markets - Foundation for Teaching Economics

“ Capitalism” is identified by its characteristic institutions

Institutions: the formal and informal “rules of the game” that shape incentives and outline expected and acceptable forms of behavior in social interaction.

• Private Property Rights

• Rule of law

• Open, competitive markets

• Entrepreneurship and innovation

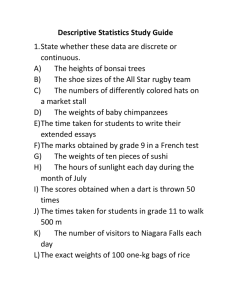

ECONOMIC ANALYSIS clearly present – the component is present in the economy with few exceptions generally present – the component is present in the economy, but with many or significant exceptions generally absent – the component is only present in the economy in some limited forms clearly absent – the component is almost entirely excluded from the economy not enough information

Present ?

Evidence?

markets private property rule of law entrepreneurship

United States

•The judiciary functions independently and predictably although serious constitutional questions have arisen regarding the government mandated health insurance decision.

•Corruption and cronyism is on the increase and is undermining the institutional integrity of the rule of law, resulting in an 86 th percentile ranking in control of corruption and a corruption perception index of 7.1 (out of 10) by

Transparency International and a decrease of 4 points in the heritage Foundation score to 71 from a previous 75 in 2010.

•Property rights are guaranteed, although affected by increasing regulations, ranking the US 19 th in the world, with a score of 85 out of 100 by the Heritage Fndn .

Specific Situation: Apple Patent Victory

Aug. 25, 2012

SAN JOSE, Calif.—Nine jurors delivered a sweeping victory to

Apple Inc. in a high-stakes court battle against Samsung

Electronics Co., awarding the Silicon Valley company $1.05 billion in damages and providing ammunition for more legal attacks on its mobile-device rivals.

Jurors Friday found that Samsung infringed all but one of the seven patents at issue in the case—a patent covering the physical design of the iPad. They found all seven of Apple's patents valid—despite Samsung's attempts to have them thrown out. They also decided Apple didn't violate any of the five patents Samsung asserted in the case.

ECONOMIC ANALYSIS clearly present – the component is present in the economy with few exceptions generally present – the component is present in the economy, but with many or significant exceptions generally absent – the component is only present in the economy in some limited forms clearly absent – the component is almost entirely excluded from the economy not enough information

Present ?

markets private property clearly present clearly present

Evidence?

Prices and products determined in markets

Patents upheld rule of law entrepreneurship clearly present clearly present

Courts act and decisions are enforced

Millions of companies operate in every sector

2012 Country Scenario Updates

Capitalism is best thought of not as “a system,” but as a continuum of institutional combinations . . . .

More capitalist

Less capitalist

Capitalism is best thought of not as “a system,” but as a continuum of institutional combinations . . . .

More capitalist

Less capitalist

Some institutional forms confer benefits on the poor

. . . and others do NOT.

Heritage:www.heritage.org/index/

Ranking Criteria:

• Size of government

• Legal system & Property rts

• Sound money

• Freedom to trade internationally

• Regulation

Process: Identify quantifiable data that can be used to rank countries.

Consider how these measures connect to the institutions we ranked in the “Will the Real Capitalism?” activity:

1. Size of Government

A. Government consumption

B. Transfers and subsidies

C. Government enterprises and investment

D. Top marginal tax rate

(i) Top marginal income tax rate

(ii) Top marginal income and payroll tax rate markets, entrepreneurship

2. Legal System and Property Rights

A. Judicial independence

B. Impartial courts

C. Protection of property rights

D. Military interference in rule of law and politics

E. Integrity of the legal system

F. Legal enforcement of contracts

G. Regulatory restrictions on the sale of real property

H. Reliability of police

I. Business costs of crime rule of law, entrepreneurship, property rights

3. Sound Money

A. Money growth

B. Standard deviation of inflation

C. Inflation: most recent year

D. Freedom to own foreign currency bank accounts entrepreneurship

4. Freedom to Trade Internationally

A. Tariffs

(i) Revenue from trade taxes (% of trade sector)

(ii) Mean tariff rate

(iii) Standard deviation of tariff rates

B. Regulatory trade barriers

(i) Non-tariff trade barriers

(ii) Compliance costs of importing and exporting

C. Black-market exchange rates

D. Controls of the movement of capital and people

(i) Foreign ownership/investment restrictions

(ii) Capital controls

(iii) Freedom of foreigners to visit markets

5. Regulation

A. Credit market regulations

(i) Ownership of banks

(ii) Private sector credit

(iii) Interest rate controls/ negative real interest rates

B. Labor market regulations

(i) Hiring regulations and minimum wage

(ii) Hiring and firing regulations

(iii) Centralized collective bargaining

(iv) Hours regulations

(v) Mandated cost of worker dismissal

(vi) Conscription

C. Business regulations

(i) Administrative requirements

(ii) Bureaucracy costs

(iii) Starting a business

(iv) Extra payments/ bribes/favoritism

(v) Licensing restrictions

(vi) Cost of tax compliance

Markets, entrepreneurship

Fraser Institute Index of Economic Freedom 2013

(Released Sept. 2013)

2011 data

10 9 8 7 6 5

Most Free: Hong Kong 8.97 Least Free: Venezuela 3.93

Fraser Institute Index of Economic Freedom 2012

(Released Sept. 2012)

2010 data

10 9 8 7 6 5

Most Free: Hong Kong 8.9 Least Free: Venezuela 4.07

2013 Rankings* (Out of 151)

• Hong Kong 1

• Singapore 2

• NZ 3

• Switzerland 4

• UAE 5

• Mauritius 6

• Finland 7

• Bahrain 8 Canada 8

• Australia 10

• Chile 11

• United Kingdom 12

• Jordan 13 (42 in 2010, 62

2012 )

• U.S. 17 (3 in 2006)

• Israel 49 (44 in 2007, 83 in

2011)

• Poland 59 (88 in 1990, 44 in

2012)

• Uganda 64 (67 in 2010, 51 in 2001, 113/113 in 1990)

• Greece 85

• Kenya 87

• Mexico 94 (69 in 2010)

• Russia 101

• Egypt 108 (from high of 46,

80 in 2010)

• India 111

• China 123 (82 in 2010)

• Iran 127

• Ethiopia 142

• Zimbabwe 149

• Myanmar 151

• Venezuela 152

* 2011 data

2012 Rankings* (Out of 144)

• Hong Kong 1

• Singapore 2

• NZ 3

• Switzerland 4

• Australia 5

• Canada 6

• Bahrain 7

• Mauritius 8

• Finland 9

• Chile 10

• United Kingdom 12

• Ireland 12

• U.S. 18 (down from 3 in 2006)

• Japan 20

• Poland 48 (88 in 1990)

• Uganda 50 (67 in 2010, 51 in 2001, 113/113 in 1990)

• Jordan 62 (42 in 2010 )

• Greece 81

• Mexico 91 (69 in 2010)

• Egypt 99 (from high of 46,

80 in 2010)

• Israel 52 (44 in 2007, 83 in

2011)

• Russia 95

• China 107 (82 in 2010)

• India 111

• Iran 111

• Zimbabwe 142

• Myanmar 143

• Venezuela 144

* 2010 data

Africa Continues to Lag Behind:

1/3 of the world’s “extremely poor”

What does recent research tell us about why Africa continues to lag behind – and what we can do about it?

Reduced Poverty Since 2000:

Research on Growth vs. Safety Net ?

1.

75% growth / 25% redistribution (Dollar, Kraay, Kleineberg study )

• context matters: averages hide wide range of variation safety net (redistribution) econ growth demographic comp .

Reduced Poverty Since 2000:

Research on Growth vs. Safety Net ?

1.

75% growth / 25% redistribution (Dollar, Kraay, Kleineberg study )

• context matters: averages hide wide range of variation

2.

economic growth is not generally associated with increased income inequality:

• the (overall) share of income going to the poorest 2 quintiles

(40%) does not change significantly with growth

• poor governance often increases income inequality for specific populations in specific locations

3.

4/5 of the improvements in the lives of the poorest 40% of the population over the past decade are attributable to economic growth; 1/5 is attributable to redistribution

Talking about “Is Capitalism Good for the Poor?”

• distinguish between “poverty” v. “poor people”

• distinguish between treating symptoms v. underlying causes

Income Share of the Poorest 10% and

Economic Freedom

3.0%

2.5%

2.0%

1.5%

1.0%

0.5%

0.0%

Most Free

Quartile

2nd

Quartile

3rd

Quartile

Least Free

Quartile

Most Free ……………. Least Free

Sources: The Fraser Institute; The World Bank, World Development Indicators, 2013.

Income of the Poorest 10% and

Economic Freedom

$12,000

$10,000

$8,000

$6,000

$4,000

$2,000

$0

Most Free

Quartile

2nd

Quartile

3rd

Quartile

Least Free

Quartile

Most Free ……………. Least Free

Sources: The Fraser Institute; The World Bank, World Development Indicators, 2013.

Growth in Developing Nations Per Capita and

Economic Freedom Quartile

%

4.0

3.5

3.0

2.5

2.0

1.5

1.0

0.5

0.0

Most Free

Quartile

2nd Quartile 3rd Quartile Least Free

Quartile

Most Free ……………. Least Free

Sources: The Fraser Institute; The World Bank, World Development Indicators, 2013.

Institutions Associated with Economic Growth

• Private Property Rights

• Rule of law

• Open, competitive markets

• Entrepreneurship and innovation

Focus of lessons 25 in “Is Capitalism

Good for the Poor?”