Senator Jack Reed (D-RI) Prior to serving in the Senate, Reed was a

advertisement

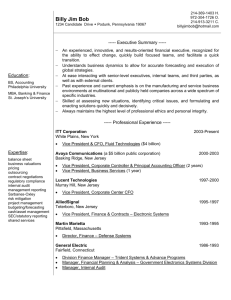

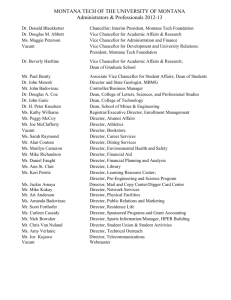

Senator Jack Reed (D-RI) Prior to serving in the Senate, Reed was a three-term Member of the U.S. House of Representatives from Rhode Island's 2nd Congressional District. During his tenure in the House, Reed championed child health care, public libraries, and campaign finance reform. He also helped strengthen our national defense and found innovative ways to promote Rhode Island's economy. Reed has been described by the Boston Globe as "a relentless advocate for his home state." A member of the powerful Appropriations Committee, which controls the purse strings of Congress, Reed continues to work tirelessly to secure federal funding for the Ocean State, such as mass transit funding and community development projects. As a senior member of the Senate Banking, Housing and Urban Affairs Committee, Reed's key economic priorities include promoting responsible budgets, bringing business to Rhode Island and creating high-paying, sustainable jobs, and strengthening the national economy. Congressman Blaine Leutkemeyer (R-MO) As the Congressman from the 3rd Congressional District of Missouri, Leutkemeyer is committed to representing the interests of the hardworking people by being a strong voice for them in Washington, D.C. Along with his strong agriculture background, he was also a small businessman, having been in the banking and insurance business. Leutkemeyer has also served as a bank regulator for the state of Missouri earlier in his career. From 1999 to 2005, Leutkemeyer was a Missouri State Representative and served as Chairman of the Financial Services Committee and was elected by his colleagues to serve as the House Republican Caucus Chairman. Building on his experience as a bank examiner, small businessman and community banker, Leutkemeyer serves as vice chairman of the House Small Business Committee where he also serves on the House Small Business Subcommittees on Health and Technology and Agriculture, Energy and Trade. Leutkemeyer also serves on the House Financial Services Committee where he also serves on the panel's Subcommittee on Financial Institutions and Consumer Credit Committee and is vice chairman of the Housing and Insurance Subcommittee. Daniel J. Bradley Daniel J. Bradley became Indiana State's eleventh president on July 31, 2008. Bradley served as the president of Fairmont State University, located in Fairmont, W.Va., from 2001 until 2008. He previously held a variety of positions at Montana Tech of the University of Montana, including vice chancellor for academic affairs and research, dean of engineering and head of the petroleum engineering department. A veteran of the US Army, Bradley holds a Ph.D. in physical chemistry from Michigan State University, a master's degree in petroleum engineering from the University of Tulsa and a bachelor's degree in petroleum engineering from Montana College of Mineral Science and Technology. During graduate studies, he spent two years at Oak Ridge National Laboratory performing his research. After graduate school, he was a postdoctoral scholar at the University of California, Berkeley in the Chemistry Department before joining the faculty at Montana Tech. David Cummins Dr. J. David Cummins is the Joseph E. Boettner Professor of Risk Management, Insurance and Financial Institutions. He also serves as the Director of the Advanta Center for Financial Institutions, and as a member of the Research Roundtable. Cummins’ research focuses on insurance economics; financial risk management; productivity and efficiency; and securitization. He has published numerous articles in the premier Risk and Insurance journals, including: the Journal of Risk and Insurance, Geneva Papers, North American Actuarial Review, and Insurance, Mathematics and Economics. Cummins has organized many conferences, and has been a panelist, discussant, moderator, and chair of many sessions in Risk and Insurance conferences. He is currently the co-editor of the Journal of Banking and Finance, the Associate Editor of eight journals in Risk & Insurance and Finance. Additionally, Dr. Cummins has served as President of the American Risk and Insurance Association. Kimberly O. Dorgan Kimberly Olson Dorgan is the Senior Executive Vice President, Public Policy of the American Council of Life Insurers (ACLI). As Senior Executive Vice President, Dorgan has overall responsibility for developing public policy and implementing legislative strategy for all of ACLI's federal legislative goals and overseeing ACLI lobbyists and PAC activities. Prior to joining ACLI in 1999, Dorgan had her own government relations business representing such non-profit clients as the Children's Television Workshop, the National Captioning Institute, and America's Public Television Stations. In 1991, she won the American Society of Association Executive's Government Relations Award of Excellence as part of a team representing America's Public Television Stations. Dorgan is a native of Washington State. She has a MA in International Affairs from the George Washington University and a BA in History from Washington State University. Martin Grace Dr. Martin F. Grace is currently the Associate Director and Research Associate at the Center for Risk Management and Insurance Research Georgia State University. He is also an Associate in the Andrew Young School of Policy Studies, Fiscal Policy Center. Dr. Grace’s research has been published in various journals in economics and insurance concerning the economics and public policy aspects of regulation and taxation. In particular, Dr. Grace has studied various aspects of the regulation and taxation of the insurance industry. Dr. Grace is a former President of The Risk Theory Society and he is a current associate editor of the Journal of Risk and Insurance. Dr. Grace earned both a Ph.D. in economics and a J.D. from the University of Florida in 1987. He joined the faculty of the Department of Risk Management and Insurance as an Assistant Professor of Legal Studies in the fall of 1987. In 1993 Dr. Grace was promoted to Associate Professor with appointments in both Legal Studies and Risk Management and Insurance. In 1998 Dr. Grace was promoted to Professor of Legal Studies and Risk Management and Insurance and in 2002, Professor Grace was named the James S. Kemper Professor of Risk Management. Brady Kelley Since September 2011, Brady R. Kelley has been the Executive Director for the National Association of Professional Surplus Lines Offices, Ltd. (NAPSLO); he is responsible for the overall management of the Association’s staff activities, services to members and business operations. Prior to joining NAPSLO, Kelley was the Chief Financial and Business Strategy Officer for the National Association of Insurance Commissioners (NAIC), responsible for all financial management and reporting, business strategy, risk management and compliance activities. During his 13 years with the NAIC, Kelley also served as the Director of Financial Services. His previous positions include Senior Vice President of Finance for the Greater Kansas City Community Foundation and Senior Accountant in the Kansas City office of PricewaterhouseCoopers LLP. Kelley received his bachelor’s degree from the University of Missouri–Columbia and also completed the Mini-MBA Program from Kansas University and Wichita State University. He received the designation of Certified Public Accountant in November 1995 and has been a member of the American Institute of Certified Public Accountants and the Missouri Society of Certified Public Accountants. Kelley is a member of the American Society of Association Executives. Monica Lindeen Monica J. Lindeen was elected Commissioner of Securities and Insurance, Montana State Auditor, in November 2008 and reelected in 2012. Her mission is to protect securities and insurance consumers through education, fairness and transparency. During her tenure, her office has returned more than $200 million to investors and insurance consumers throughout the state. Lindeen was elected the National Association of Insurance Commissioners (NAIC) Vice President in November 2012. She was also appointed to the Federal Insurance Office Advisory Board, is a member of the System for Electronic Rate and Form Filing (SERFF) Board and the National Insurance Producer Registry (NIPR) Board of Directors. In 1999, Lindeen began her career in public service representing a rural district in the Montana House of Representatives, serving four terms (1999–2006). Prior to public service, Lindeen founded Montana Communications Network (MCN), one of the first Montana-based Internet providers. From 1994 to 1996, she was a part-time faculty member in the Montana State University–Billings English Department and taught as a graduate assistant in the MSU–Billings Department of Educational Foundations. She earned a bachelor’s degree in education, specializing in English and history. She completed graduate coursework in educational foundations at MSU–Billings. Leigh Ann Pusey Leigh Ann Pusey is the president and CEO of the American Insurance Association (AIA). She oversees the organization's operations and works directly with AIA’s Board of Directors to develop and guide the strategic mission of the association. AIA is the leading property-casualty insurance trade organization, representing 300 insurers that write more than $117 billion in premiums each year. A veteran of the insurance industry, Ms. Pusey joined AIA in December 1996 and was elevated to president and CEO on February 2009. Previously she served as chief operating officer and senior vice president of government affairs where she was responsible for the association’s government affairs department and AIA’s interests before Congress and state legislatures on all matters of importance to the property-casualty industry. She began her tenure with the association as senior vice president for public affairs. Recognizing her prominence and leadership within the industry, Business Insurance Magazine has listed Ms. Pusey among their “Women to Watch.” In addition, Ms. Pusey is consistently recognized by The Hill publication as one of the top lobbyists in Washington, D.C. She is frequently quoted in the news media and consulted by policy makers and Wall Street for her views on issues facing the property-casualty industry. Charles T. Richardson Charles T. Richardson is a partner in the Washington, D.C. office of the law firm of Baker & Daniels LLP with other offices in Indiana and China. He chairs the Firm's Insurance and Financial Services Practice Group. Charlie concentrates his practice in both corporate/regulatory and insolvency areas of the insurance practice. In the corporate/regulatory arena, Charlie assists insurance companies with change in control proceedings, all types of regulatory, agent, policy approval, accounting, mergers and acquisitions, market conduct and reinsurance. He practices in the area of insurance company rehabilitations and liquidations, including representation of the National Organization of Life and Health Insurance Guaranty Associations and serves on NOLHGA's Legal Committee. He is a Qualified Independent Assessor of the Insurance Marketplace Standards Association. Charlie is a frequent speaker and author on insurance subjects and has been active in committees and working groups of the National Association of Insurance Commissioners. He is on the Advisory Board of Networks Financial Institute of Indiana State University and is a past Vice President and Director of the Federation of Regulatory Counsel and Chairs its Admissions Committee. Charlie is a graduate of the University of Michigan Law School and Indiana University. Elizabeth (Beth) Sammis Elizabeth (Beth) Sammis is a Senior Insurance Regulatory Policy Analyst at the Federal Insurance Office. Prior to joining the Federal Insurance Office in December, she held various executive positions with three health insurers and various positions in Maryland state government, including as Deputy Insurance Commissioner and Acting Insurance Commissioner. Beth has a BA in Sociology from UC Berkeley and a Ph.D. in Sociology from UCLA. David A. Sampson David A. Sampson is the president and chief executive officer of the Property Casualty Insurers Association of America (PCI), which represents more than 1,000 homeowners, auto and business insurance companies that write 38.3 percent of the nation's property and casualty insurance. As president of PCI and its affiliates, Sampson is responsible for leading PCI's strategic advocacy efforts on state, federal and international issues affecting the insurance industry. Sampson has enhanced PCI's contributions of credible, reliable data and thought leadership to policymakers at the state and federal levels. Through his counsel during the recent economic crisis, PCI provided data to differentiate the property casualty industry from other financial services sectors and highlighted the strength and stability of the industry. As a respected industry voice and proponent of private markets, Sampson is a frequent keynote speaker at industry and business events. Sampson is a regular guest on Fox News and Fox Business Network and has been interviewed by The Wall Street Journal, The New York Times, Dow Jones, Bloomberg, Politico, The Hill and the property casualty trade press. Brien Smith Brien Smith is dean of the Scott College of Business at Indiana State University and Acting Executive Director of Networks Financial Institute. He was previously associate dean for the Miller College of Business at Ball State University. Smith attained his PhD in industrial/organizational psychology in 1989 from Auburn University. He has 20 years of administrative experience in higher education and has actively participated in university governance. Smith previously served as the chair for the Department of Marketing and Management, assistant to the dean for graduate programs, and vice chairperson of the Department of Management. Smith published numerous articles in refereed proceedings and journals, including some of the best journals in the field: Journal of Applied Psychology, Journal of Applied Social Psychology, Group and Organization Management, and Journal of Business and Psychology. He has delivered presentations and speeches at national and international conferences. He has 10 years of leadership experience in the Ball State University Senate, including senate chair (twice) and faculty council chair. He is a coauthor of the current Ball State University Senate Constitution (Senate Reorganization Committee), teaches courses in human resource management, and was named the 1994-1995 Ball State University Teaching Professor (now known as the Excellence in Teaching Award). Mary A. Weiss Mary A. Weiss, Ph.D. is Deaver Professor of Risk, Insurance, and Healthcare Management at the Fox School of Business and Management of Temple University and President of the prestigious Risk Theory Society. She is a Past President of the premier insurance academic organization in the U.S., the American Risk and Insurance Association (ARIA). Weiss is Editor of Risk Management and Insurance Review and a CoEditor for the Journal of Risk and Insurance. Her research, consisting of over 30 articles, has focused on financial services conglomeration, efficiency measurement of insurers, no-fault automobile insurance, reinsurance, regulation, and underwriting cycles. Her research has appeared in the Journal of Law and Economics, Journal of Business, Management Science, The Journal of Financial Intermediation, The Journal of Risk and Insurance, Journal of Banking and Finance, Geneva Papers on Risk and Insurance Theory, and Contingencies. Weiss obtained her Ph.D. degree at the Wharton School of the University of Pennsylvania and has been on the faculty of Temple University since 1986. She was a Visiting Scholar at the Wharton School (2004-2006) and was selected as 2004 Distinguished Huebner Alumnus, Huebner Foundation, Wharton School. She served as a Distinguished Scholar at the NAIC’s Center for Insurance Policy & Research (a think tank) in 2009-2010.