Point no 3

advertisement

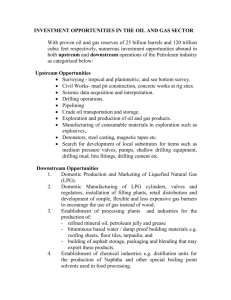

e Oil & Gas Development Company Limited Financial Analysis Report Period coverage: 1st July 2011 to 30th June 2012 Prepared and Presented by: Dr. Babur Zahiruddin Raza, Corporate Office Consultant in Human Resources & Master Trainer in H.R Applications Research Consultant Mr. J. S Khan IT Consultant Mr. Raheel Rustam Ph: 051-5584905, 5792836 Cell: 0332 – 4923235 Email: baburzahiruddin@yahoo.com, 1 Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012 TABLE OF CONTENTS SR no Description Page no 1 Financial analysis approach ------------------------------------------ 3 2 Key discussion points for AGM--------------------------------------- 9 2 Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012 1. FINANCIAL ANALYSIS APPROACH We have tried to perform holistic and integrated financial analysis of OGDCL with the help environmental analysis, industry analysis, company operational review and annual report. 1.1 Flow chart of analysis approach Environmental analysis Industry analysis Operational review of OGDCL Financial analysis 2.2 Requisite essential documents for financial analysis 3 Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012 The under mentioned documents are essential to perform comprehensive analysis of financial position, performance and cash position of OGDCL 1. 2. 3. 4. 5. Financial plan-Year 2011 to 2015 Audited financial statements-Year 2012 Internal audit reports Management letter /. Letter of internal control from external auditors Minutes of board meetings 3. Energy sector analysis Energy is considered to be the lifeline of economic development. For a developing economy with a high population growth rate, it is important to keep a balance between energy supply and emerging needs. If corrective measures are not effectively anticipated significant constraints start emerging for development activities. The rise in global energy demand has raised questions regarding energy security and increased the focus on diversification, generation and efficient allocation. The answer lies in the attainment of optimal energy mix through fuel substitution by promoting energy efficiency and renewable energy and interregional co-operation. However, oil and natural gas will continue to be the world’s top two energy sources through 2040. Pakistan’s economy has been growing at an average growth rate of almost 3 percent for the last four years and demand of energy both at production and consumer end is increasing rapidly. Pakistan’s total energy consumption stood at 38.8 million tonnes of oil equivalent in 2010-11. The relative importance of the various sources of energy consumption of Liquid Petroleum Gas (LPG), electricity and coal has been broadly similar since 2005-06. The share of gas consumption stood at the highest equal to 43.2 percent of the total energy mix of the country, followed by oil (29.0 percent). 3.1 Crude Oil The total supply of crude oil for the fiscal year 2010-11 was 75.3 million barrels. The 68.1 percent was imported and 31.9 percent was locally extracted. 3.2 Natural Gas The consumption of increasing natural gas is rapidly. As on December 31st 2011, the balance recoverable natural gas reserves have been estimated at 24.001 Trillion Cubic Feet. The average production of natural gas during July- March 2011-12 was 4236.06 million cubic feet per day (Mmcfd) as against 4050.64 (Mmcfd) during the corresponding period of last year, showing an increase of 4.57 percent. Natural gas is used in general industry to prepare consumer items, to produce cement and to generate electricity. In the form of CNG, it is used in transport sector and most importantly to manufacture fertilizer to boost the agricultural sector. Currently 27 private and public sector companies are engaged in oil and gas exploration & production activities. 4 Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012 3.3 Liquefied Petroleum Gas-LPG LPG currently contributes only 0.5 percent to the total primary energy supply in the country. However, 87 percent of its demand is met through local production. The rest is imported. This lower share is mainly due to local supply constraints and the higher price of LPG in relation to competing fuels like fuel wood, dung etc. Currently, in Pakistan, out of 27 million households, approximately 6 million are connected to the natural gas network while the rest are relying on LPG and conventional fuels such as coal, firewood, kerosene, biomass etc. LPG has thus become a popular domestic fuel for those who live in areas where the natural gas infrastructure does not exist. The annual total supply of LPG remained 467,476 tonnes; 1, 281 tonnes were produced daily during 2012, out of this 46 percent is produced in the private sector while 54 percent is produced in the public sector. The three main sources of LPG are; refineries 32 percent, gas producing fields 55 percents and imports 13 percent. 3.4 Petroleum products Petroleum products are produced from the processing of crude oil at petroleum refineries and the extraction of liquid hydrocarbons at natural gas processing plants. These products are further classified into Energy and Non-Energy products. Energy products include Motor Spirit, Kerosene, High Octane Blending Component (HOBC), High Speed Diesel Oil (HSD), Light Diesel Oil (LDO), Furnace Oil (FO), Aviation Fuels, Naphtha and Liquefied Petroleum Gas (LPG), while Non- Energy products include Lube Oil, Solvent Oil, Mineral Turpentine (MTT), Jute Batch Oil (JBO), Asphalt, Process Oil, Benzyne Toulene Xylene (BTX), Wax and Sulphur etc. During 2011 the total production of petroleum products (energy and non-energy) remained 9.40 million tones compared to 9.53 million tonnes during 2009-10; thus posting a negative growth of 1.36 percent. Out of 9.40 million tonnes 8.91 million tonnes are energy products while 0.49 million tonnes are non energy products. In these products diesel has the highest share of 34.9 percent followed by Furnace Oil (FO) having 25.9 percent. Motor Spirit and High Octane Blending Component (HOBC) together have 13.3 percent while Aviation Fuels, Naphtha and Liquefied Petroleum Gas (LPG) hold 8.8 percent, 8.6 percent and 1.9 percent respectively. Non-Energy products together have 5.3 percent share in the total production of petroleum products. The total import of petroleum products were 12.37 million tonnes while total export of petroleum products were 1.57 million tonnes in 2010-11. 4. INDUSTRY ANALYSIS We have applied the porter’s five competitive forces model to analyze the Electricity industry and its details are stated as under 4.1 Listed companies in the Oil & Gas sector 1 Attock Petroleum Limited 2 Attock Refinery Limited 3 Burshane LPG ( Pakistan)Limited 4 Byco Petroleum Pakistan Limited 5 Mari Gas Company Limited 6 National Refinery Limited 7 Pakistan Oilfields Limited 8 Pakistan Petroleum Limited 5 Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012 9 10 11 Pakistan Refinery Limited Pakistan State Oil Company Limited Shell Pakistan Limited 4.2 Threat of new entrants Flexible requirements for entry in Oil & Gas industry 4.3 Threat of substitutes At present, the substitute of electricity is not available for consumers 4.4 Bargaining power of suppliers The bargaining power of fuel suppliers is relatively strong Bargaining power of customers The bargaining power of end users is weak 5.CORPORATE AND OPERATIONAL REVIEW OF OGDCL 5.1. Ownership structure SR No 1 2 3 4 5 6 7 8 9 10 11 12 Categories Individuals Investment companies Insurance companies Joint Stock Companies Banks, DFIs, NBFIs Modarabas and Mutual Funds Foreign investors Co-operative societies Charitable Trusts Others OGDCL Employee Empowerment Trust Government of Pakistan Total Number of shareholders 21,706 7 12 129 14 71 117 1 21 120 1 1 22,200 Number of shares % age 32,026,532 646,253 17,019,982 1,445,750 10,649,548 51,055,638 524,981,937 3 970,583 5,334,054 432,189,039 3,224,609,081 4,300,928,400 0.74 0.02 0.40 0.03 0.25 1.19 12.21 0.00 0.02 0.12 10.05 74.97 100.00 5.2 Strategic direction; Vision, Mission and objectives Vision: To be a leading multinational exploration and production company Mission statement: To become the leading provider of oil and gas to the country by increasing exploration and production both domestically and internationally, utilizing all options including strategic alliances. To continuously realign ourselves to meet the expectations of our stakeholders through both management practices, the use of latest technology and innovation for sustainable growth while being socially responsible. 5.3 Overall strategic objectives 1. To build strategic reserves for future growth / expansion 6 Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012 2. To improve reliability and efficiency of supply to the customer 3. To excel in exploration, development and commercialization 4. To improve internal business decision making and strategic planning through state of art MIS . 5.4 Legal status and operational Oil and Gas Development Company Limited (OGDCL), "the Company", was incorporated on 23 October 1997 under the Companies Ordinance, 1984. The registered office of the Company is located at OGDCL House, Plot No. 3, F-6/G-6, Blue Area, Islamabad, Pakistan. The Company is engaged in the exploration and development of oil and gas resources, including production and sale of oil and gas and related activities. The Company is listed on all the three stock exchanges of Pakistan and its Global Depository Shares (1GDS = 10 ordinary shares of the Company) are listed on the London Stock Exchange. 5.5 Number of employees Regular employees: 10,185,000 Contractual employees:218,000 5.6 Quantity sold Year 2011-12 17 2 13,713 381,863 75,005 21,400 19 Wells drilled Oil & Gas discoveries Crude oil sold in thousand BBL Gas solid in MMcf LPG sold in M.Tons Sulphur sold in M.Tons White Petroleum Products sold in thousand BBL 5.7 Key strategic assets of OGDCL A. B. C. D. E. Plant & Machinery Rigs Pipelines Development and production assets Exploration and evaluation assets 5.8 Exploration and development activities As at 30 June 2012, the Company held the largest exploration acreage in the Country having thirty four (34) exploration licenses which include twenty two (22) blocks with 100% interest and twelve (12) blocks as operated JV covering an area of 61,079 Sq. Kms. 5.9 Production Products Crude oil barrels per day 7 FY 2012 37,615 FY 2011 37,370 Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012 Gas MMcf per day LPG 1,091 205 1,013 195 5.10 Identification of key business, financial and non-financial risks as statutory report of directors under section 236 of Companies Ordinance 1984 5.10.1 Exploration and Drilling Risks Exploration risks include selection of incorrect exploration acreage, inaccuracies in acquisition, processing, interpretation of seismic data and selection of exploratory well site. The Company is exposed to variety of hazards during the drilling process including well blowout, fishing, fire and other safety hazards. There is always a risk of failure in drilling exploratory wells. Risk of un-successful drilling has an adverse effect on Company's earnings and growth. 5.10.2 Commodity Price Risk The Company is exposed to fluctuations in international prices of crude oil and other petroleum products, prices of which are determined by reference to the international market prices. International oil prices are volatile and are influenced by global as well as regional supply and demand conditions. This volatility has significant impact on the Company's net sales and net profit. 5.10.3 Credit Risk Credit risk is the potential exposure of the Company to losses in case counter parties fail to perform or pay amounts due. 5.10.4 Security Conditions Security concerns in shape of armed conflict, terrorism, insurgency and political instability constitute security risk and adversely influence the Company operations causing risk of loss or production limitations, threat to the lives of the workers performing duties in these affected operational areas etc. Exposure to such risks act as an impediment in the smooth running of the Company operations particularly in the provinces of Khyber Pakhtunkhwa and Balochistan. 5.10.5 Strategic Risk Strategic risk is the current and prospective impact on Company's earnings or capital arising from adverse business decisions, improper implementation of decisions, or lack of responsiveness to industry changes. 5.10.6 Environmental Risks The Company is not insured against all potential losses and may be seriously harmed by natural disasters or operational catastrophes. The occurrence of events such as earthquakes, hurricanes, floods, blowouts, fires, explosions, equipment failure and other such events that cause operations to cease or be curtailed, may negatively affect OGDCL's business and the communities in which it operates. 5.10.7 Commercial Risk 8 Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012 Calculations of oil and gas reserves depend on estimates concerning reservoir characteristics and recoverability, which geological, geophysical and engineering data demonstrate with a specified degree of certainty to be recoverable in future years from known reservoirs and which are considered commercially producible. The commercial risk associated with the reserves is that the actual quantity of recoverable reserves may be different from the estimated proven and probable reserves. 9 Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012 Key discussion points for AGM Human Resources More than 10000 employees makes OGDCL the second biggest corporate commodity as regards number of employees being second to PTCL. It is plagued with great HR problems. a. Delay in payments to retiring employees for their buy back of shares of OGDCL under BISP. b. The principal of right man for the right job being ignored as internal audit department was headed for 4 months by non qualified person. c. Lack of recognition of merit and discouraging employees who are upright and honest. d. Lack of succession and progression planning. e. Lack of continuous on job training and application of HR principals. f. Too much of excess baggage as most of the employee are retiring in 2013 / 2014 Page 56 of Annual Report Point no 1: Five years strategic plan of OGDCL In the statutory directors reports, managing director / CEO of company state that board of directors have prepared strategic plan of 5 years for OGDCL. We make request to directors to share the key details of strategic plan for the information of members / shareholders. Page 41, 42 and 56 of Annual Report Point no 2: Security conditions, new discoveries and exploration activities In the statutory directors report, managing director share following key information Security conditions- Page 56 of annual report Security concerns in shape of armed conflict, terrorism, insurgency and political instability constitute security risk and adversely influence the Company operations causing risk of loss or production limitations, threat to the lives of the workers performing duties in these affected operational areas etc. Exposure to such risks act as an impediment in the smooth running of the Company operations particularly in the provinces of Khyber Pakhtunkhwa and Balochistan. This is potentially detrimental as Company's exploration, drilling and development activities are hampered due to unfavorable security situation resulting in affecting the Company's sustainable growth. Discoveries-Page 42 of annual report 10 Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012 The Company's exploratory efforts to locate new hydrocarbon reserves yielded two (02) new significant oil and gas discoveries at Nashpa-2 exploratory well in District Karak, Khyber Pakhtunkhwa province and at Zin X-1 exploratory well in District Dera Bugti, Balochistan province. Exploration activities-Page 41 of annual report The Company, however, could not commence operations in eleven (11) exploration blocks namely Latamber, Wali, Jandran, Saruna, Shahana, Samandar, Shaan, Kohlu, Lakhi Rud, Kalchas and Jandran West due to security reasons. In this context, OGDCL is in close liaison with the respective provincial Governments and MP&NR for early resumption of exploration activities in the said blocks. We would make request to directors to share the latest security conditions in the operational areas of Company for the information of members / shareholders of OGDCL. Page 49 of Annual Report Point no 3: The reason of change in the composition of board members-OGDCL The statutory report of directors reveals the fact that following changes had been occurred in the composition of board of directors-OGDCL. Mr. Masood Siddiqui was appointed as MD & CEO on 18 June 2012 in place of Mr. Basharat A. Mirza. Ch. Muhammad Shafi Arshad was appointed as Chairman Board on 25 July 2012 in place of Mr. Muhammad Ejaz Chaudhry. Consequent upon transfer of Mr. Ahmad Bakhsh Lehri as Chief Secretary Balochistan, Mr. Babar Yaqoob Fateh Muhammad was appointed on the Board as Director. Further, M/s Mohomed Bashir, Iskander Mohammed Khan, Mohamed Anver Ali Rajpar, Sheraz Hashmi and Raza Ullah Khan were appointed on the Board as Directors in place of M/s Syed Amir Ali Shah, Dr. Kaiser Bengali, Tariq Faruque, Wasim Zuberi and Mr. Raashid Bashir Mazari. We would make request to company management to share the reasons of changes in board of directors Note # 30.2 on Page 111 of annual report Point no 4: Non-compliance with financial reporting framework The note to the financial statements 30.2 reveals the fact; Various appeals in respect of assessment years 1992-93 to 2002-03, tax years 2003 to 2011 are pending at different appellate forums in the light of the order of the Commissioner of Inland Revenue (Appeals) and decision of the Adjudicator, appointed by both the Company as well as the Federal Board of Revenue (FBR) mainly on the issues of decommissioning cost, depletion allowance and tax rate. 11 Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012 The above mentioned note 30.2 reflects dispute of company management with tax authorities on the issues of decommissioning or depletion allowance. The tax authorities’ stance on decommissioning and depletion allowance is explicitly delineated in Part I of Fifth Schedule under section 100 of Income Tax Ordinance 2001. As per the requirements of IAS 37 and fourth schedule under section 234 of Companies 1984, the provision for disputed tax issues should be recognized in the financial statement or it should be disclosed under the heading of contingencies and commitments. Note # 30.1 on Page 111 of annual report Point no 5: Non statutory corporate tax rate on accounting profits The note # 30.1 contains tax rate of 48.68% on accounting profits of OGDCL where as statutory tax on accounting profits of companies is 35% under Division II, Part I of First Schedule of Income Tax Ordinance 2001. The directors of OGDCL are requested to clarify the query of tax rates on accounting profits for the information of members / shareholders. Page 66 of Annual Report Point no 6: Unusual share of tax obligations in the total liabilities of OGDCL The details of total liabilities of OGDCL as at 30-06-2012 are summarized below. A. Total non-current liabilities: PKR 45,362,739,000 B. Total current liabilities: PKR 24,593,682,000 C. Total liabilities: PKR 69,956,421,000 The details of tax liabilities as at 30-06-2012 are stated as under A. Deferred taxation: PKR 23,545,773,000 B. Provision for taxation: PKR 2,421,831,000 C. Total tax obligations: PKR 25,967,604,000 The % age share of tax obligations in the total liabilities of OGDCL: 25,967,604,000 / 69,956,421,000= 37% 12 Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012 The Directors of OGDCL are requested to clarify the above mentioned query of members Note # 15.2 on Page 101 of Annual Report Point no 7: Non-compliance with section 234 of Companies Ordinance 1984 and paragraph 60 of IAS 1 pertains to current and non-current distinction The 15.2.1 contains disclosure regarding classification judgment of directors to classify short term investment named as term deposit receipts under the heading of Non-current assets which constitute non compliance with paragraph 60 of IAS 1 and section 234 of Companies Ordinance 1984. Note # 18.1 on Page 104 of Annual Report Point no 8: Liquidity and credit risk pertains to circular debt The note # 18.1 reveals the fact that trade debts include amount of PKR 92,878,000,000 which is receivable from oil refineries and gas companies. The directors of company have been negotiating with Government to recover the trade 92.8 billion rupees under the circular debt arrangement. We would like to make request to directors to share details of their efforts regarding the recovery of 92.8 billion rupees during the period from 01-07-2012 to 04-10-2012. Note # 19.1 on Page 104 of Annual Report Point no 9: Provision for doubtful debts for loan and advances of 3.2 billion rupees The 19.1 provide following details regarding the loan and advances amounting to 3.2 billion rupees. “This includes an amount of Rs 3,206 million paid under protest to Inland Revenue Authority on account of sales tax demand raised in respect of capacity invoices from Uch Gas Field for the period from July 2004 to March 2011. The Company has explained its position on various forums and the issue went to Supreme Court of Pakistan which also turned down the appeal. However, the Company has filed a review petition before the Supreme Court of Pakistan and based on advice of legal counsel, the Company strongly believes that the matter will be decided in its favor.” Under the requirements of applicable financial reporting framework of OGDCL the provision for doubt debts amounting to 3.2 billion rupees should be recognized in the financial statement in order to ensure true and fair view of financial performance and position under section 234 of Companies Ordinance 1984. 13 Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012 The impact of non-recording of provision for doubtful debts is summarized as below. A. Overstatement of profits B. Understatement of expenses C. Understatement of liabilities Emphasis of matter paragraph on Page 65 of Annual Report Point no 10: Emphasis of matter paragraph in the audit report under ISA 706 The audit report contains following emphasis of matter paragraphs “We draw attention to Note 18.1 to the financial statements wherein it is stated that trade debts include an overdue amount of Rs 92,878 million receivable from oil refineries and gas companies. We also draw your attention to Note 16.3 to the financial statements wherein it is stated that long term receivable amounting to Rs 606.937 million has not been paid by Karachi Electric Supply Company Limited in accordance with settlement plan. Though the recovery of these debts have been slow due to circular debt issue, the Company considers the amount as fully recoverable for the reason given in the aforementioned notes. Our report is not qualified in respect of this matter” We would like to make request to directors of company to explain the underlying rationale and reason for emphasis of matter paragraphs in the audit report. Note # 27 on Page 109 of Annual Report Point no 11: The substantial increase in the prospecting expenditures The note # 27 on page 109 of annual report reveals the fact that prospecting expenditures were increased from PKR 2,689,007,000 to PKR 4,038,429,000 in Year 2012. We would like to make request to Company directors to explain the underlying reason of increase in the prospecting cost from year 2011 to year 2012. 14 Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012 Note # 28 on Page 109 of Annual Report Point no 12: The substantial increase in the advertising cost The note # 28 on page 109 of annual report reveals the fact that advertising cost was increase from PKR 41,765,000 to PKR 152,023,000 in Year 2012. We would like to make request to Company directors to explain the underlying reason of increase in the advertising cost from year 2011 to year 2012. Note # 24 on Page 106 of Annual Report Point no 13: Sales and profitability of OGDCL Non-financial sales data –Page 30 of annual report Year 2011-12 Quantity sold Crude oil sold in thousand BBL Gas solid in MMcf LPG sold in M.Tons Sulphur sold in M.Tons White Petroleum Products sold in thousand BBL 13,713 381,863 75,005 21,400 19 Year 2010-11 13,224 362,924 71,061 34,400 30 Financial sales data-Page 106 of annual report Year 2011-12 Rupees Gross sales Crude oil Gas Gasoline Kerosene Oil High speed diesel oil Naphtha Liquefied petroleum gas Sulphur Other operating income 15 109,413,764,000 104,924,338,000 172,820,000 48,697,000 6,464,469,000 600,142,000 96,506,000 221,720,736,000 Year 2010-11 Rupees 84,825,937,000 93,823,246,000 75,940,000 47,045,000 1,823,000 151,162,000 5,424,125,000 880,162,000 47,478,000 185,276,918,000 Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012 Commodity Price Risk The Company is exposed to fluctuations in international prices of crude oil and other petroleum products, prices of which are determined by reference to the international market prices. International oil prices are volatile and are influenced by global as well as regional supply and demand conditions. This volatility has significant impact on the Company's net sales and net profit. The analytical review of sales data, figures and commodity price risk reveals the fact that sales and profitability of OGDCL were increased primarily from price fluctuations rather sold units. In the light of above mentioned facts ,we would like to ask a question from Company directors regarding strategic business planning to mitigate the commodity price risk and desired measures to ensure organizational and financial sustainability in OGDCL. CONCLUSION AND SUMMARY OGDCL is like a jewel in the crown for Pakistan as it caters for more than 40% of the hydro carbon inputs of the petroleum industry but it is plagued with great HR and security problems. The new management with a fresh MD may play some pivotal role in stream lining the problems enumerated above but they have a long way to go and a colossal task ahead of them. On the financial side the monster of circular debt looms over their head which will be difficult to tackle in the coming quarter. The two finds at NASHPA and ZINN may give value addition to the company but putting ZINN online will be a big hurdle because of the security problems. The problems of taxation, sales tax and loss of appeal in the Supreme Court may have a negative bearing on the future profitability of the company. Finally a hold status is recommended for the shareholders of OGDCL for the future. DR. BABUR ZAHIRUDDIN 16 Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012