Money & Central Banks

advertisement

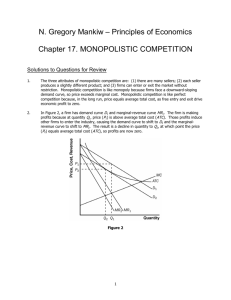

COSTS OF PRODUCTION Chapters 11 Short-Run vs. Long Run • Firms typically have several types of inputs that they can adjust to adjust production. • Long-run - When firms are able to adjust all of their inputs including physical plant. • Short-run – When firms are able to adjust only some of their inputs (usually energy, labor, and raw material costs). Productivity • Average Productivity of Labor is output per work. Total Product APL Labor • Marginal Productivity of Labor is the extra production that is obtained from an extra unit of labor. TP MPL Labor Short Run Production Function MPL is the slope of the production function which gets flatter as labor is added. Total Product ΔTP ΔLabor ΔTP TP MPL Labor ΔLabor Labor Production in the Short-Run • Given a set of fixed inputs (like plant and capital equipment), a firm can vary other inputs (typically labor) and to vary production. • Typically, as you add workers, you get more output. • Up to a point each additional worker adds synergy and adding more workers leads to more and more extra pay-off. • But at some point, capacity constraints bind, diminishing returns sets in, and the addition of extra workers will generate less and less extra production. Bakery 35 30 Loaves 25 20 15 10 5 0 Hours Productivity • Labor productivity depends on the number of workers • First, increasing, then, decreasing • Average product of labor begins decreasing when marginal product of labor drops below average. Note: Marginal Product crosses through average product at the peak of average product. As long as the next worker adds more product than the average worker, they will increase the average. Once diminishing returns set in, additional workers may add less to output than the average worker, reducing the overall average. MPL, APL MPL APL L Small Scale Schedule Hours Average Product Loaves 0 Marginal Product 0 0.10 2 0.20 0.10 0.32 4 0.83 0.21 0.58 6 2 0.33 1 8 4 0.5 3 10 10 1 Large Scale Schedule Hours 0 Average Product Output Marginal Product 0 1 10 10 1 0.333333 40 20 0.5 0.2 90 30 0.333333 0.142857 160 40 0.25 0.111111 250 50 0.2 0.090909 360 60 0.166667 Fixed Costs vs. Variable Costs • In short-run, we distinguish between the costs that are adjustable as production is adjusted (variable costs) and costs that are unchanged regardless of production (fixed costs). • Variable costs (Wages of production workers, supply and raw materials costs) • Fixed costs (Depreciation costs, Financial costs, wages of nonproduction workers). Types of Costs • Total Fixed Costs – Invariant to the number of goods produced (in the short-run) • Average Fixed Costs – Decreasing in the number of goods produced. • Total Variable Costs- Increasing in the number of goods produced. • Total Costs: Fixed Costs + Variable Costs Cost Shares Various 4 Digit Industry (USA, 1991-1996) Production Nonproduction Industry Workers Energy Materials Workers Cement 9.02% 17.83% 43.21% 4.23% Typesetting 28.17% 0.96% 18.96% 13.07% Oil Refinery 1.65% 2.62% 83.80% 1.07% Automobiles 5.41% 0.37% 71.97% 1.06% Furniture 18.03% 1.62% 47.86% 5.56% Mens Clothes 20.20% 1.23% 40.08% 7.67% NBER Productivity Database Labor Intensity 34.00% 51.50% 20.09% 23.38% 46.68% 47.49% Output (Loaves) 2.00 Fixed Costs 1000 Workers Wheat 6 Bakers Wages 60 10.00 Variable Costs 70.00 Total Costs 1070.00 10.00 1000 10 100 50.00 150.00 1150.00 20.00 1000 40 400 100.00 500.00 1500.00 30.00 1000 90 900 150.00 1050.00 2050.00 40.00 1000 160 1600 200.00 1800.00 2800.00 50.00 1000 250 2500 250.00 2750.00 3750.00 60.00 1000 360 3600 300.00 3900.00 4900.00 Bakery: Wages $10 per Worker, $5 Wheat per Loaf Total Variable Costs are increasing at an accelerating rate. Reason: Diminishing returns to variable inputs. Cost Schedule 6000 5000 4000 3000 2000 1000 0 2.00 10.00 20.00 Fixed Costs 30.00 Variable Costs 40.00 Total Costs 50.00 60.00 Costs: Average vs. Marginal • Total Costs are the sum of all relevant costs for a firm. • Average Costs: Costs per unit of output. • Marginal Cost: Extra Cost per Extra Unit of Output. Cost Schedules Output (Loaves) 2.00 Total Costs 1070.00 Average Fixed Costs 500 Average Average Variable Total Costs Costs 35 535 Marginal Costs 10.00 10.00 1150.00 100 15 115 35.00 20.00 1500.00 50 25 75 55.00 30.00 2050.00 33.33333 35 68 75.00 40.00 2800.00 25 45 70 95.00 50.00 3750.00 20 55 75 115.00 60.00 4900.00 16.66667 65 82 Average and Marginal Costs Average Fixed Costs decreases as production increases Cost Curve 140 120 100 MC equals AVC and ATC when each of the latter are at their minimum level. 80 $ AVC, ATC, MC all increase as diminishing returns kick in 60 40 20 0 AFC AVC ATC MC 2.00 35 35.00 10.00 100 15 115 10.00 20.00 50 25 75 35.00 30.00 33.333333 35 68 55.00 40.00 25 45 70 75.00 50.00 20 55 75 95.00 60.00 16.666667 65 82 115.00 Long Run Costs • In the short-run, the size of a firms physical plant is a fixed factor. • Over-time, the plant size can adjust. • In the bakery example, extra ovens can be added. Minimizing Costs in the Long Run • Consider average total cost schedules at different numbers of ovens. • Each oven will have a production level that generates the minimum average total cost. • To minimize average costs in the long-run, choose the number of ovens which will have the lowest, minimum average total cost. Connect the Dots Long Run Average Total Costs 228 208 1 Oven 188 2 Ovens 168 3 Ovens 148 4 Ovens 128 5 Ovens 6 Ovens 108 7 Ovens 88 8 Ovens 68 Output 120 110 100 90 80 70 60 50 40 30 20 10 48 If we adjust capital scale continuously, the collection of minimum points is the Long Run Average Total cost cuve Short-run ATC LR ATC Economies of Scale • When firms are able to adjust all of their inputs, they can choose a size that will minimize costs. • If a firm is able to achieve some economies of scale, increasing size will reduce the average total cost. • Sources of Economies of Scale • Production requires major expenditure on items needed to produce even zero products • Ex. Software, pharmaceuticals • Production requires many specific steps which can be most efficiently done through specialization • Ex. Airplanes, automobiles Long Run ATC increasing returns to scale. LR ATC Costs Economies of Scale Output Returns to Scale • Scale Economies is not always likely to characterize production. • If each production unit can act autonomously with identical costs then we may experience constant returns to scale. • Firms at some point experience diseconomies of scale or increasing long run average total costs. • Sources of diseconomies of scale • Limits of managerial attention. • Limits of some other fixed resource. Long Run ATC decreasing returns to scale. LR ATC Costs Constant Returns Scale Diseconomies Output Overall Cost Function LR ATC Minimum Efficient Scale MES and Market Structure • If MES is relatively large in comparison with the market demand: $ The market is most efficiently served by a single firm---natural monopoly! D LRAC Q MES and Market Structure • If MES is relatively small in comparison with market demand: Many “small” firms in the market. $ Q Learning Outcomes Students should be able to • Define and calculate various types of economic costs. • Fixed, variable, total, average, marginal. • Describe the shape of various relevant cost curves • Average Total (in LR and SR), Average Fixed, Marginal Costs • Describe the relationship between production, productivity (marginal and average) and the law of diminishing returns. PERFECT COMPETITION Chapter 12 Costs and Supply Decisions • How much should a firm supply? • Firms and their managers should attempt to maximize profits (Profits = Revenues – Costs) • Select a pricing strategy that induces a demand for a product that generates highest revenue relative to the cost of production of that level of supply. • Profits depends on response of revenues to changes in production quantities. Perfect Competition/ Price Taking • We think of some markets as characterized by perfect competition • In competitive markets, no firm has the market power to set their own price. • Firms in perfectly competitive markets take their price as given. China Price Download Characteristics of Competitive Markets • Non-differentiated goods • Large number of firms • All firms are small relative to the market • Free entry and exit. Name some uncompetitive markets Name some competitive markets in HK MES and Market Structure $ • • • • Non-differentiated goods Large number of firms All firms are small relative to the market Free entry and exit. Many “small” firms in the market. Q • If MES is relatively small in comparison with market demand: Revenues and Perfect Competition • Revenues = Price * Quantity • Average Revenue = Price • Marginal Revenue is the extra revenue generated by selling an extra good. • If production by a firm doesn’t shift the price, marginal revenue is the price. Profit Maximization: Short Run • In the short-run, firm may only have a limited number of avenues along which they may vary production. • Cost of producing each good is likely to increase. But as long as the extra revenue that the good brings in exceeds the extra cost, it will be profitable to produce it. • Maximize profits by producing up to that point that price is equal to marginal cost. Beyond that, producing more goods only subtracts from profits. Accounting vs. Economic Profits • Profits are revenues less costs. • Economic profits are revenues less explicit and implicit costs. • Economic profits attract competition so they typically don’t last. • Accountants do not fully incorporate all implicit costs including cost of equity capital or owner’s contribution of time or expertise. • Accountants do incorporate some implicit costs (such as depreciation) into their profit& loss statements. Increase Production until marginal cost reaches the price level. MC P P Profits ATC Revenues Costs Q* Revenues are price × quantity Q Profits = Revenues - Costs Profit Maximization: Price is 80 Output Average Total (Loaves) Costs 2.00 535 10.00 115 20.00 75 30.00 68 40.00 70 50.00 75 60.00 82 Marginal Marginal Costs Revenues Revenues Profits 160.00 -910.00 15.00 80.00 800.00 -350.00 35.00 80.00 1600.00 100.00 55.00 80.00 2400.00 350.00 75.00 80.00 3200.00 400.00 95.00 80.00 4000.00 250.00 115.00 80.00 4800.00 -100.00 What if prices drop? MC P P Breakeven point ATC -Profits Costs P' Revenues Q** Q Q* • The average total cost of production (when marginal cost equals price) is above the new lower price. • If the firm sets production at a level such that price equals marginal cost, but that is the best they can do in the short run. • Firms only decision is to vary production costs along those dimensions that are available. • Should the firm shut down? • No. The firm has paid costs which cannot be retrieved [SUNK COSTS]. Since the firm cannot change this, they should ignore these sunk costs in making their marginal decision. • As long as prices exceeds variable costs, produce. Profit Maximization: Price is 60 Output Average Total (Loaves) Costs 2.00 535 Average Variable Costs 35 10.00 115 15 20.00 75 25 30.00 68 35 40.00 70 45 50.00 75 55 60.00 82 65 Marginal Marginal Costs Revenues Revenues Profits 120.00 -950.00 10.00 60.00 600.00 -550.00 35.00 60.00 1200.00 -300.00 55.00 60.00 1800.00 -250.00 75.00 60.00 2400.00 -400.00 95.00 60.00 3000.00 -750.00 115.00 60.00 3600.00 -1300.00 When should the firm stop production in the short-run? MC P Breakeven point ATC P AVC P' Dropout point Q** Q Profit Maximization: Price is < 10 Output Average Total (Loaves) Costs 2.00 535 Average Variable Costs 35 10.00 115 15 20.00 75 25 30.00 68 35 40.00 70 45 50.00 75 55 60.00 82 65 Dropout! Marginal Marginal Costs Revenues Revenues Profits 20.00 -1050.00 10.00 10.00 100.00 -1050.00 35.00 10.00 200.00 -1300.00 55.00 10.00 300.00 -1750.00 75.00 10.00 400.00 -2400.00 95.00 10.00 500.00 -3250.00 115.00 10.00 600.00 -4300.00 Adjustment in the Long Run • In the longer run, firms are able to adjust the size of their plant. (adjust the number of machines in the factory, adjust the number of oil rigs). • If profits are positive. Firms will seek to build new equipment as they compete for profits. • If profits are negative, firms will shut down equipment and sell it, or possibly go out of business. • Firms will adjust their physical plant until they are making profits again. Profit maximization and the supply curve • In the short-run, firms produce up to that point where price equal marginal cost. • Supply curve is the sum of the supply curves of the different firms in the market. • In the long-run, capacity will be adjusted to the point where profits are zero (i.e. where marginal cost equals average total cost). • Long run ATC curve is collection of points where MC = ATC and is the long-run supply curve. Firm Level Supply Curve: Short Run P SFirm 1 SR ATC P* MC Output In the short run, MC curve is the relationship between firm price and production Firm Level Supply Curve: Short Run P SFirm 2 SR ATC P* MC Output Industry Level Supply Curve: Short Run P SFirm 1 +SFirm 2 +SFirm 3 SIndustry Output In the short run, the sum of the MC curves is the relationship between price and industry production Short Run Response to Increase in Demand Increase Variable Inputs P D SIndustry 2 P** 1 P* D' Q* Q** Output Firm Level Supply Curve: Short Run Short-run profits attract new entrants P 2 P** SFirm 1 SR ATC Profits 1 P* MC q* q** Output In the short run, MC curve is the relationship between price and firm production New Entrants in the Long Run Supply Increases and Price Drops P D SIndustry+SFirm N+ 1 2 P** P*** 3 1 P* D' Q* Q** Q*** Output Firm Level Response to New Entrants: Reduce Output P 2 SFirm 1 P** SR ATC 3 P*** Profits 1 P* MC q* q*** q** Output But as long as price is above minimum of ATC, there will still be profits and entry. New Entrants as Long as Profits at MES Supply Increases and Price Drops P D +SFirm N+ 1 +…+SFirm N+ J SIndustry 2 P** 3 P** P* 1 4 D' Q* Q** Q*** Q**** Output Firm Level Response to New Entrants: Reduce Output P 2 SFirm 1 P** 3 SR ATC P*** 1,4 P* MC q* q***q** Output In the short run, MC curve is the relationship between firm price and production Long Run, Supply is Flat along MES of New Entrants P D SIndustry +SIndustry 2 P** P** P* 1 4 D' SLR Q* Q** Q*** Q****Output Long Run Supply Curve • If all firms are exactly the same, then new firms have same MES as old firms and supply curve is flat. • In some cases, like oil drilling, new firms may have higher MES than old firms and supply curve is upward sloping. • Long run supply curve is flatter, more elastic than shortterm supply curve. Long Run Equilibrium • Firms are making zero profits. • Firms will be producing at their minimum efficient scale and at a minimum of ATC Learning Outcomes Students should be able to • Characterize a perfectly competitive market. • Calculate total revenue, marginal revenue and profit for a firm in a competitive market. • Describe the supply curve in a competitive market in both the short and long run. MONOPOLY Chapter 13 Market Power • Market power is the ability of a firm to affect the market price of a good to their advantage. In declining order. • Monopoly – A single producer without competition • Oligopoly Power – A small number of producers sometimes acting in concert. • Monopolistic Competition – Firms selling differentiated products. Price effects • There is a demand curve relating the quantity of a product that can be sold at a given price. • Invert the concept: For each quantity, there is a price that the market may bear. • Change the quantity and change that price • Marginal revenue Marginal Revenue • For price taking firm, marginal revenue is equal to price. • For a firm with market power, marginal revenue must include the change in the price that results from a change in quantity. P MR P QP Q MR P P Q P P P(1 Q 1 ) P(1 1 ) eD Demand Elasticity Example Demand, Revenue, Marginal Revenue Output Price Revenue Marginal Revenue 10,000.00 33.0 330,000.0 13.7 20,000.00 23.3 466,690.5 10.5 30,000.00 19.1 571,576.8 8.8 40,000.00 16.5 660,000.0 7.8 50,000.00 14.8 737,902.4 7.0 60,000.00 13.5 808,331.6 6.5 70,000.00 12.5 873,097.9 6.0 80,000.00 11.7 933,381.0 5.7 90,000.00 11.0 990,000.0 5.4 100,000.00 10.4 1,043,551.6 P 35.0 Example Demand 30.0 25.0 20.0 15.0 MR 10.0 5.0 0.0 10 20 30 40 Price 50 60 70 80 Marginal Revenue 90 Q Monopolist • Maximize Revenues by choosing an output level such that marginal revenue equals marginal cost. • Price will exceed marginal cost. Monopolists will make greater profits than a competitive firm. • Monopolists will charge higher prices and produce less output than a competitive industry. • Profits should attract new entrants to the market. • Monopoly can only survive if there are some barriers to entry. Monopolist: Constant Cost Price P* Profit MC = ATC Revenues D Cost MR QMono QPC Output Price 10,000 33.0 20,000 23.3 30,000 19.1 40,000 16.5 50,000 14.8 60,000 13.5 70,000 12.5 80,000 11.7 90,000 11.0 Marginal Marginal Revenue Revenue Cost Cost Profit 330000 80000 250000 13.66905 8 466690.5 160000 306690.5 10.48863 8 571576.8 240000 331576.8 8.842323 8 660000 320000 340000 7.790243 8 737902.4 400000 337902.4 7.042918 8 808331.6 480000 328331.6 6.476632 8 873097.9 560000 313097.9 6.028302 8 933381 640000 293381 5.661905 8 990000 720000 270000 Monopolist: General Case MC Price ATC P* Profits Revenues D MR Costs Q* Output Monopolist’s Schedule • The more elastic the demand curve, the higher the market power. • The greater the market power, the greater the markup. • Firm has more pricing power if good has fewer substitutes. Barriers to Entry • Total Control over Vital Resource • Alcoa in the aluminum market • DeBeers in Diamond market • Patents or Secret Formula: • Xerox: Controlled photocopying • Regulations: Jockey Club, SDTM • Gambling is a legally restricted monopoly • Returns to Scale: • TownGas is an regulated monopoly supplier of a particular type of piped natural gas (may have competition from LNG) Price Discrimination • Demand curve is the price customers are willing to pay. • Some customers are willing to pay a very high price. If monopolists could tailor a price to each customer they could make maximum profits. Monopolist: Price Discriminatation Price P1* P2* Profit Profit MC MR2 MR Q1 +Q2 D Output Natural Monopoly • In markets with a natural monopoly there may be one firm. • Economies of scale indicate that at marginal cost pricing firms make a loss. • Efficient production involves 1 firm. Firm will naturally charge markup and earn profits. Monopolist: High Fixed Costs Profits under Monopoly Price Under perfect competition, price equals marginal cost and the firm incurs losses. P* Profits ATC MC Losses D MR QMono QPC Output Regulation • Government may step in, usually to put a maximum price level. Should be minimum amount necessary to get the firm to operate small decisions that lead to a competitive outcome. • Average cost pricing • Information Problem. A single decision maker may not have full access to enough information. . Monopoly P 600 D 500 Average Cost Pricing ATC 400 MC 300 200 MR Competition 100 0 0 50 100 150 200 250 Q MONOPOLISTIC COMPETITION AND PRODUCT DIFFERENTIATION Chapter 14 Monopolistic Competition • Most firms produce a good that is (to a certain extent) unique. No other good has the exact same properties. • Coke, Pepsi, President’s Choice • To the extent that you are a unique producer, you will have some market power. • Price elasticity of individual products are larger than total category. But not infinite as in the case of commodity goods. Monopolistic Competition: Short-term Price MC ATC P* D MR Q* Output Characteristics of Monopolistically Competitive Markets • Differentiated Products Download • Free Entry into very similar markets. • Fixed costs of setting up production • Individual firms face downward sloping demand curve and a falling average total cost curve. • They would sell more if they could at the going rate but lowering their prices to sell more would lead to losses. No Barriers to Entry • What happens if new firms can enter? • If there are profits to be had, entrepreneurs will enter markets to provide close substitutes for profit making goods. • New goods splitting the market and better substitutes means lower, flatter demand curve. Monopolistic Competition: Entry of Competitors Price MC ATC P* P** Profits MR MR′ D′ Q** Q* D Output Monopolistic Competition vs. Perfect Competition • On a market-by-market basis, perfect competition will offer greater efficiency both in terms of minimizing deadweight losses and encouraging an efficient production scale. • Monopolistic Competition only occurs with differentiated products. • Greater variety generated by this market may compensate for loss of efficiency. Monopolistic Competition: Long-term Price MC ATC Profits P* D′ MR′′ Q* D′′ Output MR′ Monopolistic Competition vs. Perfect Competition • Similar: Both have many firms, both have zero profits and P = ATC. • Different: • P > MC : On the margin, monopolistically competitive firms want more customers. Greater variety generated by this market may compensate for loss of efficiency. • MC < ATC: Firm is operating at a level that does not minimize total costs. Variety and Monopolistic Competition • Given that most markets have the “feel” of monopolistic competition, do we have too many firms or is variety it’s own reward? • Does advertising create phony differentiation or provide information? Monopolistic Competition and Entrepreneurship • New markets are frequently developed. • For many goods, the only barriers to entry is imagination. • Entrepreneurs develop new ideas for new goods. The pay-off for entrepreneurship are short-run monopoly profits. (Ted Turner and CNN). Only in rare cases will firms be able to make long-term monopolistic profits. Unprofitable Monopolistic Competition: Short-term Price MC ATC P* MR Q* D Output Consequences of Market Power • One clear consequence of the existence of market power is that prices are higher than marginal cost and output is smaller than perfect competition. • Additional consequences of the presence of market power may be: • Complacency by firms managers (i.e. standard corporate governance measures do not generate efficiency) • Rent-seeking: Firms may put effort into constructing artificial barriers to entry rather than producing goods. Learning Outcomes • Define marginal revenue. • Characterize the relationship between price, marginal revenue, marginal cost, average total cost, and profits in a monopolistic market. • Measure the degree of market power with the Lerner index. • Describe 4 barriers to entry that may enable monopoly power. Final Exam (TBA) • When: Sunday, February 8th. TBA. • Where: TBA • What: Cover Materials in lectures on Supply& Demand, Macro Indicators, Exchange Rates, Loanable Funds, Business Cycles, Monetary Policy, Industrial Organization. • How: Format similar to practice final. • Bring writing materials, calculator, 1 A4 paper with handwritten notes on both sides. • Office Hours: Thursday, January 29th 7-8pm, Downtown campus; February 7th, 12:30-2pm.