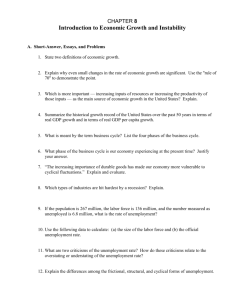

SOCIAL POLICIES IN A MARKET ECONOMY

advertisement

SOCIAL POLICIES IN A MARKET ECONOMY Joseph E. Stiglitz Beijing March 2006 Objectives of Social Policies • Redistribution – Enhancing opportunity • Access to education • Access to finance – Partially reflections of market failure – Improving Outcomes • Even if market is efficient, it may not lead to socially acceptable distribution of income Objectives • Social Protection – Market failures—absence of insurance to cover major risks • Huge loss of welfare – Lack of security cited as major problem • Problems in insurance risks: Unemployment, annuities, disability, insurance against inflation • Explained in part by theories of asymmetric information – But government has sometimes acted as a catalyst – Basic human needs • Education • Food • Social obligation (specific egalitarianism) Full Employment • Most important social policy – Unemployment represents waste of resources – But also leads to adverse social consequences – Market economies do not automatically lead to full employment – And excessive focus on inflation can lead to higher unemployment than necessary Trade-offs • Inflation vs. unemployment – Little evidence that moderate to low inflation has any effect on growth – Social programs can insure poor against inflation (indexing social security, etc.) – Continuing debate about broader distributive effects of inflation • With many studies claiming inflation “cruelest tax” flawed in identifying source of problem (oil price shock) • Well functioning markets have unskilled wages adjust fairly quickly Trade-offs • Do unemployment benefits lead to higher unemployment, because of reduced incentives to search? – If there is a lack of jobs, more search does not produce more employment (search externality—just increases expenditures on search) – But in Efficiency Wage (Shirking—Shapiro/Stiglitz) models higher unemployment benefits can result in higher equilibrium unemployment – But increased job security has more ambiguous effects on unemployment – What is clear is that markets by themselves do not necessarily result in optimal levels of severance pay and unemployment insurance (private markets typically provide little) Thinking about Redistribution • Neoclassical dichotomy—can separate “efficiency” concerns from “distributional concerns” • Today, we recognize that such separation is not possible (if there are imperfections or asymmetries of information, incomplete markets) – Social policies/concerns need to be integrated into all government programs • Assessing who benefits • Though often incidence is a complicated matter Redistribution • Government needs to think of impact of policies on pretax distribution of income (not just adjustments to given after tax income distribution) • China today is in a markedly different position from many market economies – Who are worried about deficiencies in savings/investment – And hence have been pushing for low taxation of capital • In spite of adverse effects on distribution of income • In spite of limited evidence on the impact of such “incentives” on savings – Tax preferences may actually lower net national savings • China today is trying to encourage consumption – So can employ progressive capital taxes • China is also in a different position from other developing countries – Traditional debates focused on need to extract “surplus” from rural sector – China needs to increase well-being of those in rural sector • But guard against problem in U.S.,EU, where agriculture subsidies mainly go to large, corporate farmers—huge distortion of resources and increase in inequity Opportunities • Unequal access to opportunities – Education, finance – affected by parental wealth • Lowering social mobility • Horatio Alger mainly myth – But also discrimination—discriminatory market equilibrium • Gender, race • Becker was wrong – Impossible to undo fully • Affected by differences in quality of public schools • Location/geographic, network externalities Opportunities • Huge societal costs of unequal opportunity – Efficiency—not drawing fully on most important factor—labor – Undermining Social Cohesion • Huge costs of exclusion • Manifested in anti-social behavior • But government can make a difference – Affirmative action programs – Directed expenditure programs – Promoting wider access to credit Social Protection • Huge costs to insecurity • Widespread market failure – Especially associated with adverse selection – Market efforts directed at “cream skimming” • At enormous economic and societal costs • Helps explain huge transactions cost – Help explain problems in private health insurance market • Public sector has to be worried about moral hazard (incentives) • But an integrated social insurance system (Singapore’s provident fund) can mitigate risk and minimize attenuation of incentive • Key question: how much inequality in, say, access to health/medicine should society accept? – Vexing question, especially in societies marked with high levels of inequality in other ways – Probably need to accept basic level of health care, publicly provided (financed) • With high income purchasing additional services – Good news—access to medicine only one of determinants of health • Government should work on other dimensions (nutrition, smoking, drinking) as well China’s Transition to a Market Economy • As China makes a transition to a market economy, it needs to be aware of the limitations of markets in providing basic levels of social protection – There is an important role of government • Which virtually every market economy has recognized – China should learn from the mistakes—the successes and failures of others in designing its social programs • But the strains imposed by China’s extremely rapid growth make it all the more important for its government to assume an important role China’s Transition to a Market Economy • China’s decisions will affect not only the performance of the economy – Well designed social programs can even increase productivity • Making sure that all of the country’s talents are given the opportunity to reach their potential • Correcting, or mitigating, market failures • And with a well-designed safety net, individuals may be freer to take risks than they otherwise, encouraging innovation (the Scandinavian model) • But the nature of Chinese society itself