mslpw -valuasi sumberdaya lahan

Soemarno

PMPTA-MSLPW-April 2013

Konservasi

Peningkatan

Kesejahteraan

Masyarakat

Rehabilitasi

Penghematan

SUMBERDAYA

MSL:

…….

Proses yg secara berkelanjutan mengoptimalkan manfaat SDL melalui penyerasian aktivitas manusia sesuai dg kemampuan / daya dukung SDL

Kerusakan SDL dan pencemaran LH semakin mengancam keberlanjutan pembangunan

Lemahnya penegakan hukum

Rendahnya komitmen penaatan hukum

Krisis

Ekonomi

Moneter

Rendahnya

Kepedulian

Lingkungan

Hambatan

Hak

Pemilikan

Kerusakan SDL dan pencemaran LH semakin mengancam keberlanjutan pembangunan

Kualitas hidup manusia Indonesia semakin menurun , indikatornya:

Kematian bayi lahir

Penyakit akibat

Pencemaran

Air & udara

Gizi

Anak

BALITA

Pudarnya

Budaya-

Kearifan

Masyarakat

SDA-LH

Kualitas

Kawasan

Konservasi/

Lindung

Perubahan lingkungan hidup global semakin mengancam kualitas lingkungan biosfer, indikatornya:

Suhu bumi meningkat

Perubahan pola iklim

Penipisan

Lapisan

Ozon

Pengelolaan SDA-LH telah berkembang menjadi isuisu politik yg dapat mengancam sinergisme antar daerah

Sumberdaya Air:

Permukaan

Bawah tnh

Kuantitas

Kualitas

Distribusi

Sumberdaya

Lahan &

Hutan

GOOD ENVIRONMENTAL GOVERNANCE

Lembaga

Legislatif &

Peradilan

Independen

BerkeadilanKo ntrol sosial yg efektif

Masyarakat yang

MADANI

Birokrasi

Profesional

Integritasmoral

Desentralisasi

PSDA-LH yg efektif berdaya-guna

NILAI atau VALUE

Sumberdaya lahan merupakan komoditi ekonomi yang dapat dijual, dibeli, disewakan, digadaikan, dan dikenai pajak .

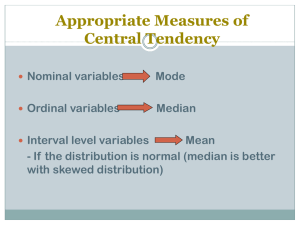

NILAI EKONOMI mempunyai tiga komponen:

1. Bendanya mempunyai manfaat (useful)

2. Ketersediannya (supply) terbatas, kelangkaan

3. Hak pemilikan, property right

Nilai ekonomi senantiasa diasosiasikan dgn Nilai Pasar

Nilai ekonomi, terkait dengan konsep:

Manfaat, Kepuasan, Utility

.

Produksi

Biaya dan Harga

VALUASI EKONOMI: Penilaian & Penaksiran

Ada tiga metode yang lazim dipakai:

1. Pendekatan perbandingan pasar

2. Pendekatan kapitalisasi pendapatan

3. Pendekatan penggantian biaya.

Perbandingan Pasar

Pendekatan ini mampu mendekati kenyataan untuk menaksir nilai pasar dari sumberdaya lahan, kesulitannya ialah mencari nilai pasar yang berlaku secara umum.

Penerapan metode ini mempertimbangkan 3 hal:

1. Aspek-aspek fisik: ukuran lahan, bentang lahan, profil tanah, kualitas dan karakteristik lahan, harapan perkembangan

2. Aspek-aspek lokasi, lingkungan ekologi & sosial

3. Aspek pasar: suku bunga, harga riil, penawaran tertinggi dan terendah

PENDEKATAN KAPITALISASI PENDAPATAN

Pendugaan nilai-pasardari lahan mengunakan persamaan dari nilai sekarang (nilai kini) dan nilai harapan di masa mendatang mengenai “sewa lahan”.

1

V = a/r [ 1 - -------- ]

(1-r) x

V = Nilai lahan a = rataan pendapatan yg diharapkan dari sewa lahan di masa mendatang r = suku bunga yg dipakai pd proses kapitalisasi x = tahun

Beberapa faktor untuk menduga nilai “a” adalah:

1. Perkiraan sewa tanah di masa mendatang

2. Tingkat kapitalisasi:

2.1. Metode penjumlahan

2.2. Ikatan investasi

2.3. Perbandingan

3. Penggunaan multiplier sewa lahan

PENDEKATAN PENGGANTIAN BIAYA

Asumsi: Ada hubungan antara biaya produksi dengan nilai pasar .

Untuk menentukan besarnya penerimaan diperlukan lima faktor:

1. Adanya teknik baku yg berlaku untuk berbagai kondisi lahan

2. Penerimaandari penggantian biaya dan taksiran nilai

3. Pendekatan yang lebih mudah dan sederhana

4. Kecenderungan penaksir dlm menentukan harga jual sebagai ukuran untuk nilai jaminan

5. Kesukaran yg mungkin timbul akibat digunakannya pendekatan kapitalisasi pendapatan.

Tiga masalah yg mungkin timbul:

1. Perkiraan biaya dari nilai yang dapat diperbandingkan

2. Penentuan biaya dari bangunan & perlengkapannya

3. Perkiraan depresiasi dan degradasi kualitas lahan

Mengestimasi penggantian biaya

1. Metode survei kuantitas

2. Metode unit biaya

3. Metode suku kuadrat dan suku pangkat tiga

The Market and Land

Use

Why is a particular piece of land used in aparticular way ?

One piece of land used for agricultural production,

Another for an industrial site, and

A third piece of land used for office blocks.

QUALITY & LOCATION of a piece of land

KUALITAS LAHAN

Kualitas lahan merupakan konsep “fungsional”, harus didefinisikan dalam kaitanhnya dengan aktivitas tertentu pemanfaatannya/penggunaannya.

Kualitas lahan untuk memproduksi tanaman tgt pd iklim, topografi, tipe tanah, dan kesuburannya; semua faktor ini berpengaruh pd pertumbuhan tanaman, biaya produksi dan biaya panen.

Setiap aktivitas penggunaan mempunyai persyaratan tertentu.

LOKASI LAHAN

Teori lokasi lahan ini pertama kali dikemukakan oleh von-Thunen dari Jerman.

Teori ini berdasarkan pada biaya angkut hasil panen pertanian ke pasar.

Nilai lokasi = f (biaya transportasi, jarak riil)

QUALITY OF

LAND

(a) Revenue & Cost

A : lahan kualitasnya rendah unt memproduksi jagung

B : lahan kualitasnya medium

C : lahan kualitasnya tinggi.

A

(b) ceiling rent

Cost of production

B

Net revenue

Total revenue

C

Low Kualitas lahan High

LOCATION OF

LAND

Teori Lokasi ini pertama kali dikembangkan oleh von Thunen.

Nilai lokasi sebidang lahan ditentukan oleh jaraknya dari pusat pasar; Jarak ini akan menentukan biaya transportasi hasil produksi lahan

(a) Revenue , Cost, Ceiling rent (Rp/ha)

Ceiling rent

Cost of transport

Cost of production

Pasar

(b) cost of transport

Pasar jarak ke pasar

Jarak ke pasar

Kentang

Daging

Total revenue

LOCATION

OF

LAND

(a) Ceiling rent (Rp/ha)

Asumsinya: Kualitas lahan sama

Petani kentang akan bersedia menyewa lahan di dekat pasar dengan nilai sewa yang lebih besar dibandingkan dengan peternak sapi potong

Daging

Kentang

Jarak ke pasar

X O X

Pasar Jarak ke pasar

Daging

Kentang

Pasar

Daging

Interaksi Lokasi -

Kualitas Lahan

Biaya transportasi biasanya dipengaruhi oleh:

1. Aksesibilitas lahan thd jalur komunikasi / transport yg baik

2. Biaya transportasi meningkat linier dg jarak ke pasar

3. Kualitas lahan tidak seragam

4. …….

(a) Harga pasir atau batu bahan bangunan (Rp/ton)

P

Revenue & cost (rp/ton)

Harga pasir di pasar

Revenue per ton pasir dikurangi biaya transpor ceiling rent

Q

Extraction cost

Lokasi A Lokasi B

Pasar Jarak ke pasar

Lokasi B mempunyai kualitas lebih baik untuk penambangan pasir dan batu, shg biaya ekstraksinya lebih murah

Industrial vs

Urban Land-Use

Penetapan lokasi industri:

1. Biaya transportasi bahan mentah

2. Biaya distribusi hasil produksi ke pasar

3. Lokasi optimum

Total Biaya transport minimum

Transport Cost per ton produce (Rp)

(a). Heavy industry

Total transport cost

Transport cost of raw materials

Transport cost of product

Raw Material

Biaya jagung

Jarak Market

(b). Usahatani Jagung

Total biaya

Biaya distribusi

Biaya produksi

Lahan usaha Jarak Pasar

Ceiling rent for

Urban- sites

Penetapan lokasi industri:

1. Lokasi Toko A dan Toko B identik, hanya Toko A lokasinya lebih dekat dengan pusat kota

2. Q

A

: Permintaan barang di toko A dg harga P

3. Q

B

: Permintaan barang di toko B dg harga P

Harga barang

P

Rp/ha

Q

B

Q

A

Demand at A

Demand at B

Kuantitas barang ceiling rent operating cost

A B

Total revenue

Urban Ceiling rent vs Landuse

Concentric landuse zoning :

1. The central zone is devoted to offices, dept. Store, commercial uses, etc.

2. Industry, residential uses, ets

3. Agriculture

Ceiling rent

Offices

Town centre

Manufacturing, Warehouses, Industry

Residential agriculture

Jarak

Offices Residensial

Industry

Industry &

Warehouses

Pertanian

Land Use

Planning

Land use planning -------- Land Suitability Analysis (LSA)

Tiga fase dalam LSA :

1. Asses the requirements of potential activities

2. Determine the capability of the land resources

3. Match land resources capability to the needs of society

Agricultural Land Use Planning (Teladan dari Young & Goldsmith)

Enam alternatif penggunaan lahan adalah:

1. Annual cropping

2. Perennial cropping

3. Livestock

4. Natural forest

5. Plantation forest

6. Tourism & Recreation.

(1). Asses requirements of potential activities

Persyaratan Arable Cropping di Malawi (Young & Goldsmith, 1977)

Karakteristik lahan Persyaratan Limitasi Diagnostic measure

Drainage

Bahaya erosi

Free

Nil/Low

Zone perakaran Deep soil Shallow soil

Easy root penetration

Retensi hara High

Poor

High

Kelas drainase tanah

Slope; Soil permeability index

Kedalaman efektif

Poor Tekstur / Struktur

Low KTK

Land Use

Planning

(2). Determine the capability of land resources

Aerial photography -------- to identify areas characteristics

Ground analysis ------------ to asses the diagnostic features of land unit

Data management -------------

Analysis & interpretasi -------

Suitability of land unit for arable cropping (Young & Goldsmith)

Land unit Drainase

Lilongwe

Thiwi

Dedza mountains

Bahaya erosi Zone perakaran

Mainly free drained Nil to Low Very good (deep

(75% free, (Slope < 3%) well structured soil)

25% imperfect)

Mainly free Low to medium Moderate

Free

(Slopes 6o) Soil depth < 100 cm

Medium to high Poor (Shallow soils)

(steep slopes)

Suitability

Highly suitable

(S1)

Marginally suitable (S3)

Permanently not suitable (N2)

Kesesuaian unit lahan untuk suatu aktifitas dinilai pd kisaran sekala:

1. S1 : Highly suitable

2. S2 : Moderately suitable

3. S3: Marginally suitable

4. N1: Currently not suitable

5. N2: Permanently not suitable.

Land Use

Planning

(3). Match land resource capability to the needs of activities

Hasil LSA menyatakan “production possibility” untuk setiap land unit, belum mencerminkan “the best allocation”

Alokasi penggunaan lahan lazimnya melibatkan kebijakan pembangunan daerah, sehingga seringkqali harus ada trade-off dalam pengambilan keputusan

Suitability of land units

Land unit Annual Perennial Livestock Natural Plantation Tourism and cropping cropping forests forests recreation

Lilongwe

Thiwi

Dedzamountains

S1

S3

N2

N2

N2

N1/N2

S2

S2

S2 n.a.

S2

S3

S2

S2

S1 n.a.

n.a

S2

Kelemahan LSA dari perspektif ekonomi:

1. Existing versus potential capability

2. Location, biasanya berkaitan dengan biaya transportasi dan konservasi SDA

3. External effects, biasanya berkaitan dengan pencemaran lingkungan

NILAI EKONOMI LAHAN

LAND VALUATION

Land valuation typically involves numerous calculations to determine how much money a plot of land is worth. Among other things, valuation requires a determination of how much the land is worth independent of any buildings, how much the neighborhood is expected to develop in future years, and the likelihood of either appreciation or depreciation. Performing land valuation is generally a very complex endeavor. Valuation assessors often use more than one method of determining land value before coming to a final number.

Knowing land value is important for a number of reasons.

Prospective land purchasers often want to know how much a piece of land is worth before investing in it, for instance. Governments also have an interest in knowing how much a given piece of land is worth in order to assess property taxes. Land valuation is the process of ascertaining the actual current value of any piece of land, developed or not.

Diunduh dari: http://www.wisegeek.com/what-is-involved-in-land-valuation.htm…………….. 26/2/2013

NILAI EKONOMI LAHAN

Prinsip-Prinsip Nilai

There are twelve principles of value used to determine highest and best use and to establish value:

1. Anticipation: the anticipated future benefits to be derived from the property.

2. Balance: the equilibrium reached in a free market when complementary uses of neighboring property permit maximum value for individual properties and the neighborhood.

3. Change: the continuing effects of economic, social, and governmental forces on the property and its environment, resulting in continuous change in market value which must be anticipated.

4. Competition: the tendency of a highly profitable use to be duplicated by others until an excess supply of similar goods and services reduces profitability, and thus value.

5. Conformity: the creation of maximum market value through a reasonable degree of similarity of property use, appearance, and owner demographics.

6. Consistent Use: the requirement to value all aspects of a property: land, improvements, and personal property on the basis of a single class of usage at any given point in time.

Diunduh dari: http://pinalcountyaz.gov/Departments/Assessor/Appraisal/Pages/Principles.aspx …………….. 26/2/2013

NILAI EKONOMI LAHAN

Prinsip-prinsip Nilai

There are twelve principles of value used to determine highest and best use and to establish value:

1.

Contribution: the incremental amount of value contributed to the total value of a property by any given component, as opposed to the actual cost of the component.

2.

Demand: the amount of a commodity, good or service that would be purchased at various prices during a specific period.

3.

Substitution: the market value of a property is affected by the cost of obtaining an equally desirable and valuable property as a substitute.

4.

Supply: the amount of a commodity, good or service that would be offered for sale at various prices during a specific period.

5.

Surplus Productivity: the net real property income after the costs of labor, capital, and management have been paid.

6.

Variable Proportions: When the quantity of one productive service is increased in equal increments, while the quantities of other productive services remain fixed, the resulting increment of product will decrease after a certain point.

Diunduh dari: http://pinalcountyaz.gov/Departments/Assessor/Appraisal/Pages/Principles.aspx …………….. 26/2/2013

NILAI - EKONOMI LAHAN

Valuasi (ekonomi) Lahan

Land valuation is accomplished through six generally accepted procedures:

1.

Direct Sales: Recent sales of similar vacant parcels are compared with the subject property. Adjustments are made for differences among the properties and are used to create indicators of value for the land under appraisal. The sales comparison approach is the most reliable method of land valuation.

2.

Reliable sales data is not always available. The assessor must then rely on other methods of land valuation.

3.

Allocation: This method is based on the principle of balance, which states that there is a sense of proportion in the four agents of production. Land, as one of the agents of production, has a logical value relationship to total property value. Sales of improved properties are analyzed and the values are allocated between land and improvements.

4.

Abstraction: In this method the cost approach is used in the analysis of the improved property sales data. The depreciated replacement cost of the improvements are subtracted from the sale price. The remainder is the indication of land value.

5.

Anticipated Use or Development: Primarily used to value land in transition from agricultural to other uses, this method subtracts total development costs from projected sales prices to derive a value for the land.

6.

Capitalization of Ground Rent: This method uses the income approach to value to establish a current value for land through its future income potential. Agricultural land in Arizona is valued using this method.

7.

Land Residual Procedure: Calculates land value by first estimating net income earned by a property and then subtracting income that can be attributed to the improvements, leaving a residual value attributable to the land.

Diunduh dari: http://pinalcountyaz.gov/Departments/Assessor/Appraisal/Pages/LandVal.aspx …………….. 26/2/2013

NILAI EKONOMI LAHAN

PENDEKATAN BIAYA = The Cost Approach

Basic steps in the cost approach are:

1.

Estimate the value of the land as if vacant

2.

Estimate the replacement cost new of the improvements

3.

Estimate the loss in value from all forms of depreciation

4.

Deduct the total amount of depreciation from the replacement cost new

5.

Estimate the same amount for any other improvements

6.

Add the land value estimate to the depreciated cost value to arrive at the total property value

Step One, land valuation, may involve any of the methods already mentioned

(allocation, abstraction, etc.)

Step Two, estimating the replacement cost new of the improvements, requires that a distinction be made between replacement cost and reproduction cost.

Diunduh dari: http://pinalcountyaz.gov/Departments/Assessor/Appraisal/Pages/CostApproach.aspx …………….. 26/2/2013

NILAI EKONOMI LAHAN

PENDEKATAN BIAYA = The Cost Approach

Replacement cost is defined as: the cost and overhead that would be incurred in constructing an improvement having the same utility as the original, without necessarily reproducing exactly the same characteristics of the property, but using today's materials, labor, and building techniques.

In other words, replacement cost represents the cost to create an equally desirable substitute property

Diunduh dari: http://pinalcountyaz.gov/Departments/Assessor/Appraisal/Pages/CostApproach.aspx …………….. 26/2/2013

NILAI EKONOMI LAHAN

PENDEKATAN BIAYA = The Cost Approach

1. Reproduction cost is defined as: the cost, including material, labor, and overhead, that would be incurred in constructing an improvement having exactly the same characteristics as the original improvement.

2. Reproduction cost is sometimes difficult to measure because the same building materials or methods are not available. Reproduction cost for an older building with 12-foot ceilings, working fireplaces in every room (as opposed to modern central heating systems), and elaborate trim would be computed on the basis of creating an identical structure today. The reproduction costs of these types of physical characteristics in older structures often tends to create an element of depreciation(value loss) identified as functional obsolescence. This is illustrated using the principle of substitution, which states that in a competitive market, a buyer will typically not pay more for a particular property than the amount to acquire a similar property with comparable utility (a satisfactory substitution). Thus, reproduction cost may often require adjustments for construction techniques, building materials and various forms of depreciation to be indicative of current market value.

3. The Replacement cost rather than Reproduction cost is used as the basis for the cost approach in most appraisal situations where cost is considered an appropriate measurement of value. Replacement Cost

New is generally applicable to most classes of property and leads to a greater degree of uniformity and equity in assessed values.

4. There are several methods used to arrive at a cost value: the quantity survey method, the unit-in-place method, and the square foot method.

Diunduh dari: http://pinalcountyaz.gov/Departments/Assessor/Appraisal/Pages/CostApproach.aspx …………….. 26/2/2013

NILAI EKONOMI LAHAN

PENDEKATAN BIAYA = The Cost Approach

The quantity survey method

requires that the appraiser create a detailed inventory of every item of material, equipment, labor, overhead, and fees involved in the construction of a property.

This method is not routinely used by appraisers because it is extremely time consuming.

Diunduh dari: http://pinalcountyaz.gov/Departments/Assessor/Appraisal/Pages/CostApproach.aspx …………….. 26/2/2013

NILAI EKONOMI LAHAN

PENDEKATAN BIAYA = The Cost Approach

THE UNIT-IN-PLACE METHOD is less detailed than the quantity survey method, but still reasonably accurate and complete.

This method combines direct and indirect costs into a single cost for a building component (the unit-in-place) which is then multiplied by the area of the portion of the building being valued to arrive at a total cost for that component.

This is the method used in the Construction Cost Manual prescribed by the Arizona Department of Revenue, for many building components.

These allow the appraiser to make adjustments for individual components for various types of structures.

Diunduh dari: http://pinalcountyaz.gov/Departments/Assessor/Appraisal/Pages/CostApproach.aspx …………….. 26/2/2013

NILAI EKONOMI LAHAN

PENDEKATAN BIAYA = The Cost Approach

THE SQUARE FOOT METHOD combines all the costs for a particular type and quality of structure into one value as a cost per square foot (or cubic foot).

This method produces a value based on the floor area of the structure.

The cubic foot method is used when the wall height varies within a building class, such as warehouses or factories.

Generally the square foot or cubic foot methods are not considered sufficiently accurate compared to the first two methods for estimating cost.

Diunduh dari: http://pinalcountyaz.gov/Departments/Assessor/Appraisal/Pages/CostApproach.aspx …………….. 26/2/2013

NILAI EKONOMI LAHAN

PENDEKATAN BIAYA = The Cost Approach

Once replacement cost new (RCN) has been calculated, depreciation must be estimated in order to arrive at a current value (unless an improvement is new, some depreciation exists).

Depreciation is defined as a loss in value due to any cause. Land does not depreciate, only

Improvements. Land may suffer value loss, but not due to depreciation. Depreciation is divided into two types: physical deterioration and obsolescence .

Physical deterioration , as the name implies, is a loss in value due to normal aging and deterioration. It can be subdivided into four types: wear and tear from normal use negligent care or lack of maintenance damage from dry rot, pests, etc. wear and tear from the elements (wind, rain, etc.)

Diunduh dari: http://pinalcountyaz.gov/Departments/Assessor/Appraisal/Pages/CostApproach.aspx …………….. 26/2/2013

NILAI EKONOMI LAHAN

PENDEKATAN BIAYA = The Cost Approach

Obsolescence is further divided into two subgroups: functional obsolescence and economic obsolescence.

Functional obsolescence is a loss in value to the improvements due to certain existing physical characteristics, and can be divided into four types:

1.

poor design or style; inefficient floor plan; excessive ceiling height

2.

lack of modern facilities

3.

out-of-date equipment

4.

superadequacy (overimprovement), or inadequacy (underimprovement)

Economic obsolescence is caused by conditions outside the property such as economic changes, legal restrictions, development of new processes, etc. It may divided into five types:

1.

proximity to negative environmental influences

2.

zoning restrictions

3.

adverse influences of supply and demand

4.

changes in neighborhood social or economic factors

5.

changes in locational demands.

Diunduh dari: http://pinalcountyaz.gov/Departments/Assessor/Appraisal/Pages/CostApproach.aspx …………….. 26/2/2013

NILAI EKONOMI LAHAN

PENDEKATAN BIAYA = The Cost Approach

1. Regardless of the type of depreciation, it can be classified as either curable or incurable.

Loss in value due to physical causes can usually be controlled by proper care, usage, or maintenance. Losses due to functional obsolescence are less likely to be curable. Losses in value due to economic obsolescence are rarely curable. For depreciation that can be cured, the cost to cure may be so high that it prohibits the restoration of the property. All of these factors must be taken into consideration when arriving at replacement cost new less depreciation (RCNLD).

2. In the tables in the Department's Construction Cost Manual, depreciation rates reflect only physical factors affecting the value of structures. These tables are developed by market analysis, and assume that normal maintenance will be performed. The rate of physical depreciation is calculated based on the age of the structure and the quality of the construction. When the overall quality of an improvement is low, normal physical deterioration is more rapid than for fair or good construction.

3. Normal physical deterioration is calculated according to actual age. Other factors are computed as they arise in individual structures. If a structure has a serious physical defect, the appraiser will first estimate the RCN, and then compute the cost to cure the physical defect (if curable) and then deduct that amount from the RCN to arrive at RCNLD.

Diunduh dari: http://pinalcountyaz.gov/Departments/Assessor/Appraisal/Pages/CostApproach.aspx …………….. 26/2/2013

NILAI EKONOMI LAHAN

PENDEKATAN BIAYA = The Cost Approach

In advalorem appraisal, deferred maintenance is not normally included in a valuation consideration.

This would have the effect of punishing property owners who kept a property in good condition and rewarding those who let properties rundown.

Special obsolescence factors may be noted and taken into consideration, but the aim is to achieve equity, so that owners of similar properties bear an equal share of the tax burden, regardless of whether they perform regular maintenance.

Diunduh dari: http://pinalcountyaz.gov/Departments/Assessor/Appraisal/Pages/CostApproach.aspx …………….. 26/2/2013

NILAI EKONOMI LAHAN

PENDEKATAN BIAYA = The Cost Approach

Maintenance should not be confused with remodeling or rebuilding. In some cases special obsolescence due to economic factors will affect an entire group of properties such as a town or a market area. This loss should be documented and applied equally to all properties in the community affected by the obsolescence.

In situations where modernization has occurred during the life of a structure, the appraiser must estimate the RCN of each type of structure and compute the effective age and/or the weighted age.

The effective age is calculated by taking the percentage of the remodeling or modernization in relation to the whole.

For example:

50% of the total structure of a house is 40 years old, 20% is 20 years old, and 30% of the structure is 5 years old.

0.50 X 40 = 20.0 0.20 X 20 = 4.0 0.30 X 5 = 1.5 25.5

The effective age of the structure is 25.5 years.

Diunduh dari: http://pinalcountyaz.gov/Departments/Assessor/Appraisal/Pages/CostApproach.aspx …………….. 26/2/2013

NILAI EKONOMI LAHAN

PENDEKATAN BIAYA = The Cost Approach

The weighted age differs from the effective age in that it is used when an improvement has two or more

"segments", each with a different construction date (as opposed to modernization or remodeling). The age is weighted according to the percentage attributable to each construction date. This approach may be used when the quality of construction is the same for both the original building and the addition(s).

For example:

A 10,000 square foot building was constructed in 1977.

An addition built in 1987 is of equal quality.

The addition is 2,000 square feet.

The total square footage is therefore 12,000.

10,000 12,000 = 83.3% is original improvement

2,000 12,000 = 16.7% is original improvement

0.833 X 1977 = 1646.84 0.167 X 1987 = 331.83 1978.67

The weighted age of the building is 1978.67, rounded to 1979. If an improvement has both remodeling and additions of differing ages, the effective age of the modernized portions is calculated first, then a weighted age of the entire improvement is calculated.

Diunduh dari: http://pinalcountyaz.gov/Departments/Assessor/Appraisal/Pages/CostApproach.aspx …………….. 26/2/2013

NILAI EKONOMI LAHAN

The Market or Comparative Sales Approach

The market approach is based on comparison of the subject property to similar properties which have been sold in the same market. Similarities and differences must be noted in detail such as: date of sale, location of property, physical characteristics, and conditions of the sale.

For investment properties, potential income should also be documented.

The conditions of the sale are extremely important when considering whether a property is comparable to the subject or not. If the parties are related, or special financing was obtained, or the seller was forced to sell by some condition of their life(a move, divorce, etc.) then the sale might have to be eliminated as invalid. Remember the definition of "market value": "the most probable price, in terms of cash, in a competitive and open market, assuming a willing and knowledgeable buyer and seller, allowing sufficient time for the sale, and assuming that the transaction is not affected by undue pressures." Some factors like size or shape or location may have to be accommodated by adjusting the value of the comparable up or down to reflect the difference between that property and the subject. The comparable is always adjusted, never the subject property.

The market approach indicates a range of possible values, rather than a precise figure, especially if few sales are available or many adjustments have to be made. In Arizona, the market approach is the most widely used for residential property valuation. It is ideal for types of property which are regularly sold, and it may be the only valid approach for valuing

NILAI EKONOMI LAHAN

The Income Approach

The income approach is used to value commercial or industrial properties, or properties which are bought and sold by investors primarily because of their income producing potential. This approach to value depends on reliable and detailed information on the income and the costs of doing business for a particular business or enterprise. This is referred to as the "income stream" of the property. The income approach defines value as

"the present worth of future benefits of owning a property." These are composed of the annual income for an estimated number of years (called the economic life of the property) plus a capital amount representing land value or land value plus some remaining worth of the improvements. This approach emphasizes investment components rather than physical components of a property.

The steps in the income approach are:

1.

Estimate potential gross income (PGI)

2.

Deduct vacancy and collection losses

3.

Add miscellaneous income to derive effective gross income (EGI)

4.

Deduct operating expenses to derive net operating income (NOI)

5.

Select appropriate capitalization rate and method

6.

Develop an estimated value

Diunduh dari: http://pinalcountyaz.gov/Departments/Assessor/Appraisal/Pages/IncomeApproach.aspx …………….. 26/2/2013

ESTIMATING LAND VALUES by Ted Gwartney, MAI. Assessor, Greenwich, Connecticut tgwartney@aol.com

Characteristics of Land

1. Land, in an economic sense, is defined as the entire material universe outside of people themselves and the products of people. It includes all natural resources, materials, airwaves, as well as the ground. All air, soil, minerals and water is included in the definition of land.

Everything that is freely supplied by nature, and not made by man, is categorized as land.

2. Land holds a unique and pivotal position in social, political, environmental and economic theory. Land supports all life and stands at the center of human culture and institutions. All people, at all times, must make use of land. Land has no cost of production. It is nature's gift to mankind, which enables life to continue and prosper.

Diunduh dari: http://www.henrygeorge.org/ted.htm …………….. 26/2/2013

ESTIMATING LAND VALUES by Ted Gwartney, MAI. Assessor, Greenwich, Connecticut tgwartney@aol.com

Characteristics of Land

1. Land's uniqueness stems from its fixed supply and immobility. Land cannot be manufactured or reproduced. Land is required directly or indirectly in the production of all goods and services. Land is our most basic resource and the source of all wealth.

2. Land rent is the price paid annually for the exclusive right (a monopoly) to use a certain location, piece of land or other natural resource. People receive wages for work, capital receives interest for investment, and land receives rent for the exclusive use of a location.

Equity and efficiency require that the local general public, who created land value, should be paid for the exclusive use of a land site. That

Payment is in the form of a land tax.

Diunduh dari: http://www.henrygeorge.org/ted.htm …………….. 26/2/2013

ESTIMATING LAND VALUES

by Ted Gwartney, MAI. Assessor, Greenwich, Connecticut tgwartney@aol.com

KARAKTERISTIK LAHAN

When considering world-wide economics, most people think that land rent contributes only a small insignificant portion of value. But as societies progress, land has become the predominant force in determining the progress or poverty of all people within a community.

Land in major or cities is so costly that people are forced to move further away and travel great distances in order to get to work and social attractions.

In the more developed countries of the world, land rent represents more than 40% of gross annual production.

Diunduh dari: http://www.henrygeorge.org/ted.htm …………….. 26/2/2013

ESTIMATING LAND VALUES

by Ted Gwartney, MAI. Assessor, Greenwich, Connecticut tgwartney@aol.com

KARAKTERISTIK LAHAN

Since land is fixed in supply, as more land is demanded by people the rent will increase proportionally. Demand is the sole determinant of land rent.

Changes in land rent and land taxes have no impact on the supply of land, because the land supply is fixed and cannot be significantly expanded.

Labor and capital are variable in supply.

A higher price for commodities causes more labor and capital to make itself available.

Labor and capital are rewarded for their work. A high price is an incentive to work harder and longer, while a low price is not an incentive to work harder and longer.

Diunduh dari: http://www.henrygeorge.org/ted.htm …………….. 26/2/2013

ESTIMATING LAND VALUES

by Ted Gwartney, MAI. Assessor, Greenwich, Connecticut tgwartney@aol.com

KARAKTERISTIK LAHAN

The rent of land, however, serves no such incentive function, because the supply of land is fixed. The same amount is available no matter how high or low the price. Buildings are not a part of land rent. Land rent results from the desire made by everyone who lives within a community to use land.

Economic rent is the only source of revenue that could be taken for community purposes without having any negative effect on the productive potential of the economy.

Economists consider rent to be a surplus payment which is unnecessary to ensure that land is available.

When a community captures land rent for public purposes, both efficiency and equity are realized.

Diunduh dari: http://www.henrygeorge.org/ted.htm …………….. 26/2/2013

ESTIMATING LAND VALUES

by Ted Gwartney, MAI. Assessor, Greenwich, Connecticut tgwartney@aol.com

Characteristics of Land

1.

The economic market rental value of land should be sufficient to finance public services and to obviate the need for raising revenue from taxes, such as income or wage taxes; sales, commodity or value-added taxes; and taxes on buildings, machinery and industry. Public revenue should not be supplied by taxes on people and enterprise until after all of the available revenue has been first collected from the natural and community created value of land. Only if land rent were insufficient would it be necessary to collect any taxes.

2.

The collection of land rent, by the public for supplying public needs, returns the advantage an individual receives from the exclusive use of a land site to the balance of the community, who along with nature, contributed to its value and allow its exclusive use.

Diunduh dari: http://www.henrygeorge.org/ted.htm …………….. 26/2/2013

ESTIMATING LAND VALUES by Ted Gwartney, MAI. Assessor, Greenwich, Connecticut tgwartney@aol.com

Land Rent Compared with Market Value

Land Market Value is the land rental value, minus land taxes, divided by a capitalization rate.

Each of these terms is defined as follows:

1.

Land Rental Value is the annual fee individuals are willing to pay for the exclusive right to use a land site for a period of time. This may include a speculative opportunity cost.

2.

Land Taxes is the portion of the land rental value that is claimed for the community.

3.

Capitalization Rate is a market determined rate of return that would attract individuals to invest in the use of land, considering all of the risks and benefits which could be realized.

4.

Land Market Value is the land rental value, minus land taxes, divided by a capitalization rate.

Diunduh dari: http://www.henrygeorge.org/ted.htm …………….. 26/2/2013

ESTIMATING LAND VALUES by Ted Gwartney, MAI. Assessor, Greenwich, Connecticut tgwartney@aol.com

The mathematical relationship is then:

Land Market Value = Land Rental Value - Land Taxes

Capitalization Rate

Land Rental Value = Market Value x Capitalization Rate + Land Taxes

For example, assume that the land rent for a site is $1,800, the land taxes are $300 and the capitalization rate is 6%, what would the land market value be?

Land Market Value = Land Rental Value - Land Taxes

Capitalization Rate

Land Market Value = $1,800 - $300 = $1,500 = $25,000

6% 6%

What would result if a larger portion of the land rent were collected? Let's consider $1,650 rather than $300.

Land Market Value = $1,800 - $1,650 = $150 = $2500

6% 6%

Diunduh dari: http://www.henrygeorge.org/ted.htm …………….. 26/2/2013

ESTIMATING LAND VALUES by Ted Gwartney, MAI. Assessor, Greenwich, Connecticut tgwartney@aol.com

PRINCIPLES OF LAND ASSESSMENT

1.

An appraisal is essentially an expert opinion of the market value of a site; the assessor must present one that is supportable and comprehensible. The assessor must develop and use specific terminology suitable and pertinent to land appraisal.

2.

Land is the entire non-reproducible, physical universe, including all natural resources. A land site includes everything within the earth, under its boundaries and over it, extending infinitely into space. In addition to a location for a house or building, a land site would include the minerals, water, trees, view, sunshine and air space. The shape of the site can be described as an inverted cone with its apex at the center of the earth and extending upward through the surface into space.

3.

In appraisal, a land site is a parcel of land that is finished and ready for use under the standards prevailing in its area. It might have the necessary public utilities in place, like gas, electricity, water, telephone and sewer, with streets, sidewalks drainage and grading completed.

Diunduh dari: http://www.henrygeorge.org/ted.htm …………….. 26/2/2013

ESTIMATING LAND VALUES by Ted Gwartney, MAI. Assessor, Greenwich, Connecticut tgwartney@aol.com

Principles of Land Assessment

1.

The assessment process is essentially the valuation of rights to use or possess land sites. Other kinds of rights include subsurface mineral rights, riparian (water) rights, grazing rights, timber rights, fishing rights, hunting rights, access rights and air rights.

2.

The assessor bases his estimate of land market value upon basic economic principles which serve as the foundation of the valuation process. There are many economic principles which people and assessors must understand and use when implementing judgment to estimate land market values. It is necessary to discuss a few of the more important principles.

3.

The principle of substitution maintains that the value of a property tends to be set by the price that a person would have to pay to acquire an equally desirable substitute property, assuming that no expensive delay is encountered in making the substitution.

A person would pay no more for a site than would have to be paid for an equally desirable site.

Diunduh dari: http://www.henrygeorge.org/ted.htm …………….. 26/2/2013

ESTIMATING LAND VALUES by Ted Gwartney, MAI. Assessor, Greenwich, Connecticut tgwartney@aol.com

PRINCIPLES OF LAND ASSESSMENT

1. The principle of supply and demand holds that the value of a site will increase if the demand increases and the supply remains the same. The value of the site would decrease if the demand decreased. Land is unique, since the supply is fixed; its value varies directly with demand.

2. The principle of anticipation contends that land value can go up or down in anticipation of a future event occurring, or a future benefit or detriment.

3. The principle of conformity contends that land will achieve its maximum value when it is used in a way that conforms to the existing economic and social standards within a neighborhood.

Diunduh dari: http://www.henrygeorge.org/ted.htm …………….. 26/2/2013

ESTIMATING LAND VALUES by Ted Gwartney, MAI. Assessor, Greenwich, Connecticut tgwartney@aol.com

Utility, Scarcity and Desirability

1.

Land value can be thought of as the relationship between a desired location and a potential user. The ingredients that constitute land value are utility, scarcity and desirability. These factors must all be present for land to have value.

2.

Land that lacks utility and scarcity also lacks value, since utility arouses desire for use and has the power to give satisfaction. The air we breathe has utility and is generally considered important, since it sustains and nourishes life. However, in the economic sense, air is not valuable because it hasn't been appropriated and there is enough for everyone. Thus there is no scarcity — at least at the moment. This may not be true in the future, however, as knowledge of air pollution and its effect on human health make people aware that clean and breathable air may become scarce and subsequently valuable.

3.

By themselves, utility and scarcity confer no value on land. User desire backed up by the ability to pay value must also exist in order to constitute effective demand. The potential user must be able to participate in the market to satisfy their desire.

Diunduh dari: http://www.henrygeorge.org/ted.htm …………….. 26/2/2013

ESTIMATING LAND VALUES by Ted Gwartney, MAI. Assessor, Greenwich, Connecticut tgwartney@aol.com

Limitations on Land Ownership and Use

While land is the gift of nature, certain legal, political and social constraints have been imposed in most societies throughout the years. Every nation imposes certain public limitations on land ownership and use for the common good of all citizens. Four forms of governmental control include:

1.

Taxation — Power to tax the land to provide public revenue and to return to the community the costs incurred to pay for the various public benefits, services and environmental protection, which are provided by the government;

2.

Eminent Domain — Right to use, hold or take land for common public uses and benefits;

3.

Police Power — Right to regulate land use for the welfare of the public, in the areas of safety, health, morals, general welfare, zoning, building codes, traffic regulations and sanitary regulations;

4.

Escheat — Right to have land revert to the public's agent, the government, when taxes are not paid or when there are no legal heirs.

Diunduh dari: http://www.henrygeorge.org/ted.htm …………….. 26/2/2013

ESTIMATING LAND VALUES by Ted Gwartney, MAI. Assessor, Greenwich, Connecticut tgwartney@aol.com

FAKTOR YG MEMPENGARUHI NILAI LAHAN

1. The physical attributes of land include quality of location, fertility and climate; convenience to shopping, schools and parks; availability of water, sewers, utilities and public transportation; absence of bad smells, smoke and noise; and patterns of land use, frontage, depth, topography, streets and lot sizes.

2. The legal or governmental forces include the type and amount of taxation, zoning and building laws, planning and restrictions.

3. The social factors include population growth or decline, changes in family sizes, typical ages, attitudes toward law and order, prestige and education levels.

4. The economic forces include value and income levels, growth and new construction, vacancy and availability of land. It is the influences of these forces, expressed independently and in relationship to one another, that help the people and the assessor measure value.

Diunduh dari: http://www.henrygeorge.org/ted.htm …………….. 26/2/2013

ESTIMATING LAND VALUES by Ted Gwartney, MAI. Assessor, Greenwich, Connecticut tgwartney@aol.com

GUNA-LAHAN YG PALING BAGUS & TERTINGGI

A land site should be made available to the users who can make the highest and best effective use of the site and maximize the site benefits for all people. The proper system of assessment and taxation of land can provide for the proper economic use of the land.

A high land tax on an improperly improved site tends to cause the site holder to either better improve his site to obtain greater return with which to pay the land tax, or to look for someone else with the means to properly improve the site.

A land tax can also provide the source of public revenue which the local governing body could use for the benefit of all people. Before an assessment can proceed, the highest and best use must be determined for each site.

Diunduh dari: http://www.henrygeorge.org/ted.htm …………….. 26/2/2013

ESTIMATING LAND VALUES by Ted Gwartney, MAI. Assessor, Greenwich, Connecticut tgwartney@aol.com

GUNA-LAHAN yg PALING BAGUS & TERTINGGI

The economics of production should provide the atmosphere for the most efficient use to be made of all land. The assessment process is based on the highest, best and most profitable use of land.

The highest and best use considers only the uses that are legally permissible

(meeting zoning, health, and public restrictions), physically possible (has adequate size, soil conditions, and accessibility), and is economically

feasible (income is anticipated). The use that meets these criteria and produces the greatest net earnings (best returns) is the highest and best use.

Diunduh dari: http://www.henrygeorge.org/ted.htm …………….. 26/2/2013

SITE VALUATION METHODOLOGY

1.

Site value is the market value of the land in its present state (as you see it) excluding any improvements made on the land.

2. Site value is the methodology used to value all non-rural land. A site valuation includes any work done, or materials used, to improve the physical nature of the land to prepare it for development and the extent the work adds value to the land.

3. It includes the value of any improvements made to the land such as filling, clearing, levelling and drainage works.

4. Site value does not include structural improvements on the land such as houses, sheds and other buildings, nor does it include excavations necessary for structural improvements on the land

(such as building foundations, footings or underground car parks).

Diunduh dari: http://www.derm.qld.gov.au/factsheets/pdf/land/l252.pdf …………….. 26/2/2013

SITE VALUATION METHODOLOGY

Site value definition

Site value is the market value of the land in its present state and includes the value of the following site improvements made to the land:

1. Clearing vegetation on the land

2. Picking up and removing stones

3. Improving soil fertility or structure

4. Works to manage or remedy contamination

5. Restoring, rehabilitating or improving its surface by filling, grading or levelling, but not by irrigation or conservation works

6. Reclamation by draining or filling, including retaining walls and other works for the reclamation

7. Underground drainage

8. Any other works done to the land necessary to improve or prepare it for development.

Diunduh dari: http://www.derm.qld.gov.au/factsheets/pdf/land/l252.pdf …………….. 26/2/2013

SITE VALUATION METHODOLOGY

SITE IMPROVEMENTS

1. Clearing—removing or destroying vegetation. This does not include pruning or clearing for garden maintenance purposes. It may include the clearing of vegetation for a proposed building pad or clearing the entire site, but does not include pruning or lopping a tree.

2. Fill—soil, rock or other material used to fill a depression or hole in the ground. Fill is usually used to create a level block in readiness for development or to reclaim low-lying land.

Diunduh dari: http://www.derm.qld.gov.au/factsheets/pdf/land/l252.pdf …………….. 26/2/2013

SITE VALUATION METHODOLOGY

SITE IMPROVEMENTS

1. Revetment—is the retaining of land for the purpose of preparing land for development. Where land has been filled or excavated such as canal estates or hillside lands, the revetment wall and/or retaining walls required to retain the land and materials are considered to be site improvements.

2. Levelling—involves moving earth from within an undulating or sloping site and dispersing it evenly over the site to create a more level topography. The process is generally known as ‘cut and fill’, and may include depositing or removing spoil from or to the site.

Diunduh dari: http://www.derm.qld.gov.au/factsheets/pdf/land/l252.pdf …………….. 26/2/2013

SITE VALUATION METHODOLOGY

SITE IMPROVEMENTS

1. Drainage works—are any underground works within the property necessary to drain underground or surface waters to improve the property by managing stormwater run off. Works may include underground pipes, agricultural slotted pipes, pits, catchment ponds, swales and the associated excavations.

2. Remediation—works undertaken to manage or remedy contamination where land is defined as contaminated land.

Diunduh dari: http://www.derm.qld.gov.au/factsheets/pdf/land/l252.pdf …………….. 26/2/2013

KONSEP KESESUAIAN LAHAN

LAND PROPERTIES:

(*) Land Quality

(*) Land characteristics

LANDUSE:

(*) Requirement

DYNAMIC ANALYSIS :

(*) Landuse Systems

(*) Agroecological Zoning