Module 8 Focus on unconditonal cash transfer

advertisement

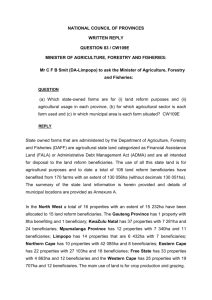

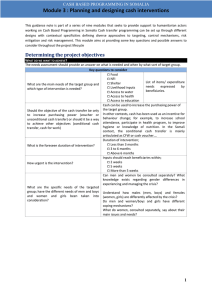

CASH BASED PROGRAMMING IN SOMALIA Module 8 : Focus on unconditional cash transfer This guidance note is part of a series of nine modules that seeks to provide support to humanitarian actors working on Cash Based Programming in Somalia. These guidance notes are meant to provide an overview of the topics while pointing to materials with more in-depth explanations. This module aims at providing some key questions and possible answers to consider throughout the project life cycle. Appropriateness Refer to module on “planning and designing cash intervention” and “implementation cash intervention” for more details. Unconditional cash transfer characteristics: Faster response. Cash transfer requires less steps and avoids the lengthy step of procurement through suppliers Beneficiaries are able to decide how to use the cash. Increase monitoring on market ability to respond. Unconditional cash transfer is the simplest cash modality. It is in fact the most risky as there is little to no control on what beneficiaries spend the cash on, how markets coop with the demand. In order for unconditional cash transfer modalities to achieve their objectives, solid monitoring methods should be in place to measure the impact of the project and to take immediate action should the modalities not allow the project to reach its anticipated objectives. Implementation The implementation of the UCT should refer to “Module 2 When is cash appropriate” and “Module 9 Risk management”. Due to high risk of diversion, for this methodology, the IO should focus on very detailed selection criteria for the beneficiaries with extensive verification of the list and detailed recording on the list of beneficiaries. Key questions to consider Structured answers More than other modalities, the duration of cash transfer project should be limited in time as the situation of the ⧠ Keep the duration of the project short population may be subject to change (evolution of vulnerability enough. status, different places of living not targeted by the project) 〖……….〗 months. For example, in Mogadishu, an NGO was supporting IDPs living in one camp. A few months after the start of the project the evaluation team was barely able to identify beneficiaries as lots of them had moved on the outskirt of the city to reduce the cost of rent and to avoid taxation from gatekeepers. The right people were still receiving the cash but as the IO was not able to find the beneficiaries, the level of monitoring control were not sufficient. The UCT provide a modality of implementation where the beneficiaries are not necessarily met on regular basis if the monitoring system is not strong enough. While voucher approach and cash for work modalities enforce more contacts between the IO and the beneficiaries. As the level of risk is high with unconditional cash transfer, the level of effort on monitoring is foreseen to be more important. Money can be sent using E transfer companies. The benefits of such a modality is that beneficiaries are identified at the beginning of the project can receive their cash directly by phone over a long period without contact with agency staff High NB: CVMG suggest for emergency UCT a period of 3 months before retargeting/re assessing. ⧠ Specific objectives of the project (support to xxx IDPs camp for example) might be amended if the situation of beneficiaries changes (relocation for example). ⧠ Maintain regular contact with beneficiaries to understand their situation and the impact of the cash transfer. This will enable to better appreciate the evolution of the target group but also to amend the project when needed. Frequency of monitoring: 〖……….〗 months. 1 CASH BASED PROGRAMMING IN SOMALIA Module 8 : Focus on unconditional cash transfer frequency monitoring is then needed. ⧠ Market follow up. ……….〗 weeks. ⧠ Level of sophistication and triangulation must be high. The competition between potential beneficiaries to be included in the project could be high and taxation on beneficiaries is may take place more easily with this approach. NB: As the use of phone is key for beneficiaries, some phone interviews through a call centre could be considered (Low cost). ⧠ Monitor regularly acceptance level by nonbeneficiaries and local authorities. ⧠ Monitor regularly possible approach to taxation. Delivering cash E-transfer companies Location Name of the company Name of the E transfer service url Nationlink E-Maal http://nationlinktelecom.com/nationlink/index.php/emaal/cash-in/ Hormuud EVC Plus is an upgraded version of Evoucher http://www.hortel.net/home.php?readmore=52 Mogadishu based Puntland Golis http://golistelecom.com/ Galkayo based Sahal Sahal Express http://www.sahalexpress.net/ Hargeisa based Telesom ZAAD Service http://www.telesom.net/index.php/services/vas-services Use of E-transfer companies Detailed understanding of the potential of E transfer companies As long as phone companies Technology can enable to know a lot – and most probably be too much – on are involved in cash transfer, beneficiary’s behaviour. The IO and the phone operator should define clear the IO can access lots of limits on which information can be accessed. A limit on monitoring and accessing information. certain level of information should also be set up. The phone enables to geo reference the location of the beneficiaries. The use of account can enable to measure how much money is remaining on the account. The list of money transfers could be tracked per client account. While it might not be possible to access this information or to always know the reason for the payment, the association of a phone number or company registered in the same E transfer system can allow understanding how much is spend per category or shop per month. ⧠ Define the list of information requested to the E transfer company and seek signed agreements by beneficiaries before inclusion in the beneficiaries list. What is the capacity of the E The pre financing approach reduces the level of risk for the IO as payment to the E transfer company would occur only when specific deliverables have been transfer company to pre reached (support documents produced, field verification done, …). However, as finance the payment? the E transfer company would take all the risk then the fees for the services are foreseen to increase. Each IO should negotiate with the E transfer the conditions 2 CASH BASED PROGRAMMING IN SOMALIA Module 8 : Focus on unconditional cash transfer of pre financing and final payment. What is the maximum amount per account on the E transfer company? What is the cost of transfer per category of transfer (between companies, between different register users, …)? 〖……….〗 USD. NB: Before some E transfer companies had a maximum capacity per account which was too low for households saving some of the cash received. Amount above this limit were rejected. This limit has now been increased. 〖…….〗 % of amount. NB: Cost of transfer is usually very low and can be free between registered client of the same E transfer company. 3