Credit card surcharges and non-transparent transaction fees: A study

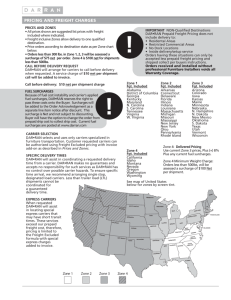

advertisement