Corporate Financial Theory

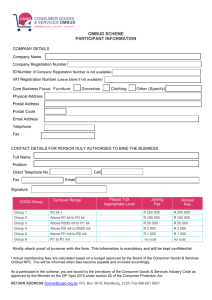

advertisement

CORPORATE FINANCIAL THEORY Lecture 9 Megers & Acquisitions Three Areas of Study 1. Determining if a Merger creates value (then developing an offer price) 2. Evaluating M&A offers in the market place (your case analysis assignment) 3. M&A Strategies (biggest area of “talk”) Today - Cover both Part 1 & 3 via lecture Part 2 via example Recent Mergers Bank of America Family Tree Note: Ironically, MBNA was once owned by a previous version of Bank of America, which sold it in an IPO. 2013 2010 2007 2004 2001 1998 1995 1992 1989 1986 1983 1980 1977 1974 1971 1968 1965 1962 Number of deals Mergers (1962-2013) 14,000 12,000 10,000 8,000 6,000 4,000 2,000 0 Sensible Reasons for Mergers Economies of Scale A larger firm may be able to reduce its per unit cost by using excess capacity or spreading fixed costs across more units. Reduces costs $ $ $ Sensible Reasons for Mergers Economies of Vertical Integration Control over suppliers “may” reduce costs. Over integration can cause the opposite effect. Pre-integration (less efficient) Post-integration (more efficient) Company S S S S S Company S S S Sensible Reasons for Mergers Combining Complementary Resources Merging may results in each firm filling in the “missing pieces” of their firm with pieces from the other firm. Firm A Firm B Sensible Reasons for Mergers Mergers as a Use for Surplus Funds If your firm is in a mature industry with few, if any, positive NPV projects available, acquisition may be the best use of your funds. Dubious Reasons for Mergers The Bootstrap Game Acquiring Firm has high P/E ratio Selling firm has low P/E ratio (due to low number of shares) After merger, acquiring firm has short term EPS rise Long term, acquirer will have slower than normal EPS growth due to share dilution. Dubious Reasons for Mergers Boot Strap Game Diversification Investors should not pay a premium for diversification since they can do it themselves. Excuse to change capital structure Dubious Reasons for Mergers The Bootstrap Game World Enterprises (before merger) EPS Price per share P/E Ratio Number of shares Total earnings Total market value Current earnings per dollar invested in stock $ $ $ $ $ 2.00 40.00 20 100,000 200,000 4,000,000 World Enterprises (after buying Muck and Slurry) Muck and Slurry $ 2.00 $ 2.67 $ 20.00 $ 40.00 10 15 100,000 150,000 $ 200,000 $ 400,000 $ 2,000,000 $ 6,000,000 0.05 $ 0.10 $ 0.067 Dubious Reasons for Mergers Earnings per dollar invested (log scale) World Enterprises (after merger) World Enterprises (before merger) Muck & Slurry .10 .067 .05 Now Time Other People’s Money Additivity Principle Estimating Merger Gains Economic Gain = PV(increased earnings) = New cash flows from synergies discount rate Q: If M&A creates value, Why? A: Synergies -Admin -Dup services -lower COC Estimating Merger Gains Questions Is there an overall economic gain to the merger? Do the terms of the merger make the company and its shareholders better off? ???? PV(AB) > PV(A) + PV(B) Estimating Merger Gains Gain PV AB ( PV A PVB ) PV AB Cost Cash paid PVB NPV gain lost PV AB ( cash PVB ) Estimating Merger Gains Example – Two firms merge creating $25 million in synergies. If A buys B for $65 million, the cost is $15 million. PVA $200 PVB $50 Gain PVAB $25 PVAB $275million Cost Cash paid PVB 65 50 $15million Estimating Merger Gains Example – The NPV to A will be the difference between the gain and the cost. NPVA 25 15 $10million NPVA wealth wit h merger - wealth wi thout merger ( PVAB Cash) PVA (275 65) 200 $10million Estimating Merger Gains Q: How Much Should A Firm Pay in a M&A? A: Theory Gain = PVAB - (PVA + PVB) A must pay B part of the gain A: Reality A usually pays B all of the gain, plus more. Why? Premium Paid by A = (Cash - MVB) + (MVB - PVB) Other People’s Money Board Meeting Takeover Methods Type of Takeovers • Hostile • Friendly • LBO • Going Private • Greenmail • White Knight Takeover Methods Tools Used To Acquire Companies Proxy Contest Tender Offer Acquisition Leveraged Buy-Out Merger Management Buy-Out Takeover Defenses White Knight - Friendly potential acquirer sought by a target company threatened by an unwelcome suitor. Shark Repellent - Amendments to a company charter made to forestall takeover attempts. Poison Pill - Measure taken by a target firm to avoid acquisition; for example, the right for existing shareholders to buy additional shares at an attractive price if a bidder acquires a large holding. Takeover Defenses Wall Street Board Meeting M&A Who Usually Benefits from M&A? Shareholders of B Lawyers & Brokers Execs in A Who Usually Losses in M&A? Shareholders of A Execs in B Employees M&A Analysis Steps for M&A Market Analysis • Briefly describe the financial & strategic history of the company • Determine pre-announcement value • Describe M&A offer • Determine merged value (examine synergies) • Compare values, offer, & market prices • Predict success of M&A • Recommend a strategy for investors and shareholders • Provide a summary analysis M&A Analysis History - News, Annual Report, 10k, etc. (Library & My Web page) (use spreadsheets to present financial facts) (reference your sources) (present both original & summary data) (remember to annualize data) Submit electronically Excel file only Named: Last Name in File Name Disney / Cap Cities Deal • • • Announcement of Offer Disney offers to acquire Cap Cities/ABC. Disney will exchange each share of Cap Cities for one share of Disney plus $65 cash. Disney will issue $10bil in new debt to finance the deal. Fact Sheet Disney CC \ ABC .EPS(curre nt) $ 2.60 5.10 .7/31 sh Price ($) 57.38 96.13 .8/1 sh Price ($) 58.63 116.25 PE ratio 22 # Shares 19 New Firm 2.33 * * 58.63 25 520 mil 154 mil EPS Growth Rate 20. % 14. % .Assets ($) 32.40 bil 15.30 bil 52.60 bil 47.70 bil 2.60 bil 0.50 bil 13.10 bil 3.10 bil 29.80 bil 14.80 bil 39.50 bil 44.60 bil EBIT 1.88 bil 1.28 bil 3.18 bil .Debt Service ($) 0.19 bil 0.04 bil 1.05 bil .Operating Inc ($) 1.69 bil 1.24 bil 2.13 bil .Taxes ($) 0.59 bil 0.43 bil 0.75 bil .Net Earnings ($) 1.10 bil 0.81 bil 1.38 bil .Debt ($ MV) .Equity ($ MV) 674 mil ? Comb Sep ** Disney Market Forecasted N.E. @ 14% growth rate Rd 7.25% 8.0 % Forecasted N.E. @ EPSx#New Shares EPS $ 2.50 $ 2.33 Disney Proforma Forecast (,000s) Perpetual discount rate = 11.36% Perpetual Avg Growth = 4% 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 $1,031,202 165,458 110,697 1,307,357 $1,198,772 191,600 116,232 1,506,605 $1,393,573 221,873 122,043 1,737,489 $1,620,028 256,929 128,146 2,005,103 $1,883,283 297,524 134,553 2,315,360 $2,189,317 344,533 141,281 2,675,130 $2,545,080 398,969 148,345 3,092,394 $2,958,656 462,006 155,762 3,576,424 $3,439,438 535,003 163,550 4,137,991 $3,998,346 619,534 171,727 4,789,607 $4,648,078 717,420 180,314 5,545,811 $5,403,390 830,772 189,329 6,423,492 959,018 164,776 58,116 1,181,910 1,114,858 190,811 61,022 1,366,691 1,296,023 220,959 64,073 1,581,055 1,506,626 255,871 67,276 1,829,774 1,751,453 296,298 70,640 2,118,392 2,036,064 343,113 74,172 2,453,350 2,366,925 397,325 77,881 2,842,131 2,751,550 460,103 81,775 3,293,428 3,198,677 532,799 85,864 3,817,340 3,718,462 616,981 90,157 4,425,600 4,322,712 714,464 94,665 5,131,841 206,240 23,164 55,349 284,753 239,754 26,824 58,116 324,694 278,715 31,062 61,022 370,799 324,006 35,970 64,073 424,049 376,657 41,653 67,276 485,586 437,863 48,235 70,640 556,738 509,016 55,856 74,172 639,044 591,731 64,681 77,881 734,293 687,888 74,900 81,775 844,563 799,669 86,735 85,864 972,268 929,616 100,439 90,157 1,120,211 1,080,678 116,308 94,665 1,291,651 8,543 9,741 11,124 12,721 14,568 16,702 19,171 22,029 25,337 29,168 33,606 38,750 276,210 314,954 359,675 411,327 471,019 540,036 619,873 712,264 819,226 943,100 1,086,605 1,252,901 Revenues Theme parks (exh 11) Motion pictures (exh 8) Consumer products (exh 12) Total revenues Costs & expenses of operations Theme Parks (80%) Motion pictures (86%) Consumer products (50%) Total costs & expenses 824,962 142,294 55,349 1,022,604 Operating income before corporate Entertainment & recreation Motion pictures Consumer products & other Total operating income Corporate Expenses G&A, Int, etc (3%) Income Taxes @ 43% Net Income 118,770 135,430 154,660 176,871 202,538 232,215 266,545 306,274 352,267 405,533 467,240 538,748 ----------------------- --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------157,440 179,524 205,015 234,456 268,481 307,821 353,327 405,991 466,959 537,567 619,365 714,154 ----------------------- --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Term Value= 10,091,303 Cash Flow 179,524 205,015 'NPV @ 19.82% = $2,713,269 Price per share = $78.65 # shares = 34.5 *Capital Investments are assumed to equal depreciation $71.72 37.83 $64.48 42.08 234,456 268,481 307,821 353,327 405,991 466,959 537,567 619,365 10,805,457 Year 0 1 2 3 4 5 6 7 8 9 10 11 12 13 Pretax cost savings, constant dollars Expected inflation rate Growth rate of FCF (nominal), in perpetuity Discount rate Ongoing investment / savings (year 3+) Pretax cost savings, current dollars Tax expense (@ 40%) After-tax cost savings Less: investment necessary to realize the savings Plus: disinvestment associated with the savings Subtotal Terminal value Free cash flow 14 Net Present Value of Cost Savings 1 2 3 4 $1,500 $3,000 $3,000 $3,000 2% 2% 2% 2% 5 $3,000 2% 2% 14% 0% $1,530 $3,121 $3,184 $3,247 (612) (1,248) (1,273) (1,299) 918 1,873 1,910 1,948 0 0 0 0 0 0 0 0 918 1,873 1,910 1,948 $0 $14,495 $3,312 (1,325) 1,987 0 0 1,987 16,892 $918 $1,873 $1,910 $1,948 $18,880 Assumptions: Growth rate WACC Tax rate 4.0% 10.2% 40% TSE Free Cash Flow 2000e Notes $2,187,208 2001e 2002e 2003e 2004e Sales $2,329,373 $2,480,785 $2,642,037 $2,813,769 $2,996,658 Cost of goods sold 1,910,086 2,034,244 2,166,470 2,307,291 2,457,260 Gross profit 419,287 446,541 475,567 506,478 539,398 Selling, general, & admin. (SG&A) expenses 125,786 131,482 140,028 146,316 155,826 Earnings before interest and taxes (EBIT) 293,501 315,060 335,539 360,162 383,572 Taxes 117,400 126,024 134,215 144,065 153,429 Net income 176,101 189,036 201,323 216,097 230,143 + Depreciation 27,950 29,770 31,700 33,170 35,960 - Capital expenditures (CAPEX) =1.1 times dep. (30,745) (32,747) (34,870) (36,487) (39,556) - increase in WC (as % change in sales) 1% (45,166) (48,102) (51,228) (54,558) (58,104) Free Cash Flow 128,140 137,957 146,925 158,222 168,443 Terminal value 2,828,362 Total Free Cash Flow $128,140 $137,957 $146,925 $158,222 $2,996,805 Dividends $128,140 $137,957 $146,925 $158,222 $2,996,805 Enterprise value Less debt Equity value Number of shares Value per share (DCF) Current price per share FCF Approach $2,291,497 $155,795 $2,135,702 64,417 $33.15 $21.98 Earnings before interest and taxes Less taxes Net operating profit after tax Less increse in net working capital Less capital expenditures Plus depreciation and amortization Free cash flow Terminal value Free cash flow with terminal value 2000 23,863 10,207 13,657 1,270 (1,582) 835 14,803 2001 27,503 12,240 15,263 1,461 1,161 900 13,541 2002 31,689 14,584 17,105 1,680 1,275 975 15,124 2003 33,614 15,811 17,803 773 1,148 1,010 16,892 2004 35,655 17,322 18,333 819 1,193 1,046 17,367 2005 37,818 18,934 18,884 868 1,240 1,085 17,861 2006 40,111 20,652 19,459 921 1,291 1,126 18,374 14,803 13,541 15,124 16,892 17,367 17,861 18,374 2007 42,542 22,584 19,958 976 14% of sales change 1,344 1,170 18,808 249,210 6% growth 268,018 Discount rate 14% Enterprise value 162,070 Less debt (46,000) Equity value 116,070 Lira/euro exchange rate 1,936 Equity value in EUR 59.95 Probabilistic Analysis: Monte Carlo Simulation Suppose we allow several assumptions to vary. What is the resulting distribution of the DCF value of equity? Sales growth years 1–3: 14%–17% Sales growth years 4–7: 5%–7% Operating cost/sales: 41%–49% Personnel cost/sales: 13%–17% Receivables/sales: 15%–18% Accounts payable/sales: 15%–18% Other payables/sales: 15/18%