that we have Q*, the optimal order

quantity, find the AHO(Q*):

AHO(Q*) =AHO(1250)

= (1,500,000)/1250 + (0.96)(1250)

= $1200 + $1200

= $2400

Sensitivity Analysis

Now we ask: How ________are the results of the

model to the assumptions and the data?

STECO should be concerned about how sensitive

the ______________________and the optimal

annual cost are to the data.

If STECO errs in estimating the _________Co and

Ch, how much effect will that error have on the

difference between the __________Q* and AHO*

and the true Q* and AHO*.

If the results are highly sensitive to the values of

the estimates, should the optimal policy for the

model be________________?

To see how the ________results will vary with

changes in the holding and ___________cost

estimates, consider four cases in which the true

___________are different from the values

selected by STECO:

In STECO’s case, the EOQ model is __________to

approximately 10% variations in cost estimates.

Inventory with Quantity

Discounts Model

The following examples are variations in the

“classic” EOQ model.

Quantity Discounts

and STECO’s Overall Optimum:

Previously, the cost of purchasing the product

was assumed to be a________, independent of Q.

However, STECO’s NC supplier will offer a

quantity ____________as an incentive for more

business.

The supplier has agreed to offer a $0.10 discount

on every NC purchased if STECO orders in lots of

at least 5000 items.

Higher order quantities will ______the number of

orders placed and increase the average inventory

level, resulting in a higher annual ________cost.

The question is, will the discount be

advantageous to STECO? To answer this, first

develop an ____________curve and then find the

order quantity that minimizes it.

Let

ATC(Q) be the annual total cost

AHO(Q) be the sum of the annual holding

and ordering cost

APC be the annual purchase cost

ATC(Q) = AHO(Q) + APC

{

AHO(Q) = Co(D/Q) + iP(Q/2)

APC = PD

Ch

ATC(Q) = Co(D/Q) + iP(Q/2) + PD

Let P = $8.00 per unit, the Regular price

equation is:

ATC(Q) = 25(60,000)/Q + .24(8.00)(Q/2) + 8.00(60,000)

Let P = $7.90 per unit, the discount price

equation is:

ATC(Q) = 25(60,000)/Q + .24(7.90)(Q/2) + 7.90(60,000)

The general shapes of the Regular and Discount

curves are shown below:

ATC(Q)

Regular Price

Note that the

discount

curve lies

below the

regular cost

curve.

Discount Price

Q*R Q*D

Q

Also note that the value of Q, say Q*D, that

___________the discount price ATC(Q) is larger

than the value of Q, say Q*R, that minimizes the

________price = ATC(Q).

Now, assuming that the __________price holds

only if STECO orders at least B items at a time.

Two situations could arise:

The dark line portions indicate the ____________

function that STECO faces.

ATC(Q)

ATC(Q)

Regular Price

Regular Price

Discount

Price

Discount

Price

Q*R Q*D

B

Q

Q*R Q*D

Q

B

If B < Q*D, STECO will achieve the __________

cost by ordering Q*D.

If B > Q*D, the optimal decision is not obvious.

The general rule is:

If B < Q*D,

If B > Q*D,

order

order

Q*D

Q*R if regular price <

discount price

ATC(Q*R) < ATC(B)

B

if not

Here is the Excel version of the quantity discount

inventory model:

Solver optimizes a ______integer nonlinear program

(MINLP) to evaluate the two EOQ functions, one with

and without the_____________.

Here are the formulas:

Inventory and Production,

A Lot Size Model

STECO has an extensive and modern heattreatment fibre cable “_________” facility that it

uses to produce a number of specialty cable items

that it then holds in______________.

Two important characteristics of this facility:

1. There is a large _____cost associated with

producing each cable product

2. Once the setup is complete, production is

at a _______and known rate.

Setup cost (____________to ordering cost) is

incurred because it is necessary to change the

plastic fibre molds and the operating temperature

in the heat-treatment facility to meet the

______________set forth by the cable standards

specification.

Each cable must have ___________attached and

under go testing for frequency response.

An order quantity of network cables arrives from

production into inventory steadily over a period

of several days.

A modification in the EOQ formula is required.

Consider a product in which

d = no. of units demanded each day

p = no. of units produced each day during a

production run

Co = setup cost that is independent of the

quantity produced

ch = cost per day of holding inventory

Note that if p < d, demand is greater than

STECO’s ability to produce.

Below is a plot of inventory on hand for the

Production Lot Size model:

Inventory

On hand

Rate of

decrease

Rate of

increase

d

p-d

Q

p

Q

d

Production

run

Time (Days)

Cycle time

The formulas are:

Max. inventory = (p-d)(Q/p)

Avg. inventory = ½ (p-d)(Q/p)

= Q/2(1-(p/d))

Holding Cost per Day = ch(Q/2) (1-(p/d))

Setup Cost per Day = Co/(Q/d) = Co(d/Q)

DHS(Q) = Co(d/Q) + ch(Q/2) (1-(p/d))

The value of Q that minimizes DHS(Q) for the

production lot size model is:

Q* =

2Cod

ch(1-(d/p))

Substituting Q* for Q in the expression for

DHS(Q) gives us an expression for the _________

daily holding and setup dost:

DHS(Q*) =

d

2Codch 1- 1p

Note that this expression does not _______on Q.

STECO must first estimate the various _________

and then obtain Q*. For illustration, let

Demand average 200 NCs per day

Setup cost is $100

Production rate is $400 NCs per day

Production cost is $1

Annual interest rate is 0.24

Number of working days per year is 240

Holding cost per day is

($1)(0.24)/240 = $0.001

The optimal production lot size for this product is:

Q* =

2(200)(100)

0.001(1-(200/400))

= 8944

The minimum daily holding and setup cost is:

= 2(200)(100)(0.001(1-(200/400)) = $4.47

A production run of this size yields a supply of

NCs large enough to satisfy demand for

8944 = 44.72 days

200

Here is the Excel model for this problem:

Here are the spreadsheet formulas: