Question 01: Mega Ltd is a private entity that supplies and

advertisement

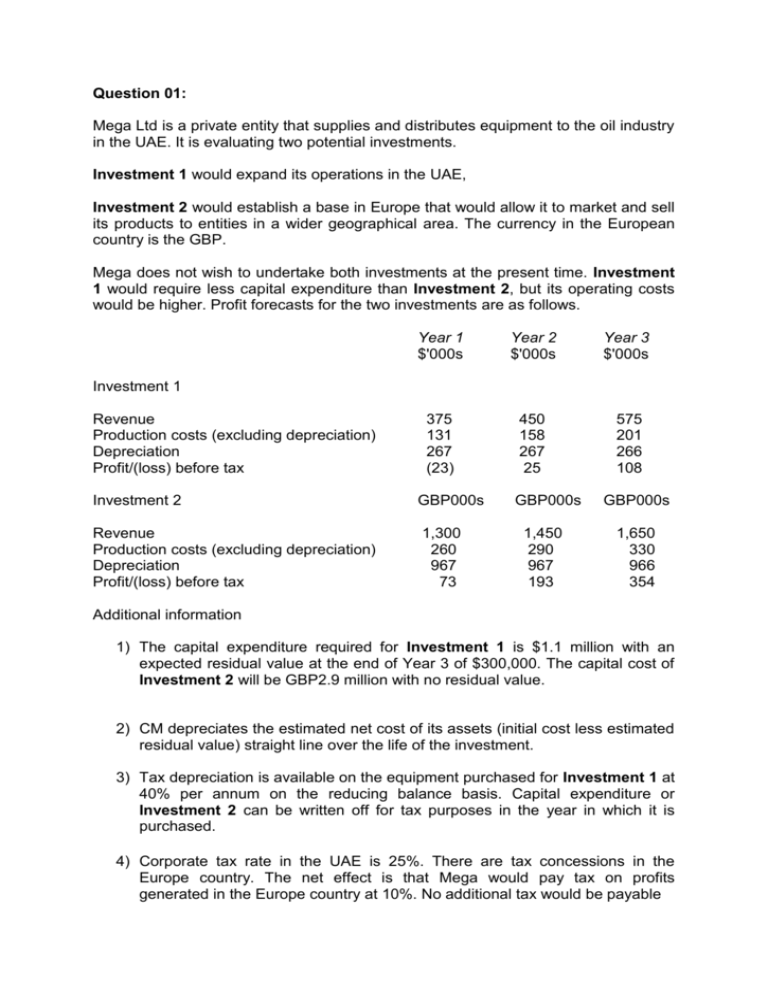

Question 01: Mega Ltd is a private entity that supplies and distributes equipment to the oil industry in the UAE. It is evaluating two potential investments. Investment 1 would expand its operations in the UAE, Investment 2 would establish a base in Europe that would allow it to market and sell its products to entities in a wider geographical area. The currency in the European country is the GBP. Mega does not wish to undertake both investments at the present time. Investment 1 would require less capital expenditure than Investment 2, but its operating costs would be higher. Profit forecasts for the two investments are as follows. Year 1 $'000s Year 2 $'000s Year 3 $'000s 375 131 267 (23) 450 158 267 25 575 201 266 108 Investment 1 Revenue Production costs (excluding depreciation) Depreciation Profit/(loss) before tax Investment 2 GBP000s Revenue Production costs (excluding depreciation) Depreciation Profit/(loss) before tax 1,300 260 967 73 GBP000s 1,450 290 967 193 GBP000s 1,650 330 966 354 Additional information 1) The capital expenditure required for Investment 1 is $1.1 million with an expected residual value at the end of Year 3 of $300,000. The capital cost of Investment 2 will be GBP2.9 million with no residual value. 2) CM depreciates the estimated net cost of its assets (initial cost less estimated residual value) straight line over the life of the investment. 3) Tax depreciation is available on the equipment purchased for Investment 1 at 40% per annum on the reducing balance basis. Capital expenditure or Investment 2 can be written off for tax purposes in the year in which it is purchased. 4) Corporate tax rate in the UAE is 25%. There are tax concessions in the Europe country. The net effect is that Mega would pay tax on profits generated in the Europe country at 10%. No additional tax would be payable in the UAE. Tax would be refunded or paid on both investments at the end of the year in which the liability arises. 5) Investment 1 would be financed by internal funds. Investment 2 would be financed by a combination of internal funds and loans raised overseas. 6) Assume revenue and production costs excluding depreciation equal cash flows. 7) The cash flow forecasts are in nominal terms. The entity's real cost of capital is 8% and inflation is expected to be 2.75% per annum constant in the UAE. 8) Mega evaluates all its investments over a three-year time horizon. 9) Cash flows are assumed to occur at the end of each year except the initial capital cost which is incurred in Year 0. 10) Operating cash flows for Investment 2 are in GBP. The current exchange rate is $1 = GBP2. $ is expected to weaken against the GBP by 4.5% per annum over the next three years. 11) Mega expected accounting return on investment is 15%, calculated as average profits after tax as a percentage of average investment over the life of the assets. Required For each of the two investments, calculate (i) The average annual accounting return on investment using average profit after tax and average investment over the life of the assets. (ii) The NPV using an appropriate discount rate calculated from the information given in the scenario. Question 02 KH is a large food and drink manufacturer and retailer based in the United States of America. To date, the company has operated only in the US but is planning to expand into South America by acquiring a group of stores similar to those operated in the US. Projected cash flows in the US and South America for the first three years of the project, in real terms, are estimated as follows. Year 0 Year 1 Year 2 Year 3 –10,000 –300 –400 –500 +350,000 +450,000 Cash flows in the USA: In US$'000 Cash flows in the South American country: In SA currency'000 –1,000,000 +250,000 US$ cash flows are mainly incremental administration costs associated with the project. SA currency cash flows are cash receipts from sales less all related cash costs and expenses. The exchange rate for the South American country's currency is extremely volatile. Inflation is currently 40% a year. Inflation in the US is 4% a year. Best estimates by KH's treasurer suggest these rates are likely to continue for the foreseeable future. The current exchange rate is SA currency 30 to US$1. The following information is relevant � KH evaluates all investments using nominal cash flows and a nominal discount rate. � SA currency cash flows are converted into US$ and discounted at a riskadjusted US rate. � All cash flows for this project will be discounted at 20%, a nominal rate judged to reflect its high risk. � For the purposes of evaluation, assume the year 3 nominal cash flows will continue to be earned each year indefinitely. Note. Ignore taxation Required Calculate the net present value of the proposed investment and a recommendation as to whether the company should proceed with the investment, supported by your reasons for the recommendation.