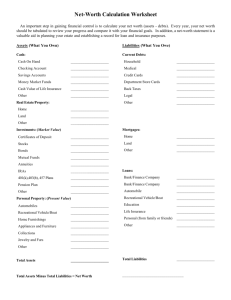

YOUR BALANCE SHEET

advertisement

YOUR BALANCE SHEET By Roger Betz, Sherrill Nott, Gerald Schwab Day 1 break to 12 p.m. In the United States Four Basic Financial Documents: • • • • Net Worth Statement (Balance Sheet) Income Statement Cash Flow Statement and a newer one -- Statement of Owner Equity Balance Sheet defined: A List of Assets Owned and Debts Owed -- At a Given Time, -- With Dollar Values Attached. If the Question Is: “Are my assets worth more than my liabilities?” The Problem is SOLVENCY! If Net Worth is Positive, the Business is Solvent Definition: $ Assets - $ Liabilities (Debts) = $ Net Worth or Equity What is the Balance Sheet or Net Worth Statement? • Picture in time -- a specific point, as in “Midnight, 12/31/XX.” • Shows financial position -- ability to handle risk • Net result of past • Very important component to track and monitor financial progress • Basic building block for financial analysis The Balance Sheet • Name -- What does this represent? Partnership, individual, combined Needs to be consistent over time • Date -- This is as of what date? • Listing of all assets and all liabilities • Balances at the bottom of form Assets = Liabilities plus Equity Balance Sheet Preparation Some Issues • IDENTIFY clearly the person(s) or the business entity being described • SEPARATE the business assets and liabilities from the personal • Be CONSISTENT as to WHEN the Balance Sheet is prepared at a minimum, prepare a net worth statement when your accounting year ends • Valuation of Assets -- costs and/or market recommend two column balance sheet The Balance Sheet is the Cornerstone to Financial Management Take out a Piece of Paper Draw some lines and label like this: Assets Liabilities Current Current Intermediate Intermediate Long Term Long Term Parts of the Balance Sheet Assets = What you own; have control of • Current assets Normally converted to cash in 12 months, like crops, market livestock, prepaid expenses, cash, savings • Intermediate Assets Useful life of one to 10 years -- machinery, breeding livestock, equipment, stocks, some buildings • Long Term Assets Normal useful life of more than 10 years -- land, buildings, stocks Selling would typically decrease volume or size of business Parts of the Balance Sheet (Current) Liabilities -- What you owe someone else (against what you own) • Current Liabilities What you are scheduled to pay in the next 12 months Unpaid bills, accrued interest, property taxes Operating loans Principal payments on term debts to be made in the next 12 months Parts of the Balance Sheet (Intermediate) Liabilities -- What you owe to someone else (against what you own) • Intermediate Liabilities What is scheduled to be paid in one to 10 years (subtract out the current position) Typically, machinery loans, breeding livestock, special use buildings Match up to the intermediate assets Parts of the Balance Sheet (Long Term) Liabilities -- What you owe to someone else (against what you own) • Long Term Liabilities What was scheduled originally as 11 or more years Land debt, house payments Match up to the long term assets Parts of a Balance Sheet (Term) Definition: • Term Debts are: Intermediate liabilities (Intermediate term) Long term liabilities Term debts are not current loans Balance Sheet Specials • 1. Rented assets Assets: 1) Belong on landlord’s balance sheet 2) Footnote on tenant’s 3) If payable, rent is short-term debt 4) Growing crops Balance Sheet Specials • 2. Growing Crops 1) Date sets the list 2) Winter Wheat 3) Value = Cost of variable inputs 3. Leased Items (tractors, pickups, buildings) Assets: • A) On user’s balance sheet = lease payments due Liabilities • B) = lease payments due Balance Sheet Specials • 4. Government Commodity Loans How To Build A Balance Sheet • 1) Do a count: – Crops: bushels, tons, etc. – Animals: head – Supplies – Buildings – Land: acres • 2) $ Prices for each of the above. – Recommend both cost and market value for term assets How To Build A Balance Sheet • 3) Machinery list (depreciation schedule?) Cost less depreciation = book value • • • • 4) Assemble the above into the format 5) Add up the assets 6) Add up the debts 7) Assets minus debts = net worth or equity “Z” Farms Balance Sheet Trends (example) Dec. 31, 19X1 Dec. 31, 19X2 Net Worth $400,000 WHY? $450,000 Change in Net Worth due to: • Retained Earnings from profits earned and retained in business • Market Valuation Equity from change in market value of assets Retained Earnings (contributed capital) Dollars earned by the business that are kept or retained for reinvestment in the business Calculated by: $ Total Assets @ Cost Value Basis $ Total Liabilities before Contingent Liabilities Valuation Equity Dollars of asset value that are created because the market value of term assets is greater than the book value Calculated by: + $ Total assets @ Market Value basis - $ Total Liabilities including Contingent Liabilities - $ Retained Earnings (contributed Capital) What a Balance Sheet is NOT • Does NOT necessarily tell you if the business is making money • Does NOT tell you where net worth came from A Good Balance Sheet 1) One page summary 2) Name and date 3) Shows type of farm 4) Cost and market columns A Good Balance Sheet 5) Indicates physical quantities of major items 6) Sequence of items Sale time: quick long 7) Assets less debts equals net worth (Own - Owe = Equity) The Balance Sheet: Building Block for Financial Analysis • • • • • Financial Position Trend Analysis Feeds Into the Income Statement Communication to Self Communicating with those outside the business • Needs Good Detail