option

advertisement

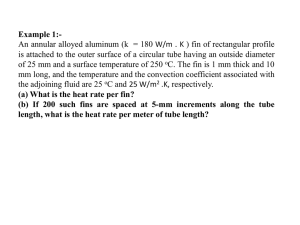

Introduction to options Some basic concepts FIN 819: lecture 6 Today’s plan Briefly review the case discussed last week. Review what we have learned so far Introduction of options • Definition of options • Position diagrams • No arbitrage argument • Put-call parity • Application of put-call parity • How does stock return volatility affect option values? FIN 819: lecture 6 What have we learned so far? So far we have discussed or reviewed some fundamental concepts and ideas about valuation • Present value concept • Discounted cash flow approach and the NPV rule • Free-cash flow calculation • Cost of capital (WACC) • CAPM • Levered and unlevered betas • Two cases related to these concepts FIN 819: lecture 7 Introduction to options What is an option in Finance? An option is a right or opportunity to do something at a specified price or cost on or before some specified date. An option, is a contract Options are everywhere. • • IBM offers its CEO a bonus that is related to the stock price (stock options) IBM postpones investment in a positive-NPV project, even if IBM has capital for taking this investment. FIN 819: lecture 7 Options Financial options Real options It depends on what is the underlying asset the option is written in FIN 819: lecture 7 Options in financial assets What is an option written in financial assets? A financial option is a right to sell or buy some financial asset at a specified price or cost on or before some specified date. • (ex: option written on IBM or Dell) A financial option can be regarded as a contract between sellers and buyers The financial asset specified in the financial option contract is often called the underlying financial asset. FIN 819: lecture 7 Real Options Real options • Options that are written on real assets are called real options • For example, the option to set up a factory is called a real option In the next two lectures, we focus on financial options, since it is easier to price them. FIN 819: lecture 7 Now we focus on (financial) options… Suppose the financial asset is common stock or stock There are two basic types of options, • Call option • the right to buy a share of stock at a specified price before or on some date. • Put option • the right to sell a share of stock at a specified price before or on some date. FIN 819: lecture 7 Strike Price, Expiration Date The specified price is called the strike price or exercise price. (the price you would like to buy/sell the underlying stock) The specified date is called the maturity date or expiration date. (the date by which you want to buy/sell the stock) FIN 819: lecture 7 Exercising an Option An option is exercised when the buyer of the option decides to buy or sell the stock at the specified price, at which time the seller must sell or buy the stock at the specified price Oh yes, according to expiration terms FIN 819: lecture 7 American vs. European Option Call options • • • Buy the stock on the specified date American call option • Buy the stock on or before the specified date Put options • • European call option European put option • Sell the stock on the specified date American put option • Sell the stock on or before the specified date Key Difference? • • European (1 date), American (many dates up until expiration date) FIN 819: lecture 7 Option Obligations Options are rights (to the buyer), and are obligations (to the seller) This means that: • • the buyer of an option may or may not exercise the option. However, the seller of the option must sell or buy the underlying assets if the buyer decides to exercise the option. Call option Put option Buyer Right to buy asset Right to sell asset Seller Obligation to sell asset Obligation to buy asset FIN 819: lecture 7 Payoff or cash flows from options at expiration date The payoff of a call option with a strike price K at the expiration date T is max( S (T ) K ,0) • Where S(T) is the stock price at time T The payoff of a put option with a strike price K at the expiration date T is max( K S (T ),0) • Where S(T) is the stock price at time T FIN 819: lecture 7 Example on payoffs Suppose that you have bought one European put and a European call on stock ABC with the same strike price of $55. The payoffs of your options certainly depend on the price of ABC on expiration Stock Price $30 40 50 60 70 80 Call 0 0 0 5 15 25 Put 25 15 5 0 0 0 FIN 819: lecture 7 Option payoff at expiration Call option $ payoff Call option value (graphic) given a $55 exercise price. $20 55 Share Price FIN 819: lecture 7 75 Option payoff Put option value Put option value (graphic) given a $55 exercise price. $5 50 55 Share Price FIN 819: lecture 7 Option payoff Call option $ payoff Call option payoff (to seller) given a $55 exercise price. 55 Share Price FIN 819: lecture 7 Option payoff Put option $ payoff Put option payoff (to seller) given a $55 exercise price. 55 Share Price FIN 819: lecture 7 Some examples Please draw position diagrams for the following investment: • Buy a call and put with the same strike price • • and maturity (straddle) Buy two calls with different strike prices (K1 and K2) and sell two calls with a strike price that equals the average strike price of the two calls you bought. (butterfly) Buy a stock and a put (protective put) FIN 819: lecture 7 Option payoff Position Value Straddle - Long call and long put Straddle Share Price FIN 819: lecture 7 Option Value Position Value Butterfly K1 Share Price FIN 819: lecture 7 K2 Option payoff Position Value Protective Put - Long stock and long put Protective Put Share Price FIN 819: lecture 7 Form your desired portfolios Suppose you have access to risk-free securities, stocks, calls and puts. Can you form a portfolio now to have the following payoffs at time T? Position Value K K K1 FIN 819: lecture 7 Share Price No arbitrage concept or one price rule If two securities have the exactly the same payoff or cash flows in every state of future, these two securities should have the same price; otherwise there is an arbitrage opportunity or money making opportunity. FIN 819: lecture 7 Example Two treasury bonds A and B both have the maturity of 10 years and coupon rate of 6%. Certainly, they should have the same price; otherwise suppose that A is more expensive than B. You can make money by buying B and short selling A. You can make money PA-PB. Do you like this beautiful idea? FIN 819: lecture 7 Put-Call Parity Let P(K,T) and C(K,T) be the prices of a European put and a call with strike prices of K and maturity of T. Then we have C( K , T ) S0 P( K , T ) KR C( K , T ) KRf T S0 P( K , T ) Where R f 1 r f FIN 819: lecture 7 T f or Let’s show put-call parity We can first use position diagrams to show put-call parity We can also simply use the payoffs in the future to show put-call parity This exercise is a good way of getting used to the ideas of the single price rule or no arbitrage argument. FIN 819: lecture 7 Position diagram Position Value Payoff of investing PV(K) in risk-free security and buying a call K Share Price FIN 819: lecture 7 Position diagram Position Value Payoff of long stock and long put K Share Price FIN 819: lecture 7 The conclusion Since both portfolios in the previous two slides give you exactly the same payoff, they must have the same price. That is, C( K , T ) KRf T S0 P( K , T ) FIN 819: lecture 7 Another way of showing put-call parity Consider the following portfolio: • Buy the stock • Buy a European put option • Borrow the present value of the strike price KR f T • Where Rf= 1+ rf The cost of this portfolio is The payoff of this portfolio • If ST >= K, the payoff is ST-K • If ST < K, the payoff is 0. FIN 819: lecture 7 S0 P KRf T Portfolio (continues) Position Stock Borrowing Put Total Final payoff of the portfolio Portfolio S0 KR f T P S 0 P KR f T ST<K ST ST>K -K -K K - ST 0 FIN 819: lecture 7 ST 0 ST - K The conclusion Since the portfolio and a call option have exactly the same payoff, their prices should be the same. That is, C( K , T ) S0 P( K , T ) KR FIN 819: lecture 7 T f Applications of option concepts and put-call parity One important application of option concepts and put-call parity is the valuation of corporate bonds. For example, suppose that a firm has issued $K million zero-coupon bonds maturing at time T. Let the market value of the firm asset at time t be V(t). FIN 819: lecture 7 Applications of option concepts and put-call parity (continue) Position Value Payoff of equity K Market value of asset FIN 819: lecture 7 Applications of option concepts and put-call parity (continue) So based on the position payoff diagram in the previous slide, we can see that the value of equity is just the value of a call option with strike price K. Then bond value =Asset value –equity value (value of call: C(K,T) Using the put-call parity, we have Bond value=PV(K)- P(K,T) (value of put ) FIN 819: lecture 7 Applications of option concepts and put-call parity (continue) Who will bear the default cost: equity holders or debt holders? The value of risky corporate bonds is equal to the value of the safe corporate bonds minus the cost of default. When will the firm default? • At time T, if the value of asset is less than K, the firm will default. P(K,T) is the cost of this default to bond holders. FIN 819: lecture 7 The value of option Since an option is a right to buy or sell securities, its price is non-negative. If the option price is negative, what will happen? If the option value must be non-negative, can you use what you have learned to value a call option or put option by considering the following two things • • Expected cash flows The risk of options FIN 819: lecture 7 Volatility and option value For options, the larger the volatility of the underlying asset, the larger the value of the option For stocks, the larger the volatility of the underlying asset, the smaller the value of stocks Why ? FIN 819: lecture 7