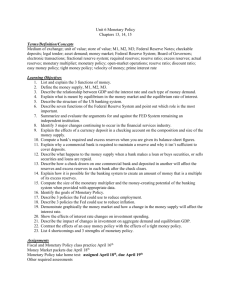

Lecture 6: Financial Programming: An Introduction

advertisement

Financial Programming An Introduction Thorvaldur Gylfason Outline Monetary approach to balance of payments Accounting relationships Trace linkages among o Balance of payments accounts o National income accounts o Fiscal accounts o Monetary accounts Proceed from linkages to financial programming Analytical model Financial programming in action What is money? Liabilities of banking system to the public That is, the private sector and public enterprises M=C+T C = currency, T = deposits The broader the definition of deposits ... Demand deposits, time and savings deposits, etc., ... the broader the corresponding definition of money M1, M2, etc. Overview of banking system Financial System Banking System (Monetary Survey) Central Bank Other Financial Institutions Commercial Banks DG = domestic credit to government DB = domestic credit to commercial banks RC = foreign reserves in Central Bank C = currency B = commercial bank deposits in Central Bank Balance sheet of Central Bank Assets Liabilities DG C DB B RC DP = domestic credit to private sector RB = foreign reserves in commercial banks B = commercial bank deposits in Central Bank DB = domestic credit from Central Bank to commercial banks T = time deposits Balance sheet of Commercial Banks Assets Liabilities DP DB RB T B Adding up the two balance sheets D R DG + DP + DB + R B + RC + B = C + T + B + DB M Balance sheet of banking system D = DG + DP = net domestic credit from banking system (net domestic assets) RC RB R= + = foreign reserves (net foreign assets) M = money supply Assets Liabilities D M R A fresh view of money The monetary survey implies the following new definition of money: M=D+R where M is broad money (M2), which equals narrow money (M1) + quasi-money One of the most useful equations in economics Money is, by definition, equal to the sum of domestic credit from the banking system (net domestic assets) and foreign exchange reserves in the banking system (net foreign assets). An alternative derivation of monetary survey Public sector G – T = B + DG + DF Private sector I – S = DP - M - B External sector X – Z = R - DF An alternative derivation of monetary survey Public sector G – T = B + DG + DF Private sector I – S = DP - M - B External sector X – Z = R - DF An alternative derivation of monetary survey Public sector G – T = B + DG + DF Private sector I – S = DP - M - B External sector X – Z = R - DF An alternative derivation of monetary survey Public sector G – T = B + DG + DF Private sector I – S = DP - M - B External sector X – Z = R - DF An alternative derivation of monetary survey Public sector G – T = B + DG + DF Private sector I – S = DP - M - B External sector X – Z = R - DF An alternative derivation of monetary survey Public sector G – T = B + DG + DF Private sector I – S = DP - M - B External sector X – Z = R - DF An alternative derivation of monetary survey Public sector G – T = B + DG + DF Private sector I – S = DP - M - B External sector X – Z = R - DF So, adding them up, we get: 0 = D - M + R because DG + DP = D Monetary approach to balance of payments The monetary survey (M = D + R) has three key implications: Money is endogenous If R increases, then M increases Important in open economies Domestic credit affects money If R increases, may want to reduce D to contain M R = M - D Here R = X – Z + F Monetary approach to balance of payments Monetary approach to balance of payments The monetary approach to the balance of payments (R = M - D) has the following implications Need to Forecast M And then Determine D In order to Meet target for R D is determined as a residual given both M and R* R* = reserve target, e.g., 3 months of imports Monetary approach to balance of payments Domestic credit is a policy variable that involves both monetary and fiscal policy Can reduce* domestic credit (D) To private sector To public sector • By reducing government spending • By increasing taxes Monetary and fiscal policy are closely related through domestic credit Linkages Balance of payments R = X – Z + F = X – Z + DF Linkages Balance of payments R = X – Z + F = X – Z + DF National accounts Y=E+X–Z Linkages Balance of payments R = X – Z + F = X – Z + DF Fiscal accounts G – T = B + DG + DF National accounts Y=E+X–Z Linkages Balance of payments R = X – Z + F = X – Z + DF National accounts Y=E+X–Z Fiscal accounts G – T = B + DG + DF Monetary accounts M = D + R = DG + DP + R Linkages: Reserves Balance of payments R = X – Z + F = X – Z + DF National accounts Y=E+X–Z Fiscal accounts G – T = B + DG + DF Monetary accounts M = D + R = DG + DP + R Linkages: Current account Balance of payments R = X – Z + F = X – Z + DF National accounts Y=E+X–Z Fiscal accounts G – T = B + DG + DF Monetary accounts M = D + R = DG + DP + R Linkages: Foreign credit Balance of payments R = X – Z + F = X – Z + DF National accounts Y=E+X–Z Fiscal accounts G – T = B + DG + DF Monetary accounts M = D + R = DG + DP + R Linkages: Credit to government Balance of payments R = X – Z + F = X – Z + DF National accounts Y=E+X–Z Fiscal accounts G – T = B + DG + DF Monetary accounts M = D + R = DG + DP + R Linkages Private sector accounts I – S = DP – M – B Balance of payments R = X – Z + F = X – Z + DF National accounts Y=E+X–Z Fiscal accounts G – T = B + DG + DF Monetary accounts M = D + R = DG + DP + R Linkages: Bonds Private sector accounts I – S = DP – M – B Balance of payments R = X – Z + F = X – Z + DF National accounts Y=E+X–Z Fiscal accounts G – T = B + DG + DF Monetary accounts M = D + R = DG + DP + R Linkages: Money Private sector accounts I – S = DP – M – B Balance of payments R = X – Z + F = X – Z + DF National accounts Y=E+X–Z Fiscal accounts G – T = B + DG + DF Monetary accounts M = D + R = DG + DP + R Linkages: Private credit Private sector accounts I – S = DP – M – B Balance of payments R = X – Z + F = X – Z + DF National accounts Y=E+X–Z Fiscal accounts G – T = B + DG + DF Monetary accounts M = D + R = DG + DP + R Model Express accounting linkages in terms of simple algebra Use model to describe how nominal income and reserves depend on domestic credit Demonstrate how BOP target translates into prescription for fiscal and monetary policy Financial programming in action List of variables M = money D = domestic credit R = foreign reserves R = R-R-1 = balance of payments P = price level Y = real income v = velocity X = real exports Px = price of exports Z = real imports Pz = price of imports F = capital inflow m = propensity to import List of relationships M=D+R M = (1/v)PY R = (1/v)PY – D R = PxX – PzZ + F PzZ = mPY R = PxX – mPY + F + R-1 (monetary survey) (money demand) (M schedule) (balance of payments) (import demand) (B schedule) The M schedule Reserves (R) M schedule 1 v D up R = (1/v)PY – D PY = v(R + D) An increase in reserves increases demand for money, and hence also income PY is nominal income GNP (PY) The B schedule Reserves (R) R = PxX – mPY + F + R-1 An increase in income encourages imports, so that reserves decline m 1 F up, e down B schedule GNP (PY) Solution to model Two equations in two unknowns 1) R = (1/v)PY – D 2) R = PxX – mPY + F + R-1 Solution for R and PY v PY D R1 PxX F 1 mv 1 mv R R1 PxX F D 1 mv 1 mv Multipliers: Algebra dPY v dD 1 mv dPY v dPxX 1 mv dR mv dD 1 mv dR 1 dPxX 1 mv Multipliers: Numbers Suppose m = ¼ and v = 4 dPY 4 4 2 dD 1 (1 / 4)4 2 dR (1 / 4)4 1 dD 1 (1 / 4)4 2 Macroeconomic equilibrium Reserves (R) M schedule D up Equilibrium F up, e down B schedule GNP (PY) Economic models Exogenous variables Change in domestic credit or the exchange rate Model Financial programming model Endogenous variables Foreign reserves and nominal income Experiment: Export boom Reserves (R) M schedule A B schedule GNP (PY) Export boom Reserves (R) M C A Exports increase B’ B GNP (PY) Export boom Reserves (R) M C An increase in exports increases both reserves and nominal income A B’ B GNP (PY) An interpretation Exogenous variables Export boom or capital inflow Model Financial programming model Endogenous variables Foreign reserves and nominal income increase Another experiment: Domestic credit expansion Reserves (R) An increase in D increases PY, but reduces R. M M’ D up D up M up PY up PzZ up R down A C B GNP Domestic credit contraction Reserves (R) M’ M C D down R* A When D falls, M also falls, so that PY goes down and PzZ also decreases. Therefore, R increases. Here, an improvement in the reserve position is accompanied by a decrease in income. B GNP (PY) Domestic credit contraction accompanied by devaluation Reserves (R) M M’ C R* F up, e down A D down B’ B When D falls, M also falls, so that PY goes down and PzZ also decreases. Therefore, R increases. Further, a devaluation strengthens the reserve position and helps reverse the decline in income. GNP (PY) Comparative statics: An overview D PxX F e p R - + + - - PY + + + - + Experiment: Inflation goes up Reserves (R) M p up A C An increase in inflation (p) increases v, so the M’ M schedule becomes flatter. Hence, R goes down and PY increases in the short run. B schedule GNP (PY) Experiment: Inflation goes up Reserves (R) p up eP/P* up p up A C B’ X down B shifts left An increase in inflation (p) makes M domestic currency M’ appreciate in real terms, so the B schedule shifts left. Hence, R goes farther down and PY can rise or fall B schedule in the short run. GNP (PY) Numerical example History and targets Record history, establish targets Forecasting Make forecasts for balance of payments, output and inflation, money Policy decisions Set domestic credit at a level that is consistent with forecasts as well as foreign reserve target Financial programming step by step 1) Make forecasts, set reserve target R* 2) 3) 4) 5) – E.g., reserves at 3 months of imports Compute permissible imports from BOP – More imports will jeopardize reserve target Infer permissible increase in nominal income from import equation Infer monetary expansion consistent with increase in nominal income Derive domestic credit as a residual: D = M – R* History Known at beginning of program period: M-1 = 800, D-1 = 700, R-1 = 100 Recall: M = D + R PxX-1 = 750, Z-1 = 800, F-1 = 50 Recall: R = PxX – PzZ + F So, R-1 = 750 – 800 + 50 = 0 Current account deficit, overall balance R-1/PzZ-1 = 100/800 = 0.125 Equivalent to 1.5 (= 0.125•12) months of imports Weak reserve position Forecast for balance of payments PxX grows by a third, so PxX = 1,000 F doubles, so F = 100 Suppose R* is set at 240. Then PzZ = PxX + F + R-1 – R* = 1,000 + 100 + 100 – 240 = 960 Level of imports is consistent with R* R*/PzZ = 240/960 = 0.25 Equivalent to 3 (= 0.25•12) months of imports Forecast for real sector Increase in PzZ from 800 to 960, i.e., by 20%, is consistent with R* equivalent to 3 months of imports Now, recall that PzZ depends on PY where P is price level and Y is output Hence, if income elasticity of import demand is 1, PY can increase by 20% E.g., 5% growth and 15% inflation Forecast for money If PY can increase by 20%, then, if income elasticity of money demand is 1, M can also increase by 20% Recall quantity theory of money MV = PY Constant velocity means that %M = %PY = ˜ %P + %Y Hence, M can expand from 800 to 960 Determination of credit Having set reserve target at R* = 240 and forecast M at 960, we can now compute level of credit that is consistent with our reserve target, based on M = D + R So, D = 960 – 240 = 720, up from 700 D/D-1 = 20/700 = 2.9% Quite restrictive, given that PY rises by 20% Implies substantial reduction in domestic credit in real terms Forecast for balance of payments PxX grows by a third, so PxX = 1,000 F doubles, so F = 100, as before R* is now set at 200, not 240. Then PzZ = PxX + F + R-1 – R* = 1,000 + 100 + 100 – 200 = 1,000 Level of imports is consistent with R* R*/PzZ = 200/1000 = 0.2 Equivalent to 2.4 (= 0.2•12) months of imports Forecast for real sector Increase in PzZ from 800 to 1,000, i.e., by 25%, is consistent with R* equivalent to 2.4 months of imports Now, recall that PzZ depends on PY where P is price level and Y is output Hence, if income elasticity of import demand is 1, PY can increase by 25% E.g., 5% growth and 20% inflation, roughly Forecast for money If PY can increase by 25%, then, if income elasticity of money demand is 1, M can also increase by 25% However, if income elasticity of money demand is 0.8, M can increase by only 20% as before Hence, if the income elasticity is 1, M can expand from 800 to 1,000 Determination of credit Having set reserve target at R* = 200 and forecast M at 1,000, we can now compute level of credit that is consistent with our reserve target, based on M = D + R So, D = 1,000 – 200 = 800, up from 700 D/D-1 = 100/700 = 14% Still restrictive, given that PY rises by 25%, but less restrictive than before History Known at beginning of program period: M-1 = 800, D-1 = 700, R-1 = 100 Recall: M = D + R X-1 = 500, Z-1 = 600, F-1 = 50 Recall: R = PxX – PzZ + F So, R-1 = 500 – 600 + 50 = -50 Current account deficit (-100), smaller overall deficit R-1/PzZ-1 = 100/600 = 0.167 Equivalent to 2 (= 0.167*12) months of imports Weak reserve position Forecast for balance of payments PxX grows by 40%, so PxX = 700 F doubles, so F = 100 Suppose R* is set at 180. Then PzZ = PxX + F + R-1 – R* = 700 + 100 + 100 – 180 = 720 Level of imports is consistent with R* R*/PzZ = 180/720 = 0.25 Equivalent to 3 (= 0.25*12) months of imports Forecast for real sector Increase in PzZ from 600 to 720, i.e., by 20%, is consistent with R* equivalent to 3 months of imports But PzZ depends on PY where P is price level and Y is output Hence, if income elasticity of import demand is 1, PY can increase by 20% E.g., 5% growth and 15% inflation Forecast for money If PY can increase by 20%, then, if income elasticity of money demand is 1, M can also increase by 20% Hence, M can expand from 800 to 960 Determination of credit Having set reserve target at R* = 180 and forecast M at 960, we can now compute level of credit that is consistent with our reserve target So, D = 960 – 180 = 780, up from 700 D/D-1 = 80/700 = 11% Quite restrictive, given that PY rises by 25% Implies substantial reduction in domestic credit in real terms Financial programming step by step: Recap Sequence of steps PzZ = PxX + F + R-1 – R* MV = PY R* Z Y Z = mPY M D D = M – R* Conclusion These slides will be posted on my website: www.hi.is/~gylfason Financial programming is an oral tradition that spans the entire history of the IMF When expressed in simple algebra, financial programming is not to be taken literally as a one-size-fits-all model Fund economists understand that countries differ, and they seek to help tailor financial programs to the needs of individual countries Even so, certain fundamental principles and relationships apply everywhere