Notes Chapter 2 - Barton College

advertisement

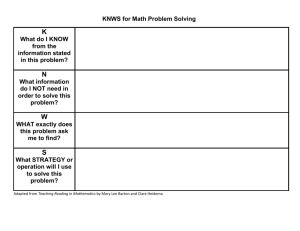

Financial Statements, Taxes and Cash Flow Chapter Two Retail Market Dollar General (NYSE:DG) on Tuesday raised its Family Dollar (NYSE:FDO) bid by 2% to $9.1 billion, or $80 a share, putting pressure on the takeover target to abandon its deal with Dollar Tree (NASDAQ:DLTR). Family Dollar has not yet backed Dollar General's offers, citing the $500 million break-up fee and antitrust concerns, and is standing by Dollar Tree's lower $8.5 billion, $74.50-a-share cash-and-stock deal. But the No. 1 deep discount retailer says it's willing to pay the break-up fee and divest up to 1,500 stores, up from a previous proposal of 700 stores, to clear regulators' concerns. View Enlarged Image "In the event you refuse to engage with us regarding our revised proposal, we will consider taking our persuasive and superior proposal directly to your shareholders," Dollar General CEO Rick Dreiling said in a letter to Family Dollar's board on Tuesday. Dollar General shares rose 1.2% to 64.73 on the stock market today. Dollar Tree rose 1.6% to 54.50. Family Dollar, which has been trading well above either prior offer, rose 0.5%, or 38 cents, to 80.21. Barton College 2-1 1 Family Dollar (FDO) Price… Barton College 2 Financial Statements and the Price of Oil Who do you think would be impacted….??? Barton College 2-3 3 Weekly Economic Indicators & Events Barton College 2-4 4 Chapter Outline • The Balance Sheet • The Income Statement • Taxes • Operational Cash Flow and the Cash Flow Identity – (Not the Statement of Cash Flows) Barton College 5 Balance Sheet • The balance sheet is a snapshot of the firm’s assets and liabilities at a given point in time Assets = Liabilities + Owners Equity • Assets are listed in order of liquidity – Ease of conversion to cash – Without significant loss of value • Anything can be sold quickly at the right price..! • Balance Sheet Identity – Assets = Liabilities + Stockholders’ Equity • Can a firm be too liquid? Barton College 6 The Balance Sheet - Figure 2.1 Assets = Liabilities + Stockholders’ Equity Total Equity = Common Stock + Paid in Capital (Surplus) + Retained Earnings Barton College 7 Net Working Capital and Liquidity • Net Working Capital – Current Assets – Current Liabilities – Usually positive in a healthy firm – Cash Flow impact looks at the change in NWC • Liquidity – – – – Ability to convert to cash quickly without a significant loss in value Liquid firms are less likely to experience financial distress But, liquid assets earn a lower return Trade-off to find balance between liquid and illiquid assets – How much NWC should we have? • • Carry Costs and Short-out become issues for short term financing Operating Cycle and Cash Cycle should be understood Chapters 16 and 17 look at understanding the optimal cash position. Barton College 8 US Corporation Balance Sheet – Table 2.1 Barton College 9 Real Balance Sheet • McGraw Hill Balance Sheet http://www.sec.gov/edgar/searchedgar/webusers.htm Direct Link to McGraw Hill (look at Higher Ed Operating Revenue……!!!) http://www.sec.gov/Archives/edgar/data/64040/000095012307014307/y41302e10vq.htm See pg 22-23 As of 1-19-16 http://www.sec.gov/Archives/edgar/data/64040/000006404015000026/mhfi-2015930xq3.htm Barton College 10 Balance Sheet Example Example Balance Sheet Barton College 11 Market vs. Book Value • The balance sheet provides the book value of the assets, liabilities and equity. • Market value is the price at which the assets, liabilities or equity can actually be bought or sold. – How do we calculate market value? – How do we determine the value of the asset? – Sometimes assets have to be written down on the books… • Market value and book value are often very different. Why? • Long Term Assets vs. Short Term Assets – Short Term: Book Value ≈ Market Value – Long Term: Book Value <> Market Value…… (Mortgage Backed) • Which is more important to the decision-making process? • What about “Human Capital”? How do we value this valuable asset…? – Apple Inc.…. Barton College 12 Market vs. Book Value • Book value = the balance sheet value of the assets, liabilities, and equity. • Market value = true value; the price at which the assets, liabilities, or equity can actually be bought or sold. – Market Value is more important to the decision-making process. Barton College 13 Market vs. Book Value S&P 500 Barton College 14 Klingon Corporation Market-to-Book ratio ------- > Market Value / Book Value MV is usually greater than 1 Notice that Long-term debt Book value and market value are the same, while NFA and Equity vary substantially. Barton College 15 Mark-to-Market Accounting • Mark the Book Value of Assets to Market Value – Credit Assets: Bonds, Collateralized Debt Obligations (CDOs) • Can severely impact Owners’ Equity (Liabilities are fixed) • BIG impact recently with Financial institutions, i.e., – Banks…. Involved with credit write downs. • In short, there are lag times between when Book values actually represent market values for an asset. Barton College 16 Bank of America (BAC) as of 1-18-13 Market Values can change quickly • ~ 85% drop in market price (per share) Barton College 17 Dell up on Rumors 1-18-13 (10% price value move) Barton College 18 Income Statement • The income statement is more like a video of the firm’s operations for a specified period of time. • You generally report revenues first and then deduct any expenses for the period • End result = Net Income = “Bottom Line” – Dividends paid to shareholders – Addition to retained earnings • Income Statement Equation: • Net Income = Revenue - Expenses • Matching principle – GAAP say to show revenue when it accrues and match the expenses required to generate the revenue – NOT always a measure of “cash flow” however. Barton College 19 US Corporation Income Statement EBIT = Operating Income Absorption-based costing as opposed to variable costing Sales - Less Variable Expense Contribution Margin - Less fixed Expenses Net Operating Income Barton College 20 Simple Income Statement Example Income Statement Barton College 21 Publicly Traded Companies • Publicly traded companies must file regular reports with the Securities and Exchange Commission (SEC) – 10K, 10Q, 8k, • These reports are usually filed electronically and can be searched at the SEC public site called EDGAR • Click on the web surfer, pick a company and see what you can find! • Example Potash Inc (chemical and fertilizer) • Example Apple Computer (computer industry) • SIC – Standard Industry Code • NAICS – North American Industry Classification System Barton College 22 Search Engines…. http://www.baidu.com/ http://www.google.com/ Barton College 23 Taxes • The one thing we can rely on with taxes is that they are always changing and they never go away…… • Marginal vs. average tax rates – Marginal – the percentage paid on the next dollar earned – Average – the tax bill / taxable income • Marginal Rates are used when we consider investment decisions. Why? • Other taxes Barton College 24 Example: Marginal vs. Average Rates • Example: Suppose your firm earns $4 million in taxable income. – What is the firm’s tax liability? – What is the average tax rate? – What is the marginal tax rate? • If you are considering a project that will increase the firm’s taxable income by $1 million, what tax rate should you use in your analysis? • Ford’s (F) tax return is over 6 feet high and requires 50 people to prepare. The IRS requires a team of auditors just to monitor the return? – Is this an efficient use of resources? Should we abolish Corporate Income Tax? Barton College 25 Same Problem (Excel) Tax on $4 million Taxable Income Levels Tax Rate Income Liability $ - $ 50,000 15% $ 50,000 $ 7,500 $ 50,001 $ 75,000 25% $ 25,000 $ 6,250 $ 75,001 $ 100,000 34% $ 25,000 $ 8,500 $ 100,001 $ 335,000 39% $ 235,000 $ 91,650 $ 335,001 $ 10,000,000 34% $ 3,665,000 $ 1,246,100 $ 10,000,001 $ 15,000,000 35% $ 15,000,001 $ 18,333,333 38% $ 18,333,334 $ 4,000,000 $ 1,360,000 - Average Rate = 34% Marginal Rate = 34% Barton College 35% 26 Average Tax Rates Barton College 27 Problems (next time) • Complete problems: – Review of financial statements and Tax • Barton College 1-8 from Chapter 2 of your text….. 28 Cash Flow and several ways to view cash flow Barton College 29 Apple set record earnings… Apple's net profit more than doubled in the first quarter of fiscal 2012 to a record $13.06 billion, while revenue soared to an all-time high of $46.33 billion from $26.74 billion a year ago…….. ~ 100 Billion in Cash and NO Debt…. Barton College 30 Apple Metrics… Barton College 31 Samsung Galaxy Upgrade? Samsung Galaxy Note 4 iPhone 6 Barton College 32 The Concept of Cash Flow • Cash flow is one of the most important pieces of information that a financial manager can derive from financial statements • The Statement of Cash Flows does not provide us with the same information that we are looking at here • We will look at how cash is generated from utilizing assets and how it is paid to those that finance the purchase of the assets Barton College 33 Cash Flow From Assets • Cash Flow From Assets (CFFA) = Cash Flow to Creditors + Cash Flow to Stockholders • Cash Flow From Assets (CFFA) = Operating Cash Flow (OCF) – Net Capital Spending – Changes in NWC • CFFA is not the same thing as the Cash Flow Statement….. – Cash Flow Direct Method on Board…. Barton College 34 Cash Flow Model Cash Flow to Creditors The cash flow identity Cash Flow from Assets = Cash flow to creditors + Cash flow to owners Cash flow to creditors = Interest – net new debt = Interest – (Ending LTD – Beg LTD) 1. Cash Flow of Assets (Firm) Cash Flow to Stockholders (owners) Cash flow from Assets = OCF – NCS – change NWC Cash to owners = Dividends – Net new equity (includes common stock and paid in capital) OCF = EBIT + Depreciation – tax NCS = (Ending NFA – Beg NFA) + Depreciation Change NWC = Ending NWC – Beg NWC $ $ OCF – change NWC Assets (Firm) $ True Cash Flow From Operations Creditors Free Cash flow of the Firm or Cash flow from Assets Stockholders (Owners) NCS (OCF- Change NWC – NCS) Barton College 35 Cash Flow Model Cash Flow to Creditors The cash flow identity Cash Flow from Assets = Cash flow to creditors + Cash flow to owners Cash flow to creditors = Interest – net new debt = Interest – (Ending LTD – Beg LTD) 1. Cash Flow of Assets (Firm) Cash flow from Assets = OCF – NCS – change NWC Cash Flow to Stockholders (owners) OCF = EBIT + Depreciation – tax Cash to owners = Dividends – net new equity (includes common stock and paid in capital) NCS = Ending NFA – Beg NFA + Depreciation Change NWC = Ending NWC – Beg NWC Retained Earnings Plowback $ OCF – change NWC True Cash Flow From Operations Barton College $ Assets (Firm) $ NCS Creditors CFFA (Free Cash Flow) Investments & Other non-operating Income Stockholders (Owners) 36 Cash Flow Model with Financial Statements Cash Flow to Creditors Cash flow to creditors = Interest – net new debt = Interest – (Ending LTD – Beg LTD) Cash Flow to Stockholders (owners) Cash to owners = Dividends – Net new equity (includes common stock and paid in capital) OCF – change NWC Assets (Firm) Free Cash flow of the Firm or Cash flow from Assets Creditors Stockholders (Owners) NCS OCF = EBIT + Depreciation – tax NCS = Ending NFA – Beg NFA + Depreciation Change NWC = Ending NWC – Beg NWC Barton College 37 Cash Flow Summary Table 2.5 Barton College 38 Example: U.S. Corporation Balance Sheet Assets Current Assets Cash Accounts Receivable Inventory Total Fixed Assets Net Fixed assets Total assets 2009 2010 $104 455 553 $1,112 $160 688 555 $1,403 $1,644 $1,709 $2,756 $3,112 Liabiities & Owners' Equity 2009 Current Liabilities Accounts Payable $232 Notes Payable 196 Total $428 Long-term debt Owners' equity Common stock and paid-in surplus Retained earnings Total Total Liabilties & Owners Equity U.S. Corporation Income Statement 2010 $266 123 $389 $408 $454 600 1,320 $1,920 640 1,629 $2,269 $2,756 $3,112 Net sales Cost of goods sold Depreciation Earnings before interest and taxes Interest Paid Taxable income Taxes Net Income Dividends Addition to retained earnings $1,509 750 65 $694 70 $624 212 $412 $103 $309 • CFFA = OCF – NCS - ΔNWC OCF = EBIT + depreciation – taxes = $694 + 65 – 212 = $547 NCS = ending net FA– beginning net FA + depreciation = $1709 – 1644 + 65 = $130 Barton College ΔNWC = ending NWC – beginning NWC = ($1403 – 389) – ($1112 – 428) = $330 CFFA = 547 – 130 – 330 = $87 39 Example: U.S. Corporation U.S. Corporation U.S. Corporation Income Statement Balance Sheet Assets Liabiities & Owners' Equity 2009 Current Assets Cash Accounts Receivable Inventory Total Fixed Assets Net Fixed assets Total assets 2010 $104 455 553 $1,112 $160 688 555 $1,403 $1,644 $1,709 $2,756 • CFFA CF/Cr $3,112 Current Liabilities Accounts Payable Notes Payable Total Long-term debt Owners' equity Common stock and paid-in surplus Retained earnings Total Total Liabilties & Owners Equity 2009 2010 $232 196 $428 $266 123 $389 $408 $454 600 1,320 $1,920 640 1,629 $2,269 $2,756 $3,112 Net sales Cost of goods sold Depreciation Earnings before interest and taxes Interest Paid Taxable income Taxes Net Income Dividends Addition to retained earnings = CF/Cr + CF/Sh = $1,509 750 65 $694 70 $624 212 $412 $103 $309 OCF – NCS – ΔNWC = $87 = interest paid – net new borrowing = $70 – ($454 – 408) = $24 CF/Sh = dividends paid – net new equity = $103 – ($640 – 600) = $63 • CFFA Barton College = $24 + $63 = $87 40 Cash Flow Example Fictious Corp Balance Sheet Assets Cash 1-Jan 100 31-Dec 150 AR 200 250 Inv 300 Current Assets NFA Total Assets 1-Jan 100 31-Dec 150 NP 200 200 300 Current Liab 300 350 600 700 LTD 400 420 400 500 CS & PIC 50 60 ARE 250 370 Total Liab 1000 1200 1000 1200 Liabilities AP Fictious Corp Income Statement Sales - Costs - Dep 2000 -1400 -100 EBIT 500 - Int -100 - Tax -200 Net Income Dividends Retained Earnings Barton College 200 80 120 41 Example: Balance Sheet and Income Statement Information • Current Accounts – 1998: CA = 4500; CL = 1300 – 1999: CA = 2000; CL = 1700 • Fixed Assets and Depreciation – 1998: NFA = 3000; 1999: NFA = 4000 – Depreciation expense = 300 • LT Liabilities and Equity – 1998: LTD = 2200; Common Equity = 500; RE = 500 – 1999: LTD = 2800; Common Equity = 750; RE = 750 • Income Statement Information – EBIT = 2700; Interest Expense = 200; Taxes = 1000; Dividends = 1250 Barton College 42 Example: Cash Flows • OCF = 2700 + 300 – 1000 = 2000 • NCS = 4000 – 3000 + 300 = 1300 • Changes in NWC = (2000 – 1700) – (1500 – 1300) = 100 • CFFA = 2000 – 1300 – 100 = 600 • CF to Creditors = 200 – (2800 – 2200) = -400 • CF to Stockholders = 1250 – (750 – 500) = 1000 • CFFA = -400 + 1000 = 600 • The CF identity holds. Barton College 43 Quick Quiz • What is the difference between book value and market value? Which should we use for decision making purposes? • What is the difference between accounting income and cash flow? Which do we need to use when making decisions? • What is the difference between average and marginal tax rates? Which should we use when making financial decisions? • How do we determine a firm’s cash flows? What are the equations and where do we find the information? Barton College 44 Critical Thinking Questions • Review questions in class….. Page 44 Barton College 45 Homework Problem Set • Assign problems and work in-class examples…. – See FIN 301 Assignment Page • Read Chapters – 3 (Financial Statements & Ratios) Barton College 46