Optimus AdvantageTM BUSNESS Payment SOLUTIONS

advertisement

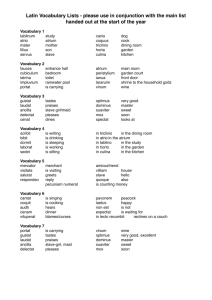

Optimus AdvantageTM Secure Document Management Business Payment Solutions using SAP HANA and AWS Overview • • • The Payment Problem The Payment Solution: Optimus Advantage How Optimus Works Payments Processing and Document Management • What Optimus Does Optimus Business Payment Solutions • Why Optimus is Secure The Secure Cloud-Based Payments Solution Validation by Electronic Signature • • • • • The Optimus Platform The Market Opportunity The Competition The Team The Investment Opportunity 1 The Payment Problem For Business • Midsize businesses still use checks to pay vendors. • Checks are slow, costly to process and invite fraud. • No integration of payments with purchase orders and invoices. • Matching payments and invoices is a slow and labor intensive effort which does not grow business. • Wire transfers and credit cards are cost prohibitive. For Banks • Check processing remains a costly process. • Use of check alternatives means loss of fee revenue. • New electronic payments standards mandated: – Single Euro Payments Area (SEPA), – International ACH (Automated Clearing House) Transactions (IAT). 2 The Payment Problem There is an unmet need for a mid-market payment solution (between $500 and $10,000) that is easy-to-use, highly reliable, secure and able to route payments globally at a reasonable cost. When asked what are businesses’ biggest crossborder payment challenges, a majority of respondents said (in order of priority): 1. The long time it takes funds to clear, 2. Payment reconciliation, 3. Tracking payment processing, and 4. Lack of foreign exchange fee transparency. Cross-Border Payments: Unmet Needs Drive Opportunities for New Payment Solutions by Erin McCune, Glenbrook Partners, April 4, 2011. Optimus will serve this unmet need by targeting small and midsize businesses which engage in international trade. Optimus will target them by licensing the Optimus Business Payment Solution to smaller commercial banks, using established banking relationships as a trusted distribution channel. 3 The Payment Solution: Optimus Advantage The “Transaction Package” Optimus Advantage will create an easily accessible Transaction Package by combining: • low cost direct credit (“push” only) ACH payments and currency conversion, • all electronic files related to the transaction (images, video etc.), and • electronic order and invoice documents converted from any format into digitally signed PDFs in a secure, cloud-based document management center. Creating an electronic Transaction Package will accelerate the processing of purchase orders, invoices and electronic payments while simultaneously matching payments with transaction documents, all in a secure environment. Optimus Advantage will license the solution to banks as a turnkey solution to enable banks to: • retain existing and attract new business customers, • reduce check processing costs as the use of online payments increases, • share in the fee revenue generated by Optimus Business Payment SolutionsTM, • meet newly emerging regulatory requirements, and • offset revenue lost from implementing new regulatory requirements. An added value of the Optimus business model is that it provides businesses with a trusted online community that can be accessed to improve sourcing and to identify new trading partners. 4 How Optimus Works Document Management: Purchase Order Buyer Submits Purchase Order 1. Buyer prepares electronic purchase order in general ledger software or at seller website. 2. Buyer accesses Optimus Advantage website and converts purchase order from its original format into a PDF using Optimus RecordTM. 3. Buyer electronically signs purchase order PDF, using Adobe EchoSign™ to verify authenticity. 4. Purchase order PDF is sent via the Optimus website to seller. 5. Purchase order PDF is stored in Optimus Record DatabaseTM, establishing a new Transaction Package. 5 How Optimus Works Document Management: Invoice Seller Submits Invoice 1. Seller receives purchase order PDF via Optimus portal and prepares invoice in general ledger software program. 2. Seller converts invoice into PDF via Optimus RecordTM. 3. Seller digitally signs invoice PDF using Adobe EchoSign™ to verify authenticity. 4. Invoice PDF is sent to buyer via Optimus. Seller attaches relevant electronic files, such as shipping manifest, voice or video recordings etc. 5. All files become part of the Transaction Package. Buyer is notified. The Invoice is added to the Transaction Package. All files of the Transaction Package are stored in the Optimus Record Database™, using SAP HANA and AWS real time processing services. 6 How Optimus Works Payment Processing and Document Management Buyer Pays Invoice 1. Buyer uses Optimus Record DatabaseTM to review invoice and Transaction Package files. 2. Payment screen is converted to PDF. Buyer may add relevant electronic files to the Transaction Package. 3. Buyer authorizes payment of Invoice using Adobe EchoSign™ electronic signature attached to PDF. 4. Payment is transferred from buyer’s bank to seller’s bank via Optimus Direct CreditTM. Seller is notified. 5. The entire Transaction Package is stored in Optimus Record DatabaseTM and available for review by seller and buyer in the Optimus Record Database supported by SAP HANA and AWS. 7 What Optimus Does Optimus Business Payment Solutions™ Optimus Direct Credit™: Used to make low cost ACH payments between buyer and seller. Optimus Currency Convert™ Used to convert currency for low cost international payments. Optimus EscrowTM: Used by buyer to escrow funds pending shipment in smaller transactions or as an alternative to a letter of credit. Optimus Record™: Combine electronic documents such as purchase orders, invoices and related data files with the payment transaction information. Optimus Digital Signit™: An Adobe EchoSign electronic signature is used to authenticate all transaction parties at each step of communication. Optimus Record DatabaseTM: Transaction Package is created and resides here - all transaction files are accessible in the Optimus Record Database supported by SAP HANA and AWS.. Optimus Source™: Generate sales leads through trade matching among Optimus Directory™ members. Real time trade leads are matched using SAP HANA real time processing. 8 Why Optimus is Secure The Secure Cloud-Based Payments Solution Optimus uses the following security measures to prevent fraud: 1. Integration of existing bank security protocols. 2. Security sign on to Optimus website is controlled by a variety of proprietary security solutions. 3. All communication between customer and server uses SSL. 4. Identity authentication through use of Adobe EchoSign™ solutions. 5. Affixing electronic signatures to documents make them subject to an audit trail, enabling verification and authentication. 6. Encryption of all customer electronic documents prevents fraudulent billing. 7. Only outbound ACH payment can be made by account holder. No ACH debit possible. 9 Why Optimus is Secure Validation of electronic signatures by Adobe EchoSign 10 The Optimus Platform Optimus has engaged Adobe, Ensemble, ACH Federal, Actimize, and Adobe EchoSign in detailed discussions to coordinate and build the Optimus platform, which will integrate the following established technology solutions: Payment Gateway: ACH Federal Electronic Document Management: Adobe LiveCycle Document Management Software Adobe EchoSign electronic signatures Trade Leads: Google Adsense/ Alibaba/Yahoo SAP HANA and AWS: Real time RAM processing and storage. 11 The Competition Ariba – Targets Fortune 500 business. Document management function, but in Ariba proprietary format only. Bill.com – Targets small business by providing their accountants discounted membership and access to client records in return for distribution. Document-payment synchronization limited to Quickbooks, Intacct and Peachtree. No international payments. Earthport – Cost–prohibitive direct payments. Encryption, but no document management solution or tradematching. Intuit – Order/ invoice solution, but no document management, digital signatures or tradematching. PayPal – C2C and C2B payment solution, relies on credit card payments system. payments is the most expensive. No document management solution. 4% charge for international Travelex – No document management, no order/ invoice solution, no digital signatures or tradematching. Optimus will distinguish itself from all of the above with its secure, low cost domestic and international payments, unique document management solution and escrow service. Banks typically charge: $25/$12 for incoming/outgoing wire transfers, $45 for international wire transfers, 1% of contract price for Letters of Credit, and offer no document management solution. Optimus will charge: Optimus Direct CreditTM : $.49 Optimus RecordTM: $2.50 $25.00 flat rate for Optimus Currency ConvertTM, $25.00 flat rate for Optimus EscrowTM, $100 for annual Record DatabaseTM subscription, … and share its fee revenue with the Banks. 12 The Market Opportunity Checks remain the primary method of business payment; they account for 80% of the payments between businesses. Electronic payments have quickly swept the consumer market and are poised to grow on the business side. Electronic payments consist of wire transfers, credit/debit cards and direct credit/debit. The most secure, cost-effective business payment solution stands to gain the greatest share of this market-in-transition as checks are abandoned. At the same time, the United States and European marketplaces annually generate over $32 trillion in shipments. This market has a constant need to find new trading partners and make international B2B payments. 13 The Team CHARLES J. MAGOLSKE – FOUNDING MEMBER • Disciplined executive with over 25 years of creative, innovative leadership in international industry. Track record in business development, acquisitions, operations and sales force management. • Specific experience includes profit and loss responsibility, the management of sales, purchasing, marketing, operations, acquisitions, competitor alliances, licenses, joint ventures, commercial disputes and new product developments. • Especially skilled in recruiting talented people, managing relationships, developing business cases, understanding issues, driving past roadblocks and motivating people to create profitable opportunities in challenging environments. • JD Loyola School of Law, Chicago, IL; MBA University of Virginia; BS magna cum laude California State Polytechnic, Pomona. MICHAEL HARRIS – FOUNDER, PRESIDENT AND CHIEF TECHNOLOGY OFFICER • Founder and President of International Services, a financial services marketing company. • Operated over 15 years with Chase Paymentech and First Data as key accounts. • Software developer with 25 years experience in systems design and implementation. • Proven ability in managing strategic software sales, marketing, and development teams. • Consultant to startup companies at the Technology Innovation Center, an Evanston, IL based business incubator. Created and moderate the www.technologyinnovationcenter.org website. • BS The Ohio State University - College of Engineering, with a minor in Computer Science and postgraduate study in the Department of Computer Science Artificial Intelligence Program. 14 The Team PATRICK VINING – VICE-PRESIDENT BUSINESS DEVELOPMENT AND LEGAL • Extensive experience in guiding financial institutions in compliance, serving as author/editor of a monthly report tracking the latest legal developments. Respected counselor to banks, captive and independent finance companies. • Published in the ABA Business Lawyer, admitted to practice in Illinois and before US District Court for the Northern District of Illinois. • Fluent in German, experience assisting investors in a variety of industries in Germany’s New Federal States following reunification. • JD cum laude with a Minor in Business, Indiana University Maurer School of Law - Bloomington; BA College of the Holy Cross, Worcester, MA. ELIZABETH MCQUERRY – INTERNATIONAL PAYMENTS CONSULTANT • Seasoned professional in cross-border payments; well versed in regulatory policy and analysis. • Extensive experience developing retail cross-border ACH, mobile and debit card solutions and SWIFT. • Prior positions include: AVP for Retail Payments at the Federal Reserve Bank of Atlanta; SVP responsible for international payments with a financial services provider facilitating international payments for global financial institutions. • Regular author on banking and payment issues in publications including Economic Review, EconSouth, and Journal of Interamerican Studies and World Affairs. • Fluent in Spanish and Portuguese. 15 • Education includes: PhD The University of Texas -- College of Liberal Arts. The Investment Opportunity Optimus Advantage LLC Investment: Optimus Advantage LLC is seeking an initial investment to build the Optimus platform. Platform development milestones include: • Customization of LiveCycle Document Management with Ensemble/ Adobe; • Construction of a functioning payment gateway with ACH Federal; • Incorporation of Adobe EchoSign electronic signatures and Actimize; and • Beta testing pilot at several identified banks. Optimus will then approach the VC community to staff before licensing to a wider group of banks and enable Optimus to go fully operational. Optimus Revenue Growth: It is projected that Optimus will generate up to $74 million in revenue at the end of three years of operation and experience exponential growth thereafter. Contact: Michael Harris, Manager Optimus Advantage LLC michael@optimusadvantage.com (847) 905-1000 16