Ch 3 - Porter Competitive Model

advertisement

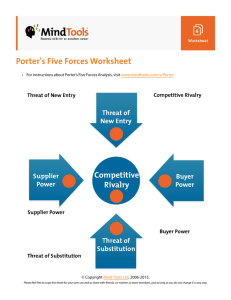

Chapter 3 Porter Competitive Model for Industry Structure Analysis Introduction • Porter Competitive Model • Value Chain Can Information Technology: • Build barriers to prevent a company from entering an industry. • Build in cost; difficult for a customer to switch suppliers. • Change the basis for competition within the industry. • Change the balance of power in the relationship that a company has with customers or suppliers. • Provide the basis for new product and services, new markets or other new business opportunities. Porter Competitive Model Potential New Entrants Bargaining Power of Suppliers Intra-Industry Rivalry Strategic Business Unit Substitute Products and Services Source: Michael E. Porter “Forces Governing Competition in Industry Harvard Business Review, Mar.-Apr. 1979 Bargaining Power of Buyers SUPPORT ACTIVITIES Generic Value Chain FIRM INFRASTRUCTURE HUMAN RESOURCE MANAGEMENT TECHNOLOGY DEVELOPMENT PROCUREMENT INBOUND LOGISTICS OPERATIONS OUTBOUND LOGISTICS MARKETING AND SALES SERVICE PRIMARY ACTIVITIES Adapted with the permission of the Free Press, an imprint of Simon & Schuster Inc.. from COMPETITIVE ADVANTAGE: Creating and Sustaining Superior Performance by Michael Porter. Copyright © 1985 by Michael E. Porter. Key Objective • Gain a competitive advantage! • Understand the forces that influence this. • Know how to use models to do an objective evaluation. Chapter 3 The Porter Competitive Model for Industry Structure Analysis A Successful IS Professional Understands both IT and the business in which they work. Has good communication skills. Can sell their IT solution to someone else’s problem. Is a self starter and can handle a large amount of personal responsibility. Manages their own career. Has a high degree of personal confidence. ATP Approach 1. Read Value Line articles for industry perspective and company information. 2. Log onto the company web page and look at general business information and most recent annual report. A. Determine dominant business. B. Identify business and IT leaders. C. Define the industry the company is in. D. Identify the major markets in which they operate and determine the market that you will analyze using the Porter Competition model. E. Start to develop an understanding of the six primary business strategies in this industry. ATP Research 1. Value Line 2. Company web page and annual report. 3. Internet search engines: Yahoo Ask Jeeves Google 4. Library reference documents 5. Jack Callon and his documents How and Where to Search Company Name and Executive Names Competitor Name/Web Pages IT Publications - Datamation, InformationWeek Business Publications - ABI, Fortune, BusinessWeek Industry Associations - e.g. Semiconductor Industry Association Financial Analysis Web pages Library Reference Desk - Barons, Moodys, etc. Jack Callon’s office Awareness of competitive forces can help a company stake out a position in its industry that is less vulnerable to attack. Michael E. Porter Competitive Strategy The Plan • Address the Concepts of the Porter Competitive Model. • Provide some industry examples using the Competitive Model. • Address the Value Chain conceptually and with industry examples. • Revisit each of these using the Airline Industry as the example in Chapter 4. Porter Competitive Model • Was not developed for IS use. • Breaks an industry into logical parts, analyzes them and puts them back together. • Avoids viewing the industry too narrowly. • Provides an understanding of the structure of an industry’s business environment. • Provides an understanding of competitive threats into an industry. Two Key Questions 1. How structurally attractive is the industry? 2. What is the company’s relative position within the industry? Why Do You Care? The collective strength of the industry forces determines the ultimate profit potential of an industry. The strongest competitive forces are of greatest importance in formulating competitive strategies. Every industry has an underlying structure, or a set of fundamental economic and technical characteristics that gives rise to these competitive forces. Why Do You Care? This view of competition pertains to industries selling products and those dealing in services. A few characteristics are often key to the strength of each competitive force. Key Industry Analysis Factors • Collecting the data. • Determining which data is crucial. • Selecting an appropriate overall approach. • Deciding on the logical starting point. Basic Objectives of the SBU 1. To create effective links with buyers and suppliers. 2. To build barriers to new entrants and substitute products. Porter Competitive Model Potential New Entrants Bargaining Power of Suppliers Intra-Industry Rivalry Strategic Business Unit Bargaining Power of Buyers Substitute Products and Services Source: Michael E. Porter “Forces Governing Competition in Industry Harvard Business Review, Mar.-Apr. 1979 Figure 3-1 Rivalry Likelihood • Profit margins. • Industry growth rate and potential. • A lack of capacity to satisfy the market. • Fixed costs. • Competitor concentration and balance. • Diversity of competitors. • Existing brand identity. • Switching costs. • Exit barriers. A Buyer Has Power If: 1. It has large, concentrated buying power that enables it to gain volume discounts and/or special terms or services. 2. What it is buying is standard or undifferentiated and there are multiple alternative sources. 3. It earns low profit margins so it has great incentive to lower its purchasing costs. 4. It has a strong potential to backward integrate. 5. The product is unimportant to the quality of the buyers’ products or services. A Supplier Has Power If: 1. There is domination of supply by a few companies. 2. Its product is unique or at least differentiated. 3. It has built up switching costs. 4. It provides benefits through geographic proximity to its customers. 5. It poses a definite threat to forward integrate into its customers’ business. 6. A long time working relationship provides unique capabilities. Definitions New Entrant: An existing company or a startup that has not previously competed with the SBU in its geographic market. It can also be an existing company that through a shift in business strategy begins to compete with the SBU. Substitute Product or Service: An alternative to doing business with the SBU. This depends on the willingness of the buyers to substitute, the relative price/performance of the substitute and/or the level of the switching cost. Possible Barriers to Entry • Economies of scale. • Strong, established cost advantages. • Strong, established brands. • Proprietary product differences. • Major switching costs. • Limited or restrained access to distribution. • Large capital expenditure requirements. • Government policy. • Definite strong competitor retaliation. Substitute Threats • Buyer propensity to substitute. • Relative price/performance of substitutes. • Switching costs. Competitive Strategy • What is driving competition in my current or future industry? • What are my current or future competitors likely to do and how will we respond? • How can we best posture ourselves to achieve and sustain a competitive advantage? Strategy Options According to Michael Porter Primary Strategies 1. Differentiation 2. Least Cost Supporting Strategies 1. Innovation 2. Growth 3. Alliance Can Information Systems: 1. Build barriers to prevent a company from entering an industry? 2. Build in costs that would make it difficult for a customer to switch to another supplier? 3. Change the basis for competition within the industry? 4. Change the balance of power in the relationship that a company has with customers or suppliers? 5. Provide the basis for new products and services, new markets or other new business opportunities? Porter Competitive Model Heavyweight Motorcycle Manufacturing Industry North American Market • Parts Manufacturers • Electronic Components • Specialty Metal Suppliers • Machine Tool Vendors • Labor Unions • IT Vendors Bargaining Power of Suppliers • Automobiles • Public Transportation • Mopeds • Bicycles • Foreign Manufacturer Potential New Entrant Intra-Industry Rivalry SBU: Harley-Davidson Rivals: Honda, BMW, Suzuki, Yamaha Substitute Product or Service • Established Company Entering a New Market Segment • New Startup Bargaining Power of Buyers • Recreational Cyclist • Young Adults • Law Enforcement • Military Use • Racers Business Strategy Model - Motorcycle Manufacturing Industry Product Strategy Type/Purpose/Size Heavyweight Off-Road Dual Purpose Road Racing Café Racer Price Strategy Entry Level Law Enforcement Moderate Market Strategy Premium Military Recreational Professional Young Adult North American Europe Japan/Asia Manufacturing Strategy Vertically Integrated Vendor Emphasis Latin America Outsource Sales/Distribution Strategy Distributors Independent Dealers Franchised Dealers Company Structure Independent Alliances Joint Ventures/Subsidiaries Information Systems Engineering Product Design Manufacturing Sales/Distribution Business Porter Competitive Model Analysis for the San Francisco Giants New Entrants Suppliers Intra-Industry Rivalry SBU: SF Giants Substitute Products and Services Buyers Porter Competitive Model Analysis for the San Francisco Giants Bay Area Market New Entrants •Arena Football League •Canadian Football •Professional Hockey •Professional Soccer •Sumo Tournaments Suppliers •Players Union •City of SF •Transportation Services •Food Service •Sovereigns •Police and Sanitation Service •Utilities •Stadium Employees Buyers •Die Hard Giants Fans •Die Hard Baseball Fans Intra-Industry Rivalry •Fair Weather Baseball Fans SBU: SF Giants •Non-baseball Fans •Rivals: Oakland A’s •Out of Town Visitors •Minor League Baseball •Opposing Team Fans •S.F. 49ers •Age Group Segments •Golden State Warriors •Groups Versus Individuals •College Athletic Events •Corporate Sponsors •High School Athletic Events •Sports Writers and Media •Movies, Stage Plays, etc. Outlets •General Travel and Travel Packages Substitute Products and Services •Televised Baseball Games - Free or Cable Service at Home •Televised Games at Sports Bars • Radio Broadcasts of Baseball Games • Rotisserie Leagues, Trading Cards, Memorabilia Porter Competitive Model Venture Capital Industry in the U.S. •More firms •More capital •Diminishing opportunities •Cut-throat competition •Higher deal prices Potential New Entrants • Low Barriers to Entry • Rapid Entry • Attractive Rates of Return • More global sources Intra-Industry Rivalry Bargaining Power of Suppliers • Concentration in the hands of a few institutions • Increasing sophistication • Better information SBU: Kleiner Perkins Caufield & Byers Rivals: Hambrecht & Quist Sequoia Capital Sierra Ventures Sequoia Capital Arthur Rock & Co. Asset Management Corp. Substitute Products and Services Bargaining Power of Buyers • Increasing sophistication • More options • Better information • Breakdown of industry boundaries VC Sponsored Companies • • • • • • • Digital Equipment Apple Computer Federal Express Sun Microsystems Compaq Lotus Development Staples Major Start-up Company Sources • Stanford University • MIT • University of Texas Venture Capital Industry • The roots of the industry can be traced to the 1920s and 1930s within the U.S. • Early companies that obtained VC funding were Eastern Airlines and Xerox. • First VC firm was ARD in 1946 founded by Ralph Flanders, President of Federal Reserve Bank of Boston. • Big push to take advantage of WWII technology developed at MIT. • The industry all but shut down between 1970 and 1977. • Economic growth implications of emerging, small companies. VC Strategies in 1960-1970 • • • • • Invest in management team and market potential. Stress value-added company building. Concentrate on start-up and early stage companies. Be a lead investor. Invest for ten years, maybe longer but harvest when appropriate. • Raise a new fund once your present fund is performing well. • Deal making and transaction skills are important but not central to the value creation process. 1980 and Beyond Strategies • Raise new funds while the money is flowing instead of when you need the money. • Rely on financial engineering for quick entry and exits. • Exploit hot IPO markets to harvest early and often. • Co-invest versus being the lead investor. • Look to later-stage LBO and MBO deals for large minimums and faster returns. • Worry less about the management team (You can shape it later). • Worry more about the fiduciary expectations of the limited partners. • Trade the horse before it dies. Porter Competitive Model Education Industry: U.S. Universities Potential New Entrants Bargaining Power of Suppliers • Faculty • Staff • Equipment and Service Suppliers • Alumni • Foundations • Business • Government • Foreign Universities • Distance Learning • Motorola U. • National Technical University Intra-Industry Rivalry Strategic Business Unit Substitute Products and Services • Books and Videotapes • Computer-Based Training • Training Companies • Consulting Firms Bargaining Power of Buyers • Students • Parents • Business • Employers • Legislators U.S. University Industry Structure Intra-Industry Rivalry: Low growth rate or shrinkage Excess capacity Undifferentiated product Competition for funding and contributions Bargaining Power of Buyers: Price Pressures Mobility Bargaining Power of Suppliers: Cost Pressures Bid Processes Are Common Unions and Tenure Barriers to Entry: Low entry barriers High exit barriers Substitutes: Easy to substitute Self-study success Porter Competitive Model Tips 1. To incorrectly define the industry can cause major problems in doing Section I of the analysis term paper. 2. You must identify the specific market being evaluated. 3. Your analysis company is the Strategic Business Unit. 4. Identify rivals by name for majors, by category for minor rivals if needed to present the best possible profile of rivals. Porter Competitive Model 5. Be sure to address the power implications of both customers and suppliers. Power buys them what? 6. Identify buyers and suppliers by categories versus companies. 7. Summarize your Porter Model analysis. Computer Industry Why is this industry more of a challenge to evaluate using the Porter Competitive Model? Old Computer Industry Layer 5 Distribution Layer 4 Application Software Layer 3 Operating System Software Layer 2 Computing Platforms Layer 1 Basic Circuitry IBM DEC HP Fujitsu NCR Figure 3-3 The New Computer Industry Layer 5 Distributors Computer Dealers Super Stores Mass Clubs Merchandisers Mail Order Value-add Resellers Direct Sales Force Other Layer 4 Applications Lotus 1-2-3 •Spreadsheets •Word Processors •Database Layer 3 Operating System Software Layer 2 Computer Platforms Layer 1 Microprocessor MS DOS Novell Netware IBM Compaq Intel X86 Microsoft Excel Windows Quattro Pro OS/2 Banyan Unix IBM Other Intel-Based PCs Motorola Apple Others Apple Macs RISC Other Power PC Figure 3-4 Computer Industry Market Segments •Supercomputers •Hardware •Mainframes •Software •Minicomputers •Services •Workstations •Telecom Networks? •Personal Computers •Peripheral Equipment PC Industry Segment 1. Passed $100 billion in sales in the first ten years. 2. Growth and competition was based on industry standards like never before. 3. This has spawned thousands of niche companies. 4. The PC has fundamentally restructured the Computer Industry. 5. Industry pioneers believe the revolution is no more than half over. Change Relative to Selling PCs 1. Languages 2. Application Packages 3. Connectivity and Compatibility 4. Multimedia 5. Groupware Computer Industry Of the top fifteen companies in 1975, only four remain: • IBM • NEC • HP • NCR The Old Computer Industry IBM and the BUNCH Burroughs Univac NCR Control Data Honeywell PC Industry Change • Atari • Compaq • Cromemco • Dell • Fortune Systems • Gateway • Wicat Systems • IBM • Kaypro • HP • Morrow Designs • NEC • Osborne Computer • Victor Technologies The Future Computer Industry 1. Traditional US Companies (large). 2. Asian Electronic Companies. 3. The New Strategy Companies. Why has the US continued to be the world leader in the computer industry? Porter Value Chain Basic Concept: 1. Deals with core business processes. 2. Enables tracking a new idea to create a new product and/or service from origination all the way to customer satisfaction. Porter Value Chain Manufacturing Industry Value Chain Research and Development Production Engineering and Manufacturing Sales Marketing and Distribution Service Retail Industry Value Chain Partnering with Vendor Managing Buying Inventory Distributing Operating Inventory Stores Marketing and Selling Value Chain Things to Remember 1. Value to customer objective is not clear. 2. Relay team concept is too time consuming and doesn’t work in the current competitive environment. 3. Maximize the value-add activities and eliminate as much as possible the things that do not add value. 4. Make sure that each step in the overall process (each function) does things consistent with the overall objective of value to customer. SUPPORT ACTIVITIES Generic Value Chain FIRM INFRASTRUCTURE HUMAN RESOURCE MANAGEMENT TECHNOLOGY DEVELOPMENT PROCUREMENT INBOUND LOGISTICS OPERATIONS OUTBOUND LOGISTICS MARKETING AND SALES SERVICE PRIMARY ACTIVITIES Adapted with the permission of the Free Press, an imprint of Simon & Schuster Inc.. from COMPETITIVE ADVANTAGE: Creating and Sustaining Superior Performance by Michael Porter. Copyright © 1985 by Michael E. Porter. Figure 3-6 Property and Casualty Industry Value Chain FIRM INFRASTRUCTURE -Financial Policy HUMAN RESOURCE MANAGEMENT -Regulatory Compliance - Accounting Agent Training Actuary Training Actuarial Methods Investment Practices TECHNOLOGY DEVELOPMENT - Legal Product Development Market Research Claims Training Claims Procedures I/T Communications PROCUREMENT •Policy Rating • Underwriting • Investment •Independent Agent Network •Billing and Collections •Policy Sales •Policy Renewal •Agent Management •Advertising INBOUND LOGISTICS OPERATIONS OUTBOUND LOGISTICS MARKETING AND SALES •Claims Settlement •Loss Control SERVICE Included with permission of Michael E. Porter based on ideas in Competitive Advantage: Creating and Sustaining Superior Performance, copyright 1985 by Michael E. Porter. Figure 3-7 Technologies in the Value Chain Information System Technology Planning and Budgeting Technology Office Technology FIRM INFRASTRUCTURE Training Technology Motivation Research Information Technology HUMAN RESOURCE MANAGEMENT Product Technology Computer-Aided Design Pilot Plant Technology TECHNOLOGY DEVELOPMENT Software Development Tools Information Systems Technology Information Systems Technology Communication System Technology Transportation System Technology PROCUREMENT •Transportation Technology •Material Handling Technology •Storage and Preservation Technology •Communication System Technology •Testing Technology •Information Technology INBOUND LOGISTICS •Basic Process Technology •Materials Technology •Machine Tools Technology •Materials Handling Technology •Packaging Technology •Testing Technology •I/nformation Tech. OPERATIONS •Transportation Technology •Material Handling Technology •Packaging Technology •Communications Technology •Information Technology •Multi-Media Technology •Communication Technology •Information Technology •Diagnostic and Testing Technology •Communications Technology •Information Technology OUTBOUND LOGISTICS MARKETING AND SALES SERVICE Adapted with the permission of the Free Press, an imprint of Simon & Schuster Inc.. from COMPETITIVE ADVANTAGE: Creating and Sustaining Superior Performance by Michael Porter. Copyright © 1985 by Michael E. Porter., p. 167. Figure 3-8 Summary of Chapter 3 The Porter Competitive Model for Industry Structure Analysis By Sandra Chu Chapter Objectives 1. To identify significant forces in addition to direct competitors and customers that impact a company’s position within an industry. 2. To understand the importance of basic objectives that a company has relative to the forces within the Competitive Model. 3. To appreciate the power implications within the Porter Competitive Model. 4. To understand the two basic strategies and three supporting strategies used by intra-industry rivals. 5. To recognize industry characteristics that make the use of the Porter Competitive Model most effective. Porter Competitive Model Potential New Entrants Bargaining Power of Suppliers Intra-Industry Rivalry Strategic Business Unit Bargaining Power of Buyers Substitute Products and Services Source: Michael E. Porter “Forces Governing Competition in Industry Harvard Business Review, Mar.-Apr. 1979 Figure 3-1 Industry Structure and the Company Position • How significant is the structure of the industry to existing companies and possible new entrants or providers of substitute products or services? • What is the company’s relative position within the industry? Porter Competitive Model • Intra-Industry Rivalry – Logical starting point. – Deals with the nature and degree of competition. • Strategic Business Unit has two primary objectives: – Create effective links with buyers and suppliers – Build barriers to new entrants and substitutes SBU and Competitive Strategies Primary Strategies: • Differentiation: be different, be unique at meeting some need valued by the customer. • Low-Cost: be the cheapest. Supporting Strategies: • Innovation: doing creative, often original things. • Growth: stressing the importance of business growth. • Alliances: competing through formalized relationships with other business enterprises. Porter Competitive Model • Threat of New Entrants – Two possible sources. – Consideration of barriers to entry. • Threat of Substitute Products or Services – Important to clearly understand the definition. – Focus on viable alternatives. – Determine attractiveness and deterrents of substitutes. The Value Chain • Systematic method for examining the business processes of a firm and the interactions between them. • Idea of a “chain” -- identify core business processes and how they can be linked. Value Chain 1. The ultimate objective is value to customer. 2. A focus needs to be on value-add activities and trying to eliminate as many activities as possible that do not add value to customer. 3. Make sure that specific business functions keep in mind the ultimate objective and not become distracted by doing things that seem to make them look good. 4. Remember that time has become a major competitive consideration and that a relay team concept can contradict this premise. Conclusions • The Porter Competitive Model is key to understanding business competitiveness. • It is important for a company to assess its position within an industry and relative to customers and suppliers. • The model can be used to understand if IT can change the competitive environment of an industry. Possible Exam Questions 1. Identify an industry where information systems act as a significant barrier to entry and explain the significance of this barrier. 2. Identify and explain the two basic strategies and three supporting strategies used by intra-industry rivals. 3. What is the primary benefit to be derived through the use of the Porter Value Chain? 4. Explain the logic of growth as a competitive strategy and provide two company examples where this was a key strategy.

![[5] James William Porter The third member of the Kentucky trio was](http://s3.studylib.net/store/data/007720435_2-b7ae8b469a9e5e8e28988eb9f13b60e3-300x300.png)