File - TUNGMUN 2015

advertisement

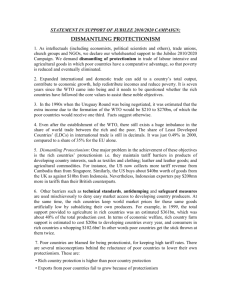

TungMUN 2015: ECOSOC Forum: United Nations Economic and Social Council (ECOSOC) Issue: (302) Measures to Prevent the Growth of Trade Protectionism in Light of Maintaining Open Trade ________________________________________________________________________ Introduction Free trade is a common method for nations and nations to cooperate and skyrocket their profits. After the approval of implementation of the economic contracts and the agreements among countries, new markets are established for the companies, international businesses, and corporations. However, the introduction of the contracts might lead to the competition among the international businesses and local businesses. Those international companies were trying to absorb the elites all over the country; hence, the competition among the regions becomes more intense. Due to the reason that there are overwhelming foreign competition, many countries now face high unemployment rate and competitive foreign markets, which potentially devastate their economies; thus, governments are now forced into pressure to implement trade protectionism*. By imposing income taxes and tariffs* on imported merchandise, the nation is able to boost its economic revenue by increasing the consuming rate of its national products. Yet, the usage of trade protectionism has led the globe into a downward spiral. International trade contributes significantly to a country’s GDP; however, after the concept of trade protectionism is introduced, trading organizations become less effective. Countries begin to set higher trading barriers, resulting inflation*, retaliation*, for instances, squeezing consumption and job losses, and such negative impacts. p.1 2 [鍵入文字] Definition of Key Terms Trade protectionism: Systems used by countries when they think their industries are being damaged by unfair competition from foreign industries. It's a defensive measure, and is usually politically motivated. It can often work, in the short run. However, in the long run it usually does the opposite of its intentions. It can make the country, and the industries it is trying to protect, less competitive on the global marketplace. Income tax: Tax levied by government directly on income, especially an annual tax on personal income. Tariffs: A tax or duty to be paid on a particular class of imports / exports. Inflation: A general increase in prices and fall in the purchasing value of money. Retaliation: Negative aftermaths/drawbacks Import Quotas: To reduce the quantity and therefore increase the market price of imported goods. The economic effects of an import quota is similar to that of a tariff, except that the tax revenue gain from a tariff will instead be distributed to those who receive import licenses. Economists often suggest that import licenses be auctioned to the highest bidder, or that import quotas be replaced by an equivalent tariff Direct Subsidies / Indirect Subsidies: Government subsidies (in the form of lump-sum payments or cheap loans) are sometimes given to local firms that cannot compete well against imports. These subsidies are purported to "protect" local jobs, and to help local firms adjust to the world markets. Governments to increase exports often use export subsidies. Export subsidies have the opposite effect of export tariffs because exporters get payment, which is a percentage or proportion of the value of exported. Export subsidies increase the amount of trade, and in a country with floating exchange rates; have effects similar to import subsidies. 2 TungMUN 2015: ECOSOC Countries Involved United States of America and People’s Republic of China: United States and People’s Republic of China possesses the most profiting trading relationships, at over USD 550 billion annually. However, both nations endorse policies that mainly targets on domestic industries Russian Federation Russia's protectionist policies, 43.4 percent were targeted bailouts and direct subsidies for local companies, the report said. Tariff measures accounted for 15.5 percent, while anti-dumping, countervailing duty or safeguard provisions constituted almost 10 percent. Other steps included cuts in foreign worker quotas, export subsidies and restrictions, and sanitary measures p.3 4 [鍵入文字] Recommendations from the Dias May delegates be aware that the issue of trade protectionism is going to severely impact your nation’s economy; hence, delegates must be fully prepared to come up with a feasible and workable resolution If fellow delegates don’t know where to start with research, PLEASE begin with: a) Why do countries being with the implementation of trade protectionism? b) How do countries implement the system of trade protectionism? c) Are there differences in trade protectionism? d) What are the effects (both positive and negative) from trade protectionism? e) What countries that have involved with trade protectionism have the most dramatic impact to a specific trading organization, region, or globe? f) How long must trade protectionism be exercised in order to save back a nation’s economy? g) Are there any alternatives? 4