Israel's Economic Overview 2005 (power point presentation)

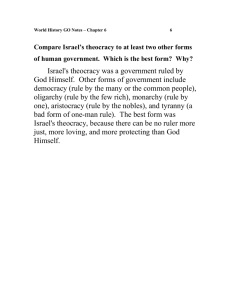

advertisement

Israel’s Economy – Main Characteristics Export Oriented Growth Rapid Development of Technology & High-Tech Industries Entrepreneurial Culture Supportive Environment for Business Investment & R&D Incentives Contents: Facts & Figures Foreign Trade Industry Doing Business in Israel Benefits & Investments Facts & Figures Facts & Figures Main Economic Indicators Criteria 2001 2002 2003 2004 GDP (current prices in B$) 113.6 104.2 110.4 117.6 GDP Real Growth rate (%) -0.9% -0.7% 1.3% 4.3% 17.6 15.9 16.5 17.3 -3.2% -2.7% -0.5% 2.5% Exports of Goods & Services (B$) 35.0 37.0 38.4 50.5 Imports of Goods & Services (B$) 42.7 45.6 44.3 57.7 Unemployment Rate (%) 9.3% 10.3% 10.7% 10.4% Inflation Rate ( CPI, end of year) 1.4% 6.5% -1.9% 1.2% Current Account (% of GDP) -1.7% -1.5% 0.5% 0.4% GDP per Capita (current prices, 000’$) GDP per Capita Growth rate (%) Source: Central Bureau of Statistics, Bank of Israel Facts & Figures Main Economic Indicators and Forecast Criteria 2002 2003 2004 2005F GDP (current prices in B$) 104.2 110.4 117.6 123.2 GDP Real Growth Rate (%) -0.7% 1.3% 4.3% 5.1% 15.9 16.5 17.3 17.9 -2.7% -0.5% 2.5% 3.2% Exports of Goods & Services (B$) 37.0 38.4 50.5 53.8 Imports of Goods & Services (B$) 45.6 44.3 57.7 60.2 Unemployment Rate (%) 10.3% 10.7% 10.4% 9.1% Inflation Rate ( CPI, end of year) 6.5% -1.9% 1.2% 2.8% GDP per Capita (current prices, 000’$) GDP per Capita Growth Rate (%) Source: Central Bureau of Statistics, Bank of Israel, Forecast: Ministry of Finance June 2005 Facts & Figures GDP and GDP per Capita (Annual % Change, in Constant Prices) 8.0 9.0 7.0 4.6 4.3 5.0 3.0 2.6 3.0 1.0 0.5 5.1 2.5 3.2 1.3 0.0 -1.0 -0.7 -0.7 -0.9 -3.0 -3.2 -2.8 -5.0 1998 1999 2000 GDP Source: Central Bureau of Statistics *Estimation 2001 2002 GDP per Capita 2003 2004 2005* Facts & Figures Business Sector GDP Growth (Annual % Change) 12 10.2 10 8 6.1 6.4 6 4 1.7 -2.4 2 -2.6 0 -2 -4 2000 2001 2002 Source: Central Bureau of Statistics, Bank of Israel *Estimation 2003 2004 2005* Facts & Figures Major GDP Components (Annual % Change, in Constant Prices) 23.1 25 20 14.9 15 10 5 7.7 6.2 5.7 2.2 1.7 6.5 5.7 3.5 4.3 2.73.4 1.3 1.1 0 0.3 -2.4 -5 -4.8 -2.0 -4.9 -1.7 -1.9 2003 2004 -7.0 -10 -11.2 -15 2000 2001 2002 Private Consumption Investment in Fixed Assets Source: Central Bureau of Statistics, Bank of Israe l *Estimation 2005* Government Consumption Exports of Goods and Services Facts & Figures Exports of Goods and Services (B$) 50.5 45.6 42.4 39.9 38.3 14.5 11.8 31.1 2000 14.2 12.3 10.9 36.3 30.1 28.1 27.4 2001 2002 Goods Source: Central Bureau of Statistics, Bank of Israel Services 2003 2004 Facts & Figures GDP Growth and Exports Growth (Cumulative Rate of Growth by Period) 188% 200% 150% 120% 115% 100% 100% 63% 62% 50% 54% 54% 34% 30% 0% 1960-1969 1970-1979 GDP Growth Source: Central Bureau of Statistics, Bank of Israel 1980-1989 1990-1999 Exports Growth 1994-2003 Facts & Figures General Government Expenditure 56% 55% 55% 55% (% of GDP) 55% 54% 54% 53% 53% 53% 53% 52% 52% 51% 51% 51% 50% 49% 48% 1995 1996 Source: Ministry of Finance, 2005 1997 1998 1999 2000 2001 2002 2003 2004 Facts & Figures Gross Tax Burden (% of GDP) 41% 40% 40% 40% 40% 40% 40% 39% 39% 39% 39% 39% 38% 38% 37% 1995 1996 Source: Ministry of Finance, 2005 1997 1998 1999 2000 2001 2002 2003 2004 Facts & Figures Budget Deficit (% of GDP) 7% 5.6% 6% 4.4% 5% 3.8% 3.8% 4% 3.0% * 2.6% 3% 2.2% 2.4% 2% 0.7% 1% 0% 1997 1998 1999 2000 2001 2002 Source: Ministry of Finance, 2005 *Forecast, Including the Disengagement Program Expenses 2003 2004 2005* Facts & Figures Current Account (% of GDP) 0.5 1 -1.3 -1.7 0.5 -1.5 -1.7 0 -0.5 -1 -1.5 -2 Source: Bank of Israel 1999 2000 2001 2002 2003 2004 0.4 Facts & Figures Net Foreign Debt (% of GDP) 11.8% 9.9% 15% 3.2% 10% 0.5% -1.8% -5.1% -9.8% 5% 0% -5% -10% 1998 Source: Bank of Israel 1999 2000 2001 2002 2003 2004 Facts & Figures Foreign Direct Investment (B$) High-Tech Bubble Burst 6 5.1 High-Tech Boom 5 4.5* 3.9 3.6 4 3.1 3 1.8 1.7 1.6 2 1.6 1 0 1997 Source: Bank of Israel 1998 *Forecast 1999 2000 2001 2002 2003 2004 2005 Facts & Figures Inflation Rate (% Change in CPI, end of year) 8.6% 7.0% 6.5% 2.8% 1.4% 1.3% 1.2% -1.9% 0.0% 1997 1998 1999 2000 Source: Economist Intelligence Unit , Bank of Israel *Forecast 2001 2002 2003 2004 2005F* Facts & Figures Unemployment Rate by Quarters* (% of Total Labor Force) 11 10.9 10.8 10.9 10.8 10.5 10.6 10.4 10.1 10.2 10 9.8 9.8 9.6 9.4 9.1 9.2 9 2003-Q3 Q4 2004-Q1 Q2 Source: Central Bureau of Statistics, Bank of Israel *Seasonally Adjusted Data Q3 Q4 2005-Q2 Facts & Figures New Employed Persons in 2004 (Change in Israeli Employed Persons, in Thousands) 73.8 33.8 28.5 21.8 15.1 12 -2.4 2001 2002 Business Sector Source: Central Bureau of Statistics, Manufacturers’ Association of Israel -3.2 2003 Public Sector 2004 Facts & Figures Estimated Growth of Main GDP Components 2005 Criteria Central Bureau of Statistics* Real GDP Growth 5.1% Business GDP Growth 6.4% Exports Growth 6.5% Private Consumption Growth 3.5% Government Consumption Growth 4.3% Investment in Fixed Assets Growth 0.3% *Published: September 2005 Facts & Figures Central Bank Interest Rates-Israel vs. USA (%) 10 9 8 Bank of Israel Rate 7 6 5 4 3 Federal Reserve Rate 2 1 0 10 8 6 4 2 2005 12 11 10 9 8 7 6 5 4 3 2 2004 12 11 10 9 8 7 6 5 4 3 2 2003 12 11 10 9 8 7 6 5 4 3 2 2002 Source: Bank of Israel, Federal Reserve Facts & Figures Israel’s Credit Rating 1992-2005 A1/A+ 6 A2/A 5 A3/A- 4 Baa1/BBB+ 3 Baa2/BBB 2 Moody's A2 Stable S&P A- Stable Fitch A- Stable Baa3 /BBB- 1 0 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 Source: Credit Rating Agencies Facts & Figures Growth Competitiveness Index, 2004 Israel Ranks 19 Out of 104 Countries (2003 Rank was 20) 1 7 11 13 15 19 21 27 23 37 46 41 47 48 60 66 o ap d an nl re g in Fi S K y U an m er G a ad an C el g ra n Is Ko g on H in pa S e c an Fr e e c ca re fri G A th ou S na hi C ly Ita o ic ex M d an ol P y e rk Tu Source: World Economic Forum, GCI 2004 Facts & Figures Business Competitiveness Index, 2004 Israel Ranks 21 Out of 103 Countries (2003 Rank was 20) 1 3 6 8 12 13 21 22 24 26 30 34 41 47 52 55 U m er .A .S G y an K U n pa Ja ce an Fr ia al tr us A el ra Is nd la Ire ia ea or K n ai Sp d In ly Ita e ec re G na hi C ey rk Tu o ic ex M Source: World Economic Forum, GCI 2004 Facts & Figures Core Technology-Innovating Economies, 2003 Israel Ranks 4 Out of 103 Countries 1 USA 2 Japan 3 Taiwan 4 Israel 5 Switzerland 6 Sweden 7 Finland 8 Germany 9 Canada Singapore 10 Source: The Global Competitiveness Report 2004-2005 Foreign Trade Foreign trade EXPORTS: The Engine of Israeli Growth In 2004, the Export Sector’s share in the total GDP growth was about 60%, making it the main contributor of GDP growth. Foreign trade Trade of Goods and Services (B$) 51 52 46 47 44 43 40 2000 44 38 2001 2002 Exports Source: Central Bureau of Statistics, Bank of Israel 42 *Estimation Imports 2003 2004 Foreign trade Trade Deficit (B$ and % of Exports) 13.0% 9.0% 3.6 4.5% 4.2 2.2% 2.0 1.0 1.5 2.0% 0.6 2000 2001 2002 Trade Deficit Source: Central Bureau of Statistics, Bank of Israel *Estimation 2003 2004 Trade Deficit as a % of Exports 1.1% 2005* Foreign trade Annual Trade* Growth 21.6% 20.5% 6.7% 4.3% 2.2% 1.3% -0.9% -7.1% -6.1% -0.7% -6.4% -6.5% 2001 2002 Exports Source: Central Bureau of Statistics, Bank of Israel 2003 Imports GDP *Note: Trade of Goods (exc. Diamonds ) 2004 Foreign trade Exports as a % of GDP 45% 45% 43% 38% 40% 35% 36% 35% 31% 30% 25% 1995 2001 2002 2003 2004 2005F* Source: Central Bureau of Statistics, Bank of Israel, Israel Export & International Cooperation Institute, Ministry of Finance *Forecast Foreign trade Exports of Goods by Commodity Group, 2004 (% of Total Exports of Goods) The High-Tech Sector Accounts for 33% of Total Exports of Goods Industrial 69% Agricultural 3% Rough Diamonds 9% Source: Central Bureau of Statistics, Bank of Israel Polished Diamonds 19% Foreign trade The Growth of Industrial Exports (B$) 40 23.7 35 30 19.5 25 2 15.5 20 15 10 5 0 8.6 1.1 2.1 3 2.4 1.8 2.9 1.8 3.6 4.5 6.2 5.1 4 ` 6.8 1993 High-Tech 1998 Medium High-Tech Source: Central Bureau of Statistics, Bank of Israel 9 2003 Medium Low-Tech 11 2004 Low-Tech Foreign trade Exports of Goods by Region 2004 (exc. Diamonds) Rest of the World 13% EU 33% Asia 16% Central & South America 4% Rest of Europe 6% USA 28% Source: Central Bureau of Statistics, Bank of Israel Foreign trade Imports of Goods by Region 2004 (exc. Diamonds) Rest of the World 14% European Union 39.5% Asia 17% South & Central America 2% USA 17% Source: Central Bureau of Statistics, Bank of Israel Rest of Europe 10.5% Foreign trade Israel’s Main Trading Partners, 2004 (inc. Diamonds) 20.2 20 B$ 15 10 7.0 4.5 4.0 5 3.5 3.1 2.7 2.4 2.2 2.1 2.1 0 a ce ia an Fr d In n hi s nd g on la er K Exports of Goods C ly h et Ita N g on d Source: Central Bureau of Statistics, Bank of Israel H K n la er itz Sw U m iu y an m g el SA er G B U Imports of Goods Foreign trade Israel’s Main Trading Partners, 2004 (exc. Diamonds) 12.3 12 10 B$ 8 6 4.4 4 2.8 2.7 2.4 2.1 2.0 2.0 1.8 1.7 1.7 2 1.3 1.2 1.1 0 U SA G er m U K N an y Ita et ly he rla nd s C hi na Ja Fr Tu an pa rk ce ey n Imports of Goods Source: Central Bureau of Statistics, Bank of Israel Sw itz B Sp el ai gi n um er la nd Exports of Goods S. K or ea Ta iw an Foreign trade Growth Rate of Commodity Exports by Selected Countries, 2003-2004 (% of Change) 43 37 33 30 25 25 22 21 21 21 20 20 20 19 19 18 18 17 17 16 16 ly Ita S U ico ex M K rk U a m en D ium g el B ce an ny Fr a m er G nd ds a n el la Ir er h et N n i pa S ld or W tria us n A de e w lia S tra us A ay w or N el ra Is il z ra B a di In ia s us R ey rk Tu Source: Global Trade Information Service (GTIS) Foreign trade Real Growth in Exports of Goods and Services - International Comparison (Annual Average for 1999-2003) 9 8.3 8 8 7.1 7 5.8 6 4.8 4.5 5 4.5 3.6 4 3.6 2.9 3 1.9 1.4 2 1 0 SA ay um gi el w or U N B al ug rt Po ce an Fr e ec re y an k ar n pa Ja G el ra Is m er m en G D d ey rk Tu n la Ire Source: OECD - Organisation for Economic Co-operation and Development Foreign trade Medium High-Tech Export Development 6.2 5.1 0.5 0.5 1.4 1.1 4.3 3.5 2003 Chemicals (exc. Pharmaceutical) Source: Central Bureau of Statistics, Bank of Israel 2004 Machinery & Equip. Transport & Electrical Equip. (B$) Foreign trade Medium Low-Tech Export Development (B$) 4.5 3.6 0.8 0.5 0.5 0.5 0.7 0.5 1 0.8 Rubber & Plastics 1.3 1.5 2003 2004 Metal Products Source: Central Bureau of Statistics, Bank of Israel Mining & Quarrying Jewellery Goldsmith Other Foreign trade Low-Tech Export Development (B$) 2.0 1.8 0.6 0.5 1.1 1.0 0.3 0.3 2003 Food products Source: Central Bureau of Statistics, Bank of Israel 2004 Textiles products Paper products Industry Industry Selected Indicators in Industry, 2001-2004 (Real Annual Change, Yearly Average) 17.6% 8.0% 7.0% 1.1% -2.4% -2.4% -3.1% -9.8% Industrial Output Employees Industrial Export 2001- 2003 Source: Central Bureau of Statistics, Manufacturers’ Association of Israel 2004 Investments Industry Industrial Production and Exports (Real Cumulative Rates of Change) 109.6% 110% 100% 92.5% 83.3% 90% 78.8% 80% 73.2% 70% 60% 46.4% 50% 36.7% 40% 30% 22.4% 22.2% 23.0% 17.0% 20% 7.5% 10% 7.2% 10.3% 11.9% 1997 1998 1999 14.8% 14.4% 2002 2003 5.4% 0% 1996 Industrial Exports Source: Central Bureau of Statistics, Bank of Israel 2000 2001 Industrial Production 2004 Industry Labor Productivity in Industry, 2000-2004 (Real Annual Change) 7.7% 6.0% 2.5% 1.3% 0.0% 2000 2001 2002 Source: Central Bureau of Statistics, Manufacturers’ Association of Israel 2003 2004 Industry A High-Tech Oriented Industry The Israeli Industry is Undergoing Long Term Structural Changes (Industrial Output Distribution 1994, 2004) 100% 90% 31% 23% 80% 70% 60% 43% 50% 43% 40% 30% 20% 34% 26% 10% 0% 1994 High-Tech Source: Central Bureau of Statistics, Manufacturers’ Association of Israel 2004 Mixed-Tech Low-Tech Industry The High-Tech Sectors led Industrial Growth 2004 (Real Annual Change) 15.1% Average 7% 3.4% 2.2% 0.2% High-Tech Mixed High-Tech Source: Central Bureau of Statistics, Manufacturers’ Association of Israel Mixed Low-Tech Low-Tech Industry The High-Tech Sectors Recruited the Largest Number of Persons in Industry in 2004 (Real Annual Change) 4.5% Average 1.1% 0.7% 0.0% -2.1% High-Tech Mixed High-Tech Source: Central Bureau of Statistics, Manufacturers’ Association of Israel Mixed Low-Tech Low-Tech Industry Israel’s Major High-Tech Exports 2004 Total High-Tech Export (Including Software): 14 B$ Software 21% Office and Computing Equipment 7% Electronical Components 12% Aircraft 9% Pharmaceutical Products 11% Equipment for Control and Supervision 20% Source: Israel Export & International Cooperation Institute, Israel Association of Software Houses Electronic Communication Equipment 20% Industry Israeli High-Tech Exports by Geographic Breakdown 2004 South and Centeral America 6% Oceania 1% Other 7% EU 24% Other European Countries 1% North America 35% Source: Israel Export & International Cooperation Institute, Central Bureau of Statistics Asia 26% Industry Expenditure on Civilian R&D in Israel & in Selected OECD Countries (% of GDP, 2002) 4.5 5 4.1 4 3.4 2.8 2.8 3 2.6 2.5 2.3 2 1.8 1.7 2 1.2 1 0 Ita ly n la K d la er ce h et Ir e U N an Fr d s nd SA U y an m er G n la er ea or itz Sw K n pa Ja d an nl Fi en l ae ed Sw r Is Source: Central Bureau of Statistics, Bank of Israel 1.1 Industry Qualified Engineers Index 5.6 5.9 6.0 6.6 6.9 6.9 7.0 ss Ru 8 7 6 6.7 an iw Ta 10 9 7.3 7.5 7.9 7.7 7.6 8.0 8.1 8.5 8.6 8.9 4.1 5 4 3 2 1 0 en ed a di In d an nl Fi el ra Is da na Ca ce an Fr nd la er itz Sw Sw l ia ra nd la st Au I re A US ia y an n ai m er n pa Sp G Ja a ly s I ta nd la er th Ne re Ko UK Source: Institute for Management Development World Competitiveness Yearbook- 2004/5 Industry Technology Index, 2004 Israel Ranks 8 Out of 104 Countries US A iw a Fin n la S w nd ed en Ja De pan Sw nma r itz erl k an d Isr ae Ko l r No ea Sin r way ga p Ge ore rm an y Ca na da Ta 6.2 6.0 5.9 5.8 5.7 5.3 5.3 5.3 5.2 5.2 5.1 5.1 5.1 4.0 Source: World Economic Forum, GCI 2004 4.5 5.0 5.5 6.0 6.5 Industry Israel’s ICT* and Business Sectors Product 2004 (Annual Growth Rate %) 37 40 30 21 20 10 10 10 6 4 2 2 3 0 -2 -3 -7 -10 -13 -20 1998 1999 2000 2001 Business 2002 2003 ICT Source: Central Bureau of Statistics, Bank of Israel *ICT: Information & Communication Technologies 2004 9 Industry Software and Electronic Industries (Israel & the World Growth Rates 1994-2004) 34 35 30 25 20 15 13 12 13 16 15 13 10 11 11 10 7 9 7 7 5 9 1 1 0 -5 -5 -10 -6 -5 -9 -12 -15 20 20 20 04 03 02 01 00 World 20 20 99 98 97 96 95 94 Source: Israel Association of Electronics and Information Industries 19 19 19 19 19 19 Israel Industry Israel’s Software Exports (B$) 3.2 3.0 2.7 2.6 2.7 2000 2001 2.6 2.7 2.0 2.2 1.5 1.7 1.0 1.2 0.6 0.7 0.3 0.2 -0.3 1995 1996 1997 1998 Source: Israel Association of Electronics and Information Industries 1999 2002 2003 2004 Industry Israel: A Major Player in the Global Biotechnology Industry Sales from the Biotech sector generated 1.8 -2.3 US B$ in 2004. Israel's share in global Biotechnology sales is about 2.5%. There are 23 Technological Incubators in Israel, more than 20% of them are Involved in Biotechnology projects. Source: Israel's Ministry of Science Industry Biotechnology 149 150 135 2000 1800 130 1800 1600 110 100 90 1200 63 70 25 600 30 209 10 -10 1000 800 50 30 1400 87 15 1988 250 600 400 336 200 50 0 1990 1993 1995 Anuall Sales (M$) 1997 1999 No. of Companies 2003 Industry Start-Ups – The Emerging Economic Force Israel Enjoys the Highest Concentration of High-Tech Companies Outside of the Silicon Valley Robert Greifeld President & CEO NASDAQ 2004 Industry Investments in High-Tech Companies 2004 Year Total in $B 1999 1.1 2000 3.2 2001 2.0 2002 1.1 2003 1.0 2004 1.5 Source: IVC - Israel Venture Capital Others 13% Internet 4% Communications 29% Semiconductors 10% Life Sciences 22% Software 22% Industry Capital Raised by Israeli VC Funds 4000 (M$) 3711 3500 3000 2500 2000 1548 1323 1500 1000 580 500 1500 92 154 123 135 724 608 299 14 0 -174 -500 * 05 20 04 20 03 20 02 20 01 20 00 20 99 19 98 19 97 19 96 19 95 19 94 19 93 19 92 19 Source: IVC - Israel Venture Capital *Forecast Industry VC Investments in Israel & Europe (M$) 1569 1600 1600 1400 1200 950 1000 811 800 599 600 320 400 200 790 761 131 851 644 457 315 255 135 62 0 l ae K r Is U s nd y an m ce en la er Source: PWC - Price Waterhouse Cooper, May 2003 2002 er G ly an Fr Ita h et n ed Sw N ai Sp 2001 Industry High - Tech Capital Raised by Israeli High-Tech Companies by Sectors (%) 100 14 16 20 18 19 22 37 33 29 15 18 22 4 4 12 11 10 14 15 13 2002 2003 2004 80 29 40 42 60 13 8 40 16 33 30 20 2 9 0 1999 Other 9 4 3 4 9 2000 2001 Semiconductors Source: IVC - Israel Venture Capital Internet Life Sciences 4 Communications Software Industry Israel’s Life Sciences Industry – Sectors 2004 AGbiotech 4% Medical IT 3% Service 1% Other 4% Pharmaceuticals 13% Biotechnology 21% Medical Devices 54% Source: Israel Life Sciences Industry 2004 Industry Israel’s Biotech Companies – Subsectors 2004 Immunology 9% Biomaterials 9% Cell& Tissue Therapy 14% Research Tools 3% Research Equipment 6% Diagnostic Kits 11% Other 4% Industrial 8% Source: Israel Life Sciences Industry 2004 Genetics 15% Drug Discovery 21% Doing Business In Israel Doing Business In Israel Foreign Investment in Israel At the crossroads of three continents – Europe, Africa and Asia – Israel enjoys an excellent reputation as a technologically advanced economy, which has made it a prime destination for investment by multinational corporations Source: World Economist Forum 2004/5 Finla nd (1 ) USA (2) Swe d en( Ger m 3 ) any( 4) Sing ap or e( 5) Taiw a n(6 Swit ) zer la nd( 7 ) Japa n (8) UK(9 Ne th ) erlan d s( De nm 10) ark(1 1) Isra e l(1 Ca na 2 ) da (1 3) Aust ria (1 4) Belg ium( 1 6) Irela n d(2 1) Ch in a (22 ) Kore a ( 24 Ne w ) Zeal and ( 26 ) Thai lan d (31) India (34 ) Doing Business In Israel Cooperation Between the Academy and Industry (1= minimal or nonexistent , 7= intensive and ongoing) 6 5.8 5.4 5.3 5.2 5 4 5.1 5.1 5.0 5.0 5.0 4.9 4.9 4.8 4.7 4.6 4.5 4.2 4.2 4.2 4.0 3.7 3.6 3 2 1 0 Doing Business In Israel Over 20 Israeli Companies are Traded on the London Stock Exchange Israel is ranked 2nd after Canada in the number of foreign companies traded on the American Technology Stock Exchange. Israel is second in the world in the number of companies of a foreign nation traded on Wall Street. Source: http://www.maarivintl.com/ Doing Business In Israel Number of Companies Traded on NASDAQ – Selected Countries 80 73 68 70 60 50 40 30 23 20 19 17 13 10 12 11 10 10 8 8 7 5 4 4 0 ea or K th g ou ur S bo m a xe ic Lu fr A th ou re S po ga s in nd S la d Is an in el irg Ir V h tis ri B ce an Fr ia al tr g us A on K g s on nd H a rl he et N n pa Ja a s ud nd m la er Is B an m ay C K U el ra Is a ad an C Compiled from NASDAQ data Doing Business In Israel Recent M&A Israeli Company Technology Acquirer Sum Time Terayon Communication Systems Inc. Communications Aris $345M 09/2005 Scitex Vision Ltd. Printing HP $230M 08/2005 Sheer Networks Ltd Communications Cisco $122M 07/2005 Siliquent Technologies Inc. Communications Broadcom $84M 07/2005 Life Sciences West Pharmaceutica l Services Inc. $42M 07/2005 Life Sciences McKesson Corp. Life Sciences $105M 06/2005 Internet eBay $620M 06/2005 Medimop Medical Projects Ltd. Medcon Telemedicine Technology Ltd. Shopping.com Doing Business In Israel Recent M&A (cont.) Israeli Company Technology Acquirer Sum Time Impulse Dynamics Healthcare Johnson & Johnson 80M$ 05/2005 Siliquent Semiconductors Fabless Broadcom ~85M$ 05/2005 Tecnomatix Software UGS Corp 228M$ 04/2005 Kagoor Voiceover Internet Juniper Networks 68M$ 03/2005 Savient Biopharmaceutical Ferring Holding SA 80M$ 03/2005 OREX Radiography Medical Equipment Kodak 51M$ 03/2005 Native Networks Communication Alcatel ~50M$ 03/2005 Oplus Technologies Processors for Digital Display Devices Intel 100M$ 03/2005 Modem-Art Semiconductors Fabless Agere Systems 150M$ 02/2005 Doing Business In Israel E-Readiness Score, 2004 8.7 USA Sweden 8.6 Switzerland 8.6 Hong Kong 8.3 Finland 8.3 8.2 Singapore 8.0 Germany 8.0 Canada 7.5 Israel 7.4 Japan 7.1 Taiwan 7.1 Spain Italy Source: World Economic Forum, GCI 2004 7.0 Doing Business In Israel Foreign Companies Invested in Israel (Examples) US • • • • • • • • • • • • • • Microsoft Pratt & Whitney AOL Time Warner Intel IBM Boeing Enterprises Cisco Systems GE Lucent 3Com Hewlett Packard Merrill Lynch Motorola Sun Microsystems Europe • • • • • • • • • • • • Siemens DaimlerChrysler Volvo Cable & Wireless Baan Volkswagen Deutsche Telecom L’Oreal British Telecom Danone Ares Sereno Unilever Asia • • • • • • • • • • • • Samsung Electronics Daewoo Nomura Hutchison Telecomm. LG Group Sony Toyo Ink Hyundai Acer Computers Sumitomo Trading Fuji Honda Doing Business In Israel IMD World Report 2004 (Examples) Country Rank 1st 2nd 3rd 4th Total Expenditure on R&D as Percentage of GDP ISRAEL SWEDEN FINLAND ILE-DE FRANCE Number of Mobile Telephone Subscribers per 1000 Inhabitants ISRAEL LUXEMBURG HONG KONG ITALY Total Public Expenditure on Education as Percentage of GDP DENMARK ISRAEL CANADA MALAYSIA University Education Meets the Needs Economy FINLAND ISRAEL SINGAPORE SWITZERLAND Consumer Price Inflation – Average Annual Rate HONG KONG ISRAEL TAIWAN JAPAN Source:Institute for management development World Competitiveness Yearbook- 2004 Doing Business In Israel Entrepreneurship Index 6.3 6.4 6.6 7.0 7.3 7.6 7.9 5.9 4.9 4.9 5.0 5.3 5.4 4.2 UK Ja pa n Ta Me G Fr Si Ko Ire Au Ca US ng an iw lan r s n xic erm A e ad tra an ce ap a an d o a l or ia y e Source: IMD - Institute for Management Development, World Competitiveness Yearbook- 2004/5 Isr ae l HK Doing Business In Israel Technology Leadership “ Thanks to quality education, Israel is one of the most advanced countries in the world. … Israel is advancing in high-tech even more than other developed countries ” Bill Gates, CEO Microsoft, World Economic Forum, Davos, January 2000 Doing Business In Israel Technology Leadership (cont.) “ Israel’s market is relatively large and sophisticated, it boasts the world’s greatest per capita number of engineers, scientists and doctors. The Israeli economy is simply a reflection of the country’s greatest natural resource which is the brainpower and ingenuity of its citizens Mike Zafirovski ,COO,Motorola 2003 ” Benefits and Investments Benefits and Investments Main Economic Structural Reforms Launched and Planned by the Government Public sector reduction Deep reform of the tax system- in process Government expenditures reduction Privatization policy: energy, transport and communication sector Next Stage: Further steps to reduce the public sector Structural reform of the capital market Structural reform of the education system Further steps in the privatization policy Benefits and Investments Government R&D Incentives The Law for the Encouragement of Industrial R&D supports R&D projects of Israeli Companies by offering conditional grants from 20%-50% of the approved R&D proposal Israel is a participant in the Sixth Framework Program for R&D of the European Union, the only non-European Associated State, fully participating in the program. Source: Ministry of Industry Trade and Labor Benefits and Investments Government R&D Incentives (cont.) The Global Enterprise R&D Cooperation Framework encourages cooperation in industrial R&D between Israel and multi-national companies (MNCs). Source: Ministry of Industry Trade and Labor Benefits and Investments Benefits for Foreign Investors To qualify for these programs the company must be internationally competitive The Law for the Encouragement of Capital Investments offers investors both investment grants and tax benefits Benefits and Investments Benefits for Foreign Investors (cont.) Grants program- Investment Grants of 24% of the approved program in Priority Area A and 10% in Priority Area B + corporate tax benefits for foreign investors at a rate of 10%. Automatic Tax Benefits Programs – offering foreign investors a complete tax exemption when investing in Priority area A for a 10 year period or alternatively a 10% corporate tax rate when not located in a Priority area. Benefits and Investments Benefits for Foreign Investors – Investment Grants (%) (Grants as a percentage of investments in fixed assets included in the Approved Enterprise Plan) Priority Area “A” Priority Area “B” 24% 10% 20% 10% Investment in Hotels 24% 10% Other Tourist Enterprises 15% --- Industrial Projects (Up to 140 Million NIS) Industrial Projects (Above 140 Million NIS) Source: Investment Promotion Center Benefits and Investments Investment in Technologies (M$) New Jersey 502 Georgia 551 584 New York 636 Washington Israel 832 Texas 861 1,804 Massachusetts 7,170 California 1 10 100 1,000 10,000 According to foreign investors, the Silicone Valley, Boston, Texas and Israel are the main centers to search for new high technology investments Q1-Q3 2004 Source: Earnest and Young, October 2004 Benefits and Investments Israel’s Free Trade Agreements USA (1985) EFTA (1992) Turkey (1997) Mexico (1999) Jordan (1995): Bilateral Trade Agreement Canada (1997) European Union – Association Agreement 2000 Romania (2000) Bulgaria (2002) Benefits and Investments Avoidance of Double Taxation Agreements Belarus Hungary Slovakia Belgium India South Africa Brazil Jamaica South Korea Bulgaria Japan Spain Canada Luxembourg Sweden China Mexico Thailand Czech republic Norway The Netherlands Denmark Philippines Turkey Finland Poland USA France Romania Germany Russia Greece Singapore Benefits and Investments Cooperation in Industrial R&D Agreements Austria USA UK Finland Spain Netherlands Canada Hong Kong Sweden China Belgium Portugal France Ireland Singapore Germany Korea Italy India Benefits and Investments Protection of Investment Agreements Albania El-Salvador Argentina Estonia Armenia Georgia Belarus Germany Bulgaria Hungary Croatia India Cyprus Czech Republic Kazakhstan Korea Benefits and Investments Protection of Investment Agreements Latvia Turkmenistan Lithuania Ukraine Moldova Uruguay Poland Uzbekistan Romania Slovakia QIZ Agreement Slovenia Egypt Thailand Jordan Turkey Benefits and Investments International Organization* Membership: BIS | BSEC (observer) | CE (observer) CERN (observer) | EBRD | FAO | IADB | IAEA IBRD | ICAO | ICC | ICCt (signatory) | ICFTU IDA | IFAD | IFC | IFRCS (observer) | ILO | IMF IMO | Interpol | IOC | IOM | ISO | ITU | OAS (observer) OPCW (signatory) | OSCE (partner) | PCA | UN UNCTAD | UNECE | UNEP | UNESCO | UNHCR UNIDO | UPU | WB | WCO | WFP | WHO | WIPO | WMO WToO | WTrO | WTO * Economic Organizations Business Contacts – Links Business Contacts With Israeli Exporters List of Israeli Trading Companies Israeli Government Portal Technology Directory For Further Information Please Contact: The Israel Export & International Cooperation Institute Efrat Cohen Adrian Filut Economist Economist Tel: +972-3-5142820/961 Fax: +972-3-5142852 Tel: +972-3-5142994 Fax: +972-3-5142852 E-mail: efrat@export.gov.il www.export.gov.il E-mail: filut@export.gov.il www.export.gov.il Editing: Alona Ron-Snir, Director Economic Department, IEICI Production: Hani Erez, Executive Media & Productions Unit, IEICI Published by: The Israel Export & International Cooperation Institute, 2005