tax effects on valuation - the Home Page for Voyager2.DVC.edu.

advertisement

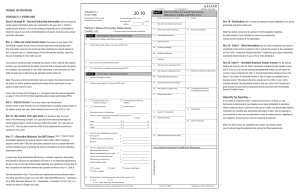

FEDERAL INCOME TAXATION LEARNING OBJECTIVES Incorporate tax considerations into the discounted cash flow analysis. Distinguish between active, passive, and portfolio income. Explain the federal income tax treatment of mortgage financing and depreciation. FEDERAL INCOME TAXATION LEARNING OBJECTIVES Discuss the differential tax treatment of ordinary versus capital gain income and ordinary versus capital assets. Explain the primary methodologies employed to defer, reduce, and/or eliminate tax liabilities. FOUR CLASSES OF REAL PROPERTY Real estate held as a personal residence. Real estate held for sale to others--dealer property. Real estate held for use in a trade or business-- trade or business property. Real estate held as an investment for the production of income - investment property. Types of Taxable Income Active income (e.g., salaries, wages, bonuses, and commissions). Portfolio income (e.g., interest, dividends, and capital gains). Passive income (e.g., rents from real estate, and royalties from oil and gas rights). General Tax Formula for Individuals Item Salaries and Wages + Business Income (Sch. C) +/- Capital Gains and Losses + Interest Income + Dividend Income +/- Rents, Royalties, and Partnerships +/- Adjustments = Adjusted Gross Income (AGI) - Personal Deductions (Itemized or Standard) - Personal Exemptions = Federal Taxable Income PASSIVE ACTIVITY LOSS RESTRICTIONS Passive losses cannot be used to reduce active or portfolio income. (TRA ’86) Passive losses may be used to reduce other passive income. (REITs) Passive losses not used may be used in future years or at the time of sale. Active participants may deduct up to $25,000 in passive losses against other non-passive income, subject to limitations. TAX ON OPERATIONS Item Net Operating Income Symbol (NOI) - Depreciation (DEP) - Interest Expense (INT) = x = Amortized Financing Costs Taxable Income Tax Rate Tax Liability (AFC) (TI) (TR) (TAX) AFTER TAX CASH FLOW FROM OPERATIONS = = Item Net Operating Income Interest Expense Principal Amortization Before-Tax Cash Flow Tax Liability After-Tax Cash Flow Symbol (NOI) (INT) (PA) (BTCF) (TAX) (ATCF) Tax Shelter Partial Tax Shelter: NOI is positive but taxable income of asset reduced due to depreciation and costs of financing Deep Tax Shelter: NOI is negative (tax loss) due to depreciation and costs of financing Tax losses may be used to reduce the taxes due on other passive income ordinary and portfolio income of qualified active participants Interest Expense and Amortized Financing Costs Interest and Prepaid Interest Costs of Financing Financing costs amortized over the term of the loan. Unused balance taken in the year sold. Depreciation Basis The original cost basis includes all costs associated with acquiring the property and transferring the title Land value cannot be depreciated The depreciable basis is the total value that can be depreciated over the recovery period Depreciable Basis = Cost Basis - Land Amount Annual Depreciation Deduction Annual Depreciation = Depreciable Basis / Recovery Period mid-month convention Cost Recovery Period Residential Income Property (27.5 years) Other Commercial Income Property (39 years) Personal Property (3-15 years) Original Cost Basis and Depreciation The original cost basis is affected by depreciation and substantial (capital) improvements Original Cost Basis - Total Annual Depreciation + Total Capital Improvements TAX DUE ON SALE Item Symbol = Net Sale Proceeds (NSP) - Adjusted Basis (AB) = Total Taxable Gain (TG) - Depreciation Recapture (DR) = Capital Gain (CG) Capital Gain Tax + Depreciation Recapture Tax = Tax Due on Sale (CGTAX) (DRTAX) (TDS) AFTER TAX CASH FLOW FROM SALE Item Symbol Gross Sale Price (GSP) - Selling Expenses (SE) = Net Sale Proceeds (NSP) - Remaining Mortgage Balance (RMB) = Before-Tax Equity Reversion (BTER) - Tax Due on Sale = After-Tax Equity Reversion (TDS) (ATER) Net Effects of Annual Depreciation Defers taxes If annual tax incidence transferred from period of operation to period of sale Reduces taxes If capital gains rate less than ordinary tax rate If tax losses can be used to offset passive income If tax losses can be used to offset other income Ordinary versus Capital Gain Income Definition of a Capital Asset Tax Treatment for Capital Assets Tax Treatment for Section 1231 Assets METHODS OF DEFERRING TAXES ON DISPOSITION Installment Sale Like-Kind Exchange TAX FACTORS AFFECTING HOME OWNERS Preferential Tax Treatment of Home Owners Capital gains of $250,000 are excluded from income for individuals ($500,000 for couples filing joint returns) Home owners allowed to deduct mortgage interest and local property taxes.