Pharmaceutical Industry Marketing and Influence

advertisement

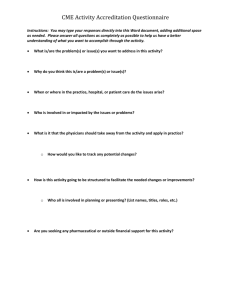

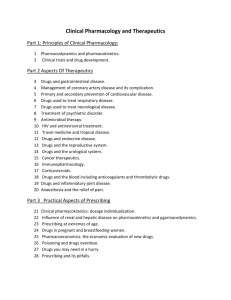

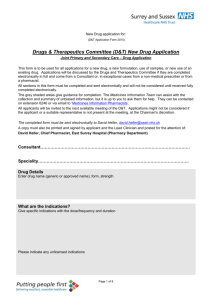

Pharmaceutical Industry Marketing and Influence Dean Haxby, Pharm.D. Associate Professor of Pharmacy Oregon State University, College of Pharmacy To receive 1.5 AMA PRA Category 1 Credits™, you must review this progam and pass the CME quiz at the end. Release Date: January 2009 Expiration Date: January 2012 Attachments • The attachments tab contains documents that supplement the presentation. • The slides are available as an attachment to print out to use as a handout for the presentation. • “Show Me the Evidence” has a list of additional resources on evidence-based drug information and industry marketing. Program Funding This work was made possible by a grant from the state Attorney General Consumer and Prescriber Education Program which is funded by the multi-state settlement of consumer fraud claims regarding the marketing of the prescription drug Neurontin. Continuing Education Sponsors Continuing Medical Education for the following activity titled “Pharmaceutical Industry Marketing and Influence”, is jointly sponsored by The University of Texas Southwestern Medical Center and the Federation of State Medical Board’s Research and Education Foundation. CME Information Program Speaker/Author: Dean Haxby, PharmD Course Director: Program Directors: Barbara S. Schneidman, MD, MPH Federation of State Medical Boards Research and Education Foundation, Secretary Federation of State Medical Boards, Interim President and Chief Executive Officer David Pass, MD Director, Health Resources Commission, Oregon Office for Health Policy and Research Dean Haxby, PharmD Associate Professor of Pharmacy Practice, Oregon State University College of Pharmacy Daniel Hartung, PharmD, MPH Assistant Professor of Pharmacy Practice, Oregon State University College of Pharmacy Target Audience: This educational activity is intended for health care professionals who are involved with medication prescribing. Educational Objectives: Upon completion of this activity, the participants should be able to: describe the purpose and expenditures for various marketing strategies and the impact on prescribing; outline techniques pharmaceutical representatives use to influence clinicians; identify strategies clinicians can use to reduce impact of marketing; describe the role of samples in marketing and the impact of samples on prescribing; identify drug sample regulatory requirements and options to improve sample use; summarize research findings on the impact of direct-to-consumer advertising of prescription drugs; identify potential conflicts of interest. CME Policies Accreditation: This activity has been planned and implemented in accordance with the Essential Areas & Policies of the Accreditation Council for Continuing Medical Education through the joint sponsorship of The University of Texas Southwestern Medical Center and the Federation of State Medical Boards Research and Education Foundation. The University of Texas Southwestern Medical Center is accredited by the ACCME to provide continuing medical education for physicians. Credit Designation: The University of Texas Southwestern Medical Center designates this educational activity for a maximum of 1.5 AMA PRA Category 1 Credits™. Physicians should only claim credit commensurate with the extent of their participation in the activity. Conflict of Interest: It is the policy of UT Southwestern Medical Center that participants in CME activities should be made aware of any affiliation or financial interest that may affect the authors presentation. Each author has completed and signed a conflict of interest statement. The faculty members’ relationships will be disclosed in the course material. Discussion of Off-Label Use: Because this course is meant to educate physicians with what is currently in use and what may be available in the future, “off-label” use may be discussed. Authors have been requested to inform the audience when off-label use is discussed. DISCLOSURE TO PARTICIPANTS It is the policy of the CME Office at The University of Texas Southwestern Medical Center to ensure balance, independence, objectivity, and scientific rigor in all directly or jointly sponsored educational activities. Program directors and authors have completed and signed a conflict of interest statement disclosing a financial or other relationship with a commercial interest related directly or indirectly to the program. Information and opinion offered by the authors represent their viewpoints. Conclusions drawn by the audience should be derived from careful consideration of all available scientific information. Products may be discussed in treatment outside current approved labeling. FINANCIAL RELATIONSHIP DISCLOSURE Faculty David Pass, M.D. Dean Haxby, Pharm.D Daniel Hartung, Pharm.D., MPH Barbara S. Schneidman, MD, MPH Type of Relationship/Name of Commercial Interest(s) None Employment/CareOregon None None Learning Objectives 1. Describe the purpose and expenditures for various marketing strategies and the impact on prescribing 2. Outline techniques pharmaceutical representatives use to influence clinicians 3. Identify strategies clinicians can use to reduce impact of marketing 4. Describe the role of samples in marketing and the impact of samples on prescribing 5. Identify drug sample regulatory requirements and options to improve sample use 6. Summarize research findings on the impact of direct-toconsumer advertising of prescription drugs 7. Identify potential conflicts of interest Important Contributions by the Pharmaceutical Industry • Development of new treatments that improve health and well-being • Make substantial contributions to educational, health care and professional organizations • Provide indigent care programs Pharmaceutical Manufacturers • Are for-profit companies • Primary mission is to increase share holder value • This is accomplished by: – developing new products – successfully marketing those products – having an effective lobby to protect and advance their interests 2007 Fortune 500 Profits J &J 21% Pfizer 37% Merck 20% Abbott 8% Wyeth 21% BMS 9% Eli Lilly 17% Amgen 21% Schering 11% Pharmaceutical Industry • One of the most profitable industries in the US • Industry advocates argue these profits are justified because: – Required to support R & D – Tremendous value of medications – High risk of the industry • A report by Tufts University says it costs $802 million to bring a drug to market Industry Critics • Profits are excessive • Drug development cost figures grossly inflated – exclude tax deductions/credits, include capital opportunity cost (1/2 of total), skewed sample of drugs, industry figures not verifiable • Government funds much of critical research on new drugs • Uninsured cannot afford medications Public Citizen Pharmaceutical Industry Marketing • • • • A key to industry profitability Highly effective Very sophisticated Multi-pronged campaigns targeting clinicians and patients Pharmaceutical Industry Promotion & Marketing $35,000 Samples Expenditure ($ millions) $30,000 Detailing DTC $25,000 Professional Advertising Samples $20,000 $15,000 $10,000 Detailing Professional Advertising $5,000 DTC $0 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 Year Source: N Engl J Med 2007;357:673-81. 2005 Dollars Annual Increase in US Prescription Drug & Total Health Expenditures Annual % Change Rx Drugs 20% 17% 17% 18% 16% 15% 16% 13% 14% 13% 12% 10% 11% 11% 12% 11% 11% 8% 6% 10% 9% 6% 7% 7% 4% 6% 8% 12% 9% 5% 5% 5% 5% 5% 6% 9% 9% 8% 8% 6% 7% 7% 9% Health 2% 0% 1990 1992 1994 1996 1998 2000 2002 2004 2006 Expenditures by Type of Marketing 2004 ($ Billions) Samples Detailing DTCA IMS 15.9 7.3 4 CAM 6.3 20.4 4 Total 15.9 20.4 4 Percent 28% 36% 7% Meetings E-promo. Journals No data No data 0.5 2 0.3 0.5 2 0.3 0.5 3% 0% 1% Unmonitored Total No data 27.7 14.4 47.9 14.4 $57.5 25% Gagnon MA, Lexchin J. PLoS Medicine 2008;5:1-5 Pharmaceutical Representatives • Still the major focus of pharmaceutical marketing • Approximately 100,000 reps in 2005 vs 38,000 in 1995 • 1 rep per 6 MDs in US and 1 rep per 2.5 targeted MDs • 6 million detail visits annually • Cost estimate $12 - $13 thousand per MD on detailing (IMS data) • PhRMA:”serves an essential function in the health care delivery system” Characteristics of Representatives • • • • Presentability/appearance Outgoing personality Excellent interpersonnal skills Assertive Representative Training • How to be observant and assess clinician personalities • How to adjust approach based on reactions and profile information • How to gather and use personal information to establish a connection • How to monitor impact of various marketing strategies on prescribing Plos Medicine 2007;4(4):0621-25 How Representative Can Tailor Approach • Friendly clinician • Frame interactions as gesture of friendship • Skeptical clinician • Use literature, humility, appeal to their “high intellect” • High prescribers • Make best effort to establish personal connection, best gifts Plos Medicine 2007;4(4):0621-25 How Representaive Can Tailor Approach • Clinician prefers competing product • Find out why, try to capture a niche • Refuses to see reps • Try to work through office staff, can get useful information • Thought leaders • Friendly thought leaders groomed for speaking circuit. Monitor impact of local talks and their allegience Plos Medicine 2007;4(4):0621-25 Targeted Clinicians • High volume prescribers • Specialists: scripts they initiate can continue for years by PCPs • Opinion leaders • Low volume, non-influential clinicians receive much less attention Physician Rating of Rep Information Usefulness 60% 50% 40% 30% 20% 10% 0% Very Somewhat Not Very Not at All No Answer Useful Kaiser Family Foundation Report March, 2002 Physician Rating of Accuracy of Representative Information 80% 70% 60% 50% 40% 30% 20% 10% 0% Very Somewhat Not Very Not at All Kaiser Family Foundation March, 2002 No Answer Stages of Rep/Provider Interactions • Acknowledgement of relative status – Valuable time, opinion leader • Find out what is known • Outline benefits of product – Expert name drop • Provider resistance • Reinforcement of role – Compliments, sympathy • Closure: ensure opportunity for return, gifts, obligation BMJ 2001;323:1481-84 Benefits to Provider • Pleasant respite from workday demands • Someone who is “impressed” with their “superior knowledge” • Can be object of flattery and sympathy – Psychological benefits • Receipt of gifts • Can present themselves as skeptic – Questions information, doesn’t agree to prescribe • Can feel like they were in control BMJ 2001;323:1481-84 Representative Goals • • • • • Develop positive relationship Opportunity for future contact Create a sense of obligation Control agenda Promoting product appears secondary in many interactions Influence on Prescribing • Studies show that prescribing is influenced by industry representatives • Higher cost, less rational prescribing is associated with: – Frequency of use of representatives as an information source – Perceived credibility of representative • Even a few minutes of contact can impact prescribing Arch Fam Med 1996;5:237 Soc Sci Med 1988;26:1183 Perceived Influence of Pharmaceutical Reps 70% 60% 50% 40% None A Little A Lot 30% 20% 10% 0% You Other MDs Am J Med 2001;110:551 Physician/Drug Representative Meetings Specialty Family Physicians Internal Medicine Cardiology Pediatrics Surgeons Anesthesiology Meetings/Month 16 10 9 8 4 2 N Engl J Med 2007;356:1742-50 Physician Industry Relationships Benefits Samples Gifts Travel/CME funding Payments Any Relationship % Reporting 78% 83% 35% 28% 95% N Engl J Med 2007;356:1742-50 Physician Factors Associated With Receipt of Payments • Practice with < 25% Medicaid/uninsured • Private practice – Less likely in hospital/HMO setting • • • • University/Medical School Role as a preceptor Developer of clinical guidelines Cardiology specialty (of the six specialties studied) N Engl J Med 2007;356:1742-50 Physician Interactions With Detailers • Physicians are aware of potential conflicts • Interactions are welcomed • Reps described as: – Pleasant – Friendly – Helpful J Gen Intern Med 2007;22:184-90 Methods to Deal With Potential Conflict of Interest • Eliminate the conflict – Can be difficult and painful • Rationalization – “Its educational” – “Patients need samples” • Denial – “It doesn’t influence me” – “I take it with a grain of salt” J Gen Int Med 2007;22:184-90 Clinician Marketing Data • One of best market research systems in the world • Manufacturers have extensive data • Collect information from pharmacies, PBM’s, AMA and Government • Can track impact of different strategies • Profiles help target efforts Ann Intern Med 2007;146:742-8 AMA Master File • Has been sold to industry for decades • Contains physician identifier data that can be linked to other prescribing data • Generated 16% of AMA revenue in 2005 • Due to member concerns, a new “opt out” option allows individual physicians to request that companies not share their individual data with representatives • Most doctors do not know about the program and few have signed up (<1%) Ann Intern Med 2007;146:751-2 How to “Opt-out” • Physicians can enroll by going to the following website: – www.ama-assn.org/go/prescribingdata • Purchasers of the data must agree to restrict prescriber profiling by reps for those who have opted out • Must be renewed every three years and manufacturers have 90 days to comply after requesting the opt-out Ann Intern Med 2007;146:742-48 Conclusions on Representative Marketing • Industry invests billions on detailing • Most prescribers meet with representatives • Representatives are skilled at developing relationships with and influencing clinicians • Meetings with representatives are associated with less rational prescribing and increased costs • Most physicians feel they are not influenced What Can Clinicians Do? • Reduce or eliminate contact with industry representatives – “Just say no” • Identify and use unbiased and independent sources of prescribing information – Medical letter, prescribers letter, cochrane data-base of systematic reviews, Oregonrx.gov – See the document in attachments for sources of evidence-based drug information • Opt-out to limit use of AMA master profile Drug Samples • A major marketing strategy • An estimated $18 billion (retail value) distributed in 2005 • Estimated use: 10-20% of patient encounters • Primary industry goals : – Influence prescribing habits/get patients on med – Representative access, a reason to visit Trends in Retail Value of Sample Distribution 20 18 16 14 12 10 8 6 4 2 0 Retail Value $ Billions 1996 1998 2000 2002 2004 Arguments for Samples • A source of medications for the indigent • Reduces cost to patient • Provider can test effectiveness and tolerability before committing patient to long term use • Prescribers can gain experience with a product Arguments for Samples • Can start therapy immediately • A way around formulary or PA requirements • Can assist with patient instruction • Improves patient satisfaction • Enhances patient-provider relationship / gift giving Arguments Against Samples • Loss of pharmacist review/counseling • Clinician unfamiliarity may increase chance of medication errors • Sub-optimal treatment choices may be made • Labeling/documentation is often deficient • Storage concerns – Environment – Security Arguments Against Samples • Estimated that only about half reach patients • Ethical concerns with personal use by providers • Only branded expensive drugs are sampled which increases overall cost of care • Inconsistent supplies for indigent patients Survey of Sample Use • • • • 12% of Americans received samples 13% of patients with insurance received samples 10% of the uninsured received samples 72% of sample users were above 200% of the federal poverty level • 82% of sample users had health insurance the entire year while 18% were uninsured at least part of the year Am J Public Health 2008;98:284-9 Sample Use in Pediatrics • 4.9% of children received samples in 2004 • 10% of those receiving a prescription medication received samples • 84% went to patients with insurance the whole year • Over 500,000 children received drugs that were subsequently subject of serious safety concerns Pediatrics 2008;122:736-42 Samples Influence on Prescribing • Randomized 29 Internal Medicine residents to a no sample and sample group • No sample group was: – Less likely to use an advertised brand drug – Trend towards less expensive drugs Am J Med 2005;118:881-4 Samples Influence on Prescribing • Studied 32 family medicine resident and faculty physicians prescribing for hypertension before and after a ban on samples • Prescribing of first-line agents increased from 38% to 61% • Impact was greatest on residents Fam Med 2002;34:729-31 Other Research on Sample Use • In a physician survey of the effect of sample availability on prescribing, it was concluded that sample availability influences choice of drug and can lead to suboptimal drug selection (J Gen Int Med 2000;15:478-83) • Samples are frequently used by clinicians or their family members; and by office staff: in one clinic the retail cost of samples taken was $10,000 (JAMA 1997;278:141-3) Sample Impact on Cost and Continuation • Patient out-of-pocket costs increased 47% (p<0.001) • Total Rx costs increased 38% (p< 0.0001) • The odds of continuing the same medication was dramatically lower after receipt of a sample than a prescription: OR, 0.22 (CI 0.08 – 0.65) Medical Care 2008;46:394-402 Conclusions on Drug Samples • Samples are a major marketing tool – Reps gain access • Sample use can lead to higher costs for both patients and the health care system • Sample use may compromise the quality of prescribing • Samples are less likely to go to the uninsured Prescription Drug Marketing Act (PDMA) • Due to abuse, sample regulations were implemented in 1987 (PDMA) • Applies to manufacturers • Manufacturers must keep records of sample distribution • Requires signed requests by prescribers • Requires appropriate storage conditions JCAHO Sample Requirements • • • • • • • Applies to hospitals and health-systems Same standards as non-sample medications Written policies and procedures Proper, secure storage, regular inspections Labeled and dispensed like other meds Documentation same as other orders An effective recall mechanism Strategies to Improve Sample Use • Apply JCAHO requirements • Develop sample formulary – Consider use of generic samples • Clinics can ban samples – No Free Lunch has developed a patient education leaflet entitled “Why we don’t have free samples” – It is available for download free of charge at www.nofreelunch.org – Helps to support clinics that choose not to accept samples Direct to Consumer (DTC) Advertising • Advertising directly targeting consumers • In 1997, the FDA relaxed regulations • Eliminated requirement to list all side-effects – Allowed referral to another source of information such as a toll free number or website • The US and New Zealand are the only developed countries to allow DTC advertising for Rx drugs Trends in DTC Advertising 5 4.5 4 3.5 3 2.5 2 1.5 1 0.5 0 $ Billions 1996 1998 2000 2002 2004 2006 Type of DTC Advertising • Print Advertising – Magazines – Newspapers • Television • Radio • Internet Direct-to-Consumer Expenditures Nexium (AstraZeneca) $224 Million (2005) Lunesta (Sepracor) $214 Million (2005) Vytorin (Merck/SP) $155 Million (2005) Coke Classic $146 Million (2004)* Source: Donohue JM. NEJM. 2007;357:673-81; *WSJ Oct 7, 2005; **WSJ Apr 16, 2004 Bud Light $136 Million (2003)** PhRMA Position on DTC Ads • Serves to improve public health – Prompts people to seek care – Promotes informed discussions – Provides useful information to consumers • Improves compliance • Physicians are in control, thus it won’t lead to inappropriate prescribing Public Citizen Position on DTC • Promotion not education • Ads increase demand for newer more expensive products, thus increase costs • Physician gate-keepers susceptible to marketing • Can stimulate inappropriate use • Can harm doctor-patient relationship • FDA is grossly understaffed to regulate www.publiccitizen.org Systematic Review of DTCA • Patients who request a drug are 16x more likely to get it • DTCA campaigns significantly increase trend of Rx volume of targeted drugs • DTCA campaigns can increase new diagnoses • Concern about risks of treating minor conditions • To date no studies of patient satisfaction or health outcomes Qual Saf Health Care 2005;14:246-50 Kaiser Family Foundation Study • 30% of adults have talked to their doctor as a result of seeing a drug ad • 44% of these individuals were prescribed the drug they asked about • Showed TV ads for Nexium, Lipitor and Singulair Kaiser Family Foundation November, 2001 Kaiser DTC Study Results • Ads prompt patients to talk with their provider • Those with greatest health needs most likely to take action – 25% without condition would discus further • Educational ability is mixed – Patients can identify condition, drug name, and need to see doctor; but most felt they knew little or nothing more about the condition or drug – Many subjects could not recall side effects or where to get additional information Kaiser Family Foundation November, 2001 Clinician Response to DTCA Based Medication Requests • Survey of PCPs comparing clinician responses to a request for more information based on DTC ad vs. a reference book • Requests based on DTC adds: – Were more likely to become annoyed – Less likely to answer questions – Less likely to provide written information Arch Intern Med 2003;163:1808-12 Survey Respondents Response to a Hypothetical Denied Request • • • • 46% thought they would be disappointed 25% would try to change prescribers mind 24% might try a different doctor 15% thought they would switch to a new doctor Health Affairs 2000;19(2):110-128 Influence of Patient Requests on Antidepressant Prescribing • 298 physician visits by standardized pts • Patients presented with symptoms of two conditions: major depression, adjustment disorder • Divided into three groups – Asked about Paxil – Asked about antidepressants in general – No mention of drug therapy JAMA 2005;293:1995-2002 Influence of Patient Requests on Antidepressant Prescribing • Major Depression – Asked about Paxil – Asked about antidep. – No med inquiry %Rx % Rx Paxil 53% 76% 31% 52% 3% 13% 55% 19% 5% 67% 26% 0% • Adjustment Disorder – Asked about Paxil – Asked about antidep – No med inquiry JAMA 2005;293:1995-2002 DTC Model • Advertising increases awareness of condition and treatment • Awareness motivates patients to seek care or treatment • Requests lead to increased prescribing • DTC essentially adds patients to the manufacturers sales force Common Patient Misperceptions • Many think DTC ads are reviewed and approved by the FDA before an add is released • Some patients think DTC advertised drugs are completely safe and only highly effective agents are advertised DTC Advertising Conclusions • DTCA works to increase sales • There is a substantial return on investment for manufacturers • While DTCA can increase the rate of treatment, research shows there is potential for increases in both appropriate and inappropriate treatment • Policies are needed to mitigate risks of DTCA in the US Common Techniques Used in Ads • • • • • Drug touted as unique, new or first Appeal to authority Bandwagon appeal Appeal to celebrity Appeal to fear Slide Courtesy of NoFreeLunch.org Disease Mongering • Strategies to expand markets • Promotional campaigns change the way people think about common ailments – Menopause becomes hormone deficiency – Shyness becomes social anxiety disorder – Acid indigestion becomes gastroesophageal reflux disease • Lowering thresholds for treating common conditions • The US has 5% of the worlds population yet accounts for 50% of drug consumption • For an entertaining video that provides a hypothetical example, go to www.youtube.com and search for motivational deficiency disorder. Click on a new epidemic. Selling Sickness by Moynihan and Cassels Regulation of Marketing • FDA responsible for oversight, not Federal Trade Commission (FTC) • Research suggests journal ads often do not meet all FDA requirements • FDA does not have adequate staff • FDA’s power is limited • Impossible to regulate what reps say Industry Sponsored CE Programs • Industry invests heavily in educational programs as part of their overall marketing plan • $2.4 billon spent on CME in 2006 – 712,163 hours of education – 61% supported by commercial sources • It may be very difficult to critically evaluate information provided Assessing Bias in Commercially Supported CME • • • • Disclosure: Required whether COI present or not Branding Ideally should present levels of evidence Favorable presentation of data, especially using low level evidence • Watch out for verbiage suggesting weak evidence: “its possible”, “may be”, “in my experience” • Unapproved use of products – Off-label drug use must be clearly identified Questions to Ask • Why am I attending? • Are there better sources of information? • Will I be able to critically evaluate this information? Conclusions • The primary mission of a pharmaceutical company is to generate profit and increase shareholder value • Effective marketing helps companies achieve their mission • Enormous amounts are expended in the marketing of prescription drugs, primarily for detailing, samples and DTCA • Industry marketing is sophisticated, influential and impacts health professionals decision making Conclusions • Industry marketing can lead to sub-optimal prescribing • Current marketing practices are controversial and opinions vary depending on ones perspective • Clinicians can make choices to avoid undue influence • Using unbiased and evidence-based sources of drug information and avoiding commercial sources as much as possible is an important step • Consider signing up for the AMA opt-out program to prevent detailers from using your individual prescribing data at www.ama-assn.org/go/prescribingdata Thank you This work was made possible by a grant from the state Attorney General Consumer and Prescriber Education Program which is funded by the multi-state settlement of consumer fraud claims regarding the marketing of the prescription drug Neurontin. CME Instructions • Please complete the survey, quiz and program evaluation questions. • Click the finish button. • Fill out the form and send (email/fax/mail) in to the address supplied to receive CME. PROPERTIES On passing, 'Finish' button: On failing, 'Finish' button: Allow user to leave quiz: User may view slides after quiz: User may attempt quiz: Goes to URL Goes to Next Slide After user has completed quiz At any time Unlimited times