Cost Reduction and Control

advertisement

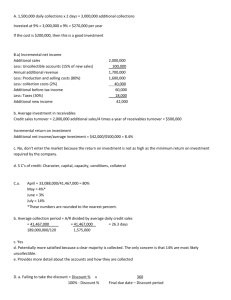

1 Cost reduction refers to the real and permanent reduction in the unit cost of the goods manufactured or services rendered. COST REDUCTION CAN BE EFFECTED BY EITHER OF THE FOLLOWING WAYS: (i) By reduction in unit cost of production: This is usually brought by elimination of wasteful and non-essential elements in the design of products and from techniques and practices carried out. (Any reduction in costs due to changes in Government policy like reduction in taxes or duties or due to price agreements do not come into the area of cost reduction as these are not real and permanent reductions in costs). 2 (ii) By increasing productivity: This refers to increase in the volume of output with the expenditure remaining the same. But this should not be achieved at the cost of the characteristics and quality of the product. AREAS OF COST REDUCTION: 1. Design 2. Factory organisation and method 3. Product planning 4. Factory layout and equipment 5. Utility services 6. Marketing 7. Finance 3 Cost control is concerned with keeping the expenditure within acceptable limits. Its major assumption is that costs are in control unless costs exceed budget or standard by an excessive amount. DIFFERENCES BETWEENCOST CONTROL COST REDUCTION 1. Controls costs towards Represents real and permanent achievement of predetermined decrease in costs. target or goals. 2. It is a routine exercise. It is a planned process. 3. It is a preventive function. It is a corrective function. 4 COST CONTROL IS EFFECTED THROUGH BUDGETING & STANDARD COSTING Budgeting: A budget may be defined as a comprehensive and coordinated plan of action, expressed in monetary terms. It is prepared and approved prior to the budget period and may show income, expenditure and capital to be employed to attain the objective. Standard costing: In this, standards are set and actuals are compared with the standard. Corrective measures are undertaken for any discrepancy found between the standard and actuals. 5 TECHNIQUES OF COST REDUCTION 1. VALUE ANALYSIS: Value analysis is the identification of unnecessary cost i.e. cost that neither provides quality, nor use, nor life, nor appearance, nor customer satisfaction. Thus value analysis attacks costs at production stage. 2. ECONOMIC BATCH QUANTITY: (EBQ) EBQ is that point where carrying costs equals set up cost approximately. At this point the total cost will also be minimum. 3. ECONOMIC ORDER QUANTITY: (EOQ) EOQ is the quantity fixed at a point where total cost of ordering and the cost of carrying the inventory will be minimum. 6 ILLUSTRATION: A publishing house purchases 2000 units of a particular item per year at a unit cost of Rs.20/-. The ordering cost per order is Rs.50/- and the inventory carrying cost is 25%. Find the optimal order quantity and the minimal total cost including purchase cost. If 3% discount is offered by the supplier for purchase in lots of 1000 or more, should the publishing house accept the offer? SOLUTION: Optimal order quantity or EOQ = 2 x annual consumption x ordering cost per order inventory carrying cost per unit 7 2 x 2000units x Rs.50 Rs.20 x 0.25 = 200units. CALCULATION OF MINIMUM TOTAL COST WITHOUT DISCOUNT: No. of orders to be placed for getting 2000units = 10orders Average inventory (200units / 2) = 100 units Purchase price of 2000units @ Rs.20/unit = Rs.40000 Ordering cost (10orders @ Rs.50/order) = Rs. 500 Carrying cost for 100uts (avg. inventory) (Rs.20*0.25) = Rs. TOTAL COST 500 = Rs.41000 8 CALCULATION OF TOTAL COST WITH 3% DISCOUNT WHEN PURCHASE ORDER QUANTITY IS 1000 UNITS: Unit cost after 3% discount (Rs.20 – 3% of Rs.20) = Rs.19.40 Lot size = 1000 uts No. of orders for 2000units @ 1000units / order = 2 orders Avg. inventory (1000 uts per order / 2) = 500 uts Purchase cost for 2000 uts @ Rs.19.40/ut. = Rs.38800 Ordering cost for 2 orders at Rs.50/order = Rs. 100 Carrying cost for avg. inventory (500 * 19.40 * 0.25) = Rs. 2425 TOTAL COST = Rs.41325 9 The above computation shows that supplier’s offer of 3% discount should NOT BE ACCEPTED because it will INCREASE COST by Rs.325/- as compared to the EOQ of 200 units. Counter offer of higher discount should be made if the cost is to be less than Rs.41000/-. 10 4. ACTIVITY BASED COST MANAGEMENT: ABC assumes that resource-consuming activities cause costs. Its aim is to directly control the activities that cause costs, rather than cost. By managing activities that cause costs, costs will be managed in the long run. Cost causing activities – designing, engineering, manufacturing, marketing, etc. 11 A CASE STUDY IN ABC: Under ABC in a direct mail printing firm, cost reduction occurred by developing plans to eliminate idle time and reduce the total set-up time rather than layoff employees. The firm was reporting decreasing profit although operating at capacity. Its short-run solution was to reduce the labour force, which is a cost the company can control in short run. A study of activities in the printing process, however, indicated a set-up time of 35 hours on complex orders with employees being idle 25% of the time during set-up. ABC demonstrated that this idle time was costing the firm approximately US$.41000 in wages per complex order. 12 5. JUST-IN-TIME APPROACH: (JIT) The aims of JIT are to produce the required items, at the required quality and in the required quantities, at the precise time they are required. JIT helps in cost reduction by – a. elimination of non-value-added activities, b. zero inventory, c. zero defects, d. zero breakdowns, e. single batch ordering. Though the above goals are unlikely to be achieved, it represent targets and create a climate for continuous improvement 13 and excellence. 6. TOTAL QUALITY MANAGEMENT: (TQM) TQM works on the philosophy that all business functions are involved in a process of continuous quality improvement. TQM reduces cost by producing the products correctly the first time rather than wasting resources making substandard items and incurring additional expenditure on inspection, rework and scrapping. It helps organisations to achieve their quality goals by providing reports and measures that will improve quality. TQM aims at a customer-oriented process of continuous improvement that focuses on delivering products or services of consistent high quality in a timely fashion. 14 7. SUPPLY CHAIN MANAGEMENT: (SCM) SCM attempts to build a cost effective chain beginning with the ultimate customer and links all the previous suppliers under one platform. An effective SCM eliminates most of the activities in between customers and raw material suppliers along with associated costs. Most of the non-core activities are outsourced and hence fixed costs are kept minimal. Close interaction between the corporate R&D and the suppliers facilitates continuous improvements in product design, process methodologies, etc. resulting in customer value enhancement and cost reduction. A rupee spent on the supply chain can give more value than a rupee spent on marketing. The supply chain is part of the 15 service offering. A CASE STUDY: ESCORTS TRACTORS FARMS – BPR resulted to target cost reduction per tractor by 20 %. Introduced in process involving the manufacturers of rear axles, one that required maximum movement of materials across the halls. Pre-reengineering, the manufacture involved 9 changes in ownership, had 21 workers in any given shift, and lead-time of 19 days. Today the process requires only 12 workers per shift, and lead-time has fallen to 8 hours. “The physical resources are easy to change. The key to success lies in motivating employees up to the grass root level to initiate change, not just accept it.” Farm Tract has extended its efforts to SCM and reduced the number of vendors and brought down the total acquisition cost by 5%. 16 8. PERT ANALYSIS: Programme Evaluation Review Technique (PERT) reduces cost by giving an optimum schedule for the activities necessary to complete a project. SOME OTHER COST REDUCTION TECHNIQUES ARE 9. Simplification and Standardisation 10. Design analysis 11. Substitute material utilisation 12. Production planning and control 13. Technological forecasting 14. Market research etc. 17 Non-Conventional Approach • Material Cost • Manpower Cost • Cost Management Initiatives – Selling and Distribution • Funding Cost 18 Non-Conventional Approach (Contd) • Material cost – Cost reductions thru’ – E-sourcing • Discovery of new sources • Competitive pressures • Rationalisation of suppliers – Thrust on Value Engineering • Re-Visiting Designs • Application oriented engineering – Product Life Cycle Management 19 Non-Conventional Approach (Contd.) • Manpower Cost – Right-sizing of Employees – VRS Schemes – Optimum utilisation of Manpower • Transition from Machine engagement time to ManEngagement time. – Productivity-linked wage settlements – Adopting new concepts • MOST • CELL Layout 20 IMPORTANCE OF COST CONTROL AND COST REDUCTION FOR CORPORATE TURNAROUND The importance of cost control and reduction in a manufacturing organisation can never be overemphasized. These phrases that were mere clichés not too long ago, have now come to acquire a new meaning in the last few years. In fact, it may not be an overstatement to say that the revival and subsequent boom in the corporate sector in the last couple of years was primarily driven by the conscious efforts towards controlling costs. 21 Whether it be manpower reduction, controlling overheads, reducing input costs or bringing down finance charges, Corporate India has done it all in the effort to stay profitable in the new milieu. There have been basically two drivers behind this emergence of cost consciousness in the corporate sector. First is the compulsion to stay profitable, which is the basic instinct of any company. 22 As the demand cycle goes through a dip and sales begins to shrink, companies typically look inward to keep afloat. And the time-tested way of doing this is by slashing at the cost structure and save money. However, it is the second reason that is the more significant one. In a highly competitive market place increasingly populated by multinationals, the best way for Indian companies to survive and grow is by offering better quality products at cheaper price. The only way to do this is by constantly chipping away at the cost structure to eliminate unproductive expenditure so that the company will have the pricing freedom in the marketplace. 23 The old equation of COST + MARGIN = SELLING PRICE has now been turned on its head to mean that MARGIN = SELLING PRICE – COST. Of this, only one variable, cost, is under the control of the company while the market dictates selling price. Margin therefore is a function of how efficient the company is in controlling costs. 24 CHANGING PERSPECTIVE OF PROFIT COST + PROFIT = SALES In a sellers market cost and profits are reimbursed by the customer. SALES - COST = PROFIT With more players in the market place, Selling price is determined by the market forces ; having locked to a level of cost , focus is on cost control and reduction . Cost information is for tactical decision making. SALES -PROFIT = COST Selling price is determined by market forces: Profit is determined by the risk/return profile of business with a focus on cost management to achieve the targeted results. 25 ROLE OF COST REDUCTION IN TATA MOTORS’ TURNAROUND – FROM A Rs.500 CRORE LOSS TO Rs.500 CRORE PROFIT IN 2 YEARS! Tata Motors presents a classic case study of how studious efforts at cost control can pay rich dividends. The company reported a historic loss of Rs.500 crore in 2000-01 when doomsayers said that the company would be history soon. But the company bounced back and proved them wrong by registering a Rs.510 crore profit in 2002-03 literally rising like Phoenix from the ashes. How did the company manage this? Of course, the business environment improved and sales of commercial vehicles, its primary product, began to grow. 26 But there was also some silent work done in the background that helped the turnaround in Tata Motors’ fortunes.That was cost control. The company managed to eliminate as much as Rs.900 crore in costs in just two years’ time. Instead of concentrating on any one aspect of cost, the company slashed them across the board. Thus, there was a reduction in material costs, staff costs through VRS, interest costs and in other expenditure. Of course, it did help that interest rates during the period were low but there can be no doubt that the company showed exceptional financial management skills to overcome the dark phase. 27 EMERGING BUSINESS MODELS In the Present Scenario, the very nature of competition will change. Increasingly customers will demand Ever-greater choice, so that products and services are customised for market segments of one customer. Procurement will find new ways of working with suppliers and new ways of working internally. New business models will emerge that organisations must learn to recognise and understand. The key issues - the driving forces, the charactistics of new business models , the keys to success and the challenges companies face. 28 FIVE FORCES OF NEW ECONOMY • • • • • Globalisation of both markets and sources. Open for business 24 x 7. The rapid expansion of internet. Continued evolution of transport services. Service economy. 29 CHARACTERISTICS OF NEW MODELS • Focus on core activities. • Automation/integration. • Complexity of relationship. • Ubiquitous and real-time information. • Organisational structure. 30 KEYS TO SUCCESS • The Supply Chain • The Balance of Power • The Competitive Landscape • Service not Product • Future Cast 31 32