Federal Loan Volume in California - California Institute for Federal

advertisement

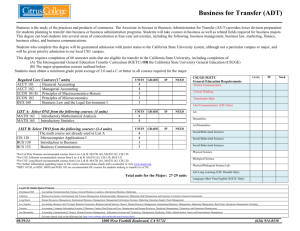

California Institute: Congressional Briefing on Student Financial Aid September 26, 2007 Anne McKinney, CCC Allison Jones, CSU Carolyn Henrich, UC Sam Kipp, EDFUND Congressional Briefing on Student Financial Aid September 26, 2007 Anne McKinney Presenter California Community Colleges o Mission – To provide upward social and economic mobility through a commitment to open access and student success by delivering high quality, affordable and comprehensive higher education o Number of colleges – 109 o Number of students – 2.5 million o Demographics – Through the California Master Plan for Higher Education, the CCC is designated as the State’s “open door“ for citizens of any race, age, gender or income level o Governance structure – Chancellor’s Office (state agency); 72 local districts and governing boards; 109 colleges o Unique – California Community Colleges have legislatively designated multiple missions: associate degrees and certificates; transfer; basic skills and English language proficiency; economic and workforce development and lifelong learning o Diversity – African American 8%; Asian 12%; Hispanic 29%; White 35%; Other 16% Federal Aid at California Community Colleges Grants to Students: o Pell Awards – $598 m/256,000 students o Federal Work Study – $25.4 mil/13,000 students o Federal SEOG – $29 m/61,000 students o Federal Loans – $128 m/42,000 students Outreach -- Financial Aid staff held over 71,000 financial aid events for their own students, high schools, community & faith-based groups/1.3M persons served Other Aid Resources Utilized at California Community Colleges State Aid: o Cal Grants – $76 m/67,000 students o Institutional Aid – Board of Governors (BOG) Fee Waivers -- $273 m/717,000 students o Scholarships – $15 m/15,000 students o Private Loans – not tracked o Specialized programs – $12-15m/3,000 students Academic Competitiveness Grant (ACG) Program Purpose: Additional resources for needy students – up to $750 for 1st academic year & up to $1,300 for 2nd Eligibility: Student must be: – – – – Federal Pell Grant recipient U.S. citizen enrolled full time in a degree program have completed a rigorous secondary school program See: http://www.ed.gov/admins/finaid/about/ac-smart/2007/state-programs07.html – maintain cumulative GPA of 3.0 or higher Restrictions: – ACG + Pell Grant may not exceed cost of attendance – Grants ratably reduced to ensure grants to all eligible – Awards reduced by USDE if funds insufficient California Community College Issues Issues: ACG Definitions Sec 401A states: “….a full-time student … U.S. citizen….in the case of a student enrolled or accepted for enrollment in -- (A) the first academic year of a program of undergraduate education at a two- or four- year degree- granting institution of higher education…”. Recommendations: Extend ACG participation to eligible students enrolled in “certificate programs in which units can be applied as credit towards a degree”. Extend participation to include prorated awards for “part-time” eligible students and eligible “non-citizens”. Allow participating institutions to define the student’s award year and academic year as contained in the Senate Reauthorization proposal. Redefine ACG eligibility period as “up to the first 4 semesters of study (or FT equivalence) in an eligible program with degree applicable coursework” and realign ACG payments to be in equal increments for all payment periods. Contact Information Anne McKinney Asst. Vice Chancellor Federal Government Relations 916-445-1780 AMCKINNEY@CCCCO.EDU The California State University Allison G. Jones Assistant Vice Chancellor Academic Affairs Office of the Chancellor The California State University The California State University: Mission and Governance – Mission To provide high-quality, accessible, affordable, and student-focused education Prepare graduates for the workforce Significant impact on economy of California – 23 campuses – 450,000 students Largest public university-system in country – Governance 25-member Board of Trustees, the majority of whom are appointed by the governor to 8-year terms Faculty, alumni, and two student trustees serve 2-year terms The California State University – 23 Campuses – CSU Bakersfield CSU Channel Islands CSU Chico CSU Dominguez Hills CSU East Bay CSU Fresno CSU Fullerton Humboldt State CSU Long Beach CSU Los Angeles California Maritime Academy CSU Monterey Bay CSU Northridge Cal Poly Pomona CSU Sacramento CSU San Bernardino San Diego State San Francisco State San Jose State Cal Poly San Luis Obispo CSU San Marcos Sonoma State CSU Stanislaus The California State University - Students – A diverse mix Average undergraduate age is 25 44% are independent from parents 25% have dependents 80% work and 36% work 30 hours or more 30% are first generation in family to attend college 40% from households where English in not the primary language spoken 54% are students of color Unique Characteristics of the CSU (Pt. 1) – Affordability Average annual student fee (“tuition”) = $3199 (2006-07) – Diversity CSU provides more than half of all undergraduate degrees granted to state’s Latino, African American, and Native American students 12 Hispanic Serving Institutions – Community Service More than 185,000 students participate in community service annually, donating nearly 30 million hours, the minimum wage equivalent of $200 million In 2005-06, more than 25% of CSU’s total Federal Work Study funding was designated for community service placements, well above the national average of 14% and more than triple the minimum federal requirement Unique Characteristics of the CSU (Pt. 2) Workforce Preparation – CSU graduates help drive California’s aerospace, healthcare, entertainment, information technology, biomedical, international trade, education, and multimedia industries. CSU confers 65 percent of California’s bachelor’s degrees in business, 52 percent of its bachelor’s degrees in agricultural business and agricultural engineering, and 45 percent of its bachelor’s degrees in computer and electronic engineering. – The California State University also educates the professionals needed to keep the state running. It provides bachelor’s degrees to teachers and education staff (87 percent), criminal justice workers (89 percent), social workers (87 percent) and public administrators (82 percent). – Altogether, about half the bachelor’s degrees and a third of the master’s degrees awarded each year in California are from the California State University. All Sources of Aid at CSU (2005-06) Total aid (all sources) – 235,757 students (unduplicated) received $1.8 billion ($7,548 average) Grants to Students (federal, state, and institutional) – 178,272 students received $842 million ($4,723 average) – Of above, Pell Grants received by 116,198 students totaling $317 million ($2,727 average), which represents 17.8% of total aid – Grants represent 47.3 percent of total aid Work Study – 8,100 students received $18.3 million ($2,261 average) – Work Study represents 1% of total aid Loans to Students – 139,362 students received $919 million ($6597 average) – Loans represent 51.7% of total aid Federal Aid at CSU (2005-06) Grants: – Pell: 116,198 awards totaling $317 million 17.8% of all aid – SEOG: 20,322; $11.2 million; $550 average; .6% of all aid – BIA:117; $345K; $2951 average; .0% – Other Federal Grants: 1,642; $2.9 million; $1,774 average; .2% Federal Work-Study – 8,100; $18.3 million; $2,261 average; 1% of total aid Federal Loans – 137,010; $869 million; $6,342 average; 48.4 of all aid Hispanic Serving Institutions Other Aid Resources Utilized at CSU (2006-07) State Aid – Cal Grants: 56,879; $166 million; $2909 average; 9.3% of all aid Institutional Aid – State University Grants: 107,433; $228 million; $2,122 average; 12.8% of all aid – EOP Grants: 20,091; $17.4 million; $866 average; 1% of all aid Scholarships: 11,581; $23.5 million; $2,026 average; 1.3% of all aid Private Loans: 4,344; $31.9 million; $7,346 average; 1.8% of all aid Other: 37,066; $76.4 million; $2061 average; 4% of all aid How Federal Policymaking Affects the CSU Increasing Pell Grants – Academic Competitiveness Grants (ACG) – National Science and Mathematics Access to Retain Talent Grants (SMART) TEACH grants: provide $4000/year in scholarships to encourage outstanding candidates to teach in high need schools and/or high need subject areas CSU Priorities in the 110th Congress Pell Grants: – Support overall funding increases – Support Year-Round provision– 2nd Grant for students to pursue year-round study to shorten time-to degree Early Intervention Programs – Expand GEAR UP and TRIO, vital to preparing underrepresented students for college and decreasing need for remediation In 2005-06, 17 key systemwide and 169 campus outreach programs served 1,462 K12 schools, serving 162,240 students Key to student success Hispanic Serving Institutions – Advocate Title V changes to expand and strengthen Hispanic Serving Institutions Campus-based Aid Programs – Support altering current campus-based aid distribution formula to assure allocation of funds on a fair-share basis to institutions with growing populations of students with need and to new campuses, which have been most disadvantaged by current formula Veterans Benefits – Support legislation that increases and improves benefits to expand higher education opportunities for veterans, especially for Reserve and National Guard in particular Contact Information Allison Jones ajones@calstate.edu 562.951.4744 OR CSU Office of Federal Relations Jim Gelb, George Conant, Lucy Hamilton-Duncan 202.434.8060 Student Financial Support at the University of California California Institute for Federal Policy Research September 2007 Overview UC is a comprehensive public research institution and California’s Land-Grant University The Regents of UC oversee this “public trust,” which is autonomous under the California Constitution 10 campuses 230,000 students; 180,000 undergraduates More than half of UC students receive grants & scholarships More than two-thirds receive some federal aid (inc. loans) 29% of UC undergraduates receive Pell Grants, which is the highest percentage of any comparable research institution Federal Aid at UC Pell Grants Academic Competitiveness Grants SMART Grants SEOG – Supplemental Educational Opportunity Grants Perkins Loans Federal Work Study Federal Student and Parent Loans Typical on-campus undergrad cost to attend UC $7,446 $ 892 $1,475 $2,412 $11,755 $23,980 fees health insurance premiums books & supplies incidental expenses housing and food Total Net Cost of UC by income $0 $24,000 $1,630 $5,600 $20,000 $16,000 $14,380 $14,380 $12,750 $14,080 $8,780 Parent Contribution Grant Support $12,000 Student Loan and Work Expectation $8,000 $4,000 $9,600 $9,600 $9,600 $9,600 $9,900 $20K Annual Income $40K Annual Income $60K Annual Income $80K Annual Income Independent Student $0 (Living on campus: $23,980) UC Concerns about the federal need-analysis formula The federal need analysis process is inequitable, particularly in areas where housing costs are high The formula needs updating to reflect the increasing proportion of income that families devote to housing costs HEA Title IV Need Analysis The need analysis process is outlined in the Higher Education Act as a means to determine the amount of money a student and the student’s family may be reasonably expected to contribute toward postsecondary education in a given academic year Expected Family Contribution Available income of the student and the student’s parents Number of dependents in the family Dependents in postsecondary education Net assets of the student and parents Age of the parents Additional parental employment expenses Income Protection Allowance 22% housing 78% everything else An updated formula would reflect regional sensitivity The revised formula would improve the fairness in targeting Pell Grants and ACG/SMART Grant dollars A formula change would also affect students’ eligibility for federal loans Sample Data The “family” we use to illustrate this case has two parents and two children; one in college Income is $35,000 per year Local housing costs are based on HUD’s 2007 estimates of “Fair Market Rent” for two-bedroom rental of standard quality On average the current allowance covers 70% of US housing costs Changes in EFC Family Location Expected Family Contribution Revised EFC (annual) Brownsville no change Great Falls no change Knoxville no change Wichita no change Provo no change Kenosha $2,968 no change Seattle $2,698 Minneapolis $2,673 Miami $1,761 San Diego Boston $501 $0 Changes in Pell Awards Family Location Expected Pell Award Revised Expected Pell (annual) Award (annual) Brownsville no change Great Falls no change Knoxville no change Wichita no change Provo no change Kenosha $1,342 no change Seattle $1,612 Minneapolis $1,637 Miami $2,639 San Diego $3,809 Boston $4,310 Contact Information Carolyn Henrich University of California Office of Federal Governmental Relations 1608 Rhode Island Avenue, N.W. Washington, D.C. 20036 202.974.6308, office carolyn.henrich@ucdc.edu EDFUND Dr. Samuel M. Kipp III President Rancho Cordova, CA EDFUND Overview EDFUND, a California nonprofit public-benefit corporation, is the nation’s second largest provider of student loan guarantee services under the Federal Family Education Loan (FFEL) Program EDFUND was created in 1997 as an auxiliary of the California Student Aid Commission because it was not possible to provide competitive, responsive, high-quality student loan services within a state agency structure. Federal Loan Volume in California FY 2005-06 Others $1.5 Billion 27% EDFUND $2.9 Billion 51% Direct Loans $1.3 Billion 22% EDFUND guarantees more than 50% of the FFEL Loan Volume in the state of California EDFUND Accomplishments 1,600 schools nationwide use EDFUND as their guarantor Saved students more than half a billion dollars in college costs Provide more than 600 free training and outreach sessions to students and institutions each year Reduced loan default rate from 14.4 to 8.6 percent Employ more than 600 resident Californians adding $54 million a year to the state’s economy in salaries and benefits Collected nearly $4 billion in unpaid defaulted loans Generate millions of dollars of tax revenue for the state Helping Student Borrowers During Their Entire Education Experience Outreach publications and services help students and families make informed choices about paying for college Partner with students, parents, schools and lenders to ease the application and origination process Provide entrance and exit counseling, enrollment status updates and other borrower support services during in-school and grace periods Offer counseling, financial and debt management, delinquency and default prevention assistance during the entire repayment period Collection recovery and loan rehabilitation Innovative EWC Program Helps Highest Risk Borrowers Students who withdraw before degree or program completion are personally counseled in our Voluntary Flexible Agreement (VFA) Early Withdrawal Counseling Program and are: – Almost twice as likely to return to school; – Much less likely to become delinquent at any time during their first year after leaving school; – Much more likely to return to or remain in a positive repayment status one year after leaving school; and – One-third less likely to default within two years of leaving school Important Loan Issues for California Students and Institutions California has the most ethnically and economically diverse student population in the country. – The future of the state’s economy depends on making access to postsecondary education a reality for all students. Loans, particularly federal loans, are the single largest source of financial aid for California students. Continued access to loans and timely, high quality, responsive support services are critical to maximizing California students’ chances for successful educational and repayment experiences. Guaranty agencies, such as EDFUND, play a critical role by providing innovative programs and support services that best meet the distinct needs of all California students. Contact Info: Dr. Samuel M. Kipp, III President (916) 526-8010 SKipp@edfund.org Jack Gorman Director - Washington, DC Office 202.997.9736 jgorman@edfund.org California Institute: Congressional Briefing on Student Financial Aid September 26, 2007 Anne McKinney, CCC Allison Jones, CSU Carolyn Henrich, UC Sam Kipp, EDFUND