Helpful-Hints-for-Completing-Form-8941-for-small

advertisement

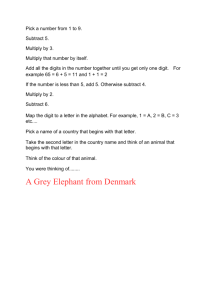

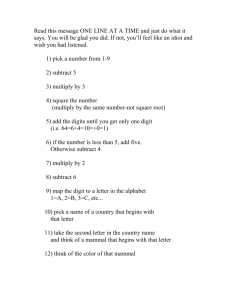

Helpful Hints for Completing Form 8941 Identifying number is the Organization Federal Identification Number (FEIN). Line 1: Report here all employees of the organization, whether part-time or full-time and whether offered health insurance or not. For this line, even a part-time person is counted as a whole number. Do not include independent contractors (such as a janitor working for an outside service), nor any “seasonal” employees who work 120 days or fewer. Line 2: Report the number of Full Time Equivalents (FTEs) employed by the organization, both those with health insurance and those without. A person working 20 hours per week is ½ an FTE. A person working half the year is ½ an FTE. Do not include contracted or self-employed people (those to whom you issue a Form 1099 and not a Form W-2). Do not include leased or contracted employees (i.e., janitor working for another company). Do not include “seasonal” workers who work fewer than 120 days. No employee, regardless of the amount of overtime, can be counted for more than 1.0 FTE. Line 3: First, add together the amount of salaries and wages paid in 2011. Do NOT include seasonal employees working less than 120 days. Do NOT include contracted, leased, or self-employed persons. For calendar year organizations, the total amount will equal the amount reported on Line 5c of Form 941 (Taxable Medicare Wages for the year). Second, divide the total salaries paid the number of FTEs you wrote on Line 2. You must use the FTE number as the denominator. Line 4: The amount actually paid by the organization for health insurance premiums paid during the tax year. Line 5: Use the benchmark amounts for each tax year. Multiply the number of persons with single coverage times $5,186 for 2011 (further reduced by the percentage paid by the employee). Multiply the number of persons with other than single coverage time $12,671 for 2011 (further reduced by the percentage paid by the employee). Add together the amounts computed in each category. Line 6: Enter the smaller number comparing the amounts on Line 4 vs. Line 5. Line 7: Multiply Line 6 by 25%. Line 8: If Line 2 is 10 FTEs or less, write the same number as Line 7. Go to Line 9. If the number of FTEs is above 10, use the following formula: a. b. c. d. e. Number of FTEs written on Line 2 Subtract 10 from the result on “a” Divide amount on “b” by 15 Multiply amount on “c” by the amount on Line 7 Subtract the amount on “d” from amount on Line 7 this amount on Line 8. ______ ______ ______ ______ ______ Then write Line 9: If the amount on Line 3 is less than $25,000, write the same number as line 8. Go to Line 10. If the number on Line 3 is about $25,000, use the following formula: f. Average salary written on Line 3 g. Subtract $25,0000 from amount on “f” h. Divide amount on “g” by $25,000 least 3 decimal places i. Multiply the decimal computed in “h” by Line 7 j. Subtract the amount on “I” from amount on Line 8 this amount on Line 9. ______ ______ ______ Round to at ______ ______ Then write Line 10: Typically -0-. Line 11: Write the same number as written on Line 4. Line 12: Write the smaller number comparing the amounts on Line 9 vs. Line 11. Line 13: Write the number of persons enrolled in the health plan. Line 14: Write the number of FTEs in the health plan. Line 15: Typically -0-. Line 16: Probably same amount as Line 12. Line 17 and Line 18: NFPs should skip these lines. Line 19: Not all payroll taxes should be reported here. Not all payroll taxes qualify for the credit. Only (3) types of payroll taxes qualify: 1. Medicare tax (not Social Security taxes) withheld from the paychecks for ALL employees, whether that particular employer has health insurance coverage or not. 2. Medicare tax (not Social Security taxes) paid by the employer for ALL employees. 3. Federal income tax withheld from the paychecks for ALL employees. It may help to consult the quarterly Form(s) 941 that make up the (4) quarters of your fiscal tax year. Federal income taxes withheld are reported on Form 941, line 3, and Medicare taxes are reported on Line 5c (column 2). Calendar year taxpayers can use the W-3 Transmittal (box 2 plus box 6 doubled to include the employer’s match on the Medicare taxes). Line 20: Write the smaller number comparing the amounts on Line 16 vs. Line 19. This is the amount of your refund to write on Form 990-T, Line 44f.