Finance Midterm Exam - Spring 2011

advertisement

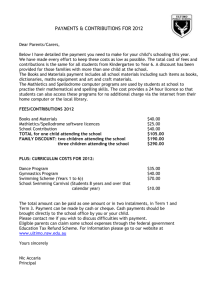

Fin 539 Spring 2011 Dr. Moffett Midterm Exam Name: ____________________________________________ Write neatly, anything I cannot read is wrong. No cell phones or graphing calculators allowed or visible. Turn off your cell phones. Multiple choice problems are worth 3 points each. 1. A(n) ____ asset is one which can be quickly converted into cash without significant loss in value. a. current b. fixed c. intangible d. liquid e. long-term 2. Your _____ tax rate is the amount of tax payable on the next taxable dollar you earn. a. deductible b. residual c. total d. average e. marginal 3. _____ is calculated by adding back non-cash expenses to net income and adjusting for changes in current assets and liabilities. a. Operating cash flow b. Capital spending c. Net working capital d. Cash flow from operations e. Cash flow to creditors 4. When making financial decisions related to assets, you should: a. always consider market values. b. place more emphasis on book values than on market values. c. rely primarily on the value of assets as shown on the balance sheet. d. place primary emphasis on historical costs. e. only consider market values if they are less than book values. 5. Depreciation: a. is a noncash expense that is recorded on the income statement. b. increases the net fixed assets as shown on the balance sheet. c. reduces both the net fixed assets and the costs of a firm. d. is a non-cash expense which increases the net operating income. e. decreases net fixed assets, net income, and operating cash flows. 6. Martha’s Enterprises spent $2,400 to purchase equipment three years ago. This equipment is currently valued at $1,800 on today’s balance sheet but could actually be sold for $2,000. Net working capital is $200 and long-term debt is $800. Assuming the equipment is the firm’s only fixed asset, what is the book value of shareholders’ equity? a. $200 b. $800 c. $1,200 d. $1,400 e. The answer cannot be determined from the information provided. 7. Given the tax rates as shown, what is the average tax rate for a firm with taxable income of $126,500? Taxable Income Tax Rate $0 - 50,000 15% 50,001 - 75,000 25% 75,001 - 100,000 34% 100,001 - 335,000 39% a. b. c. d. e. 21.38% 23.88% 25.76% 34.64% 39.00% 8. The financial ratio measured as net income divided by total assets is known as the firm’s: a. profit margin. b. return on assets. c. return on equity. d. asset turnover. e. earnings before interest and taxes. 9. Which of the following will increase sustainable growth? a. Buy back existing stock b. Decrease debt c. Increase profit margin d. Increase asset requirement ratio e. Increase dividend payout ratio 10. Neal’s Nails has an 11% return on assets and a 30% dividend payout ratio. What is the internal growth rate? a. 7.11% b. 7.70% c. 8.34% d. 8.46% e. 11.99% 11. You are the beneficiary of a life insurance policy. The insurance company informs you that you have two options for receiving the insurance proceeds. You can receive a lump sum of $50,000 today or receive payments of $641 a month for ten years. You can earn 6.5% on your money. Which option should you take and why? a. You should accept the payments because they are worth $56,451.91 today. b. You should accept the payments because they are worth $56,523.74 today. c. You should accept the payments because they are worth $56,737.08 today. d. You should accept the $50,000 because the payments are only worth $47,757.69 today. e. You should accept the $50,000 because the payments are only worth $47,808.17 today. 12. The government has imposed a fine on the Not-So-Legal Company. The fine calls for annual payments of $100,000, $250,000, and $250,000, respectively over the next three years. The first payment is due one year from today. The government plans to invest the funds until the final payment is collected and then donate the entire amount, including investment earnings, to a national health center. The government will earn 3.5% on the funds held. How much will the national health center receive three years from today? a. $613,590.00 b. $614,622.50 c. $615,872.50 d. $616,006.00 e. $619,050.05 13. The total interest paid on a zero-coupon bond is equal to: a. zero. b. the face value minus the purchase price. c. the face value minus the market price on the maturity date. d. $1,000 minus the face value. e. $1,000 minus the par value. 14. If its yield to maturity is less than its coupon rate, a bond will sell at a _____, and increases in market interest rates will _____. a. discount; decrease this discount. b. discount; increase this discount. c. premium; decrease this premium. d. premium; increase this premium. e. None of the above. 15. The primary reason that company projects with positive net present values are considered acceptable is that: a. they create value for the owners of the firm. b. the project’s rate of return exceeds the rate of inflation. c. they return the initial cash outlay within three years or less. d. the required cash inflows exceed the actual cash inflows. e. the investment’s cost exceeds the present value of the cash inflows. 16. The internal rate of return is: a. more reliable as a decision making tool than net present value whenever you are considering mutually exclusive projects. b. equivalent to the discount rate that makes the net present value equal to one. c. easier for managers to comprehend than the net present value. d. dependent upon the interest rates offered in the marketplace. e. a better methodology than net present value when dealing with unconventional cash flows. 17. You are considering the following two mutually exclusive projects that will not be repeated. The required rate of return is 11.25% for project A and 10.75% for project B. Which project should you accept and why? Year 0 1 2 3 a. b. c. d. e. Project A Project B -$48,000-$126,900 $18,400 $ 69,700 $31,300 $ 80,900 $11,700 $ 0 project A; because its NPV is about $335 more than the NPV of project B project A; because it has the higher required rate of return project B; because it has the largest total cash inflow project B; because it returns all its cash flows within two years project B; because it is the largest sized project 18. The most valuable investment given up if an alternative investment is chosen is a(n): a. salvage value expense. b. net working capital expense. c. sunk cost. d. opportunity cost. e. erosion cost. 19. The cash flow from projects for a company is computed as the: a. net operating cash flow generated by the project, less any sunk costs and erosion costs. b. sum of the incremental operating cash flow and after-tax salvage value of the project. c. net income generated by the project, plus the annual depreciation expense. d. sum of the incremental operating cash flow, capital spending, and net working capital expenses incurred by the project. e. sum of the sunk costs, opportunity costs, and erosion costs of the project. 20. Toni’s Tools is comparing machines to determine which one to purchase. The machines sell for differing prices, have differing operating costs, differing machine lives, and will be replaced when worn out. These machines should be compared using: a. net present value only. b. both net present value and the internal rate of return. c. their effective annual costs. d. the depreciation tax shield approach. e. the replacement parts approach. PART II. Work any 4 of the 5 problems. Each is worth 10 points. Show your work only if you want credit for the problem. 1. Note that in all of our cash flow computations to determine cash flow of the firm, we never include the addition to retained earnings. Why not? Is this an oversight? 2. The IRR rule is said to be a special case of the NPV rule. Explain why this is so and why it has some limitations NPV does not? 3. Marvelous Machines is considering a 3-year project with an initial cost of $618,000. The project will not directly produce any sales but will reduce operating costs by $265,000 a year. The equipment is depreciated straight-line to a zero book value over the life of the project. At the end of the project the equipment will be sold for an estimated $60,000. The tax rate is 34%. The project will require $23,000 in extra inventory for spare parts and accessories. Should this project be implemented if Marvelous requires a 9% rate of return? Why or why not? 4. Bruno’s, Inc. is analyzing two machines to determine which one it should purchase. The company requires a 14% rate of return and uses straight-line depreciation to a zero book value. Machine A has a cost of $290,000, annual operating costs of $8,000, and a 3-year life. Machine B costs $180,000, has annual operating costs of $12,000, and has a 2-year life. Whichever machine is purchased will be replaced at the end of its useful life. Which machine should Bruno’s purchase and why? (Round your answer to whole dollars.) 5. The most recent financial statements for WOO: Income Stmt Sales $54,000 Costs 34,000 Taxable income $19,200 Taxes (34%) 7,528 Net Income $12,672 Balance Sht Current Assets $26,000 Long Term Debt $58,000 Fixed Assets 105,000 Equity 73,000 Total $131,000 Total $131,000 Assets and costs are proportional to sales. The company maintains a constant 30% dividend payout ratio and a constant debt-to-equity ratio. What is the maximum increase in sales that can be sustained assuming no new equity is issued?