Legislative and Industry Trends

advertisement

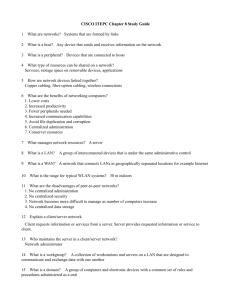

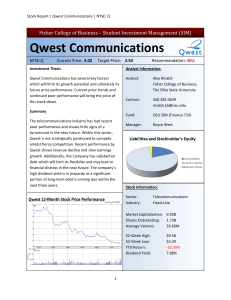

Chapter 7 Legislative and Industry Trends Introduction • The computer and telecommunications industries employ millions of people worldwide • Changes in technology are rapidly changing the faces of these industries and effecting managers, employees, and customers The Semiconductor Industry • Worldwide demand tops $200 billion • The top 10 suppliers account for nearly half the total market • Greater than 80% of the market is controlled by firms based in the U.S. and Japan The World’s Largest Semiconductor Suppliers The Computer Industry • A dynamic industry with continual changes Hardware Suppliers • A diverse group of products ranging from notebooks to supercomputers, storage, and printers • Server sales amounted to $60 billion in 2000 • Supercomputer sales are accelerating as corporations need higher levels of computing power to deliver services The Software Business • Continues to grow with 2001 sales of $195 billion • Employment in the U.S. in the packaged software business is 336,000 • The industry leader is Microsoft with domination of the desktop operating system and application package markets Industry Dynamics • The industry is characterized by multinational corporations in multiple overlapping strategic alliances and partnerships • Regulation of the industry by government, intense competition, and consumer demand are continually impacting these industries Information Infrastructure • The US telecommunications market for equipment and services in 2003 is projected to exceed $700 billion • Two factors drive this demand: – Transmission bandwidth – Switching capacity Telecommunications Regulation • In the US, telecom firms are regulated by local, state, and national government • Major national legislation has included: – Communications Act of 1934 – Cable Communications Policy Act of 1984 – Communications Satellite Act of 1962 – The 1956 Consent Decree with AT&T – Modified Final Judgment of 1982 – The Telecommunications Act of 1996 The Divestiture of AT&T • AT&T was a monopoly provider of telephone service in the US • Over time, the government required a progressive opening of infrastructure to competitors • In 1982, AT&T was split into seven independent Regional Bell Operating Companies (RBOCs) The Breakup of AT&T • Many startup firms entered the market • Cable companies began to offer voice service • Phone companies attempted to offer video • RBOCs began to join with cable companies in a regional focus to reestablish monopolies on communications 1996 Telecommunications Act • A wide reaching act aimed at fostering an open market in communications based on aggressive competition • It covered cable, broadcast, and telephone providers • It fostered competition between RBOCs and Incumbent Local Exchange Carriers (ILECs) 1996 Telecommunications Act • The Act increased the oversight of the FCC with numerous ruling and judgments • The FCC set rates and formulae for reimbursement in order to “level the playing field” • Unfortunately, this meddling created disincentives for investment and a confusing landscape for investors FCC Actions • The Act granted the FCC broad new powers • They created 80 major regulations in the first 4 years • The FCC has put in place rules that subsidize some users at the expense of others • These rule have created a confusing environment resulting in massive litigation Implementation Realities • Local wireline competition is minimal • Long distance competition is robust, but startups are unable to compete against established players • Established long distance companies are under extreme financial stress with WorldCom, Sprint, and MCI all in or near bankruptcy Privatization Around the Globe • 69 members of the WTO opened their markets to competition • Governments sold off telephone assets to investors • Competition brought new capital flows from around the world, modernizing and expanding the telecommunications infrastructure Industry Transformations • With changes in the regulatory landscape, the industry underwent dramatic transformations, consolidation, mergers, joint partnerships, bust and bankruptcy, divestitures, and a sector depression Local Service Providers Industry Consolidation • Bell Atlantic, NYNEX, Verizon, and GTE – 1997 - Bell Atlantic and NYNEX merged to control 30% of the US local lines – Entity renamed Verizon – 1998 – Verizon and GTE merged to form the largest phone company in the US • 100 million lines throughout the US Industry Consolidation • SBC, Pacific Telesis, SNET, Ameritech – 1997 – SBC merged with Pacific Telesis – 1998 – SBC bought SNET – 1999 – Merged with Ameritech • 59.5 million lines in 13 states Industry Consolidation • BellSouth – Focused on international expansion controlling 6.2 million customers in 10 Latin American countries in 2000 Industry Consolidation • US West, Qwest, Time Warner, Frontier – US West pursued a cable strategy buying Wometco Cable, Georgia Cable Holdings, and 25% of Time Warner Cable – In 1997 it bought Continental Cablevision – Qwest bought US West and divested parts to Global Crossing – Global Crossing filed for bankruptcy, and Qwest is in shaky financial shape Local and Long Distance • The MFJ created local and long distance areas of service; these areas were called LATAs • RBOCs could provide inter-LATA service if they could prove (with the FCC’s 14-point checklist) that effective competition existed in the local market Traditional Long Distance Providers • With increased competition, profits decreased as pricing power eroded • Providers attempted to differentiate themselves by entering other markets such as data (WorldCom) or wireless (Sprint) • These moves required enormous amounts of capital expenses and huge debt burdens Long Distance Competition • AT&T started in a dominant position, but pursued a cable strategy wasting capital • WorldCom acquired MCI, but in the succeeding years began to misrepresent its finances, and filed for bankruptcy • Sprint created a wireless network, but is currently in financial difficulty due to its highly leveraged balance sheet Cellular and Wireless • Consolidation of the parent wireline companies is producing needed consolidation in wireless companies • Consolidation is more difficult in the wireless sector because not only do the geographic service areas need to work, but the cellular technologies of the two companies need to be similar (TDMA, GSM, or CDMA) Major U.S. Wireless Operators International Wireless • People in many countries worldwide are exchanging wireline phones for wireless • In 2002, there were more than 1 billion wireless subscribers • Ericsson predicts 1.6 billion global subscribers by 2005 as China and other third world countries begin to build out a cellular infrastructure Leading Global Wireless Operators Satellite Cellular • At one time this was thought to be the next frontier with cell sites in orbit • Eight companies attempted to build an orbital system • To date none of these have been successful, and investor capital has dried up, closing this cellular mode for the foreseeable future Global Telecom • Privatization in the 1990s has begun to radically reshape the global marketplace • As emerging economies grow, the demand for voice and data services will continue to expand • These markets are immature, and will require huge capital outlays to develop The World’s Largest Phone Companies The Fall of the Monopoly System • The current phone system in the US has its roots in the Bell System • Over the past two decades, enormous changes have reshaped the industry • Stresses from regulators, customers, competitors, technology and financial markets have radically transformed the face of the playing field Implications • The IT industry is undergoing rapid changes that are profoundly affecting managers at all levels and in all segments of business • The dynamic nature of the telecommunications landscape will offer bold and innovative management the tools and technology to deliver competitive products and service; it will also punish those unable or unwilling to adapt