Q1 2003 Financial Results Management Presentation

advertisement

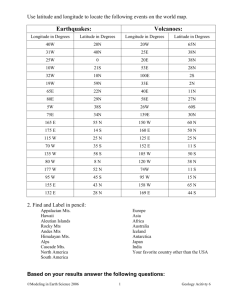

Mobile TeleSystems Financial and Operational Results First Quarter Ended March 31, 2003 June 26, 2003 Internet site: www.mtsgsm.com/ir email address: ir@mts.ru 1 2003: Implementing the strategy Remaining a leader in Russia Market share nation-wide remained at 37%* Market share in Moscow increased from 43% at YE2002 to 46%* Expanding the regional franchise New GSM licence for Saratov region (population of 2.7 million) received MTS acquired 51% of a leading operator in Tatarstan for $61 million Consolidating of acquired operators MTS brand and new tariffs were introduced to Dontelecom (Rostov) and Kuban GSM (Krasnodar) Exploiting opportunities in the CIS countries Acquired a 57.7% stake in UMC, a leading mobile operator in Ukraine. The ownership was subsequently increased to 83.7% in June 2003. Reducing the cost of capital MTS placed a $400 mln bond in January 2003 to finance its expansion *According to AC&M-Consulting as of May 31, 2003 Mobile TeleSystems, June 26, 2003 2 Income Statement Highlights MTS reports strong top line and bottom line growth Revenue EBITDA Net income 80% 82% 87% 446.1 224.8 80.2 123.5 247.6 42.8 Q1 02 Q1 03 Revenues were boosted mainly by organic growth of MTS business Q1 02 Q1 03 MTS maintains EBITDA margin of 50% Q1 02 Q1 03 Strong net earnings growth Note: See Attachment A for definitions of EBITDA and EBITDA margin and a reconciliation of both financial measures. Mobile TeleSystems, June 26, 2003 Source: MTS 3 Strong Subscriber Growth MTS is a market leader in Russia and the CIS with over 11.23m subs as of June 25, 2003 MTS together with its subsidiaries currently operates in Russia (9.23m subs) and Ukraine (1.99m subs) MTS’ 49%-owned joint venture in Belarus services around 165,000 customers MTS Subscriber Base, 1998-2003 (mln) 12.0 UMC contributes 2 mln users to MTS subs base 9.0 6.0 3.0 0.1 0.3 1.2 2.7 6.6 11.2 1998 1999 2000 2001 2002 25 June 2003 - Source: MTS Mobile TeleSystems, June 26, 2003 4 The Booming Market The mobile population in Russia grew by 10m in 2002 and by an additional 5.3m in the first five months of 2003 to 23.5m, fueled by a growing economy and a greater demand for telecommunications services. Mobile penetration is currently at 16%* Russian Mobile Market Growth (mln subscribers) and MTS Market Share 25.0 50% 20.0 37% 35% 37% 40% 33% 15.0 30% 23% 10.0 20% 16% 12% 5.0 0.5 10% 0.7 1.4 3.4 8.0 18.0 23.5 - 0% 1997 1998 1999 2000 2001 2002 Jun-03 Source: AC&M-Consulting *According to AC&M-Consulting as of May 31, 2003 Mobile TeleSystems, June 26, 2003 5 #1 Provider in Russia MTS continues to be the market leader in the Russian market with a 37%* market share MTS market share in the Moscow market has increased from 43% at yearend 2002 to 46% at the end of May 2003* The Company’s strategic objective is to remain as the leading mobile phone operator in Russia both in terms of revenues and number of subscribers *According to AC&M-Consulting as of May 31, 2003 Mobile TeleSystems, June 26, 2003 6 Tapping the market in Ukraine At the end of Q1 2003 UMC, MTS’ subsidiary in Ukraine, had 1.82 million subscribers of which around 71% were using pre-paid services The company provided services to around 2 million subscribers as of June 25, 2003 As of end of May 2003, UMC controlled around 45% of the cellular market in Ukraine* UMC Subscriber Base, 1998-2003 (mln) 2.0 1.5 1.0 0.5 0.1 0.3 0.4 0.9 1.7 2.0 1998 1999 2000 2001 2002 25 June 2003 - *According to Ukrainian News as of May 31, 2003 Mobile TeleSystems, June 26, 2003 7 Building the footprint in Belarus MTS’ unconsolidated subsidiary started operations in Belarus in June 2002 and has so far built a market share of 21%* competing against the only incumbent GSM operator MTS LLC Subscriber Base in Belarus (in thousands) 180 165 139 150 120 106 83 90 60 43 30 22 18 14 11 8 4 64 53 25 ne Ju M ay pr il A M ar ch y br ua r Fe r nu ar y Ja m be ec e D ov e m be r r ob e N O ct m be r Se pt e ug u st ly A Ju Ju ne 0 *According to AC&M-Consulting as of May 31, 2003 Mobile TeleSystems, June 26, 2003 8 Breakdown by Regions Subscribers (thousands) Region Moscow License Area December 31, 2001 March 31, 2002 June 30, 2002 September 30, 2002 December 31, 2002 March 31, 2003 2 035.4 2 084.6 2 351.2 2 688.2 3 082.3 3 540.4 2% Growth Central (ex. Moscow) 276.1 334.0 33.9 46.7 Growth St Petersburg Licence Area Growth North-West (ex. St Petersburg) Growth South Growth Urals Growth Siberia Growth Far East Growth Total 46.4 28.4 na 52.6 151.1 26.3 2 650.3 Growth 420.8 21% Growth Volga 13% 38% 264.1 469% 36.0 27% 482.4 na 58.8 12% 189.9 26% 31.2 19% 3 527.8 26% 212.7 356% 400.5 52% 55.6 55% 541.7 12% 99.2 69% 244.8 29% 40.6 30% 29% 287.8 29% 35% 565.2 33% 41% 37% 64% 67% 34% 22% 66% 23% 26% 15% 442.2 26% 73.2 33% 13% 90.6 36% 6 644.7 24% 12% 232.9 390.3 54.0 46% 993.5 202.1 309.0 8% 223 885.7 164.3 17% 834.4 152.6 726.1 14% 446.1 775.5 91.1 15% 798.2 381.6 5 427.7 24% 15% 701.4 541.9 4 367.0 33% 14% 24% 7 601.3 22% 14% Source: MTS Mobile TeleSystems, June 26, 2003 9 Developing the Infrastructure At the end of Q1 2003, MTS together with its consolidated subsidiaries operated 6,142 base stations and 72 switches In addition, MTS’ joint venture in Belarus operated 242 base stations and one switch Number of Base Stations Number of Switches 8 000 80 UMC had 1,320 base stations 6 000 72 UMC had 8 switches 6142 60 48 4453 4 000 40 2125 2 000 709 163 347 1997 1998 31 20 1123 13 2 - 6 8 1998 1999 1999 2000 2001 2002 31 March 2003 Source: MTS Mobile TeleSystems, June 26, 2003 1997 2000 2001 2002 31 March 2003 Source: MTS 10 Licences Coverage As of June 25, 2003 MTS’ GSM licences covered a population of 169.2m, including 110.2m in Russia, 10m in Belarus and 49m in Ukraine Murmansk Anadyr Kaliningrad # St. Petersburg Petrozavodsk Arkhangelsk Pskov Novgorod Naryan-Mar Vologda Tver Minsk Smolensk Yaroslavl Syktyvkar Moscow Kostroma Kaluga Salekhard Ivanovo Bryansk Kirov Tula Vladimir Кiev Kudymkar Kursk Orel Ryazan N. Novgorod Khanty-Mansiysk Lipetsk Izhevsk Belgorod Tambov Perm Voronezh Kazan Ekaterinburg Saratov Ufa Tumen Rostov-on-Don Samara Chelyabinsk Kurgan Krasnodar Omsk Orenburg Maikop Elista Novosibirsk Barnaul Gorno-Altaysk Blagoveschensk Kyzyl Yuzhno-Sakhalinsk Khabarovsk Source: MTS Mobile TeleSystems, June 26, 2003 11 Profitability of Regions MTS operations in the regions of Russia added $18.9 million to the Company’s bottom line in Q1 2003 Other Entities in Russia (Regional Segment) UMC US$ mln Total Intercompany Eliminations MTS (Moscow Segment) Revenues 446.1 -19.3 302.0 133.5 29.9 Depreciation and amortisation 75.2 44.0 25.5 5.7 Net operating income 149.6 -2.7 98.1 43.4 10.8 Net income 80.2 -2.7 62.5 18.9 1.5 Note: MTS has consolidated UMC from March 1, 2003 Source: MTS MTS’ business is organized on a geographical operations basis. Performance is measured and reported based on operating income by legal entity. Currently, MTS reports operations in Russia in two segments: MTS OJSC and Rosico (“Moscow Segment”) and all other legal entities in Russia combined. The Moscow Segment includes operations in the Moscow license area in addition to operations in Ivanovo, Kirov, Kaluga, Kostroma, Komi Republic, Kurgan, Nizhny Novgorod, Orenburg, Perm, Ryazan, Pskov, Saratov, Smolensk, Tambov, Tula, Tumen, Tver, Vladimir, Chelyabinsk, and Yaroslavl. The second geographical segment includes all of our other Russian legal entities not included above, most notably our operation in the north-west of Russia, including St. Petersburg, and southern Russia, including Krasnodar. Mobile TeleSystems, June 26, 2003 12 Key Operating & Financial Data MTS Operations in Russia MOU - Usage per subscriber decreased in Q1 2003 largely because of seasonal factors ARPU - continued to decline partially as a result of decreased usage but also as a result of an increase in the number of mass-market subscribers in the subscriber mix Churn - the general market trend of growing churn continued during Q1 2003. Today, programs aimed at encouraging customer loyalty have become increasingly important for the Company Q1 2002 Q2 2002 Q3 2002 Q4 2002 Q1 2003 $26.7 $25.0 $25.2 $21.2 $18.5 MOU (minutes) 142 167 175 175 148 Churn rate (%) 9.8 7.7 6.5 10.1 11.6 SAC per gross additional sub (US$) $36 $39 $32 $34 $30 ARPU (US$) Source: MTS Mobile TeleSystems, June 26, 2003 13 SAC Breakdown SAC per gross subs addition in Russia continued to decline in 2003 reflecting the lower cost of attracting mass-market subscribers (in particular, the lower commissions paid to dealers for Jeans subscribers) Subscriber Acquisition Cost per Gross New Subscribers (US$) 50 Dealer commission 40 30 1.1 9 Avertising and promotion Handset subsidy 1.0 0.4 1.0 8 9 0.1 11 8 20 27 27 24 24 22 Q1 2002 Q2 2002 Q3 2002 Q4 2002 Q1 2003 10 - Source: MTS Mobile TeleSystems, June 26, 2003 14 Key Operating & Financial Data MTS Operations in Ukraine Q1 2003 March 2003 $15.9 $16.3 MOU (minutes) 87 87 Churn rate (%) 8.9 3.1 SAC per gross additional sub (US$) $51 $44 ARPU (US$) Source: MTS Mobile TeleSystems, June 26, 2003 15 Disclaimer Some of the information in this presentation may contain projections or other forwardlooking statements regarding future events or the future financial performance of MTS, as defined in the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. You can identify forward looking statements by terms such as “expect,” “believe,” “anticipate,” “estimate,” “intend,” “will,” “could,” “may” or “might” the negative of such terms or other similar expressions. We wish to caution you that these statements are only predictions and that actual events or results may differ materially. We do not intend to update these statements to reflect events and circumstances occurring after preliminary offering memorandum dated as of January 28, 2003 and to reflect the occurrence of unanticipated events. We refer you to the documents MTS files from time to time with the U.S. Securities and Exchange Commission, specifically, the Company’s most recent Form 20-F. These documents contain and identify important factors, including those contained in the section captioned "Risk Factors," that could cause the actual results to differ materially from those contained in our projections or forward-looking statements, including, among others, potential fluctuations in quarterly results, our competitive environment, dependence on new service development and tariff structures; rapid technological and market change, acquisition strategy, risks associated with telecommunications infrastructure, risks associated with operating in Russia, volatility of stock price, financial risk management, and future growth subject to risks. Mobile TeleSystems, June 26, 2003 16 Attachment A EBITDA should not be considered in isolation as an alternative to net income, operating income, net cash provided by operating activity or any other measure of performance under U.S. GAAP. We believe that EBITDA is viewed as a relevant supplemental measure of performance in the wireless telecommunications industry and we define EBITDA as operating income excluding depreciation and amortization. EBITDA margin is defined as EBITDA as a percentage of our net revenues. We believe EBITDA and EBITDA margin to be relevant and useful information as these are one of important measurements used by our management to measure the operating profits or losses of our business. EBITDA is also one of many factors used by the credit rating agencies to determine our credit ratings. EBITDA and EBITDA margin should be considered in addition to, but not as a substitute for, other measures of financial performance reported in accordance with accounting principles generally accepted in the United States of America. EBITDA and EBITDA margin, as we have defined them, may not be comparable to similarly titled measures reported by other companies, who may refer to EBITDA as Adjusted EBITDA. EBITDA is often calculated by adjusting net income to exclude only depreciation and amortization, income taxes and interest. If EBITDA were so calculated it would have been: $211.5 million, $116.5 million, $172.0 million for Q1 2003, Q1, 2002 and Q4 2002, respectively. The following table provides a reconciliation of EBITDA to operating income: US$ million (unaudited) Q1 2003 Q1 2002 Q4 2002 EBITDA $224.8 $123.5 $182.7 Less: depreciation and amortisation ($75.2) ($41.6) ($59.0) Operating income $149.6 $81.9 $123.7 Mobile TeleSystems, June 26, 2003 17 Attachment A (continued) The following table provides a reconciliation of EBITDA margin to operating income as a percentage of net revenues: As a percentage of net revenues (unaudited) Q1 2003 Q1 2002 Q4 2002 EBITDA margin 50.4% 49.9% 44.6% -16.9% -16.8% -14.4% 33.5% 33.1% 30.2% Less: depreciation and amortization as a % of net revenues Operating income as a % of net revenues If the Company were to reconcile EBITDA to net income, following would be the reconciliation: US$ million Net income Q1 2003 Q1 2002 Q4 2002 $80.2 $42.8 $85.2 Add: depreciation and amortisation $75.2 $41.6 $59.0 Add: income taxes $40.5 $25.9 $16.3 Add: interest $15.6 $6.2 $11.6 $13.8 $4.3 $14.8 ($0.7) $0.8 $1.0 $0.2 $1.9 ($5.2) $224.8 $123.5 $182.7 Add: minority interest Add (less): currency exchange and translation losses (gains) Add (less): Other expenses (income) EBITDA as reported Mobile TeleSystems, June 26, 2003 18