Auctions

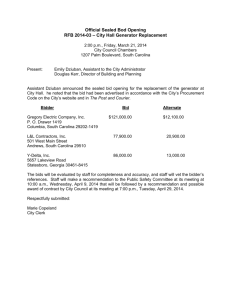

advertisement

Bidding Strategy and Auction Design Josh Ruffin, Dennis Langer, Kevin Hyland and Emmet Ferriter Auctions Auctions entail the transfer of a particular object from a seller to a buyer for a certain price. It is a useful way to sell commodities of undetermined quality. Auctions can be used for single items such as a work of art and for multiple units of a homogeneous item such as gold or Treasury securities. It is the purest of markets: a seller wishes to obtain as much money as possible, and a buyer wants to pay as little as necessary. Why do we care? Auctions are a multi-billion dollar business The US Treasury uses auctions to determine mortgage rates The FCC uses competitive bidding to allocate licenses for broadcasting on the electromagnetic spectrum Stores such as Filene’s Basement use a pricing strategy that reduces the price on items remaining on the racks for longer than a certain time Auction Formats First Price Auction – The individual who submits the highest bid wins the auction, and pays that submitted highest bid; can be applied to any type of auction Second Price Auctions – The individual who submits the highest bid wins the auction, and pays the amount submitted by the second highest bidder; can be applied to any type of auction Sealed Bid Auctions – Bids are submitted privately and each bid is evaluated simultaneously; the highest bidder becomes the winner; can be applied to any type of auction Open-outcry Auctions – Bids are submitted openly and publicly for rival bidders to evaluate; the highest bidder becomes the winner; can be applied to any type of auction English Auction – The auctioneer announces a low price and invites ascending bids until no one is willing to go above the last bid made; the last bidder wins Dutch Auction – The auctioneer announces a high price and then announces successively lower bids; the bidder who calls a halt to such announcements first wins the auction Common-value Auctions – The value of the object is the same for all bidders; each bidder’s estimated valuation vary slightly; also known as “Objective-value” Private-value Auctions – Each bidder places his/her own and unique valuation to the good; for example, valuations can be influenced by sentimental issues and/or imprecise monetary estimates; also known as “Subjective-value” Winner’s Curse – When the winner, and highest bidder, are forced to bid and pay a higher price for the good than its true value (to win) Risk-averse Bidders – A bidder is more concerned about the losses caused by underbidding than the costs associated with bidding at or close to their true valuations; risk-averse bidders want to win without ever overbidding Which format is the best? The answer depends upon many variables. 1.Seller’s perspective: - tries to reach the highest selling price - decrease incentives to cheat -affiancy (for perisible items) Winner’s Curse Vickrey’s Truth Serum In open outcry auctions, the winning bidder essentially pays the valuation of the second highest bidder, since the winner will not bid more than the minimum on the final bid. In sealed envelope auctions, the winner pays his bid, regardless of the distance between it and the second highest bid. As a result, a strategic bidder shades his bid lower than his true valuation in order to retain some profit. William Vickrey devised a method to ensure that bidders would bid their true valuation: the highest bidder wins, but only pays the second highest bid. So, the second-price sealed-bid auction is called “Vickrey’s Truth Serum.” The Seller’s Choice Before showing why the second-price auction works, we will consider the position of the seller. It’s clear that, by selling the item for the second highest price, the seller is making less profit. In essence, he is buying information (the true valuation of each bidder). However, in the first-price auction, the seller is also making less profit when the bidders shade their bids. The seller must decide which form of auction will reduce his profit less. Vickrey’s Claim For any sealed-bid auction, the bidder has three strategies: A) bid their true valuation B) bid under their valuation C) bid over their valuation For a first-price sealed-bid auction, the best strategy is for the bidder to bid under his valuation. Vickrey says that in the second-price auction, the best strategy for every bidder is to bid their true valuation. Why Vickrey’s Claim is True Consider a second-price sealed-bid private-value auction for some item, and let v = your true valuation of the item b = your bid r = the highest bid besides yours All bids less than r are irrelevant, since they have no effect on whether you win or lose. Now, we must consider two cases: a) where b < v b) where b > v Shading Up Suppose you bid higher than your true valuation (b > v) Then if I) (r < v) i.e., the next highest bid is less than your valuation, so you win the item and turn a profit. However, if you had bid (b = v), you would’ve still won, and would’ve turned the same profit. Shading Up Else if II) (v < r < b) i.e., the next highest bid is between your valuation and your bid, then you win the item, but you must purchase it for more than your valuation. So, you should’ve bid (b = v); although you would’ve lost the item, you wouldn’t have sustained a loss. Shading Up Else if III) (b < r) i.e., you do not have the highest bid. If you had bid (b = v), you still would’ve lost. 1st Summary In cases I and III, bidding (b > v) has the same result as bidding (b = v). In case II, bidding (b > v) is worse than bidding (b = v). So, there is no reason to bid (b > v) instead of (b = v) since 1/3 of the time, the result is worse, and 2/3 of the time, the result is equal. Shading Down Suppose you bid lower than your true valuation (b < v) Then if I) (r < b) i.e., the next highest bid is less than your bid, so you win the item and turn the profit. However, if you had bid (b = v), you would’ve still won, and would’ve turned the same profit. Shading Down Else if II) (b < r < v) i.e., you do not have the highest bid, which is less than your valuation. So, you should’ve bid (b = v); you would’ve won the item and turned a profit. Shading Down Else if III) (v < r) i.e., you do not have the highest bid, which is above your valuation. If you had bid (b = v), you would’ve still lost. 2nd Summary In cases I and III, bidding (b < v) has the same result as bidding (b = v). In case II, bidding (b < v) is worse than bidding (b = v). Again, there is no reason to bid (b < v) instead of (b = v) since 1/3 of the time, the result is worse, and 2/3 of the time, the result is equal. Overview So, we have shown that bidding your true valuation is better than both bidding under your valuation and bidding over your valuation. Therefore, it is clear that, in a secondprice auction, the best strategy for each bidder is to bid their true valuation. So Vickrey’s Truth Serum works Jack v. Jill Let’s consider a specific example. Suppose Jack and Jill are bidding on a painting. Assume the following: a) Jill values the painting at $100. b) Jill considers it equal possible that Jack could value the painting at $100 or at $80. c) In the event that Jack and Jill make the same bid, the winner is decided by a coin toss. d) Jack and Jill can only make bids of $100 and $80. So, this example is more limited than the last. Jill’s Point of View Jill know that she values the painting at $100. She considers the following possibilities: a) Jack values the painting at $80 with probability ½. In this case, she wins the painting with probability 1. b) Jack values the painting at $100 with probability ½ also. In this case, she wins the painting with probability of ½, according to a coin toss. So she calculates her odds at winning at: ( 1 )( ½ ) + ( ½ )( ½ ) = ( ¾ ). Jill’s Payoff So, Jill’s expected gain is ( ¾ )(100) + ( ¼ )(0) = 75. However, this equation ignores the fact that Jill must pay the seller. Since this is a secondprice auction, she pays $80 with probability ½ and she pays $100 with probability ( ½ )( ½ ) = ( ¼ ). So, Jill’s net gain is ( ¾ )(100) – (80)( ½ ) – (100)( ¼ ) = 10. Can Jill Increase Her Payoff? Can Jill increase her payoff by bidding $80? To answer this, Jill must consider two payoff matrices: a) if Jack values the painting at $100 b) if Jack values the painting at $80. If Jack’s Value is $100 If Jack values the painting at $100, Jill considers this matrix: 100 80 100 (0, 0) (20, 0) 80 (0, 20) (10, 0) So, a strategy of bidding $100 is dominant for Jill. If Jack’s Value is $80 If Jack values the painting at $80, Jill considers this matrix: 100 80 100 (0, 10) (20, 0) 80 (0, 0) (10, 0) So, again, a strategy of bidding $100 is dominant for Jill. Overview So, again we can see from this specific, yet more limited example that truthful bidding is the dominant strategy is the second-price auction. Again, Vickrey’s Truth Serum proves to be effective.