Solutions 14

advertisement

ECON 101: Principles of Microeconomics – Discussion Section Week 14 – Spring 2015

Content for Today

Game Theory

Monopolistic Competition

1. Game or not? (If yes, what’s the strategy for each player?)

a.

b.

c.

d.

Deciding whether to buy an umbrella or not before you leave the house

Auction, in which the buyer with a highest bid will get the object

A bull decides to fight or flee when faced with a wolf

Buying a second-hand car from your friend Sam

Games feature players who behave strategically. So (a) is not a game since there

is only one player. It’s your individual decision. (b) is a game in which the

strategy of each buyer is her bid. (c) is a game in which the strategy of the bull is

{fight, flee}. (d) can be treated as a game since you may need to negotiate with

your friend Sam, and your strategy will be the price you offer.

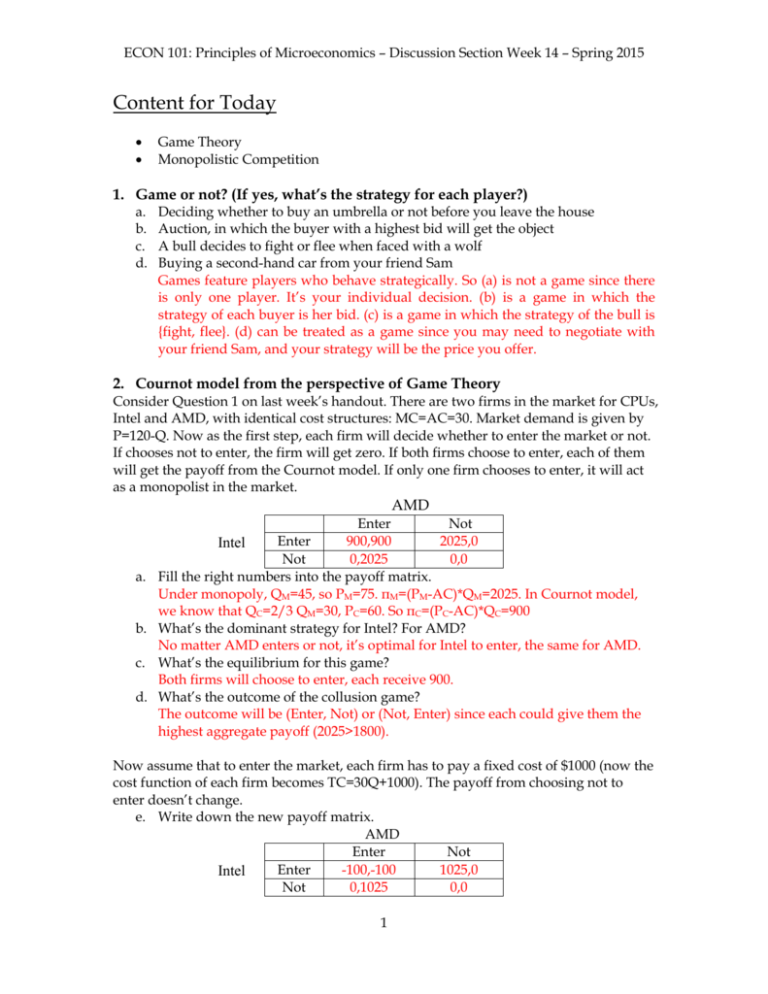

2. Cournot model from the perspective of Game Theory

Consider Question 1 on last week’s handout. There are two firms in the market for CPUs,

Intel and AMD, with identical cost structures: MC=AC=30. Market demand is given by

P=120-Q. Now as the first step, each firm will decide whether to enter the market or not.

If chooses not to enter, the firm will get zero. If both firms choose to enter, each of them

will get the payoff from the Cournot model. If only one firm chooses to enter, it will act

as a monopolist in the market.

AMD

a.

b.

c.

d.

Enter

Not

Enter

900,900

2025,0

Intel

Not

0,2025

0,0

Fill the right numbers into the payoff matrix.

Under monopoly, QM=45, so PM=75. πM=(PM-AC)*QM=2025. In Cournot model,

we know that QC=2/3 QM=30, PC=60. So πC=(PC-AC)*QC=900

What’s the dominant strategy for Intel? For AMD?

No matter AMD enters or not, it’s optimal for Intel to enter, the same for AMD.

What’s the equilibrium for this game?

Both firms will choose to enter, each receive 900.

What’s the outcome of the collusion game?

The outcome will be (Enter, Not) or (Not, Enter) since each could give them the

highest aggregate payoff (2025>1800).

Now assume that to enter the market, each firm has to pay a fixed cost of $1000 (now the

cost function of each firm becomes TC=30Q+1000). The payoff from choosing not to

enter doesn’t change.

e. Write down the new payoff matrix.

AMD

Enter

Not

Enter

-100,-100

1025,0

Intel

Not

0,1025

0,0

1

ECON 101: Principles of Microeconomics – Discussion Section Week 14 – Spring 2015

f.

Does Intel have dominant strategy now? How about AMD?

No. Intel will choose Enter if AMD chooses Not, and choose Not if AMD chooses

Enter.

g. What’s the Nash Equilibrium in this scenario?

There are two NEs. One is (Not, Enter), and the other is (Enter, Not).

h. From your perspective, which NE is more likely to appear?

It depends on the reality. For example if Intel is well known for its aggressive

firm culture then AME may not be willing to choose entering, and (Enter, Not)

will be the final outcome. We call this equilibrium a focal point.

i. What’s the outcome if both firms play their max-min strategy?

For Intel, the worst outcome is -100 from choosing Enter and 0 from choosing

Not. So Intel will choose Not. Similarly, AMD will choose Not. So the outcome is

(Not, Not).

j. How could you change the payoff matrix above so that the equilibrium will be

like the one in prisoner’s dilemma? That is: at equilibrium both firms have to

accept a second-best outcome.

A possible change is as follows:

AMD

Enter

Not

Enter

-100,-100

1025,-200

Intel

Not

-200,1025

0,0

Now the first-best outcome is (Not, Not), but both firms will choose Enter. That’s

a prisoner’s dilemma.

We can see that small changes in parameters can lead to a totally different equilibrium

outcome.

3. Monopolistic Competition in the oatmeal market

Consider the market for oatmeal. There are many firms selling similar products, each

faced with a market demand curve: P=16-q. The total cost of each firm is given by

TC=q2+4, and marginal cost given by MC=2q.

a. What quantity and price will each firm choose?

MR=16-2q. Let MR=MC, then we have 16-2q=2q. So q=4, and p=16-q=12.

b. What’s the profit of each firm?

Revenue=p*q=48. Cost=16+4=20. So Profit is Revenue-Cost=28.

c. Is this market in long-run monopolistically competitive equilibrium? If not, what

needs to happen to bring it to LR equilibrium?

No, since each firm has positive profit. What will need to happen is the demand

curve will need to shift in because more firms would be entering the market and

taking away some of the demand.

2