COURSE SYLLABUS Course Title : Macroeconomic Theory II

advertisement

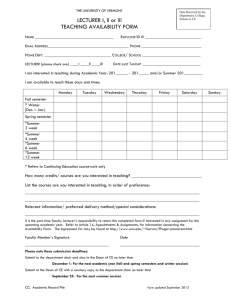

COURSE SYLLABUS Course Title Coordinator Course Code Credit Semester Prerequisite Course Course Description : Macroeconomic Theory II : Prof. Dr. Hermanto Siregar : EKO 222 : 3(3-0) : Even/4 : EKO 203 : This course is designed to provide knowledge for the students on the performance of open macroeconomics with its all implications in achieving internal and external equilibriums particularly in developing countries. : After completing this course, students are expected to be able to explain the performance of open macroeconomics with its all implications in achieving internal and external equilibriums particularly in developing countries. Learning Outcome Sessio Learning Outcome n (Basic Competency) 1 Students can explain the openness and performance of macroeconomics 2-4 Students can explain open macroeconomics – Concepts, Issues, and Institutions - Teaching Material Introduction Scopes of Macroeconomics II The openness and performance of macroeconomics Introduction Balance of Payment Concept Exchange Rates Concept Purchasing Power Assessment Learning Indicator Method Explain the scope Lecture and of macroeconomics discussion II, the openness and performance of macroeconomics Assessmen Time t Criteria Written Lecture: test 3 x 60 minutes Explain the concepts in open macroeconomics, the concepts of issues and Written test Lecture and discussion Lecture: 3 x 60 minutes Lecturer Reference Macroecon omic Theories II Lecturer Team 1 (Chapter 1) Macroecon omic Theories II Lecturer Team 1 (Chapter 2) Sessio Learning Outcome n (Basic Competency) Teaching Material - - 5-6 Students can explain open macroeconomic models - Parity Concept Terms of Trade Concept Issues and problems of Demand Shocks Issues and problems of Inflation Shocks Issues and problems of Term of Trade Shocks Issues and problems of The Debt Crisis Shocks Issues and problems of Demand Shocks Issues and problems of The Dutch Disease Issues and problems of Capital Flow and Macroeconomic Instability Issues and problems of Currency Substitution and Capital Flight Policy goals and instrument Institutional development Introduction Policy issues and Tinbergen Rule Absorption and Balance Assessment Indicator institutions. Explain open macroeconomic models. Learning Method Lecture and discussion Assessmen t Criteria Written test Time Lecture: 3 x 60 minutes Lecturer Reference Macroecon omic Theories II Lecturer 1 (Chapter 3) Sessio Learning Outcome n (Basic Competency) 7 Teaching Material of Payment - Monetary Approach and Balance of Payment - Mundell-Fleming model - Mundell-Fleming model with wages and price adjustment - Tradable Sector and Nontradable Sector Models Students can explain - Introduction of foreign foreign capital aid flows investment and - Foreign private capital economic growth flows - Issues with and management of large capital flows 8 Students can explain debt crisis and capital flight - Introduction - Debt crisis in the 1980s - Capital flight 9 Students can explain budget deficit, Inflation and Balance of Payment 10 Students can explain - Introduction - Macroeconomic consequences of budget deficit - Political Economy of budget deficits - Introduction Assessment Indicator Learning Method Assessmen t Criteria Time Lecturer Reference Team Explain the causes of foreign capital needs and their effects on the economy. Lecture and discussion Written test Lecture: 3 x 60 minutes Macroecon omic Theories II Lecturer Team 1 (Chapter 4) MID-TEST/UTS (50%) Explain the causes Lecture and of debt crisis and discussion capital flight. Written test Lecture: 3 x 60 minutes 1 (Chapter 5) Explain the Lecture and economic and discussion political consequences of budget deficit. Written test Lecture: 3 x 60 minutes Macroecon omic Theories II Lecturer Team Macroecon omic Theories II Lecturer Team Explain Written Lecture: Macroecon 1 and Lecture and 1 (Chapter 6) Sessio Learning Outcome Teaching Material n (Basic Competency) money growth, - Inflation: Monetary inflation and Phenomenon monetary policy - Money development as a source of Government Revenue - Inflationary financing in developing countries 11 Students can explain - Monetary models of money growth, inflation under the fixed inflation and and floating exchange monetary policy: rate systems advanced level - Monetary policy as stabilization tool 12-13 14 Assessment Learning Indicator Method develop model that discussion connects money growth, inflation, and monetary policy. Explain and develop model that connects money growth, inflation, and monetary policy: advanced level. Students can explain - Introduction Explain the exchange rate - Exchange rate as the price exchange rate policies signal of the approaches policies and their on exchange rate policies consequences on - Political economy of the economy. inflation - Maintaining competition Students can explain the political economy in Macroeconomic Management: The Needs for Institutional Changes - Introduction - Institutions and organizations - Sources of Government’s failure - The needs for Institutional Changes Assessmen Time t Criteria test 3 x 60 minutes Lecturer Reference omic Theories II Lecturer Team (Chapter 7) Lecture and discussion Written test Lecture: 3 x 60 minutes Macroecon omic Theories II Lecturer Team 1 (Chapter 7) Lecture and discussion Written test Lecture: 3 x 60 minutes Macroecon omic Theories II Lecturer Team 1 (Chapter 8) Explain the role of Lecture and institutions in discussion macroeconomic management. Written test Lecture: 3 x 60 minutes Macroecon omic Theories II Lecturer Team 1 (Chapter 9) Sessio Learning Outcome n (Basic Competency) Teaching Material Assessment Indicator Learning Method Assessmen t Criteria Time Lecturer FINAL TEST/UAS (50%) LITERATURE REFERENCE 1. Akhtar Hossain dan Anis Chowdhury. 1998. Open-Economy Macroeconomics for Developing Countries, Edwar Elgar Publishing Limited. Cheltenham, UK. Lecturer Team : Prof. Dr. hermanto Siregar, Prof. Dr. Rina Oktaviani, Dr. Yeti Lis Purnamadewi, Prof. Noer Azam Achsani ASSESSMENT FORMAT : Mid-test (UTS) Final test (UAS) : 50 % : 50 % Reference