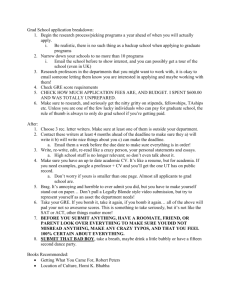

What They Don't Teach You in Graduate School

advertisement

What They Don’t Teach You in Graduate School Scott Dietzen, Ph.D. CTO, BEA Systems & CMU CS ’92/ CMU Applied Math/CS ’84 scott@dietzen.com 1 Dedication And Acknowledgements • This talk dedicated to the memory of Bruce Nelson, CMU CS ’82 – http://www.cs.cmu.edu/about/development/aboutnelson.html • Why I volunteered (i.e., why I felt sufficiently presumptuous) – Bruce help plant the seeds that inspired my entrepreneurship as well as my time on the dark side (working in marketing & sales) – I’ve had some modest success as an entrepreneur • Transarc IBM (Principal Technologist) • WebLogic BEA (V.P. Marketing – Ha!, CTO) • Acknowledgements – I plagiarized heavily from Bruce’s talk – Borrowed some content from top-tier VCs • Special thanks to Redpoint, Accel – Borrowed some content from fellow entrepreneurs • Special thanks to the WebLogic team • And Paul Maritz (Lessons Learned at Microsoft) Scott Dietzen What They Don’t Teach You in Grad School ’03 2 The Missing Syllabus • Technology adoption cycle • The hurdles to commercial success • Why non-technical issues matter • Why technologists feel underpaid • High-tech company organization • Start-ups • Venture capital • Managing for success Scott Dietzen What They Don’t Teach You in Grad School ’03 3 Classic Technology Adoption Curve Adoption Client/server RDBMS Late adoption (cash cow) Mainframe, AS/400 software Mainstream adoption Web application platform Crest of hype Web services Early adoption Black lash against hype Innovation Scott Dietzen This is the best case scenario--all technology aspires to be legacy! At any point on the curve, new technologies may wash out (few make past each phase) Market Growth/Consolidation What They Don’t Teach You in Grad School ’03 Time 4 High Tech Efforts For success Laser focus on specific customers—not theoretical— and vivid understanding of pain and needs Clear understanding of needs hierarchy (what are they buying? Where is the pain/need in their priority stack?) Most typical downfall Cool technology, but insufficient business value Too high-level a value proposition—doesn’t connect with new spending realities and specific pain points Unrealistic goals – Time/money insufficient to reach demonstrable value Scott Dietzen What They Don’t Teach You in Grad School ’03 5 Why High-Tech Efforts Fail (Cont.) • Miss technology sea changes – Proprietary networks (SNA, IPX, AppleTalk IP), SQL (Unify) – Java/J2EE (NetDynamics, Kiva, ATG, BroadVision, …) • Too much complexity for mainstream adoption? – DCE, CORBA, SAA, ATM, Infiniband – Web platform (Web services, J2EE, .NET) still at risk • Weak execution – Team comes apart or doesn’t come together – Focus wanes – Not sufficiently responsive to change • Ferocious competition – 40+ web application server vendors 3 viable today Scott Dietzen What They Don’t Teach You in Grad School ’03 6 Why Non-Technical Issues Matter • In the “real” world, technology is the means to the end – not the end • To change IT in the “real” world, you need to make the business case to the technology end-user – Define compelling value proposition – Articulate the return on investment (ROI) • There is a very high hurdle for doing this – Think about receiving phone solicitations at your home • This is why marketing and especially sales are so highly-valued Scott Dietzen What They Don’t Teach You in Grad School ’03 7 Why Do Technologists Feel Underpaid The intellectual level needed for system design is in general grossly underestimated. I am convinced more than ever that this type of work is very difficult and that every effort to do it with other than the best people is doomed to either failure or moderate success at enormous expense. –Edsger Dijkstra Because they don’t understand the game • Technologists often feel sales and especially marketing are trivial • But in most companies, R&D is <5%; even in high-tech R&D it is generally <20% • If this were not an optimal model, then the free market would correct it Scott Dietzen What They Don’t Teach You in Grad School ’03 8 Technology Company Organization Corporation Finance and Administration Engineering Research (Huge Companies) Marketing Sales Manufacturing Services: Consulting and Support Advanced Development Customers (Most Companies) (Solvent Companies) Scott Dietzen What They Don’t Teach You in Grad School ’03 9 How Departments Contribute Value Marketing Defines, targets and articulates value (specifications and collateral) Engineering Refines and implements value (designs and tunes products) Manufacturing Physically creates value (products) Sales Creates desire for and demonstrates value (explains products) Service Preserves, transfers and enhances existing value (care and customization) Finance and Administration Administers the value-adding machine (company and customers) Scott Dietzen What They Don’t Teach You in Grad School ’03 10 Marketing Marketing represents the company to the “target” customer • Strategic marketing – Directs product strategy and often corporate strategy (in conjunction with company thought leaders) – Owns the company business plan – Product/technical marketing – Pricing, channel strategy, competitive strategy • Tactical marketing – – – – – Scott Dietzen Public relations Demand creation (finding/qualifying new customers) Public face (literature, top-level web-site, events, advertising, etc.) Strategic partnerships Company and product naming/corporate identity (Ouch!) What They Don’t Teach You in Grad School ’03 11 Marketing/Engineering Interaction With respect to Engineering, Marketing: • Determines product lines and families • Specifies individual products externals at a high-level – Engineering owns the internals and the details • Is usually responsible for planning product configurations, packaging, and documentation • Sets prices, options, and schedules product introductions Scott Dietzen What They Don’t Teach You in Grad School ’03 12 Sales Sales represents the company to the customer (and vice versa) • Actively approaches and cultivates new customers • Demonstrates a products added value and helps customer internal champions overcome objections • Is customer’s liaison to the company for pre-sales support, postsales product improvements, and win/win business dealings • Forecasts business bottom-up – Revenue forecasts are prime corporate feedback loop • Note: Sales channels are typically very expensive (This is a fundamental start-up conundrum) Scott Dietzen What They Don’t Teach You in Grad School ’03 13 Marketing/Sales Interaction With respect to Sales, Marketing: • Forecasts business top-down (Sales goes bottom up) • Selects distribution channels (in conjunction with Sales) – Value chain can be complex (Value-added ISVs, SIs, OEMs) – Some product requirements come out of channel model • Provides sales tools to sell (transfer genuine confidence) company and product value proposition – Literature, advertising, demos, benchmarks, competitive analysis, product training, roadshows, seminars, and so on • Conducts sales training (nontrivial) Scott Dietzen What They Don’t Teach You in Grad School ’03 14 Life of a CTO Extremely inter-disciplinary role • Spend time with – Customers and partners via sales (50% in my case) – Industry orchestration (Standards) – Engineering (defining release themes and refereeing disputes) – Corporate strategy/governance – Evaluating start-ups/ISVs as partners/acquisitions – Investors and financial analysts – Industry analysts and press • In practice – Meetings, presentations, phone calls, and email – Stretched a mile wide and ½ an inch deep – Far more grunt work than deep thinking (worse than academia) Scott Dietzen What They Don’t Teach You in Grad School ’03 15 Comedy Break #1: Top Ten Signs You May Be Traveling Too Much (All true stories) 6. You have to go to the hotel front desk to have them look up your room number (since it’s not on the plastic key) 7. Flight attendant’s greet you by name 8. You’ve eaten nothing but airplane food for more than 24 consecutive hours 9. You read the hotel stationary to find out what city and country you’re in 10. You have a nightmare about being on an airplane, and then you wake up on an airplane Scott Dietzen What They Don’t Teach You in Grad School ’03 16 Comedy Break #1: Top Ten Signs You May Be Traveling Too Much (All true stories) 1. Your neighbor mows your lawn for you 2. A United pilot tells you you’ve been flying ½ as many miles per year as he does 3. You work a full Wednesday in Japan, fly to the states at the end of the day, and arrive in time for work – 10am Wed. morning! 4. A constant state of sleep deprivation ensures that you instantly adjust to any time zone 5. Not only can’t you remember where you parked, but you don’t even know the make, model, or color of your rental car (worse in a blizzard) Scott Dietzen What They Don’t Teach You in Grad School ’03 17 Why Do Technologists Feel Underpaid (Redux) Because they don’t understand the game • Responsibility for product and company success is paramount, and rewarded accordingly • Accurately defining the product for the target market is generally much harder than building it – Domain expertise is often more valuable than programming skills • Working with others (leading and managing) is harder than programming – Leaders are most highly valued, then managers, then individual contributors • Asking for money is hard; orchestrating a technology purchase can require months of grunt work; and negotiating enterprise licenses can be excruciating • As a result, the biggest bucks go to the management team and to sales people on commissions Scott Dietzen What They Don’t Teach You in Grad School ’03 18 Start-Ups Successful high-tech start-ups (generally) • Identify existing target market • Have channel of distribution to that market • Have unfair technology advantage • Have time to market advantage • Have tremendous growth potential Start-up employees • Are freed from maintenance/legacy • But must work very, very hard • Are usually substantial stock holders • Have to wear multiple hats • Must be able to work well on a team Scott Dietzen What They Don’t Teach You in Grad School ’03 19 Evaluating A Start-Up • Evaluate from an investor’s view point – Review the business plan, not just the technology – Corollary: Avoid the technically interesting, but commercially unviable – Ask hard questions about risk and competition – Under non-disclosure, get as much detail as you can about financing structure (this may be tough!) – Meet with angle investor’s/VCs if you can • Most of all – Do you love the team, love the technology, and have fire in your belly! Scott Dietzen What They Don’t Teach You in Grad School ’03 20 Joining A Start-Up • Equity considerations should be primary – Expect to take a significant pay cut over what you could make elsewhere • Translate equity offers into percentage of the company (Shares outstanding range from 8m to 20m+) – Founders should expect single digit percentage – Lead founder often in double digits – CEO 5% – Management team 2% – Senior engineers <1% (even early on) Scott Dietzen Fractional Ownership of an Typical 1st Round Tech Venture 45% Investors 20% Founders/ wizards 10% Management team 15% 1st year employees 10% Later employees What They Don’t Teach You in Grad School ’03 21 Premier Venture Capital Why? • Defacto seal of approval for company/product • Trade share of ownership for resources • Let the pro’s finance the money-losing first years of company development (Your risk should be opportunity cost) • Get into the network • Early warning about competition • Help with recruiting the management team • Easier to get money down the road • Smarter than “industry” money Why not? • Dilution • Interference/loss of control Scott Dietzen What They Don’t Teach You in Grad School ’03 22 VC Profile of an Early Winner Operational excellence A real and defensible business Insightful & compelling value Real business & business model Defensible value proposition barriers A business that works at scale Translate strategy to action Focus, honesty, discipline, measures Speed – including “time to decide” A bias for action – “knee of the curve” Leadership – values & culture Management TEAM Open, respectful, honest communication Reverence for the customer, fear of the competition Aggressive, thoughtful, adaptive, reflective Optimistic, hardy, creative, tough Scott Dietzen What They Don’t Teach You in Grad School ’03 23 Venture Capital Home Run Illustration WebLogic Funding • Employee option strike price starts at zero (founder) and goes up to $.33/share • Angel financing: Regis McKenna, Frank Caufield, Ali Kutay • First (and final) round in ‘97: $12.5m in venture and strategic industry funding – VCs: TL Ventures & Bay Partners (Both got board seats) – Industry: Intel and Cambridge Technology Partners (SI) • Sale to BEA 10 months later – Approximately 10X+ return on investment (home run) – Grand slam if they held (BEAS goes from $25 to ~$350, split adjusted) BEA Funding • First (and final) round in ‘95: $50m from Warburg Pincus! • As most of the limited partners held, their ROI reached 100X Scott Dietzen What They Don’t Teach You in Grad School ’03 24 Current VC Environment Conventional wisdom Back to basics Dumb or bubble money has left the market Kind of like the early 90’s Reality: Nothing basic about pounding hangover from the excesses of the late 90’s Major overhang of companies funded in the boom Still too much capital flooding the obvious categories History suggests that the downturn could be much more prolonged Scott Dietzen What They Don’t Teach You in Grad School ’03 25 2002 So Far… Like It’s 1998 Deal Flow and Equity into Venture-Backed Companies (annual) Amount Invested ($B) 6100 6,000 4510 $100 5,000 $93.9 4,000 $75 3034 $50 1896 2174 $6.8 $9.9 2509 3,000 $49.0 $34.6 1313 $25 Number of Deals $12.8 $17.7 1558 2,000 $14.6 1,000 $0 0 1995 1996 1997 1998 Amount Invested ($B) 1999 2000 2001 YTD02 Number of Deals Source: VentureOne Scott Dietzen What They Don’t Teach You in Grad School ’03 26 80% Of Dollars Directed At 2nd And Later Rounds Investment by Round Class % of Amount Invested 100% 80% Later Round 60% Second Round 40% First Round 20% Seed Round 0% 1995 1996 1997 1998 1999 2000 2001 YTD 02 Source: VentureOne Scott Dietzen What They Don’t Teach You in Grad School ’03 27 Environment Uninvested Venture Capital 40 6 Accumulated Capital Over-commitments ($B) 35 5 Years of Uninvested Capital 30 4 25 Years of Uninvested Capital at 1995 Investment Pace 20 3 15 2 10 1 5 0 0 1995 Scott Dietzen 1996 1997 1998 1999 2000 What They Don’t Teach You in Grad School ’03 2001 28 Venture Capital In ‘03 • In 2000, 653 venture funds raised $107B • In 2001, 331 venture funds raised $40.7B • In 2002, 108 venture funds raised $6.9B • Moreover, 26 firms gave $5B back to their limited partners • So net new $1.9B go into venture funds in ’02 (95% drop!) • Total over-committed capital for all private equity is $100B! Scott Dietzen What They Don’t Teach You in Grad School ’03 29 Technology Investment Cycle—4 Phases 1967-1969: Semiconductors 1981-1983: PC & Workstation 1970-1971 Bubble (~2 yrs) 1996-1999: Internet FreeFall 1984-1985 2000-2001 (~2 yrs) 1961-1966 Firming (~5 yrs) 1975-1980 Bottoming (~3 yrs) 1990-1995 Scott Dietzen 1972-1974 1986-1989 Today… What They Don’t Teach You in Grad School ’03 30 Bottoming—Company Hangover From 1995-2000: 14,463 978 Companies funded Went public 1,529 Were acquired 1,180 Went out of business 10,776 Remaining Mortality effects, me-too effects still working their way through the system Source: Venture Economics; Venture Source Scott Dietzen What They Don’t Teach You in Grad School ’03 31 Internet Investment Settles At Early Levels Equity Investment by Internet Dimension Amount Invested ($B) $10 $8 Business Services Software/ Database $6 Infrastructure $4 ISPs Content $2 Electronic Commerce $0 3Q99 1Q00 3Q00 1Q01 3Q01 1Q02 3Q02 Source: VentureOne Scott Dietzen What They Don’t Teach You in Grad School ’03 32 Industry Allocations Fluctuate In 2002 Equity Investment by Industry Sector % of Investment 100% Information Technology 80% 60% Healthcare 40% Products & Services 20% 0% 3Q99 1Q00 3Q00 1Q01 3Q01 1Q02 3Q02 Source: VentureOne Scott Dietzen What They Don’t Teach You in Grad School ’03 33 Software Clearly Dominant In 3Q’02 Percentage of Overall Venture Investment, by Industry Retailers 1% Other 1% Biopharmaceuticals Services 9% 13% Products 1% Healthcare Services 2% Prod. & Serv. Healthcare 10% 24% Medical Devices 8% Medical IS 1% Software 32% Info. Tech. 65% Communications 16% Semiconductors 9% Source: VentureOne Scott Dietzen Electronics 5% Information Services 2% What They Don’t Teach You in Grad School ’03 34 What VCs Want • VCs generally are not anticipating disruptive technology (e.g., internet, optical networking) revolutions near term • Broad, hugely ambitious plays are out; More realistic narrowly targeted (segmented) plays are in • So don’t get too enamored with technology • The game today is applying technology to a business problem that customers will gratefully pay to solve! – No more “Just get the eyeballs today, and figure out how to monetize later” • Corollary: Technology is only a small part of the business plan. Compelling marketing and selling strategy are essential Scott Dietzen What They Don’t Teach You in Grad School ’03 35 What VCs Want (Cont.) Funding to Milestones Idea is Feasible Beta or FCS Model is defined and proven Valuation Risk (ß) Capital Seed Scott Dietzen R&D Ship What They Don’t Teach You in Grad School ’03 Expansion 36 What VCs Want (Continued) • Make the business case – What is the customer’s return on investment (ROI) that will allow you to defy gravity • Industry/domain expertise on management team is mandatory! • Strong syndication – Money was a commodity in the bubble. No more – Other smart, well connected VCs in the deal – Angels also key – Shared risk or herd mentality? – Entrepreneurs need multiple VCs on the hook! Scott Dietzen What They Don’t Teach You in Grad School ’03 37 Mind of a Successful Entrepreneur • Late ’90s (Bubble) – “Go big or go home” – Build infrastructure, spend ahead of the curve – Get “buzz” – Time to market is the key – Raise only the minimum required; ROE is a function of time – Optimize for the upside Scott Dietzen • Today (Reality) – “Survivor” – Milestone-based spending, lag $ behind the curve – Get (named) customers! – Cash flow breakeven is key (min. team, share hotels, gear on EBay, …) – Raise enough to get to a significant milestone; ROE is a function of tangible business progress – Protect the downside What They Don’t Teach You in Grad School ’03 38 Start up/VC Summary • Despite the economy, major shifts continue to occur • In many ways, great time to be starting a company – Costs are down dramatically – Talent is available – Luxury of being out of market scrutiny • But, caution and prudence still rule the day – Industry exceedingly well funded – Business fundamentals not a “V” recovery • Experience matters Scott Dietzen What They Don’t Teach You in Grad School ’03 39 Comedy Break #2: Sabbatical Actually Helped My Career! Scott Dietzen What They Don’t Teach You in Grad School ’03 40 Managing For Success So you’ve got money in the bank. Now what? Three golden rules: • Cash is your life supply, manage it ruthlessly • Get the first version out the door quickly... don't wait for the perfect product • Bad decisions happen; recognize them, fix them quickly, and move on Scott Dietzen What They Don’t Teach You in Grad School ’03 41 Managing For Success I • Take great care in team building – For start-ups/new product launches, only small teams of world-class talent will do – Ensure critical team roles are filled • Architect – Sweats the content (big picture and details) • Manager – Sweats the process • Product manager – Customer/scenario/solution champion • The “Cheer leader”/“Ass-kicker” – Demands/inspires excellence and commitment – Some overlap possible – Success depends upon excellent teaming among four roles Scott Dietzen What They Don’t Teach You in Grad School ’03 42 Managing For Success II Establish key scenarios/priorities to guide decision making around product development/releases • Product releases should have a small (2-4) number of themes • Do’able in reasonable timeframe • Validate themes with customers • And then “get ruthlessly and relentlessly behind them” • Use scenarios to allocate resources • Use scenarios to organize engineering – Push ownership down as low as possible (to the natural scenario “owner”), but no lower • Focus, focus, focus— High-tech projects can easily get distracted (the earlier in the life-cycle, the greater the danger) Scott Dietzen What They Don’t Teach You in Grad School ’03 43 Managing For Success III • Acquire with extreme caution – For people and IP?; or – For market/customers? – Know who is going to manage it beforehand – Carefully balance • Assimilation • Preservation • BEA has done 30+ acquisitions, but only a couple major waves of change (“Built Entirely on Acquisitions”) – Tuxedo provided initial engineering culture – WebLogic first major agent of change – CrossGain/WestSide second major agent of change (still running its course) Scott Dietzen What They Don’t Teach You in Grad School ’03 44 Start-Up Lessons • BEA/WebLogic won because some big bets paid off – Web would push more business logic to server-side – Java was a great language for server-side programming • Java on the client would drive Java on the server (Mostly wrong!) – Java VM architecture would prove to be dislocating agent for existing OLTP architectures (Tuxedo, CORBA) – Need a API standard for the server – Enter J2EE – Bundled suite of platform services Web application server – Free trial web download (over sales objections) • The jury is still out on BEA’s future big bets – Can we continue to carve out a niche between Microsoft and IBM? – Can we extend web/Java platform to encompass integration – EAI, B2B, UI (portal), data (XML Query) Scott Dietzen What They Don’t Teach You in Grad School ’03 45 What’s Hot: Web Application Platform • Complexity of programming business applications • Complexity/performance of XML processing – Semi-structured content repository meets file system and database • Complexity of application integration – More semantic models of XML data mapping/transformation – Choreography/orchestration missing • Complexity of operations, administration, and management – More adaptive (self-configuring, self-healing) systems to meet a quality of service • • • • Business activity monitoring (BAM) Security infrastructure (may be oversubscribed) Wireless (historically oversubscribed, still working off excess) Data center consolidation on disposable hardware (may be oversubscribed) Scott Dietzen What They Don’t Teach You in Grad School ’03 46 Recommendations for The Would-Be Entrepreneurs • Can you be a BSO (blind, stupid optimist)? • Learn how to write and speak well • Learn to be a consummate team player • But also be a leader – Step up and take responsibility • Spend some time working on the technology transfer/business side (technical marketing, technical sales, consulting) • Consider auditing classes in entrepreneurship at GSIA • Learn to be comfortable making decisions from incomplete information • Have some fun now (while you still can) Scott Dietzen What They Don’t Teach You in Grad School ’03 47 Bruce’s Final Oral Exam • Purely technical issues are of tertiary importance. Predicting technology evolution and delivering high-added value to the business are first and second • CS graduate school most typically blissfully ignores this • Start-up companies have the best wealth potential, but require the highest effort, discipline, commitment, and risk • The greatest technical influence comes out of connecting technology to the business (technical marketing, product management, CTO, etc.) • Compensation is commensurate with responsibility and ability to assimilate incomplete information and act decisively upon it • Many Ph.D.’s with maturity become great technical managers. Far fewer become great marketeers or executives Scott Dietzen What They Don’t Teach You in Grad School ’03 48 Thank you! Value-added contributions most welcome (If this can be made sufficiently valuable, then I’d like to do it annually) Scott Dietzen What They Don’t Teach You in Grad School ’03 49