MBA: HEALTH SERVICES MANAGEMENT

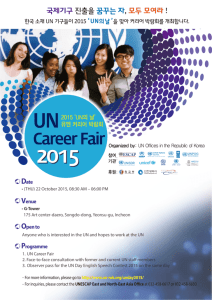

advertisement

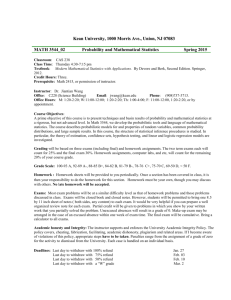

MBA: HEALTH SERVICES MANAGEMENT COURSE SYLLABUS Course title: Instructor: Phone No.: Credit Hours: E-mail: Management Accounting (HSM 606) Professor Mishiel Suwaidan 7211111 (6723) 3 Credit hours msuwaidan@yu.edu.jo Course Description: This course is designed to provide introductory level of instruction to graduate students of health services management who are studying management accounting for the first time. It offers fundamentals of financial accounting and management accounting concepts and techniques that will help individuals prepare for work in an environment where an understanding of management accounting is important to success. In general this course covers two main areas: accounting principles and managerial accounting. Specific Course Objectives: After completing this course, you should: 1. Understand fundamentals of financial accounting and complete accounting cycle. 2. be able to prepare and analyze financial statements 3. Understand fundamentals of management accounting. 4. Be able to use management accounting tools to solve common business management problems and understand the impact of decisions of both internal and external financial statements. Assessment: First Exam Second Exam Assignments Final Exam Total 25 points 25 points 10 points 40 points ------------100 points Course Materials: Weekly schedule lists chapters that will be covered from each of the following text books: 1. Weygandt, Kieso, and Kimmel, Accounting principles, 10th edition, Wiley & Sons, Inc., 2012. 2. Weygandt, Kimmel and Kieso, Managerial Accounting, 6th edition, Wiley & Sons, Inc., 2012. 3. Garrison, Noreen, & Brewer, Managerial Accounting, 12th edition, McGraw-Hill Irwin, 2008 4. David W. Young, Management Accounting in Health care Organizations, Jossey-Bass, Sept. 2003. Textbook web page: On line tutors and quizzes are available at the Garrison & Noreen Managerial Accounting 12th edition textbook website: http://www.mhhe.com/garrison 10e Additional Information: - Teaching Methods: Lectures, cases, project. - Examinations: Student will be examined in theory and its application. Exam questions may consist of multiple choices, short and long problems. You are responsible for all material covered in the text, readings, homework, or lectures. No make-up exams will be given. Grade related to excused absences at mid term exam will be added to the final exam. A student must submit in writing to the instructor concerned the reasons for the absence no later than three days as of the resumption of attendance. Unexcused absences result in grade of zero for that particular exam. Class Schedule Month February March April May Date Day Chapter 7 Thu. Accounting principles 14 Thu. Accounting principles 21 Thu. Accounting principles 28 Thu. Accounting Principles 7 Thu. First Exam 14 Thu. 21 Thu. Managerial Accounting Ch.1 & Ch. 2 Managerial accounting, Cost Terms, Concepts, and Classifications Ch.5 Cost-volume-Profit Analysis 28 Thu. 4 Thu. Ch. 6 Cost-Volume- Profit Analysis: Additional Issues Ch. 7 Incremental Analysis 11 Thu. Ch. 8 Pricing 18 Thu. Ch. 9 Budgetary Planning 25 Thu. Ch. 12 Planning for Capital Investment 2 Thu. 9 Thu. Second Exam Ch. 13 Statement of Cash Flows Ch.16 Financial Statement analysis 16 Thu. Final Exam