YOUR BALANCE SHEET

advertisement

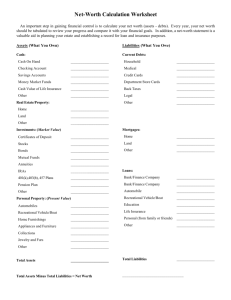

YOUR BALANCE SHEET Roger Betz, Sherrill Nott, Gerald Schwab, Barbara Dartt FIRM AoE team In the United States Four Basic Financial Documents: • • • • Balance Sheet (Net Worth Statement) Income Statement Statement of Cash Flows and a newer one -- Statement of Owner Equity Balance Sheet Purpose • Determines solvency of business Balance Sheet Defined • List of Assets Owned and Debts Owed – At a point in time – With dollar values attached + $ Assets - $ Liabilities (Debts) = $ Net Worth or Equity The Balance Sheet • Name -- What does this represent? – Partnership, individual, combined – Needs to be consistent over time • Date -- This is as of what date? • Listing of all assets and all liabilities • Balances at the bottom of form • Assets - Liabilities = Equity Balance Sheet Preparation Some Issues • IDENTIFY clearly the person(s) or the business entity being described • SEPARATE the business assets and liabilities from the personal • Be CONSISTENT as to WHEN the Balance Sheet is prepared – at a minimum, prepare a net worth statement when your accounting year ends • Valuation of Assets -- costs and/or market – recommend two column balance sheet The Balance Sheet is the Cornerstone to Financial Management Balance Sheet Asset Types • Current assets (<1 year) – Consumed or converted to cash in 12 months e.g. crops, market livestock, prepaid expenses,cash, savings • Intermediate (1-10 years) – e.g. machinery, breeding livestock, equipment, stocks, some buildings • Long Term (>10 years) – e.g. land, buildings, stocks – Selling would typically decrease volume or size of business Asset Value Determination • Book Value (cost basis) – Useful for trend analysis • Fair Market Value – Useful to determine liquidation value Balance Sheet Debt Types • Current liabilities (<1 year) – To pay in the next 12 months e.g. bills, accrued interest, taxes, operating loans • Intermediate (1-10 years) – What is scheduled to be paid in 1 to 10 years e.g. machinery loans, special use buildings • Long Term (>10 years) – Scheduled originally to be paid in 11 or more years e.g. land debt, house payments Parts of the Balance Sheet (Current) Liabilities -- What you owe someone else (against what you own) • Current Liabilities – What you are scheduled to pay in the next 12 months – Unpaid bills, accrued interest, property taxes – Operating loans – Principal payments on term debts to be made in the next 12 months Parts of the Balance Sheet (Intermediate) Liabilities -- What you owe to someone else (against what you own) • Intermediate Liabilities – What is scheduled to be paid in 1 to 10 years (subtract out the current position) – Typically, machinery loans, breeding livestock, special use buildings – Match up to the intermediate assets Parts of the Balance Sheet (Long Term) Liabilities -- What you owe to someone else (against what you own) • Long Term Liabilities – What was scheduled originally as 11 or more years – Land debt, house payments – Match up to the long term assets Parts of a Balance Sheet (Term) Definition: • Term Debts are Intermediate liabilities (Intermediate term) Long term liabilities Term debts are NOT current loans How to Build a Balance Sheet 1) Do a count: Crops: bushels, tons, etc. Animals: head Supplies Buildings Land: acres 2) $ Prices for each of the above. Recommend both cost and market value for term assets How to Build a Balance Sheet 3) Machinery list (depreciation schedule?) Cost less depreciation = book value 4) Assemble the above into the format 5) Add up the assets 6) Add up the debts 7) Assets minus debts = net worth or equity How to Build a Balance Sheet 3) Machinery list (depreciation schedule) Cost minus depreciation = book value 4) Assemble the above into the format 5) Add up the assets 6) Add up the debts 7)Assets minus debts = net worth, or equity Take out a Piece of Paper Draw some lines and label like this: Assets Current Liabilities Current Intermediate Intermediate Long Term Long Term What is the Balance Sheet? • Picture in time -- a specific point, as in “Midnight, 12/31/20XX.” • Shows financial position--ability to handle risk • Net result of past • Very important component to track and monitor financial progress • Basic building block for financial analysis What a Balance Sheet is NOT • Does NOT necessarily tell you if the business is making money • Does NOT tell you where net worth came from Change in Net Worth due to: • Retained Earnings – from profits earned and retained in business • Market Valuation Equity – from change in market value of assets Retained Earnings (contributed capital) Dollars earned by the business that are kept or retained for reinvestment in the business Calculated by: + $ Total Assets @ Cost Value Basis - $ Total Liabilities before Contingent Liabilities Balance Sheet Specials 1. Rented assets 1) Belong on landlord’s balance sheet 2) Footnote on tenant’s 3) If payable, rent is short-term debt Balance Sheet Specials 2. Growing Crops 1) Date sets the list 2) Winter Wheat 3) Value = Cost of variable inputs Balance Sheet Specials 3. Leased Items (tractors, pickups, buildings) Assets: A) On user’s balance sheet = lease payments due Liabilities B) On user’s balance sheet = lease payments due Balance Sheet Specials 4. Government Commodity Loans Valuation Equity Dollars of asset value that are created because the market value of term assets is greater than the book value Calculated by: + $ Total assets @ Market Value basis - $ Total Liabilities inc. Contingent Liabilities - $ Retained Earnings (contributed Capital) A Good Balance Sheet 1) One page summary 2) Name and date 3) Shows type of farm 4) Cost and market columns A Good Balance Sheet 5) Indicates physical quantities of major items 6) Sequence of items Sale time: quick ---> long 7) Assets less debts equals net worth (Own - Owe = Equity) The Balance Sheet: Building Block for Financial Analysis • • • • • Financial Position Trend Analysis Feeds Into the Income Statement Communication to Self Communicating with those outside the business • Needs Good Detail