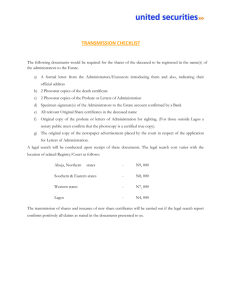

Life Insured Spousal Trust

advertisement

A Matter 0f Trust Jim Bird, CFP, CLU, CH.F.C., FLMI, J.D., LL.B.,TEP Regional Tax & Estate Planning Consultant Burlington, Ontario Estate Planning Principles • Protect and control assets • Maintain flexibility • Retirement plan • Succession plan - who takes over, when under what circumstances Estate Planning Principles re: Taxes • • • • Save or defer taxes and probate fees Pay tax at lowest marginal tax rate Fully utilize capital gain exemptions Take advantage of any “rollovers” Estate Tax Issues • Capital gains taxes arising on death • Recapture of depreciation • Taxation of registered funds • Probate fees Probate Fees (Ontario) • • • • .5% on first $50,000 1.5% on rest Levied on the “Value of Estate” Exemption provided on court form: • Insurance payable to a named beneficiary, or assigned for value • assets held on joint account and passing by survivorship • real estate situated out of Ontario Probate Fees (Ontario) Letters Probate will be required in the following situations: • • • • Estate is involved in litigation Minor children are beneficiaries Real property is to be transferred Assets in a bank or financial institution are greater than $10,000 - $15,000 • Publicly traded shares or Canada Savings Bonds are to be transferred Multiple Wills • Possible method to reduce probate fees • Useful for shareholders of private companies • Can be used to avoid probate on value of private company Trusts • Created during life (“inter vivos”) or at death (“testamentary”) • Trust Uses: 1. Family Trust 2. Spousal (new term “Partner”) 3. Alter-ego/Joint Partner 4. Insurance Trust 5. Trust for Minor or Disabled What is a Trust? Settlor Beneficiaries Trustee Components of a Trust • Settlor - creator or transferor • Trustee - holds legal title • Beneficiaries - entitled to use or enjoyment • income/life • capital/residual • Corpus - trust property • Terms - establish specific rules for duties and operation Trusts - Benefits • • • • • • Transfer ownership but retain control Flexibility Confidentiality Creditor protection Minors and disabled adults cared for Useful in tax/probate planning How are trusts taxed? • Disposition of property on the way in • Except…spousal and alter ego • Separate taxpayer - separate tax return • Testamentary trusts are taxed like individuals • Inter vivos trusts are taxed at a flat rate - the highest marginal rate • Taxed on income from trust property • Deduction for income paid or payable to a beneficiary How are trusts taxed? • Flow through character of income • Deemed disposition of capital property every 21 years • Life Insurance is not capital property • Distribution of trust property to a capital beneficiary at “cost amount” • Except…spousal and alter ego • Attribution 1. Family Trust • Transferring future growth in the family business (often part of an estate freeze) • Income splitting (kiddie tax) • Capital gains exemption multiplication • 21 years and roll out Family Trusts • Common Question • Kiddie Tax - is family trust still useful? • Common Answer • CONTROL; FLEXIBLE DISTRIBUTION; ASSET PROTECTION; CREDITOR PROTECTION….. • Income split with adults (over 18) • capital gains split with minors 2. Partner (Spousal) Trust Why do we use them? • CONTROL OVER ASSETS • spendthrift spouse • preserve assets for children • second marriages • TAX ADVANTAGES • tax-deferred transfer of assets • no 21 year rule • deemed disposition on 2nd death Partner (Spousal) Trust • Common Issues • income must be paid/payable to spouse • spouse does not have to take income • EXCLUDES CAPITAL DIVIDENDS RECEIVED • capital can only be available to spouse during lifetime • doesn’t have to be available to spouse • can’t be available to anyone else Planning Opportunities with Life Insurance PROBLEM: Dad Dad Dad Dad Dad in 2nd marriage - married to Young Sex Kitten owns shares of family business wants to provide income to YSK wants to preserve value of shares for his kids doesn’t want to accelerate tax liability on shares Planning Opportunities with Life Insurance What’s Dad to do?: If leave shares to kids • lose spousal rollover and accelerate tax • what income is available for YSK? • compliance with FLA If leave shares to YSK • get tax deferral • no assurance YSK will leave them to kids SOLUTION: Life Insured Spousal Trust Life Insured Spousal Trust • Spousal trust to preserve shares for kids • Life insurance in corporation to redeem shares on YSK’s death • dad freezes in favour of kids • trust holds preferred shares of corporation • corporation owns joint-second life insurance policy • Redemption subject to stop-loss Planning Opportunities with Life Insurance THE PLAN: •establish spousal trust •corporation purchases Life Insurance •joint second on dad and sex-kitten •minimal level coverage on each •elect AV on first death AV proceeds create CDA credit for corporation If desired, corporation can redeem shares from trust using capital dividends on first death Planning Opportunities with Life Insurance • What have we Done? • Avoided deemed disposition on dad’s death • Redeemed shares without stop-loss rules • Capital dividends not paid to YSK - retained in trust for kids • Income from retained asset payable to YSK • Roll and Redeem 3. Alter Ego and Joint Partner • Transferor must be at least 65 years old • Only settlor or settlor and spouse can receive income during lifetime • Allowed to roll assets into the trust • Inter vivos (taxed at highest rate) • Eliminate probate fees Top Ontario Marginal Tax Rates on Investment Income 2004 Interest Income - 46.4% Dividend Income - 31.3% Capital Gains - 23.2% Top Alberta Marginal Tax Rates on Investment Income 2004 Interest Income - 39.0% Dividend Income - 24.1% Capital Gains - 19.5% 4. What is an Insurance Trust? • An arrangement whereby the capital of the trust is derived from the receipt of insurance proceeds When to use an Insurance Trust: 1) To ensure life insurance proceeds reach the hands of persons intended 2) To ensure insurance proceeds stay out of the hands of persons not intended to benefit Life Insurance Trust • • • • • • Separate testamentary trust Income splitting opportunity Avoids probate Creditor protection Orderly distribution Flexibility Life Insurance Trust • Fred Creates by Will or by Separate Trust Deed • Fred Establishes terms • capital paid to kids at 25 and 30 • power to encroach • income distributed to kids each year • income splitting opportunities - 3 taxpayers are better than 1 (Trust, Pebbles, Wilma) Minor Beneficiaries: The Insurance Act (Ontario) • • Insurance proceeds cannot be paid to an individual prior to attaining the age of majority They have no legal capacity in Ontario until age 18 Minor Beneficiaries • Designate children as beneficiary to avoid paying probate (Bare Trust) • BUT result will be children will take all at age of majority • Trustee will have to go to court for appointment and direction • Cannot encroach on capital 5. Disabled Beneficiaries • Ontario Disability Support Program • is the child dependent on ODSP? • will future employment preclude continued receipt? • do they get disability income from another source (CPP)? • are they nearing age 65 … OAS/GIS will replace ODSP? • size of estate? • ODSP include health benefits package “Grandparented” Recipients • Lifetime exemption from review of the medical health status of the individual • Cancellation of ODSP requires the individual to qualify in another category, some may not (new definition appears to be more restrictive) ODSP Financial Eligibility • If the individual has assets that exceed the limits they risk ODSP cancellation or suspension Exempt Assets • • • • principal residence modified vehicle $5,000 of assets $100,000 (lifetime limit) in a trust from a inheritance or life insurance proceeds • discretionary trust (Henson Trust) $100,000 Trust • Funds may be left directly to a disabled individual • by will • because a family did not have a will • ODSP eligibility can continue if the funds are held in trust and the total lifetime amount does not exceed $100,000 (be careful of accumulations) $100,000 Trust • The individual MUST establish a trust in every case where the asset limit ($5,000) would otherwise be exceeded, even if the individual is capable of managing the funds him/herself • Trust bank account • Cash surrender value of a life insurance policy (annuities, GIA’s, segregated funds) Discretionary “Henson” Trust • Tool to create a trust where no monetary limit applies • Testamentary discretionary trust: Trustee has absolute discretion as to when and how much money the individual would receive, must have more than one beneficiary • The court holds that this is not an asset of the disabled beneficiary if properly structured Discretionary Trust • Income and capital do not vest in the beneficiary • Beneficiary can keep their government benefits • Trustees have authority to decide which beneficiary gets income/capital and amounts Other Considerations Trustee Attributes • Knowledge and skill • Cautions • Determine expertise needed • investments • tax/legal • family needs • Is the estate large enough to hire professional trustee A Matter 0f Trust Jim Bird, CFP, CLU, CH.F.C., FLMI, J.D., LL.B.,TEP Regional Tax & Estate Planning Consultant Burlington, Ontario