Valuation Methods

advertisement

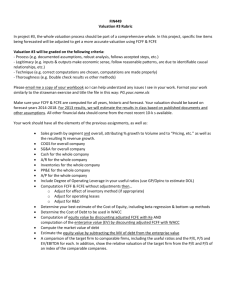

Valuation FIN 449 Michael Dimond Discounted Cash Flow Valuation Michael Dimond School of Business Administration Discounted Cash Flow Valuation • What is it: In discounted cash flow valuation, the value of an asset is the present value of the expected cash flows on the asset. • Philosophical Basis: Every asset has an intrinsic value that can be estimated, based upon its characteristics in terms of cash flows, growth and risk. • Information Needed: To use discounted cash flow valuation, you need – to estimate the life of the asset – to estimate the cash flows during the life of the asset – to estimate the discount rate to apply to these cash flows to get present value • Market Inefficiency: Markets are assumed to make mistakes in pricing assets across time, and are assumed to correct themselves over time, as new information comes out about assets. Michael Dimond School of Business Administration Valuation: Simplicity vs Clarity Simplest DCF approach - constant growth model: 2013 FCFE 6,604.4 CF0 Ke 8.97% Constant growth 5.0% plus cash 40,979.0 Equity value 215,846.2 Number of shares 31,072.0 Intrinsic value/share $ 6.95 • Risk and long-term CF growth assumptions matter, but we could easily build a table to model sensitivity to changes in growth and cost of capital. Michael Dimond School of Business Administration Valuation: Simplicity vs Clarity Simplest DCF approach - constant growth model: 2013 FCFE 6,604.4 CF0 Ke 8.97% Constant growth 5.0% plus cash 40,979.0 Equity value 215,846.2 Number of shares 31,072.0 Intrinsic value/share $ 6.95 2-stage growth model: 2013 FCFE Ke Years 1-5 Growth LT growth (after Y5) plus cash Equity value Number of shares Intrinsic value/share $ 6,604.4 CF0 8.97% 10.0% 5.0% 40,979.0 258,279.2 31,072.0 8.31 FCFE CF1 7,264.8 CF2 7,991.3 CF3 8,790.5 CF4 9,669.5 CF5 10,636.5 Michael Dimond School of Business Administration Valuation: Simplicity vs Clarity 2-stage growth model: 2013 FCFE Ke Years 1-5 Growth LT growth (after Y5) plus cash Equity value Number of shares Intrinsic value/share $ 6,604.4 CF0 8.97% 10.0% 5.0% 40,979.0 258,279.2 31,072.0 8.31 3-stage growth model: 2013 FCFE Ke Years 1-5 Growth Years 6-10 Growth LT growth (after Y10) plus cash Equity value Number of shares Intrinsic value/share $ 6,604.4 8.97% 10.0% 7.0% 5.0% 40,979.0 275,120.1 31,072.0 8.85 FCFE CF1 7,264.8 CF2 7,991.3 CF3 8,790.5 CF4 9,669.5 CF5 10,636.5 These models are great and you get an answer quickly, but they are very high level. FCFE CF6 11,381.0 CF7 12,177.7 CF8 13,030.1 CF9 13,942.2 CF10 14,918.2 Michael Dimond School of Business Administration Advantages of DCF Valuation • Since DCF valuation, done right, is based upon an asset’s fundamentals, it should be less exposed to market moods and perceptions. • If good investors buy businesses, rather than stocks (the Warren Buffett adage), discounted cash flow valuation is the right way to think about what you are getting when you buy an asset. • DCF valuation forces you to think about the underlying characteristics of the firm (fundamentals) and understand its business. If nothing else, it brings you face to face with the assumptions you are making when you pay a given price for an asset. Michael Dimond School of Business Administration Disadvantages of DCF valuation • Since it is an attempt to estimate intrinsic value, it requires far more inputs and information than other valuation approaches • These inputs and information are not only noisy (and difficult to estimate), but can be manipulated by the savvy analyst to provide the conclusion he or she wants. Michael Dimond School of Business Administration Disadvantages of DCF Valuation (con’t) • In an intrinsic valuation model, there is no guarantee that anything will emerge as under or over valued. Thus, it is possible in a DCF valuation model, to find every stock in a market to be over valued. This can be a problem for – equity research analysts, whose job it is to follow sectors and make recommendations on the most under and over valued stocks in that sector – equity portfolio managers, who have to be fully (or close to fully) invested in equities Michael Dimond School of Business Administration When DCF Valuation works best • This approach is easiest to use for assets (firms) whose – cashflows are currently positive and – can be estimated with some reliability for future periods, and – where a proxy for risk that can be used to obtain discount rates is available. • It works best for investors who either – have a long time horizon, allowing the market time to correct its valuation mistakes and for price to revert to “true” value or – are capable of providing the catalyst needed to move price to value, as would be the case if you were an activist investor or a potential acquirer of the whole firm Michael Dimond School of Business Administration Discounted Cashflow Valuation t = n CF t Value = t t = 1 (1 + r) where CFt is the cash flow in period t, r is the discount rate appropriate given the riskiness of the cash flow and t is the life of the asset. • For an asset to have value, the expected cash flows have to be positive some time over the life of the asset. • Assets that generate cash flows early in their life will be worth more than assets that generate cash flows later; the latter may however have greater growth and higher cash flows to compensate. Michael Dimond School of Business Administration Equity Valuation • The value of equity is obtained by discounting expected cashflows to equity, i.e., the residual cashflows after meeting all expenses, tax obligations and interest and principal payments, at the cost of equity, i.e., the rate of return required by equity investors in the firm. Value of Equity = where, t=n CF to Equity t (1+ k )t t=1 e CF to Equityt = Expected Cashflow to Equity in period t ke = Cost of Equity • The dividend discount model is a specialized case of equity valuation, and the value of a stock is the present value of expected future dividends. Michael Dimond School of Business Administration Firm Valuation • The value of the firm is obtained by discounting expected cashflows to the firm, i.e., the residual cashflows after meeting all operating expenses and taxes, but prior to debt payments, at the weighted average cost of capital, which is the cost of the different components of financing used by the firm, weighted by their market value proportions. CF to Firm t (1+ WACC) t t =1 t= n Value of Firm = where, CF to Firmt = Expected Cashflow to Firm in period t WACC = Weighted Average Cost of Capital • The difference between equity value and the value of the firm is the value of claims on assets (e.g. Debt) Michael Dimond School of Business Administration Cash Flows and Discount Rates • Assume that you are analyzing a company with the following cashflows for the next five years. Year CF to Equity Int Exp (1-t) CF to Firm 1 $ 50 $ 40 $ 90 2 $ 60 $ 40 $ 100 3 $ 68 $ 40 $ 108 4 $ 76.2 $ 40 $ 116.2 5 $ 83.49 $ 40 $ 123.49 Terminal Value $ 1603.0 $ 2363.008 • Assume also that the cost of equity is 13.625% and the firm can borrow long term at 10%. (The tax rate for the firm is 50%.) • The current market value of equity is $1,073 and the value of debt outstanding is $800. • Calculate the Equity Value and the Firm Value. Michael Dimond School of Business Administration Equity versus Firm Valuation Method 1: Discount CF to Equity at Cost of Equity to get value of equity • Cost of Equity = 13.625% • PV of Equity = 50/1.13625 + 60/1.136252 + 68/1.136253 + 76.2/1.136254 + (83.49+1603)/1.136255 = $1073 Method 2: Discount CF to Firm at Cost of Capital to get value of firm • Cost of Debt = Pre-tax rate (1- tax rate) = 10% (1-.5) = 5% • WACC = 13.625% (1073/1873) + 5% (800/1873) = 9.94% • PV of Firm = 90/1.0994 + 100/1.09942 + 108/1.09943 + 116.2/1.09944 + (123.49+2363)/1.09945 = $1873 • PV of Equity = PV of Firm - Market Value of Debt = $ 1873 - $ 800 = $1073 Michael Dimond School of Business Administration First Principles of Valuation • Never mix and match cash flows and discount rates. • The key error to avoid is mismatching cashflows and discount rates, since discounting cashflows to equity at the weighted average cost of capital will lead to an upwardly biased estimate of the value of equity, while discounting cashflows to the firm at the cost of equity will yield a downward biased estimate of the value of the firm. t=n CF to Equity t Value of Equity = (1+ k e )t t=1 CF to Firm t Value of Firm = t t =1 (1+ WACC) t= n Michael Dimond School of Business Administration The Effects of Mismatching Error 1: Discount CF to Equity at Cost of Capital to get equity value PV of Equity = 50/1.0994 + 60/1.09942 + 68/1.09943 + 76.2/1.09944 + (83.49+1603)/1.09945 = $1248 Value of equity is overstated by $175. Error 2: Discount CF to Firm at Cost of Equity to get firm value PV of Firm = 90/1.13625 + 100/1.136252 + 108/1.136253 + 116.2/1.136254 + (123.49+2363)/1.136255 = $1613 PV of Equity = $1612.86 - $800 = $813 Value of Equity is understated by $ 260. Error 3: Discount CF to Firm at Cost of Equity, forget to subtract out debt, and get too high a value for equity Value of Equity = $ 1613 Value of Equity is overstated by $ 540 Michael Dimond School of Business Administration DCF Methods Compared • FCFE//Ke – Equity cash flow method • FCFF//WACC – Corporate valuation method • FCFF//Ku – Adjusted present value method (APV) Michael Dimond School of Business Administration DCF: Equity cash flow method UNROUNDED FCFF D E TC wd we Terminal growth Kd Debt (n=-1) Debt (n=0) t Rf Rm MRP β Ke 1000.0 5000.0 13417.7 18417.7 0.2715 0.7285 3.5% 5.0% 4830.9 5000.0 40% 3% 10% 7% 1.2 11.4% Equity Cash Flow Method (FCFE//Ke) FCFE (n=0) 1024.2 g 3.5% Ke 11.4% PV 13417.7 Equity Intrinsic Value 13417.7 Michael Dimond School of Business Administration DCF: Corporate valuation method UNROUNDED FCFF D E TC wd we Terminal growth Kd Debt (n=-1) Debt (n=0) t Rf Rm MRP β Ke 1000.0 5000.0 13417.7 18417.7 0.2715 0.7285 3.5% 5.0% 4830.9 5000.0 40% 3% 10% 7% 1.2 11.4% Corporate Valuation Method (FCFF//WACC) FCFF (n=0) 1000.0 g 3.5% WACC 9.1% PV 18417.7 Debt (n=0) 5000.0 Equity Intrinsic Value 13417.7 Michael Dimond School of Business Administration DCF: Adjusted present value method (APV) UNROUNDED FCFF D E TC wd we Terminal growth Kd Debt (n=-1) Debt (n=0) t Rf Rm MRP β Ke 1000.0 5000.0 13417.7 18417.7 0.2715 0.7285 3.5% 5.0% 4830.9 5000.0 40% 3% 10% 7% 1.2 11.4% APV Method (FCFF//Ku) FCFF (n=0) g Ku PV Int Exp (n=0) t Tax savings g Ku PV Total of PVs Debt (n=0) Equity Intrinsic Value 1000.0 3.5% 9.7% 16795.0 241.5 40% 96.6 3.5% 9.7% 1622.7 18417.7 5000.0 13417.7 Michael Dimond School of Business Administration DCF results compared • In theory, the methods produce equivalent results Method Equity CF -> Corp Val -> APV -> Intr. Value 13417.7 13417.7 13417.7 $ Diff 0.0 0.0 0.0 % Diff 0.0% vs Corp Val 0.0% vs APV 0.0% vs Equity CF • This is rarely the case in the real world… Michael Dimond School of Business Administration Discounted Cash Flow Valuation • What is it: In discounted cash flow valuation, the value of an asset is the present value of the expected cash flows on the asset. • Philosophical Basis: Every asset has an intrinsic value that can be estimated, based upon its characteristics in terms of cash flows, growth and risk. • Fundamental Analysis derives those cash flows from the underlying, or fundamental, operations of the business. Michael Dimond School of Business Administration